Covered California builds small group health insurance exchange.

California’s health insurance exchange, Covered California, announced that Pinnacle Claims Management, Inc., will be leading the implementation of their small business group health insurance plans. Pinnacle will be the administrator for the Small Business Health Options Program (SHOP) authorized to be included for state health insurance exchanges in the Affordable Care Act.

Will California small business want to offer health insurance?

While having a fully functional small business portal is important, it still remains to be seen how many of the estimated 375,000 small businesses in California will actually participate. A major impetus for many small businesses, either sole proprietor or 2 to 50 employees, has come from either the owner or one of the owner’s family members not being eligible for an individual health plan because of a pre-existing condition. Small group plans are guarantee issue regardless of your medical conditions.

Guarantee issue is a game changer

With the introduction of guarantee issue individual and family plans through Covered California in 2014, there is one less reason to continue offering health insurance in a small group setting. In addition, small businesses face no penalties for not offering health insurance. Large employers, 51+ employees, face a variety of penalties if they don’t continue to offer health insurance to their employees after 2014. It might be very enticing for many small businesses that now have small groups to drop the plan, let the employees get insurance through Covered California, and have one less management headache to worry about.

Small group benefits package

Of course, there are numerous reasons why a small business should consider offering health insurance to their employees. [download id=”52″]

- A benefits package that includes health, dental, and vision helps attract and retain employees

- Health insurance premiums with held from payroll checks are pre-tax dollars and lowers income tax for employee and employer contribution for FICA.

- Potential Tax credits to the small business for offering health insurance.

- Vision and dental plans have traditionally been better values than similar individual plans

- May help lower workers’ compensation premiums

- Premium rate gap is diminishing between individual and small group plans.

Covered California small biz tax credit

Perhaps the biggest reason for a small business to offer health insurance to their employees is the potential tax credit. In 2014 employers with up to 25 FTE employees may be eligible for a 50% tax credit on the employer contribution of the employees health insurance premium. As usual, other rules and restrictions apply to this offer. [download id=”51″]

- Average employee wage must be $50,000 or less.

- Employers with 10 or fewer employees averaging $25,000 will get the maximum credit.

- Insurance must be purchased through Covered California to be eligible.

- Must contribute 50% to the employee’s health insurance premium

- Total tax credit can’t exceed total income and Medicare taxes withheld including employers share of Medicare tax.

Is the headache worth the tax credit?

One scenario might be if a small business has 3 employees, contributes 50% of their insurance premium and the total contribution for all 3 employees is $500 per month. If all the conditions are met, they could potentially earn a tax credit equal to 50% of their contribution or $3000 ($250 x 12 months). This effectively means the employer is only contributing 25% toward their employee’s health insurance. All businesses are different and their enrolled agent or CPA should be consulted on estimating their maximum tax credit.

Rates are equalizing

Individual and family plans (IFP) always used to have lower rates than small group plans. This was accomplished by insurance companies creating a pool of healthy people from the denial of coverage to those with pre-existing conditions, rating up those with certain medical conditions, and covering fewer benefits than small group plans. The ACA mandates that both types of health insurance, individual or small group, include coverage for the same ten Essential Health Benefits

- Outpatient services

- Emergency room

- Hospitalization

- Maternity and newborn

- Mental health and substance abuse treatment

- Prescription drugs

- Rehabilitative services

- Laboratory tests, imaging, x-rays

- Preventive and wellness office visits

- Pediatric services including oral and vision care

Maternity coverage, gender neutral rating

With both individual and small group plans being guaranteed issue and having the same benefits covered, the premium disparity that once existed has shrunk tremendously. Except for the guarantee issue, California has already mandated that individual plans have many of the same elements as small group plan offerings. All individual plans must include maternity as a covered benefit and the rates can’t be based on gender. Consequently, individual and family plans in California have spiked in advance of full implementation of the ACA. On the upside, Californians will experience a smaller sticker shock when the ACA goes live in 2014.

Still waiting for the actual plans

Because the small group plans to be offered under Covered California have not been released, it is hard to make any comparisons to current small group plans. Dental and vision plans under small group plans have usually been a little better than those offered on the individual market. The good dental and vision small group plans needs a minimum of 5 covered employees. Small businesses can also offer group life and disability insurance to their employees but these products won’t be offered thought the exchange.

Employee choice and number crunch

Employees will have to determine if they want to insure their family members under the small business plans offered. The employer is under no obligation to make any contribution to the dependents health insurance premiums. It might be that the employee can secure health insurance for his or her dependents at a lower monthly rate through the individual and family portal on Covered California. Individuals and families making up to 400% of the federal poverty line are eligible for immediate tax credits to lower their monthly premiums. In some cases, family members may qualify for expanded Medi-Cal and have no monthly premium payment.

Employer control over plans

Employers will select the metal level the employees can choose plans from (Bronze, Silver, Gold, Platinum).The metal levels reflect an increasing responsibility of the insurance company to pay for all incurred healthcare expenses as the value of the metal increases.

- Bronze 60%

- Silver 70%

- Gold 80%

- Platinum 90%

Employees may choose a plan that accepts their current doctor or hospital system. The employers will also determine the level of contribution they will make on behalf of each employee, whether they will make contributions to dependents and if dental or vision plans will be offered.

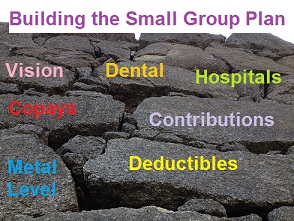

Easier building blocks, but still work

Overall, the path to building a small group plan should be easier with more options for the employees. The management decisions are the first task as the the small business owner needs to decide if it even makes financial sense to offer a group plan to the employees. It would be great if there was a small business calculator or spreadsheet for crunching some of those numbers. OK, I’ll work on that next week.