Covered California has decreased the copayments for many health care services in 2017. This applies pressure on the insurance companies to increase the rates to cover the additional claim expenses not covered by the consumer.

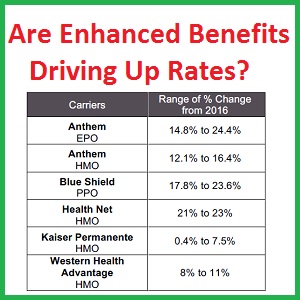

Many Californians are facing sticker shock over the new health insurance premiums for their 2017 individual and family plans. Covered California and the insurance companies have pointed the finger at the elimination of the Affordable Care Acts reinsurance provision for the health plans. However, another contributing factor is the lower copayments on specific benefits Covered California has mandated in the new health plans. Consumers will be paying less for some out-of-pocket expenses. As the health plans must make up the difference for consumer’s lower cost-sharing, the rates must inevitably reflect this reality.

What is driving up health insurance rates?

By far the largest force driving the 2017 health insurance rates higher is elimination of the reinsurance program.

Covered California 2017 Health Plan Rate Book

In many ways 2017 will be a transitional year for premium rates in California and across the nation, primarily due to the end of the Affordable Care Act’s reinsurance, a program that subsidized health care plans that enrolled higher-cost individuals. Reinsurance was designed to help keep rates down during the first three years of the exchanges to stabilize the market and attract more consumers to build a healthy risk mix. Covered California estimates that this one-time adjustment added between four and six percentage points to this year’s rate change.

[wpfilebase tag=fileurl id=1584 linktext=’Covered California 2017 Rate Booklet’ /]

More people using more health care services

Other contributing factors, outside of the reinsurance program, cited by different health insurance companies, are higher than expected utilization of health care services by their members. In other words, health plan members had more health care challenges that needed care than they anticipated. The cost of providing health care was exacerbated by some individuals who purchased health insurance through the Covered California enrollment system with a fraudulent qualifying event for a Special Enrollment Period.

Deductibles and Maximums increase in 2017

One of the first things consumers will notice is that the deductible and maximum out-of-pocket amounts have increase for most of the metal tier level plans. Even though those maximum caps have increased, there has been a decrease in many routine copayments that the vast majority of consumers use on a regular basis. For example, the office visit copayment was decreased for the Silver through Platinum level plans. The copayment for urgent care services was decreased to mirror the office visit copayment.

Copayments reduced or eliminated in 2017 health plans

The Emergency Room Physician Fee copayment was eliminated on all plans. California is one of a handful of states that prevents most hospitals from hiring doctors. So doctors always bill separately for most hospital health care services they perform. Now, the insurance company will have to absorb the bill from the attending physician in the ER. Of course, the ER Facility Fee copayment was increased potentially offsetting any reduction in the Physician Fee copayment.

Table of Consumer Cost-Sharing Changes

The dollar figures in Red indicate the amount that the copayment decreased from 2016 to 2017 standard benefit design health plans. Blue dollar amounts represent and increase.

| Benefit | Bronze | Silver | Gold | Platinum |

| Office Visit Copay | $5 | ($10) | ($5) | ($5) |

| Specialist Visit Copay | $15 | $0 | $0 | $0 |

| X-Rays | $0 | $5 | $5 | $0 |

| Imaging | $0 | $50 | $25* | $0 |

| ER Facility Fee | $0 | $100 | $75 | $0 |

| ER Physician Fee | No Charge | ($50) | No Charge** | No Charge** |

| Urgent Care | ($45) | ($55) | ($10) | ($25) |

| Drugs | ||||

| Tier 2 | $0 | $5 | $5 | $0 |

| Tier 3 | $0 | $10 | $5 | $0 |

| Medical Deductible | $300 | $250 | $0 | $0 |

| Max. Out of Pocket Ind. | $300 | $550 | $550 | $0 |

| *Copayment Plan Only | ||||

| **Coinsurance Plan Only | ||||

| Silver 73 | Silver 84 | Silver 94 | ||

| Office Visit Copay | ($10) | ($5) | $0 | |

| X-Rays | $15 | $0 | $0 | |

| Imaging | $50 | $0 | $0 | |

| ER Facility Fee | $100 | $25 | $20 | |

| ER Physician Fee | ($50) | ($40) | ($25) | |

| Urgent Care | ($50) | ($20) | ($1) | |

| Drugs | ||||

| Tier 2 | $5 | $0 | $0 | |

| Tier 3 | $5 | $0 | $0 | |

| Medical Deductible | $300 | $100 | $0 | |

| Max. Out of Pocket Ind. | $250 | $100 | $100 |

Tier 4 Cost Cap

A large consumer benefit that was instituted in 2016 was the maximum prescription drug cost. For Silver through Platinum Plans, after any applicable pharmacy deductible, Tier 4 specialty drugs are capped at $250 per month. While this is great protection for the consumer, the health insurer must still grapple with the escalating cost of specialty drugs on the market. This again increases pressure to increase rates to cover pharmaceutical costs.

No copayment increase is real consumer benefit

The combination of a decrease in the copayment for some health plan services, coupled with no net increase on other benefits, is one driver of increasing health insurance rates. The bulk of health care utilization that generates claims to the health plans are the regular routine office visits, labs, and prescription drugs. Most consumers never require a health care service that is subject to the deductible. Most people never have to use the emergency room. Most consumers never hit their maximum out-of-pocket amount which triggers the health plan to pay 100% of all covered benefits.

Where is the consumer choice?

The voice, or stakeholder, who is missing in the design of the health plans are the vast number of individuals and families who purchase these plans. For many people, they would rather have a higher emergency room or urgent care copayment if it translates into a lower monthly premium rate. In other words, one size of health plan does not fit all people. Consequently, we have relatively good plans designed by Covered California that help many consumers reduce their routine out-of-pocket cost. But lower consumer cost-sharing translates into higher health insurance premiums.