Filtering Health Plan Selection Based on Providers, Hospitals, Drugs, Plan Type, and Monthly Rates

Health insurance can be horribly confusing. Figuring out which health plan is best for you and your family can be a chore, especially if you have multiple carriers and plans types to choose from. One simple approach to selecting a health plan is to filter out plans that don’t offer what you need. Then you can focus on those plans that do meet your priorities for providers, hospitals, prescription medications, plan type, cost sharing, and finally, the monthly premium.

Creating A Health Plan Coverage Table

Whenever someone contacts me for assistance for figuring out which health plan is best for them, I don’t ask how much they can afford, but rather, which doctors to they want to see. Each health plan has a network of doctors, hospitals and other providers. It can be daunting, but you need to confirm if the doctors you need and want to keep are in-network for the health plan by doing an online provider search. This should be followed up with a call to the provider’s office to confirm they are in-network.

Narrow you your health plan options by determining which of your doctors are in-network with available health plans being offered to you.

Which Health Plans Does Your Preferred Doctors, Hospitals, Labs Accept?

Don’t accept a provider office’s response that they take any PPO plan. That just means they will submit a claim on your behalf to the PPO plan, but they still may be out-of-network. If the provider is out-of-network you’ll have to pay the full amount for the health care services until you reach any out-of-network deductible. Your best value is always visiting in-network providers.

Not all health plans cover all Brand Name drugs, and they may be in different tier levels adding to the expense of monthly health care costs.

Does The Health Plan Covered Your Prescription Drugs And At What Tier Level?

While many generic drugs are covered by most all health plans, they don’t always cover many specific Brand Name drugs. You need to review the health plan’s drug formulary to confirm if your specific drug is covered. If several health plans cover your medication, look to see what Tier level the drug is under. Drug plans usually have four Tiers with Tier 1 being the least expensive for generics. Some plans may cover your drug in Tier 2, while another plan may offer it in Tier 3. The difference in Tier levels can easily mean another $25 per month in prescription drug costs or more on a single prescription.

Health Care Services Table

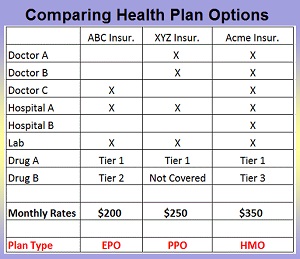

Before I start gathering coverage information, I create a table with preferred or “must have” providers, hospitals, and drugs in rows, with the available health plans across the top columns. I then mark which health plan has the providers in-network and if the drugs are covered and at which Tier.

Creating a health plan services or coverage table will allow you to compare health plans side by side for elements that you want in your health insurance.

In this example, ABC and XYZ insurance have some of the providers in-network, but not all. Only Acme insurance has all the providers and drugs covered, but Drug B is going to cost a little more because they have it listed as a Tier 3 drug.

But just because Acme Insurance has all the bases covered, that doesn’t automatically mean you should select that health plan. If the plans are essentially the same, let’s say a Silver Plan with a $2,500 deductible and the office visit, labs, and drug copays the same, you need to compare the monthly rates against the health care providers and drug coverage.

Even though Acme Insurance covers everything you need, it is $150 more per month than the least expensive ABC Insurance. Is Acme Insurance worth $150 more per month? Is it mission critical that you see Doctor A and B? Can you live without having Hospital B in-network? And remember that Drug B is going to cost a little bit more per month because it is Tier 3.

For some people, they will take the savings provided by ABC Insurance and pay out-of-pocket to see Doctors A and B out-of-network if necessary. XYZ Insurance is still less expensive than Acme, it just doesn’t cover Drug B. Again, how essential is it that you have Doctor C or Hospital B in-network? Perhaps you can meet with your doctor to find another suitable drug that is on the XYZ Insurance drug formulary since your current Brand Name drug is not covered. You can also appeal to have your medication included in the drug formulary.

Finally, you need to consider if the plan’s organizational type (EPO, HMO, or PPO) are what you want in a health plan.

- EPO, Exclusive Provider Organizations, allows you to see any provider in-network, but they don’t cover any of the costs to see an out-of-network provider.

- PPO, Preferred Provider Organization, allows you to see any provider in-network, and after any applicable out-of-network deductible, the plan may cover part of the cost for out-of-network providers.

- With an HMO, Health Maintenance Organization, you must visit your Primary Care Physician first, then if necessary, he or she will refer you to a specialist. HMOs, like EPOs, cover no out-of-network costs.

For some people, XYZ Insurance may look the most appealing. Since it is a PPO, they might get some cost sharing for their out-of-network health care services for providers who are not covered as in-network. Neither ABC nor Acme Insurance will cover any out-of-network costs because they are an EPO and HMO respectively.

While creating a health care services table by insurance plan won’t answer all your questions or make the final decision on which plan to choose, it should add some clarity and confidence in making your final decision because you have compared the health plans to one another based on health care services and prescription drug that are important to you and your family.

Watch the video I created that goes through the steps of creating a health care coverage table.