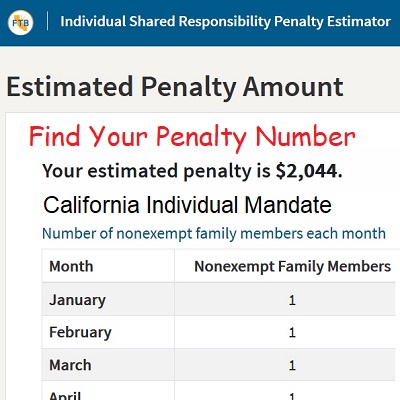

The California Franchise Tax Board has released an online tool for estimating the penalty for not having health insurance in 2020. For older individuals, compared to the cost of health insurance, the penalty is relatively inexpensive. A 55-year-old individual with California taxable income of $100,000 will only suffer a penalty of $2,044. The cost of a basic standard Bronze plan from Anthem Blue Cross in Nevada County is $779 per month or $9,248 annually.

California’s individual mandate penalty highlights the ridiculously high rates for health insurance in the Golden State. Of course, the rates reflect the ridiculously high cost of health care services in California. For a single adult, age 55, that person would have to earn around $475,000 before penalty exceeded the cost of a basic Bronze plan in Nevada County. ($475,000 x 2% = $9,500.)

California Penalty Not Sever Compared To Health Insurance

The penalty for not having health insurance will be based on the months that you or your family were not covered. If you had coverage for part of the year, you will not be assessed a penalty for those months. For moderate to high income earners, who will never be eligible for any health insurance premium subsidy, the penalty is not much of a monetary inducement to get coverage. California Franchise Tax Board Individual Mandate Penalty Page and Estimator Tool.

For example, a 55-year-old individual who earns $100,000 and had no health insurance for 6 months of the year, he or she will only face a penalty of $1,022. However, there is an incentive to apply for no cost MAGI Medi-Cal coverage. If the individual had no income in the months where they had no coverage, they would qualify for Medi-Cal.

Medi-Cal Option To Avoid Penalty

Let me emphasize this situation. A single adult who earns $100,000 in reportable taxable income, regardless of whether that income occurred all in one month or over the year, is ineligible for any health insurance premium tax credit subsidy. If they do receive any subsidy, when they file their state or federal income tax return, the person will have to repay it all.

But if this same person has no income in February, after potentially earning all their $100,000 in January, that person is eligible for Medi-Cal. Why? Because Medi-Cal looks at your monthly income and not your annual income in most circumstances. Coverage gaps of three consecutive months or less is not subject to the penalty.

If the California Franchises Tax Board (FTB) evaluates the penalty or subsidy eligibility like the IRS has, they don’t care when you made your income. They only care about the single annual income figure. If you had no income in July, and you had no coverage for the same month, you will face a penalty for 1/12 of your total annual income in that month.

California Subsidy Option

A family of 4, 2 adults and 2 children, who have an income of $100,000 would receive a California individual mandate penalty of $2,085, according to the FTB penalty estimator. That same family, residing in Nevada County, would be eligible for a premium subsidy greater than the cost of the health insurance. In this scenario the family would only pay $4 per month or $48 for the year.

This same family with an income of $200,000 is ineligible for any health insurance premium subsidy. There annual cost to insure the family with a basic Bronze plan in Nevada County would be $25,105.44 for 2020. Without coverage, the penalty is estimated to be $3,537. Which would you choose?

Unaffordable Exemption Option

The FTB lists on their website that if the coverage is considered unaffordable (the cost exceeds 8.24% of the household income) there will be no penalty. For our family of 4 at $200,000, the cost of the least expensive Bronze plan is $25,000 which is 13% of the household income. Theoretically, this family would not be subject to the individual mandate penalty. Here again, the stupidly high cost of health insurance is working against the individual mandate penalty that was meant to spur people to enroll in coverage.

This disparity between penalty and the cost of health insurance is driving people to enroll in indemnity plan, discount health care plans, and the health care sharing programs. None of these programs are a substitute for real health insurance. But if a family can save $20,000, even after paying the penalty for not having coverage, that sort of cash goes a long way to meeting basic living expenses in California, plus a few trips to urgent care. And if the family is not subject to the penalty because the coverage is considered unaffordable, the individual mandate penalty is moot.