Outreach, sales and marketing is the largest budget expense for Covered California for fiscal year 2017 – 2018.

Covered California will spend 1/3 of its operating budget for fiscal year 2017 – 2018 on marketing health plans for the health insurance companies. $105 million will be spent by Covered California to encourage consumers to enroll in health insurance with most of the marketing money being spent during open enrollment for 2018. In an era when many people accuse health insurance companies of spending too much money on marketing and administration, and not enough on health care for its members, should Covered California be spending over $100 million to promote these very health insurance companies?

34% Of Budget For Marketing Insurance Companies

Covered California is funded entirely from a 4 percent assessment or commission from the health plans that consumers enroll into for individuals and families. The assessment on small group enrollments is 5.2%. If a family of four enrolls in an individual and family health plan through Covered California and the total unsubsidized premium amount is $1,200 per month, Covered California assesses the health plan $48 or 4%. Covered California does not receive any state or federal funding – excluding the original grant money to develop the exchange back in 2013.

The current enrollment for Covered California individual and family plans is approximately 1.34 million individuals with another 36,600 small group members. For fiscal year 2017 – 2018, Covered California is estimating that individual and family enrollment will climb to 1.40 million and small group will grow to 54,210. The projected 2017 – 2018 enrollment will generate revenue of $314.4 million, which includes $1.1 million from the assessment on individual and family dental insurance enrollments according to the FY 2017 – 2018 budget.

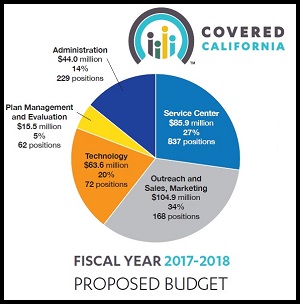

Covered California is proposing spending $313.9 million for fiscal year 2017 – 2018

The 2017 – 2018 fiscal year Covered California budget shows 34% of their budgeted expenses going toward sales and marketing efforts on behalf of health insurance companies.

- Administration $44 million, 14%

- Customer Service Center Operation $85.9 million, 27%

- Plan Management and Evaluation $15.5 million, 5%

- Technology, CalHEERS $63,6 million, 20%

- Outreach, Sales, and Marketing $104.9 million, 34%

The biggest expense is advertising, essentially on behalf of health insurance companies. The only way an individual or family can be determined eligible for the monthly tax credit subsidy to lower their health insurance is by enrolling through Covered California. The health insurance companies still collect the full premium amount from subsidized consumers: the subsidized amount from the consumer and the remaining subsidy from Covered California.

There is obviously a value added benefit for families to enroll in health insurance through Covered California because of the potential reduction in the monthly premium with the subsidy. Plus, the consumer pays no additional fee or premium amount to go through Covered California or use a Certified Insurance Agent to help them enroll in a health plan.

Health insurance companies also sell plans off-exchange or directly to consumers. But there is no ACA subsidy for off-exchange plans. The rates for the standard benefit design plans through Covered California must be mirrored to off-exchange consumers. In other words, the family of four who enrolled in a health plan through Covered California and the monthly premium was $1,200; would pay the same unsubsidized premium amount if they went direct to the health insurance company. However, for off-exchange enrollments, the health insurance companies don’t have to pay Covered California the 4% assessment.

Within the FY 2017 – 2018 budget, Covered California estimates there are approximately 800,000 individuals enrolled in off-exchange plans that are equivalent to the plans offered through Covered California. The presentation at the Covered California Board meeting in May noted 1.1 million individuals in off-exchange plans. The difference might be in grandfathered and non-standard benefit plan off-change enrollments, in addition to, the standard benefit design plan enrollment.

Both the Covered California Board presentation and the budget mentioned that when the 4% assessment is spread out of over the total enrollment for the health plans, on- and off-exchange, the net assessment is 2.5%. But that is assuming that each health plan or health insurance company has the same mix of enrollments, 60% on-exchange and 40% off-exchange. Some health plans such as L.A. Care Covered or Molina may have the bulk of their individual and family enrollments come through Covered California. This would mean they are paying a higher percentage in assessments to Covered California than an insurance company that has a lower percentage of their enrollments through Covered California.

But why is the assessment even significant and why does Covered California try to minimize the expense to the health insurance industry. First, 4% percent is a good chunk of change for some of the plans. Agents, on the high side, only earn a 2% commission, and the average is below that number because each health plan has a different agent compensation model. Second, I assume that this assessment becomes an expense and part of the Medical Loss Ratio. Under the ACA, individual and family health plans must spend 80% of their health care premiums on health care expenses or improvements to the quality of care. That leaves them 20% for administration, compliance, sales and marketing efforts. It’s good marketing spin to minimize the average cost for health plans participating in Covered California from 4% down to 2.5%.

If Covered California is doing the bulk of advertising, and driving consumers into health plans, the insurance companies can spend less on their own marketing efforts. This might be a good situation for the health insurance companies who have larger off-exchange enrollments because they can focus on those consumers for whom they won’t have the recurring 4% assessment. Unfortunately for the health plans who derive 80% or more of their enrollments from Covered California, they are realizing a higher cost of doing business with the exchange than carriers who have a more diversified book of business.

In a certain sense, Covered California is no different than any other agent trying to enroll consumers and earn a monthly commission. I suppose there are other industries that must spend 1/3 of their forecasted revenue on marketing just to maintain their sales, but the percentage seems excessive on the face of it. You have to wonder how sustainable a business model is if spending 33% of the budget on marketing is necessary for survival. It also raises the question of if the exchange based model is the most efficient means of qualifying consumers for the Premium Tax Credit and distributing the subsidy.

Many of these same health insurance companies also sell Medicare Advantage plans. When they enroll a Medicare beneficiary into one of their Medicare Advantage Plans, Medicare pays them a monthly contracted rate. Medicare does not engage in advertising on behalf of the health insurance companies. The insurance companies do all their own marketing. In short, many of these companies are already qualifying individuals for enrollment into Medicare Advantage plans and receive the subsidy payment directly from the federal government. There is no exchange to promote their business or distribute the subsidy dollars to them.

The primary mission of Covered California is to determine the eligibility of consumers for either Medi-Cal or the Advance Premium Tax Credits. They have actually helped more people enroll into Medi-Cal than a Covered California private plan for which they received the 4% assessment. To a certain extent, their marketing activities are also subsidizing the California Department of Health Care Services which administers Medi-Cal in cooperation with the counties’ social services departments. In an indirect way, the assessments the health plans pay to Covered California are helping people who are not eligible for a private plan at least get health insurance through Medi-Cal.

The Covered California marketing expense may actually be more efficient than if all of the health plans ran their own campaigns. Covered California is helping drive people to review all their options for health insurance within the exchange. However, the health insurance companies also offer off-exchange plans known as non-standard benefit designs. These plans still meet the actuarial metal tier levels of Bronze or Silver, but they may have deductibles, copays, and coinsurance that are different from the Covered California Qualified Health Plan design. (Qualified in the sense that they are eligible for the tax credit subsidy.)

To maximize the marketing and enrollment efforts, Covered California should also allow these non-standard benefit design plans to be sold through the exchange. In this manner, Covered California could truly become the complete exchange for ALL individual and family plans offered to consumers in the state. The Covered California system is good at allowing people to compare their health insurance options. If this model is good enough for the Qualified Health Plans, it is good enough to include the non-standard benefit design plans. If all of the enrollments went through Covered California, all of the health plans would be realizing the same cost of doing business as all of their individual and family plans sold would be subject to the 4% assessment.

[wpfilebase tag=file id=2163 /]

[wpfilebase tag=file id=2162 /]