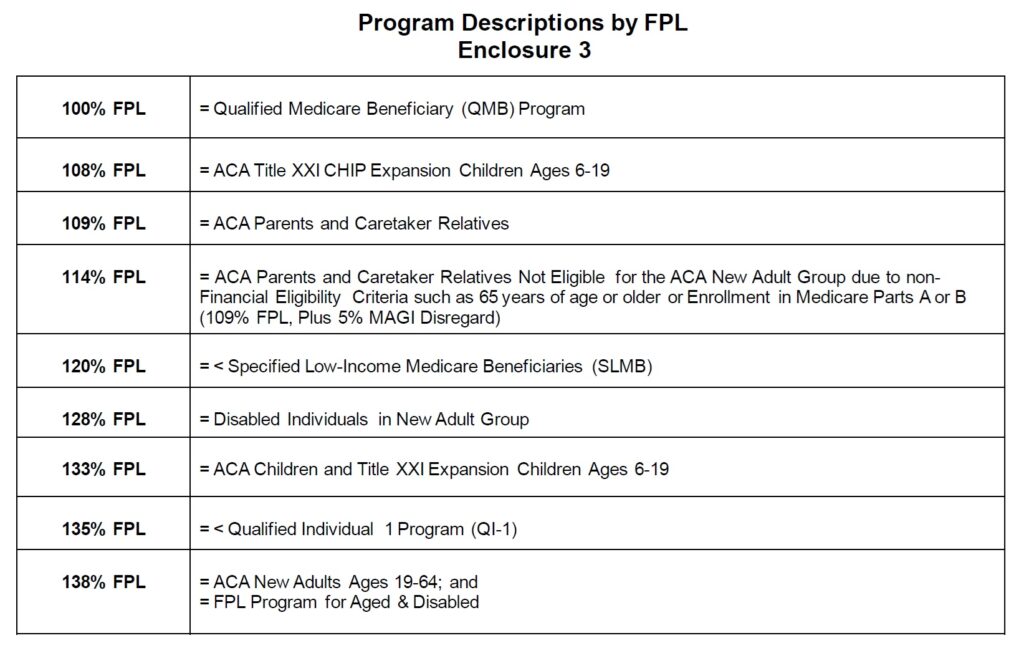

Medicare Savings Program Medi-Cal Income Considerations

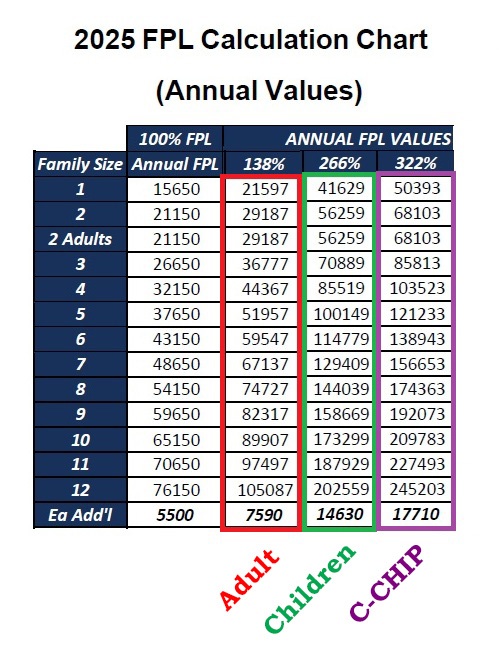

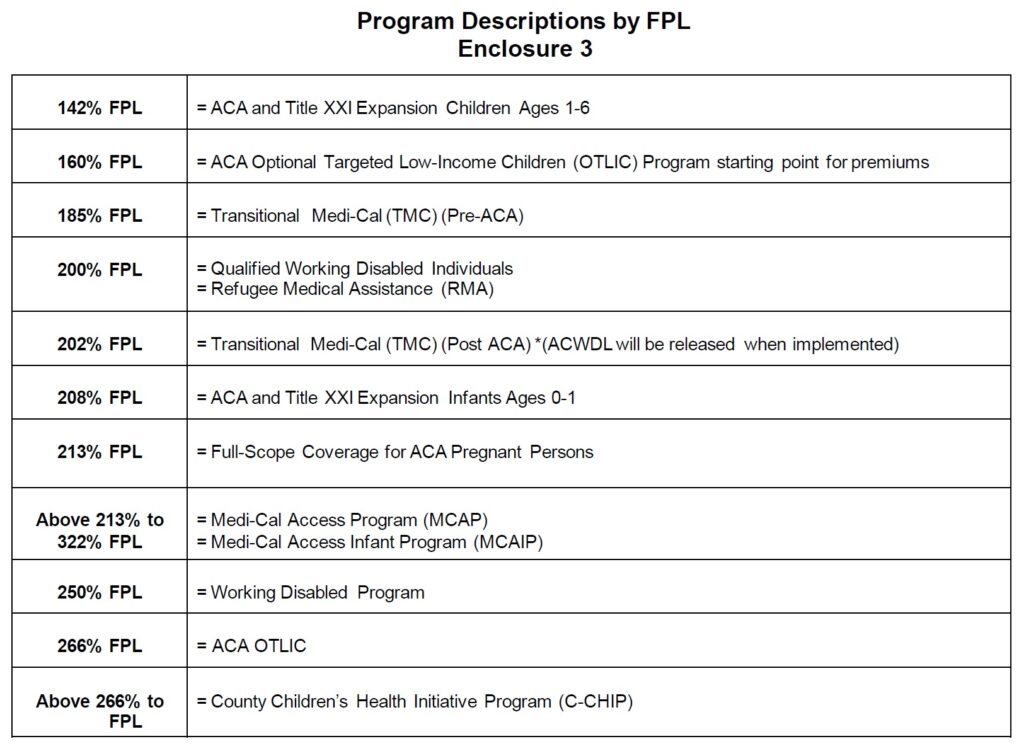

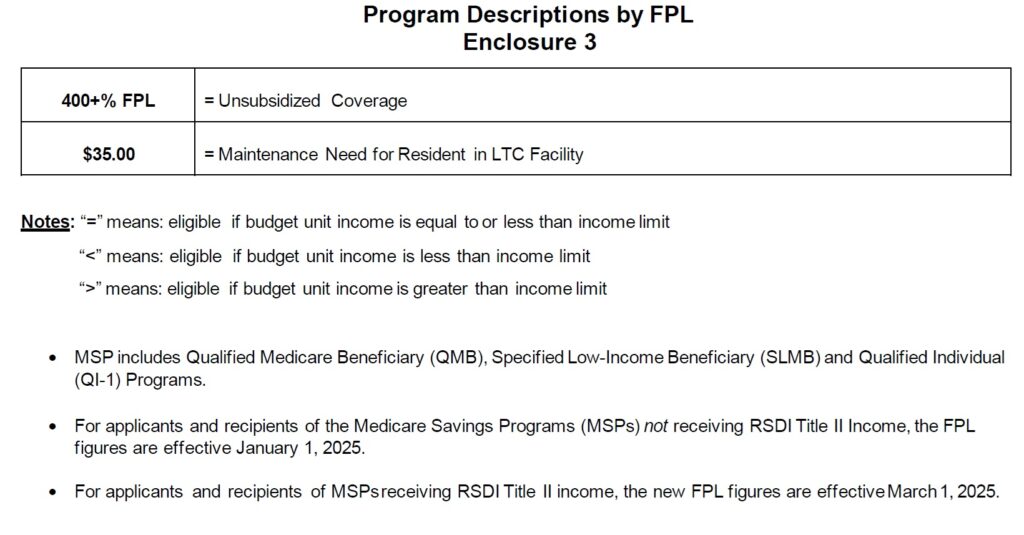

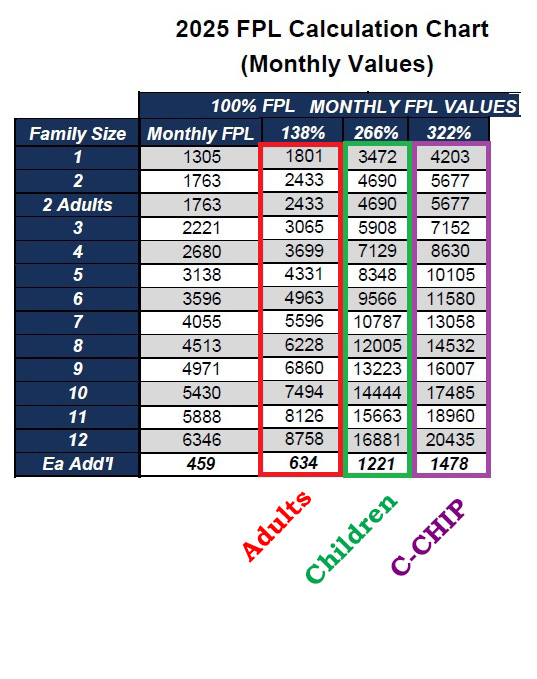

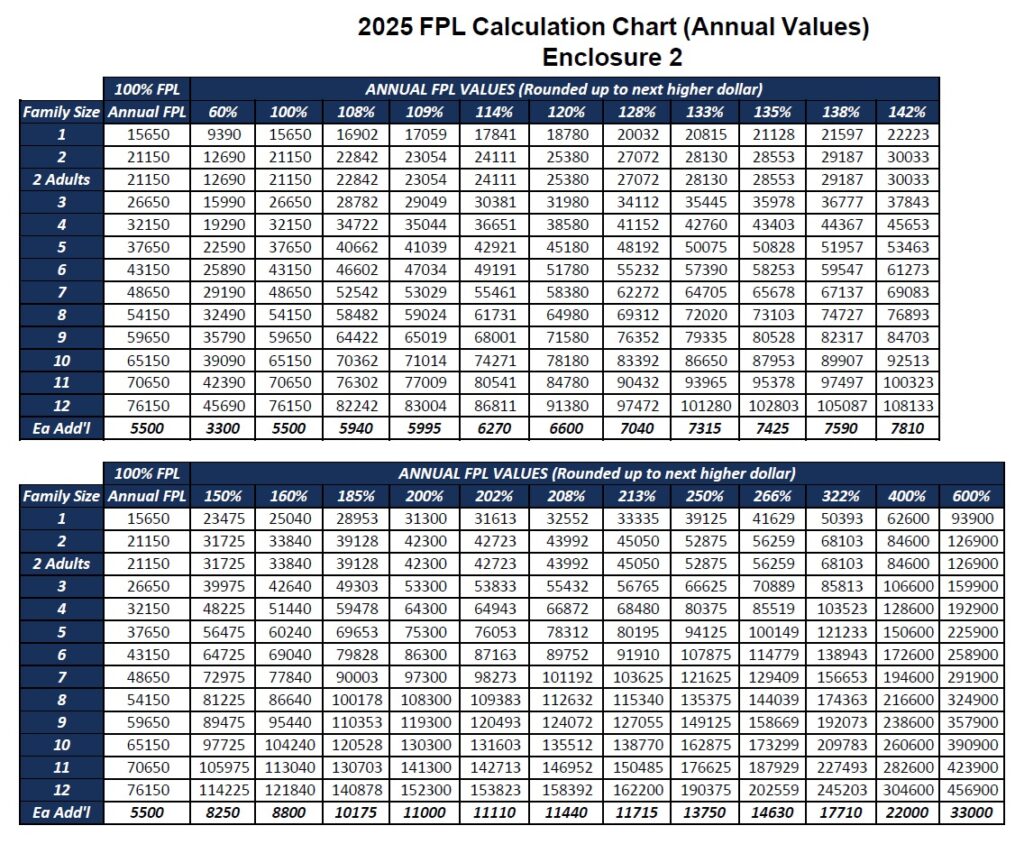

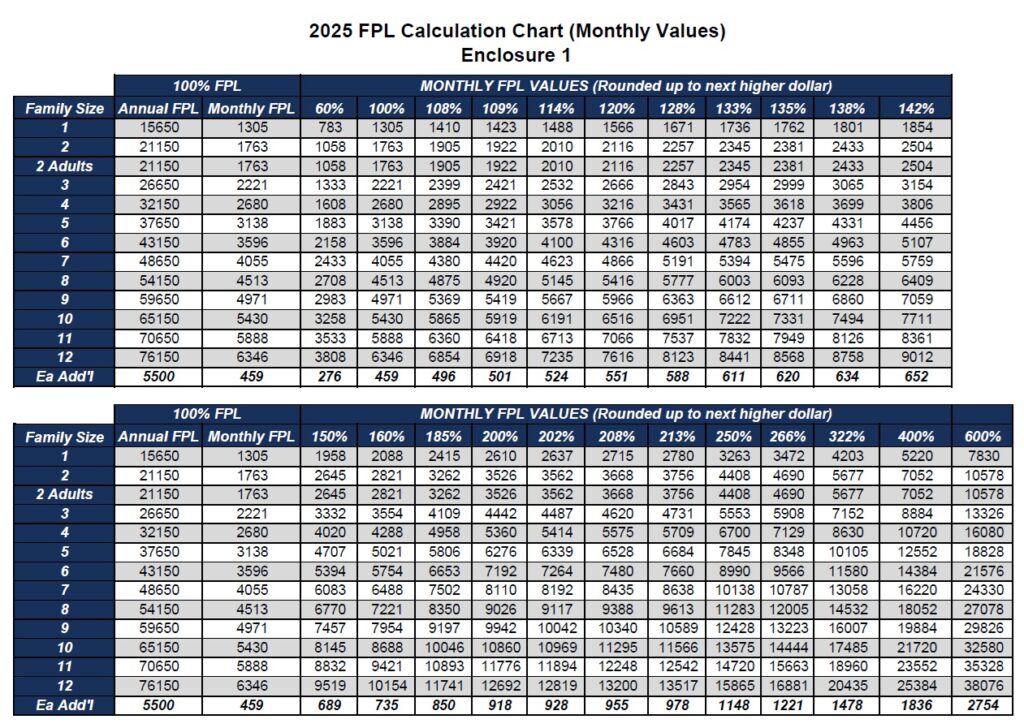

2025 Income Values for MAGI Medi-Cal Adults and Children

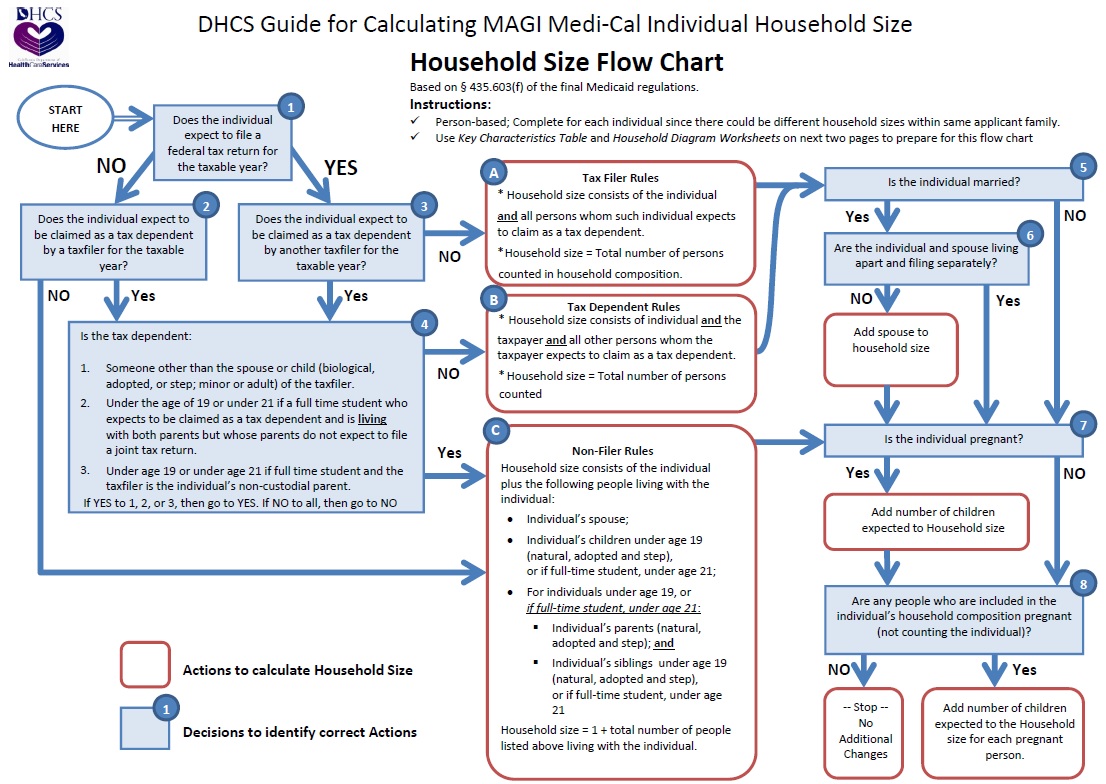

Family Size is based on the Federal Tax Household; who you file taxes with, spouse and dependents. Roommates are not in your family.

Get help completing the Medi-Cal annual renewal paperwork from local county organizations.