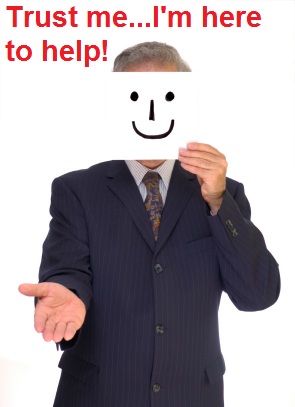

Even though the insurance industry lost the battle against the Affordable Care Act, they still wage a war to weaken the mandates and regulations contained within healthcare reform. They cloak their opposition in the form of membership and donations to organizations that appear to be consumer friendly but advocate for changes in the ACA that will benefit the insurance companies.

Coalition to weaken healthcare reform

The Essential Health Benefits Coalition (EHBC) seeks to weaken or strip away the ten essential health benefits that the ACA mandates should be included in all new health insurance plans.

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services, including behavioral health treatment

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services and chronic disease management, and

- Pediatric services, including oral and vision care

EHBC states, “The coalition is committed to adoption of an essential health benefits package that is affordable and flexible in order to better enable employers and individuals to obtain and maintain health care coverage.”

The terms affordable and flexible are meant to appeal to consumers. The real aim is to reduce the potential costs to employers and insurance companies. Through supporting the EHBC, insurance companies can maintain an “arms length” distance from the lobbying efforts to weaken the ACA while they promote themselves as advocates for health care services.

A list of EHBC members reveals the true intent of this front group of a coalition: U.S. Chamber of Commerce, National Federation of Independent Business, National Association of Manufacturers, National Association of Wholesaler-Distributors, National Association of Health Underwriters, Blue Cross and Blue Shield Association, Retail Industry Leaders Association, Prime Therapeutics, America’s Health Insurance Plans, Express Scripts, Inc., Pharmaceutical Care Management Association, American Osteopathic Association, National Association of Dental Plans, Delta Dental Plans, Council for Affordable Health Insurance, Communicating for Agriculture, and The IHC Group

Trade or Collusion Group?

Another group that has long lobbied against healthcare reform is America’s Health Insurance Plans (AHIP). This health insurance trade group is active in representing health insurance issues at the federal level. One of their stated missions is to advocate for public policies that expand access to affordable health care coverage to all Americans through a competitive marketplace. All of the Board of Directors are from health insurance companies.

AHIP has consistently taken positions against the ACA. They have come out against the health insurance tax, minimum essential benefits, restrictions on age ratings and the personal coverage requirement in terms of the guarantee issue. Just like the EHBC, AHIP pounds away at the potential increased costs of coverage as an argument to weaken the ACA. It remains to be seen how much premiums will rise because of all the mandates. What is clear is that many people in the individual market will finally have access to comprehensive health insurance and not the loop-hole filled plans of the past.

In 2012, AHIP spent $9,340,000 on lobbying efforts on behalf of health insurance companies. Of course, this was in addition to the millions of dollars spent by health insurance companies independently.

Helping the consumer or the insurance industry?

Another warm and fuzzy sounding organization is Foundation For Health Coverage Education (FHCE). They state, “Our mission is to simplify public and private health insurance eligibility information in order to help more people access coverage.” The stated purpose of founder AND insurance-industry veteran Phil Lebherz was to publicize the numerous free and low-cost health coverage options that people might be eligible for but not enrolled. The primary reason people who want insurance but don’t have it is because of cost or they were denied because of pre-existing condition.

While it is a laudable goal to help people find health insurance they may qualify for, a big emphasis is connecting people to tax-payer supported Medicaid programs and high-risk pools. Health insurance companies would rather have the government take on the risk of people with chronic medical issues so they don’t have to. With guarantee issue as part of the ACA, the insurance companies are fearful of what those medical expenses will do to their bottom line. From their perspective it is better that the tax-payer underwrite the health insurance and accept the risk.

Pushing people onto government programs

One of the confounding threads of logic concerning health care reform from many of these organizations is the advocacy of increased subsidies for those who can’t afford insurance. They want to reduce taxes, reduce benefits to reduce premiums and at the same time push off the high expense medical consumer on the government. This just spreads the costs across all tax-payers but spares the insurers from losses.

A look at FHCE Advisory Board gives you a hint at the political bent of the foundation.

Carly Fiorina: as a Republican candidate for Senate in California she advocated for the repeal of healthcare reform.

David Helwig retired President and CEO of West Region for Wellpoint, Inc. parent company of Anthem Blue Cross.

Leonard Schaeffer past Chairman and CEO of Wellpoint. Wellpoint, it should be pointed out, purchased an administrator of state Medicaid programs so they are set to reap the benefits of expanded Medicaid enrollment under the ACA.

Congressman Tom McClintock (R): voted for the Ryan Budget Bill that would end Medicare as we know it, eliminate funding for State Health Insurance Exchanges and repeal the ACA.

FHCE claims to be non-partisan but their board speaks for itself. These are not the people I can trust to really steer a health insurance advocacy foundation in the best interest of those without health insurance. I suspect their real aim is to keep those most in need of health insurance, those with chronic medical conditions, away from private insurance companies and on government programs.

Underwriters of bigger commissions

National Association of Health Underwriters (NAHU) is yet another organization with close connections to the health insurance industry. Comprised of health insurance agents, don’t let the term underwriter mislead you, health insurance companies are members at the local chapters and sponsor many of their events. The legislative priorities of NAHU for 2012 mirrored many of the insurance carrier’s priorities as well. Virtually all of their priorities centered on weakening the ACA.

Reform Medical Loss Ratio: remove agent commissions from the administrative costs of insurance company. An agent commission is just another marketing cost. As an agent I know. Most of my time is spent on marketing and administration on behalf of clients. There is no healthcare service component to an agent commission.

Containing Health Care Costs: removing benefits and coverage mandates of the ACA. This will do nothing to lower health care costs but it will reduce premiums.

Making Health Coverage more Affordable: allowing individuals to receive subsidies outside of the state health insurance exchange. This will lead to an increased market for agents and more opportunity for fraud. Again, NAHU wants the tax-payer subsidies to help them increase their potential client base that will be steered toward a state exchanged where they will receive little if any compensation from.

These legislative priorities seem to have been written by the insurance companies themselves. As an insurance agent, my number one priority is to get the best plan for the client.

Secret council of health insurance

Finally, there is this little funky organization called Council For Affordable Health Insurance (CAHI). The CAHI website gives no clue as to who funds their operations. But it is safe to say they really don’t have the consumer’s best interest at heart.

The Council for Affordable Health Insurance (CAHI) is an association of insurance companies, actuarial firms, legislative consultants, physicians and insurance agents. We provide educational materials for consumers, legislators, employers and other interested parties.

Some how a council made up of insurance, actuarial folks, political consultants and agents doesn’t sound like the best mix of people to develop affordable health insurance alternatives.

As far as I can tell, all they do is pump out reports that advocate against any healthcare regulation that might impact the health insurance industries profits. Part of this is advocating for expanded tax credits for the uninsured and funding high-risk pools. It is odd that these conservative organizations are always supporting increased government money when they claim government is the problem.

They also want to eliminate state mandates and allow for reasonable underwriting. The latter is essentially a call to scrap guarantee issue health insurance. They claim that having to insure sick folks will raise the cost for everyone else. Essentially, they want to scrap the ACA and let insurance companies go back to either denying people health insurance or tack on addition rate increases for their medical conditions. No surprise here, they praised the Republican Party’s Platform that called for the repeal of the ACA.

Look behind the consumer friendly name

More front organizations for the health insurance industry seem to be popping up everyday. They masquerade as business and consumer friendly groups but are really lobbying on behalf of the insurance industry. Part of the strategy is create enough independent sounding organization advocating the positions of the insurance industry to create a critic mass of credibility. As in, “With so many consumer organizations claiming guarantee issue health insurance is evil, it must be evil.” The problem is these front organizations are often times puppets and the strings are being pulled by the the insurance industry.