Some Covered California consumers will need to get a second revised 1095-A in order to file their federal taxes.

Consumers who purchased health insurance through Covered California may be receiving revised 2016 1095-As without requesting one. The revised 1095-As are popping up in consumer’s Covered California accounts and being mailed to them. Consumers should carefully compare the original 1095-A sent out by Covered California to the revised document to make sure it is correct.

Revised 1095-A Without Consumer Request

For one family, Covered California originally issued a 1095-A on January 12, 2017. Covered California issued a revised 1095-A on February 1, 2017. The original 1095-A only included the household members as of the end of the year. The revised 1095-A included their daughter who was on the family plan through the first half of 2016 and then left when she gained employer sponsored health insurance.

However, the daughter was not a dependent to the primary tax filer and should have received her own 1095-A. The revised 1095-A also had indicated the family was receiving the month Advance Premium Tax Credits (APTC) for every month, when in reality, they opted against having any APTC applied for most of the year. The original 1095-A was actually closer to being correct for the household than the revised version.

The CalNOD62B_2016 notice the family received with the revised 1095-A noted,

You are getting this letter because Covered California has received new information from you or your health plan carrier. As a result, we have corrected or voided your Internal Revenue Service (IRS) Form 1095-A.

The family is confused about what new information was sent to Covered California. Because they have switched health plans in 2017 from their 2016 health insurance, they are having a difficult time getting information out of the 2016 carrier.

What consumers must do is reconstruct their payment history with their health plan for 2016 if they think either the original or revised 1095-A is in error. This means getting the billing statements and record of payments to the health plan for 2016. If changes were made to the Covered California (removing or adding a household member, changing APTC amount, etc.) they can review those changes, and when they occurred, through the Transaction History page of the Summary page of their Covered California account. Consumers can then compare the APTC received by the health plan to lower their monthly rate with what Covered California states on the 1095-A.

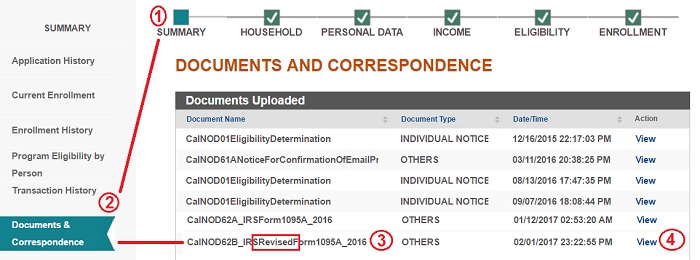

To find all your 1095-As: From Covered California Home Page 1. Click on Summary. 2. Click on Documents & Correspondence. 3. Find original or Revised 1095-A. 4. Click View to download a copy to your computer.

It’s also possible that the consumer indicated an adult child was a dependent when he or she was really not. Children can stay on the family plan until age 26, but may also be filing their own tax return. The 1095-As may not accurately reflect this situation and may need to be corrected. But before a consumer requests either a first or second revision of their 1095-A, they should know exactly what the APTC amounts should have been as documented by the health plan premium invoices they paid.

Online Covered California 1095-A Dispute Form

Resources For Covered California 2016 1095-As

[wpfilebase tag=list id=389 pagenav=1 /]

What is The SLCSP or Second Lowest Cost Silver Plan?