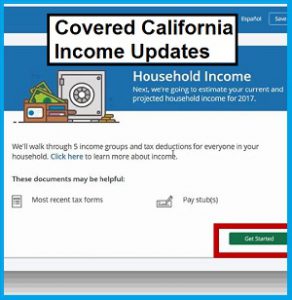

Covered California updates their income section to be more user friendly.

Covered California has made several changes to their income section both to the user interface and behind the scenes. In February, the income section of the online Covered California application was restyled to be more user friendly with little icons representing family members. Behind the scenes, new triggers for income verification were implemented. Plus, Covered California is trying to move away from consumers submitting affidavits and offering an income attestation form.

Income Section Make-Over

The overall theme of the new income page section seems to be to reduce consumer intimidation with data pack presentations. Instead of straight forward layouts where you enter income and dates, which was reflected in a spreadsheet format, the new format has the consumer move through multiple pages to enter the data. The new section is also meant to help guide consumers to providing the correct information and not make fatal income entries that lead to Medi-Cal eligibility.

Deleting Old Income Entries

An odd quirk of the new income section is that it retains date information. I attempted to update an income entry for a client that had previously had an end date associated with it. While the new entry looked good, and I indicated the income would continue into the future, the Covered California CalHEERS program would not add the income to total estimated income amount. The entry was there, but it wasn’t being added. As I worked with Covered California on the issue, the old end date briefly flashed on the screen in the edit window. I completed deleted the income entry and then added a new entry with the same income amount and the program took it and added to the household income.

Redetermination of APTC With Income Increases

One correction Covered California made to the rules governing the calculation of the monthly subsidy might shock some consumers. Previously, when a consumer or agent reported an increase to the household income, the Advance Premium Tax Credit (APTC) monthly subsidy was calculated based on the new monthly income. This resulted in some families receiving too much APTC for the year. The IRS calculates the Premium Tax Credit on the final Modified Adjusted Gross Income (MAGI) reported on form 8962 associated with the federal income tax form 1040.

Subsidies May Drop to $0

For example, the Brown family estimated their income at the beginning of the year to be $30,000. Covered California calculated they were eligible for a $6,000 annual Premium Tax Credit or $500 per month ($6,000 divided by 12 months.) Then in June, the Brown family reported a new annual income of $60,000. This new income level only made the Browns eligible for $2,500 Premium Tax Credit.

Under the old rules, Covered California recalculated the APTC to be $208.33 per month starting in July. That would have made their total APTC subsidy from Covered California to be $3,000 for the first six months and $1,249.98 for the second six months for a total amount of $4,249.98.

The IRS does not care if the Brown’s received too much APTC in the first six months of the year relative to their final MAGI. The Browns had to repay $1,749.98 in excess APTC they received based on their final MAGI of $60,000.

Under the new rules, Covered California will compare the dollar amount of the APTC the family had already received, against what the Premium Tax Credit will be for their new increased MAGI amount. Since the Brown’s had already received $3,000 in APTC, but are only eligible for $2,500 with the higher income, the subsidy for the enrollment months of July through December will drop to zero.

Download the most January 2017 amended Individual Eligibility and Enrollment Regulations at the end of the post.

6496. Eligibility Redetermination during a Benefit Year.

(m) redetermination in accordance with this section results in a change in the amount of APTC for the benefit year, the Exchange shall recalculate the amount of APTC in such a manner as to:

(1) Account for any APTC already made on behalf of the tax filer for the benefit year for which information is available to the Exchange, such that the recalculated APTC amount is projected to result in total APTC for the benefit year that correspond to the tax filer’s total projected premium tax credit for the benefit year, calculated in accordance with Section 36B of IRC (26 USC § 36B) and 26 CFR Section 1.36B-3; and

(2) If the recalculated APTC amount is less than zero, set the APTC provided on the tax filer’s behalf to zero

If an individual or family has moved from another state where they were enrolled in a state based exchange or a federally facilitated exchange such as Healthcare.gov, Covered California may not know how much APTC has already been forwarded on the consumer’s behalf. Consequently, if the new income is higher, the consumer should try to estimate what their Premium Tax Credit will be for the tax year and adjust any Covered California APTC so they don’t receive too much subsidy.

Self-Employed and Small Businesses

For people who are self-employed and run small businesses, it can be a chore to verify the household income. Covered California uses the federal hub to verify a variety of household information such as citizenship, lawful permanent residence, and income. They can get data from the last IRS tax return, but they cannot view the tax return. Covered California matches the reported household income on the application to IRS figures. Previously, if there was a deviation of 10% from the IRS figure and the Covered California number, that triggered a request to the consumer to verify their income.

Adjusted Gross Income on line 37 of the 1040 is different than the Modified Adjusted Gross Income reported on form 8962. Specifically, the MAGI can include non-taxable income such as Social Security retirement benefits, SSDI, and nontaxable interest. If the federal hub only contains line 37 dollar amount, a household member receiving Social Security benefits added into the MAGI could trigger an income verification request.

Increased Income Variation Before Income Verification Trigger

Under the new rules, the income deviation has been expanded to 25%. This should result in fewer people receiving requests for income verification. Within the ACA, a consumer can verify their income by submitting a notarized affidavit attesting to their estimated income on the Covered California application. However, these affidavits can be a hassle for the consumer to produce and even more difficult for Covered California to interpret. I have seen hand written affidavits that were accepted only because someone at Covered California could read cursive hand writing, which is becoming a lost art in the digital age.

From Affidavit to Attestation

Covered California now has their own attestation form that does not need to be notarized. It is similar to the attestation that a consumer is not incarcerated or has filed their income taxes. The income attestation form can be faxed or uploaded to the consumer’s Covered California account. I have read nowhere in the rules and regulations that affidavits will not be accepted. But I have heard from some consumers that Covered California will only accept affidavits from the consumer’s CPA. But that might be a misunderstanding.

Are You Dead?

Oddly, I have one client who received a Covered California letter requesting proof that she was not deceased. Seriously. We do not know how this happened. She is very much alive and has repeatedly tangled with Covered California over their goofy errors. Perhaps they wished she were dead. There is no attestation form to verify you are not deceased. In lieu of an official reporting, she wrote out in cursive hand writing

I, state your name, am not deceased. This statement is true and correct. Dated. Signed.

I guess Covered California will have to develop another form for people to attest to the fact that they are not dead.

[wpfilebase tag=file id=2138 /]

[wpfilebase tag=file id=2137 /]

Selected Sections of Covered California’s Individual Eligibility and Enrollment Regulations

6482. Verification of Family Size and Household Income Related to Eligibility Determination for APTC and CSR.

(b) For all individuals whose income is counted in calculating a tax filer’s household income, in accordance with Section 36B(d)(2) of IRC (26 USC § 36B(d)(2)) and 26 CFR Section 1.36B-1(e), or an applicant’s household income, calculated in accordance with 42 CFR Section 435.603(d), and for whom the Exchange has a SSN, the Exchange shall:

(1) Request tax return data regarding MAGI and family size from the Secretary of the Treasury and data regarding Social security benefits described in 26 CFR Section 1.36B-1(e)(2)(iii) from the Commissioner of Social Security by transmitting identifying information specified by HHS to HHS; and

(2) Proceed in accordance with the procedures specified in Section 6492(a)(1) if the identifying information for one or more individuals does not match a tax record on file with the IRS.

(c) For all individuals whose income is counted in calculating a tax filer’s household income, in accordance with Section 36B(d)(2) of IRC (26 USC § 36B(d)(2)) and 26 CFR Section 1.36B-1(e), or an applicant’s household income, calculated in accordance with 42 CFR Section 435.603(d), the Exchange shall request data regarding MAGI-based income in accordance with 42 CFR Section 435.948(a).

(e) An applicant’s annual household income shall be verified in accordance with the following procedures.

(1) The annual household income of the family described in subdivision (d)(1) shall be computed based on the tax return data described in subdivision (b)(1) of this section.

(2) An applicant shall attest to a tax filer’s projected annual household income.

(3) If an applicant’s attestation indicates that the information described in subdivision (e)(1) of this section represents an accurate projection of the tax filer’s household income for the benefit year for which coverage is requested, the tax filer’s eligibility for APTC and CSR shall be determined based on the household income data in subdivision (e)(1) of this section.

(4) If the data described in subdivision (b)(1) of this section is unavailable, or an applicant attests that a change in household income has occurred, or is reasonably expected to occur, and so it does not represent an accurate projection of the tax filer’s household income for the benefit year for which coverage is requested:

(A) The applicant shall attest to the tax filer’s projected household income for the benefit year for which coverage is requested; and

(B) The applicant’s attestation of the tax filer’s projected household income shall be verified in accordance with the process specified in Sections 6484 and 6486.

6484. Verification Process for Increases in Household Income Related to Eligibility Determination for APTC and CSR.

(a) The Exchange shall accept the applicant’s attestation regarding the tax filer’s annual household income without further verification if:

(1) An applicant attests, in accordance with Section 6482(e)(2), that a tax filer’s annual household income has increased, or is reasonably expected to increase, from the income described in Section 6482(e)(1) for the benefit year for which the applicant(s) in the tax filer’s family are requesting coverage; and

(2) The Exchange has not verified the applicant’s attested household income to be within the applicable Medi-Cal or CHIP MAGI-based income standard, in accordance with the process specified in Medicaid regulations at 42 CFR Sections 435.945, 435.948, and 435.952 and CHIP regulations at 42 CFR Section 457.380

(b) If the data sources described in subdivision (a)(1) of this section are unavailable the applicant shall provide additional documentation requested by the Exchange to support the attestation, in accordance with Section 6492.

6486. Alternate Verification Process for APTC and CSR Eligibility Determination for Decreases in Annual Household Income or If Tax Return Data Is Unavailable.

(a) A tax filer’s annual household income shall be determined based on the alternate verification procedures described in subdivisions (b) and (c) of this section if:

(1) An applicant attests to projected annual household income in accordance with Section 6482(e)(2);

(2) The tax filer does not meet the criteria specified in Section 6484;

(3) The Exchange has not verified the applicant’s attested household income to be within the applicable Medi-Cal or CHIP MAGI-based income standard, in accordance with the process specified in Medicaid regulations at 42 CFR Sections 435.945, 435.948, and 435.952 and CHIP regulations at 42 CFR Section 457.380

(4) One of the following conditions is met:

(A) The IRS does not have tax return data that may be disclosed under Section 6103(l)(21) of IRC (26 USC § 6102(l)(21)) for the tax filer that is at least as recent as the calendar year two years prior to the calendar year for which APTC and CSR would be effective;

(B) The applicant attests that the tax filer’s applicable family size has changed, or is reasonably expected to change (or the members of the tax filer’s family have changed, or are reasonably expected to change), for the benefit year for which the applicants in his or her family are requesting coverage;

(C) The applicant attests that a change in circumstances has occurred, or is reasonably expected to occur, and so the tax filer’s annual household income has decreased, or is reasonably expected to decrease, from the income obtained from the data sources described in Section 6482(b)(1) for the benefit year for which the applicants in his or her family are requesting coverage;

(D) The applicant attests that the tax filer’s filing status has changed, or is reasonably expected to change, for the benefit year for which the applicants in his or her family are requesting coverage; or

(E) An applicant in the tax filer’s family has filed an application for unemployment benefits.

(b) If a tax filer qualifies for an alternate verification process based on the requirements specified in subdivision (a) of this section and the applicant’s attestation to projected annual household income, as described in Section 6482(e)(2), is no more than 25 percent below the annual household income computed in accordance with Section 6482(e)(1), the applicant’s attestation shall be accepted without further verification.

(c) If a tax filer qualifies for an alternate verification process based on the requirements specified in subdivision (a) of this section and the applicant’s attestation to projected annual household income, as described in Section 6482(e)(2), is greater than 25 percent below the annual household income computed in accordance with Section 6482(e)(1), or if the tax data described in Section 6482(b)(1) is unavailable, the Exchange shall verify the applicant’s attestation of the tax filer’s projected annual household income in accordance with the following procedures:

(1) The Exchange shall use:

(A) Annualized data from the MAGI-based income sources, as specified in Section 6482(c); or

(B) Other HHS-approved electronic data sources

(2) If the applicant’s attestation indicates that the information described in subdivision (c)(1) of this section represents an accurate projection of the tax filer’s household income for the benefit year for which coverage is requested, the Exchange shall determine the tax filer’s eligibility for APTC and CSR based on the household income data in subdivision (c)(1) of this section.

(3) If electronic data are unavailable or the applicant’s attestation to projected annual household income, as described in Section 6482(e)(2), is more than 25 percent below the annual household income computed using data sources described in subdivision (c)(1) of this section, the Exchange shall follow procedures specified in Section 6492(a)(1) through (4).

(4) The Exchange shall accept the applicant’s attestation without further verification if:

(A) The applicant’s attestation to projected annual household income, as described in Section 6482(e)(2), indicates that a tax filer’s annual household income has increased, or is reasonably expected to increase, from the data described in subdivision (c)(1) of this section for the benefit year for which the applicant(s) in the tax filer’s family are requesting coverage;

(B) The Exchange has not verified the applicant’s attested household income to be within the applicable Medi-Cal or CHIP MAGI-based income standard, in accordance with the process specified in Medicaid regulations at 42 CFR Sections 435.945, 435.948, and 435.952 and CHIP regulations at 42 CFR Section 457.380; and

(C) The applicant’s attestation to projected annual household income specified in subdivision (c)(4)(A) of this section is reasonably compatible with other information provided by the applicant, if applicable. If the Exchange finds that the applicant’s attestation is not reasonably compatible with other information provided by the applicant, the Exchange shall request additional documentation from the applicant in accordance with the procedures specified in Section 6492.

6492. Inconsistencies.

- a) Except as otherwise specified in this Article, for an applicant whose attestations are inconsistent with the data obtained by the Exchange from available data sources, or for whom the Exchange cannot verify information required to determine eligibility for enrollment in a QHP, or for APTC and CSR, including when electronic data is required in accordance with this section but data for individuals relevant to the eligibility determination are not included in such data sources or when electronic data from IRS, DHS, or SSA is required but it is not reasonably expected that data sources will be available within one day of the initial request to the data source, the Exchange:

(1) Shall make a reasonable effort to identify and address the causes of such inconsistency, including through typographical or other clerical errors, by contacting the application filer to confirm the accuracy of the information submitted by the application filer;

(2) If unable to resolve the inconsistency through the process described in subdivision (a)(1) of this section, shall:

(A) Provide notice to the applicant regarding the inconsistency; and

(B) Provide the applicant with a period of 95 days from the date of the notice described in subdivision (a)(2)(A) of this section to either present satisfactory documentary evidence through the channels available for the submission of an application, as described in Section 6470(j), except by telephone, or otherwise resolve the inconsistency.

(6) When electronic data to support the verifications specified in Section 6478(d) or Section 6480 is required but it is not reasonably expected that data sources will be available within one day of the initial request to the data source, the Exchange shall accept the applicant’s attestation regarding the factor of eligibility for which the unavailable data source is relevant.