The ACA tax credit first starts with estimating the household’s affordable contribution to their health insurance premium.

The 1095-A Health Insurance Marketplace Statement doesn’t give a clue on how the Monthly Advance Payment of Premium Tax Credit is calculated. Even though consumers who purchased health insurance through the Marketplace entered their Modified Adjusted Gross Income (MAGI) into the enrollment system, this income in not listed on the 1095-A they receive. The MAGI is pivotal to calculating the tax credit and part of the formula can be found on Form 8962 Premium Tax Credit reconciliation.

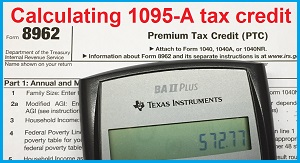

Calculating the ACA tax credit

The ACA tax credit, whether taken monthly to reduce the health insurance premium or calculated with the federal tax return, is based on a straight forward formula. Essentially, the tax credit formula determines how much a household is expected to contribute to their health insurance if their income is less than 400% of the federal poverty line (FPL). This contribution amount is compared to the Second Lowest Cost Silver Plan in the households region. The difference between the SLCSP and the household’s expected contribution is the ACA tax credit.

Form 8962 calculates household contribution

Part 1 of Form 8962, Annual and Monthly Contribution Amount, is the first part of the tax credit formula. The calculation in Part 1 is the same formula the Marketplace exchange or the numerous tax preparation programs use to determine the expected household contribution.

| Part 1 Form 8962 | Household of 3 | |

| Line 3 | $72,350.00 | Family MAGI |

| Line 4 | $19,530.00 | FPL from Instruction F8962 |

| Line 5 | 370% | Line 3 divided by line 4 |

| Line 7 | 0.095 | Expected percentage from Instructions F8962 |

| Line 8b | $572.77 | Line 3 multiplied by Line 7 divided by 12 months |

Estimating MAGI

For this example we have a household of three people with an estimated MAGI of $72,350 per year. The federal poverty line (FPL) of $19,530 is

Part 1 of Form 8962 determines the household’s contribution to health insurance.

found on the instructions for Form 8962. The MAGI divided FPL yields a percentage of 370%. From the Applicable Figure table in the instructions for Form 8962 we learn that affordable percentage for this family’s income to be spent on health insurance premiums is 9.5%. In other words, the most this family should have to pay is 9.5% of their Modified Adjusted Gross Income toward making a health insurance premium. See: What counts as Modified Adjusted Gross Income

Affordable family contribution

The family’s MAGI multiplied by .0950 (9.5%) is $6,873.25 or the affordable annual health insurance premium. If you divide the new found affordable premium by twelve months, under the ACA, the family should have to shoulder no more than $572.77 per month. Now that lines 1 – 8b of Form 8962 have determined the affordable health insurance premium; how is the tax credit figure?

Second Lowest Cost Silver Plan

The determination of the actual tax credit is done by the Marketplace for the specific pricing or rating region formthe family’s residence. California is broken up into 19 different rating regions. The family’s affordable health insurance premium is compared against the Second Lowest Cost Silver Plan (SLCSP) in the rating region. For this family, the SLCSP is $854.23 for the entire household based on each person’s age. The SLCSP of $854.23 minus the family’s expected contribution of $572.77 equals a difference of $281.46. The difference between the SLCSP and the family’s contribution is the tax credit. See: What is the SLCSP?

Tax credit tied to the SLCSP

The maximum tax credit that will be advanced every month to lower the health insurance premium is the difference between the SLCSP and family’s affordable contribution. If a health plan with a premium less than the tax credit is selected, only the amount to cover the monthly insurance rate will be advanced. The tax credit doesn’t increase in size if the family selects a plan more expensive than the SLCSP.

Changing the MAGI

Unless the household makes a change to their estimated income during the year, the tax credit will always stay the same. This is the point that is causing families to owe excess Advance Premium Tax Credit to the IRS. They earned more money than they originally estimated. In this example, the family estimates a MAGI of $60,000. The lower estimated income increased the necessary tax credit to meet the health insurance premium for the SLCSP which is illustrated below.

| Part 1 Form 8962 | Household of 3 | |

| Line 3 | $60,000.00 | Family MAGI |

| Line 4 | $19,530.00 | FPL from Insturction F8962 |

| Line 5 | 307% | Line 3 divided by line 4 |

| Line 7 | 0.095 | Expected percentag from Instructions F8962 |

| Line 8b | $475.00 | Line 3 multiplied by Line 7 divided by 12 months |

1095-A reports the tax credit advanced

In reality, determining the Annual and Monthly Contribution Amount on Form 8962 was performed when the family first enrolled. The 1095-A Health Insurance Marketplace Statement is the report of the SLCSP and the calculated tax credit. But the 1095-A doesn’t included the original MAGI estimate so it seems disconnected to the process of reconciling the tax credit on Form 8962. I think it would be a good idea if the Marketplace added a column on the 1095-A that reported the estimated MAGI and expected household contribution dollar amounts from the enrollment. They already indicated the SLCSP, which can change if the individual or family moves to another rating region. The additional information would allow the household to visual how the tax credit changed with income and is relative to the SLCSP.

If the 1095-A included a Household Contribution and MAGI column, taxpayers would have a better understanding of how their tax credit was calculated.

Family contribution and MAGI on a 1095-A

In the example above the family started out with an estimated MAGI of $72,350 at the beginning of the year. In April the household revised their MAGI down to $60,000. The net result of the decrease of income is that the monthly contribution decreased and the eligible tax credit increased. The sum of the household contribution and the tax credit will always equal the Second Lowest Cost Silver Plan. If the family’s estimated MAGI through the Marketplace stays at $60,000 when they file their taxes, then they would receive an additional credit for the difference between the lower tax credit for those months the MAGI was $72,350 and the higher tax credit they receive when the MAGI was dropped to $60,000.

All of the IRS forms and instructions can be downloaded from my page IRS – ACA