Bronze 60 plans stating the 100% coinsurance after the deductible is met can be confusing to most everyone.

2019 Bronze Plan 100% Coinsurance

For 2019 the standard benefit design Bronze 60 has a $6,300 individual deductible, $12,600 for a family. Yet, as in previous years, the deductible doesn’t really mean much to the average consumer. Once you have met deductible you are still paying 100% of the negotiated rate for most health care services. The maximum out-of-pocket amount is $7,550 for and individual and $15,100 for a family. The three office visits at the set $75 copayment, labs at $40 (not subject to the deductible), plus any prescription medications costs all go towards meeting the maximum out of pocket.

If you are unlucky enough to be prescribed a really expensive prescription medication that costs over $500 per month, there is some small relief. Once you have met a $500 pharmacy deductible, a single prescription will not cost more than $500 per month.

For the average person, you have to consider the $7,550 maximum out-of-pocket amount as the deductible. Once you have hit the maximum out-of-pocket amount, the health plan will cover all in-network medical expenses and prescription drugs. Until then, assume you will be paying the full negotiated rate (100% coinsurance on the part of the plan member) for all health care services, regardless of the deductible amount.

2018 Bronze Deductibles & Coinsurance

The 2018 standard Covered California Bronze plan has a $6,300 medical deductible, $500 pharmacy deductible and a $7,000 maximum out-of-pocket (MOOP) amount. Excluding preventive services, the member pays 100% of the negotiated health care service rates except for the 3 office visits and $40 lab tests.

When the health plan member spends $500 on prescription medications from a retail pharmacy, any monthly prescription over $500 is capped at $500 for a 30 day supply. In other words, the most you will pay for a really expensive drug once you’ve hit your pharmacy deductible is $500 per month. 2018 Health Plan Benefits Table

Once the member has spent $7,000 on health and pharmacy costs, the plan will cover all listed benefits for the plan at no charge to the plan member.

The question that many people have is, “What happens when you meet the $6,300 medical deductible?” This is question is one that no one seems to have a clear answer to including the health plans or Covered California. The other plans such as Silver, Gold, and Platinum have a coinsurance percentage triggered by meeting any medical deductible. For example, once you meet the $2,500 Silver plan deductible, you start paying 20% coinsurance for those health care services not subject to a set copayment. Once the Silver plan deductible, copayments, and coinsurance equals $7,000, the MOOP, then the plan covers all services 100%.

But the Bronze plan has no coinsurance cost-sharing provision in it. One health plan speculated that once you have met the medical deductible, but not the MOOP, the member will be billed for the copayments of any office visits and labs until the member MOOP is $7,000.

Perhaps the best way to view the Bronze plan is as an asset protection plan. Just assumed you will be on the hook for $7,000 in health and pharmacy costs before the plan really kicks in. Considering the Bronze and Silver plans each have a MOOP of $7,000, and if you are not offered an enhanced Silver plan, a Bronze plan at a lower premium may be worth a serious look. October 13, 2017

One of the most baffling health plan descriptions is the 2016 Bronze 60 health plan that states that the member is responsible for 100% coinsurance after the deductible. Most people who read this immediately shake their head and think, “I have to pay for all of my health care services EVEN AFTER I meet the deductible?” There really is no reason to buy health insurance if it never helps with the costs. The second part of the equation, not always referenced, is the calendar year maximum out-of-pocket amount of the Bronze plan which does limit a health plan members health care expenses.

100% coinsurance of the pharmacy deductible

The standard benefit design of the Bronze 60 plan was tweaked in 2016 to accommodate a pharmacy deductible. To provide some relief from skyrocketing drug prices, Covered California added a prescription drug cap for high cost medications. On the Silver through Platinum plans this takes the form of a $250 maximum Tier 4 copayment after any pharmacy deductible has been met. In order to trigger a drug cap maximum on the Bronze plans Covered California had to add a pharmacy deductible. Once a Bronze plan member spends $500 on prescription medications, they then become eligible for monthly drug cost cap of $500 pre prescription.

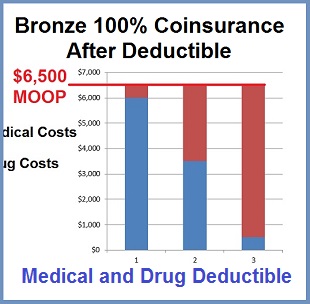

Bronze Deductibles and Maximum out of pocket amount

Standard benefit design Bronze 60 plans are now nominally comprised of a $6,000 medical deductible and a $500 pharmacy deductible. The Bronze plan also includes a $6,500 calendar year maximum out-of-pocket amount (MOOP). Once the member spends $6,500 on their health care expenses, the health plan picks up the costs of all the covered benefits in the health plan. Except for making the monthly premium payment, the member will spend nothing on drugs and health care costs covered by the health plan once the MOOP is met.

Coinsurance is usually cost sharing

Traditionally, once a member met their deductible they went into cost sharing or coinsurance with the health plan until they reached their MOOP. For instance, once a Silver 70 plan member meets their $2,250 deductible, they go into 20% coinsurance. Once the combination of the deductible, coinsurance, and the accumulation of set copayments PLUS drug expenses equals the Silver 70 MOOP, the member no longer has to share the cost of health care services OR prescription medications.

Bronze 60 plan members can meet their calendar year maximum out of pocket by spending any combination of dollars on either medical or drug costs. If the plan member has spent nothing on prescription drugs, they must spend another $500 after the $6,000 medical deductible (or 100% coinsurance), before they reach the $6,500 MOOP.

Hitting the Bronze MOOP

For the Bronze 60 plans, it is not clear what the member’s cost share or 100% coinsurance accumulates toward once they have met their $6,000 medical deductible OR why there isn’t a reduced cost sharing percentage. In order to hit the $6,500 MOOP of the Bronze 60 plans, the member has to spend another $500. This amount is also the pharmacy deductible amount. But if the member takes no medication, then the pharmacy deductible is a moot point. For the Bronze plan the medical deductible and the MOOP can be the same dollar amount. But for purposes of the Summary of Benefits and Coverage documents, they must state that the member pays 100% coinsurance after the $6,000 deductible. And they should have added, until the member reaches $6,500 MOOP.

Any combination of medical and drug costs

It’s possible that a Bronze 60 plan member could spend $500 on medications and $6000 on medical expenses to reach $6,500 MOOP. It’s also possible that a Bronze 60 plan member could meet their MOOP by spending $3500 on medical expenses and $3,000 on medications. Alternatively, a Bronze 60 plan member could reach their MOOP almost entirely based on prescription medication costs. The bottom line is that virtually nothing is covered under the Bronze plan until the member spends a combination $6,500 in a medical and drug costs.