It appears the health plan invoiced for the higher premium plus the excess subsidies paid in January and February. Consequently, the March invoice was $314.00 the combination of $275.58 + $19.21 + $19.21.

Kevin Knauss: Health, History, Travel, Insurance

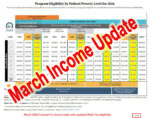

Covered California has revised their income table to reflect the higher federal poverty levels. The higher dollar amount numbers are effective March 2026. The revision only applies to Medi-Cal programs. When reviewing any income table update, make sure the date in the lower right-hand corner is 3/2026. That is the revised table from the 10/2025 […]

The dental plan review and spreadsheet leans heavily on Delta Dental. However, there are many dental plans from other carriers that work just as well and are competitively priced. While you can enroll directly with many dental plans, there are situations where you must use a specific marketing channel such as the Morgan White Group or Covered California.

However, there can be no mistake that AI is becoming more sophisticated in providing financial analysis for health insurance. There is a large population of people for which the AI analysis is good enough to base a health insurance decision upon. This makes health insurance agents obsolete in many situations.

Similarly, Social Security Disability benefits are added to the MAGI. What surprises people is that they may receive a lump sum check for previous months of disability payments from when the disability application was first file. This lump sum benefit covering several months can push the household income over 400 percent.

Spam prevention powered by Akismet