One of the strategies for enrolling hundreds of thousands of California residents in new Covered California health plans was to have an army of in-person Certified Enrollment Counselors. While these folks are trained on how to fill out the Covered California application, they don’t necessarily have any background in health insurance or how it works. Are the Certified Enrollment Counselors (CEC) qualified to answer simple to complex questions about health insurance and will they be there next month when their client has issue?

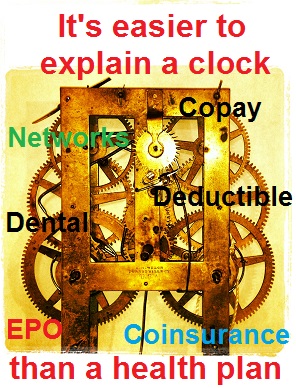

Health insurance has grown more complicated

The health insurance plans offered through Covered California are more complicated today than they were before the new ACA rules. Not only do Certified Insurance Agents (CIA) and CECs have to be knowledgeable about income and household rules, they also need to understand how the new plans work. The questions revolving how a health plan actually works is a moot point if the applicant is Medi-Cal eligible. But for families that have multiple health challenges, prescriptions and providers, it can be difficult to compare all the plans to determine which one is right for the household.

Client questions about health insurance

Here are a few questions that clients have asked me about the new health plans.

- What’s the difference between a PPO, EPO and HMO?

- Can I see a PPO doctor if I’m in an EPO?

- Where can I find the Summary of Benefits and Evidence of Coverage to compare plans?

- What is covered in the new transgender health benefits under California law?

- How do I find if my doctor, hospital or provider is in-network?

- What is the difference between the “in-network” and “out-of-network” deductible?

- What is the difference between a deductible and the maximum out-of-pocket amount?

- How does the insurance company calculate what adds to the deductible and maximum out-of-pocket amounts?

- What are the benefits of a family plan?

- Who do I call if I have problem with my health plan?

- What do I do if my health plan rejects a claim or denies a procedure?

- Can I go out-of-network to get my “no cost” preventive care office visits?

- If I am traveling out of state, can I visit a doctor and will it be covered?

- Is family counseling covered under the mental health provisions?

- How do I find out which drugs are covered in the plan?

- What is a tiered drug formulary?

- I also have another health plan, which one will be primary pay?

Do Covered California CECs have the time to research health plan questions?

If most of the CECs can answer most of these questions I would be impressed. Most CIAs can’t answer all the questions. They have to spend hours on the phone or researching Evidence of Coverage documents to find the answers to specific questions and situations. Will the CECs perform the same due diligence in customer service? If a CEC gives wrong information or enrolls someone into the wrong plan are they held accountable?

It’s all about education and advocacy

Both CECs and CIAs have pledged to represent all the carriers fairly. CECs are under the additional restrictions of not being able to provide an opinion or recommend which health plan a family should select. If the CECs honor the pledge and have little background in how the health plans actually work, they are doing a disservice to their clients by not properly educating them on their best choices. Not only should CECs and CIAs enroll new members, we should also be advocates on their behalf. That takes time, knowledge and experience.

Will the CEC be there in the future?

Don’t get me wrong, the CEC program is a valuable resource for enrollment. Most of the CECs and Certified Enrollment Entities focus on Medi-Cal eligible individuals and families. Those are pretty simple enrollments and essentially hand the application over to the county for processing. But if the family’s income moves out of the Medi-Cal range, will the CEC be around to help guide them into a private health plan with premium assistance?

Clients hurt by health plan fine print

If you note a hint of frustration in my writing, you are correct. Covered California has elevated the CEC in-person assistance program to be equivalent to a trained, experienced and certified insurance agent. I’ve met many excellent CECs, but they have limited training and understanding of how health insurance really works. Their lack of knowledge and future availability to help their families leaves those people vulnerable to “fine print” of the health insurance companies. CECs can’t rely on Covered California for assistance with health insurance questions because the call center staff have no more back ground in how the health plans work than the in-person counselors.

Covered California is pushing quantity over quality

Over these last four months of open enrollment CIAs have logged thousands of hours working with Covered California and health insurance carriers to effectuate enrollment and provide necessary information to clients who seek our services. Covered California has conveniently ignored the complexity of health insurance and how it works. They only want to enroll families to meet their “numbers”. In this respect they are no better than some of the slick insurance agents and websites that put profits before people. Covered California is creating enrollment programs that focus on quantity as opposed to quality enrollments that best serve California residents.