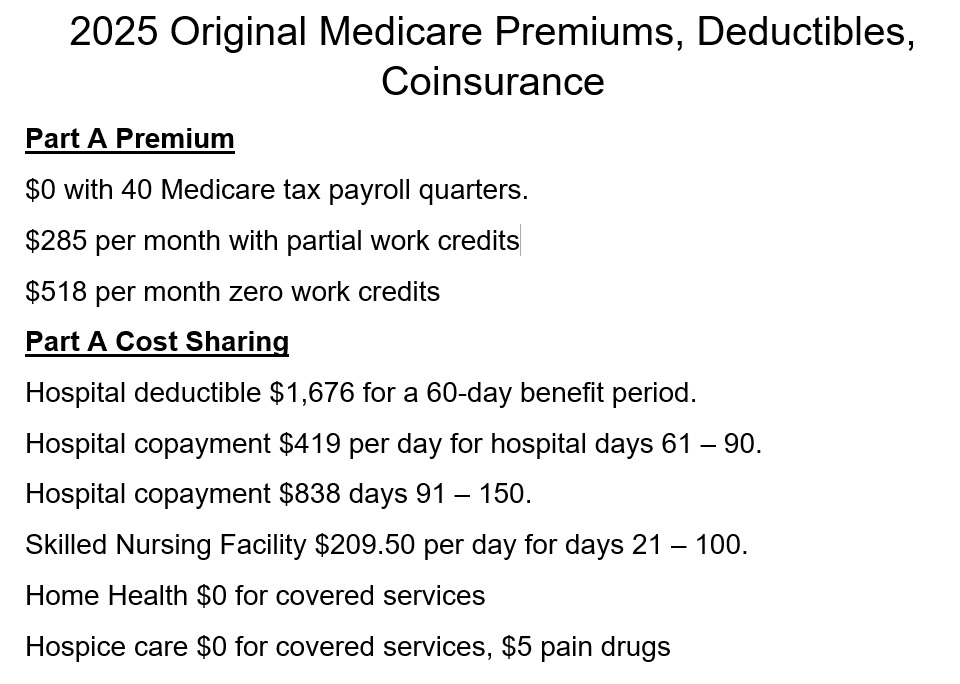

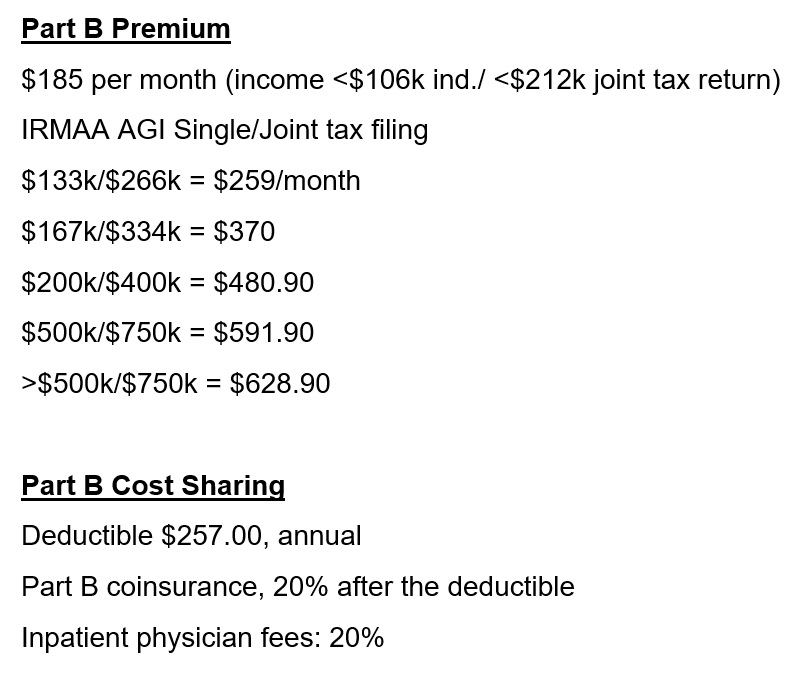

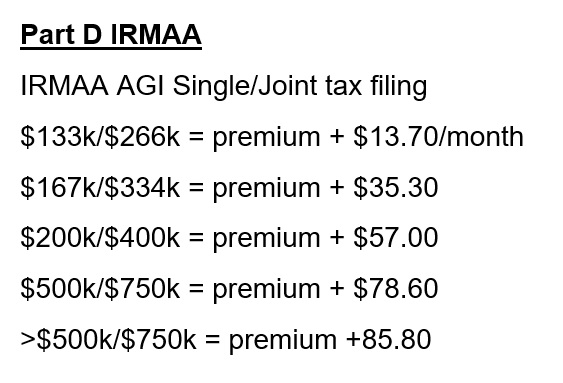

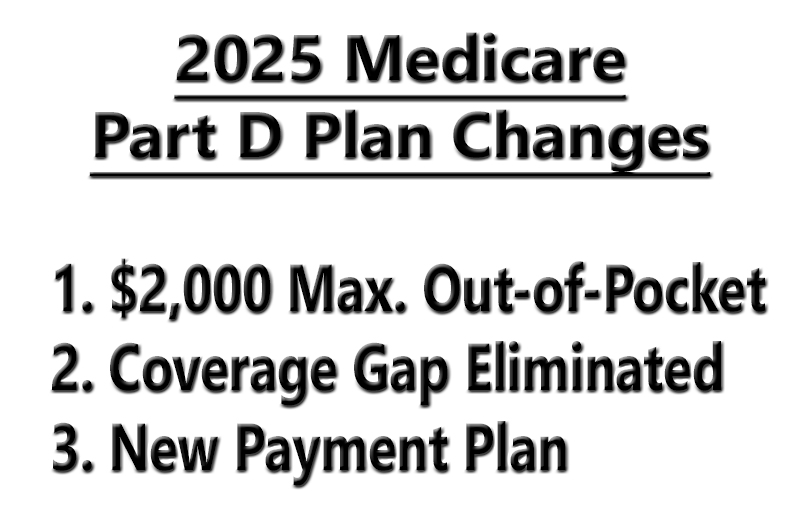

2025 Medicare Part D Plan Changes, Cost Structure, Payment Plan

Part B Enrollment Before Leaving Employer Group Plan

Outline of the steps and forms you need to activate Part B with the Social Security Administration before you leave you employer group plan. Medicare Part B Enrollment after You leave Employer Health Plan – (insuremekevin.com)

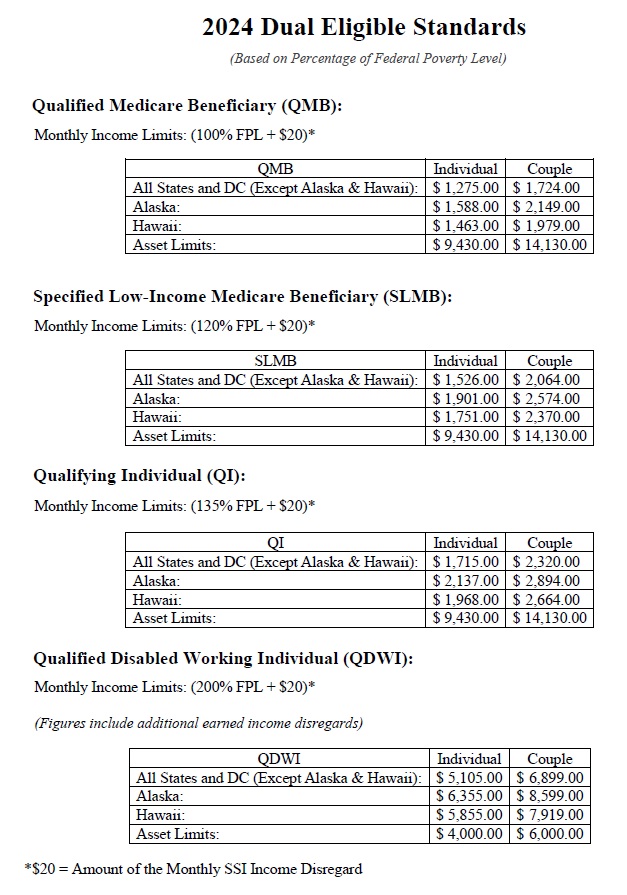

Medicare Medi-Cal Income Levels for 2024

What is a Medicare Advantage Plan?

Basics of Original Medicare, Medicare Advantage, Supplements, Part D

If you call me with questions about Medicare, you’ll be talking to the guy on the right – Kevin Knauss. I am the customer service representative and I work out of my house to help people enroll in Medicare insurance products. Phone: 916-521-7216

Part B Late Enrollment Penalty Waiver

CMS is offering equitable relief to certain Medicare beneficiaries currently enrolled in Medicare Part A and coverage through the individual Marketplace (i.e., a Marketplace plan for individuals or families and not for employers (also referred to as SHOP)). This equitable relief provides eligible individuals with an opportunity to enroll in Medicare Part B without penalty. Further, CMS is offering equitable relief to eligible individuals who were dually enrolled in Medicare Part A and coverage through the Marketplace and subsequently enrolled in Medicare Part B with a late enrollment penalty. This equitable relief provides these individuals an opportunity to request a reduction in their Medicare Part B late enrollment penalty. This tip sheet explains the equitable relief, eligibility criteria and steps for Medicare beneficiaries if they want to enroll in Medicare Part B or request a Medicare Part B late enrollment penalty reduction.

Determining Eligibility for both Medicare and Medi-Cal Extra Help

People who turn 65 and may have been receiving a hefty subsidy through Covered California to reduce their health insurance premium can be shocked at the costs of enrolling in Medicare. However, there are a variety of resources to assist Medicare beneficiaries to lower their health insurance and health care costs. Assistance from both Social Security and Medi-Cal may be an option for some Medicare beneficiaries depending on their household income. Click the title to read the full post.

Covered California clarifies Medicare questions for individuals

If you are enrolled in Medicare, you do not need to do anything with Covered California. If you have Medicare you are covered. No matter how you receive your Medicare benefits, whether through Original Medicare or a Medicare Advantage Plan, you will have the same benefits and security you have now. You will receive new benefits, such as more preventive services and increased savings on brand-name drugs. [Read More]

Are You Frustrated with Your Medicare Options?

- Should I take Part A?

- Should I take Part B and when?

- What about Part D?

- What’s the Difference between a Medicare Advantage Plan and a Medigap Plan?

- Can I get help with Medicare costs?

Kevin Knauss

7 Steps to help you make the best Medicare choice for you.

- Read the information Medicare sends you to learn about the basics of Original Medicare: Parts A and B.

- Become familiar with the Part D Prescription Drug Plan, Medicare Advantage Plans and Medicare Supplements.

- Go to Medicare.gov to find out which plans are offered in your area.

- Review your lifestyle and finances to help guide you between the different options.

- Do you need help paying for Medicare costs? Contact Social Security and Medi-Cal to see if you qualify for help.

- Request information on the different plans you might be interested in and talk to family and friends to see what they are happy with. Never rely on one source, person or company for information.

- If you need additional clarification call me, Kevin Knauss Ph: 916-521-7216, and we will get your questions answered.