California individual and family plans include benefits for home health care and skilled nursing facility care. These benefits are available to individuals who enroll in a health plan through Covered California or direct from the carrier.

The vast majority of people will never use either home health care or skilled nursing facility benefits of their health plans. However, these benefits, after you have been discharged from the hospital, can greatly aid recovery after surgery or other debilitating illness. There are limits on the services provided and, depending on the health plan, they can be expensive.

It is always more pleasant to recuperate at home if you are ambulatory after your illness or accident. While you may be able to get to the bathroom and dress yourself, you may need still health care provided by nurse, physical or occupational therapist. The home health care benefit does not include a live-in assistant. They are limited to daily visits by a health care professional.

For specific benefits and costs of the home health care and skilled nursing facility benefit consult your health plans summary of benefits and Evidence of Coverage documents.

Home Health Care Benefits

The first step is to have a written treatment plan developed by your attending physician. The home health care must be authorized by the health plan. There will be specific orders for the type of home care you need such as

- Registered Nurses

- Physical Therapists

- Occupational Therapists

- Speech and language pathologists

- Licensed clinical social worker

- Home Health Aides

- Related medical supplies

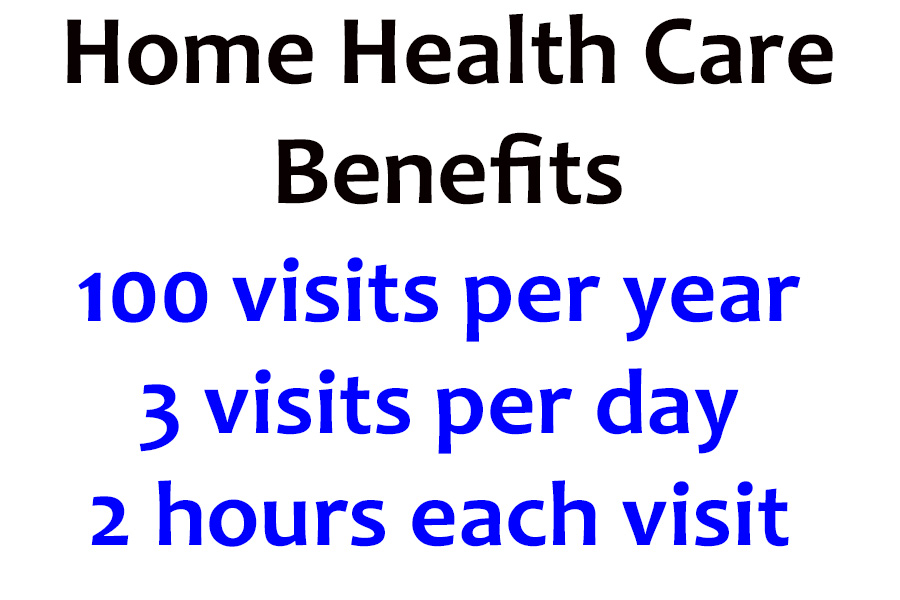

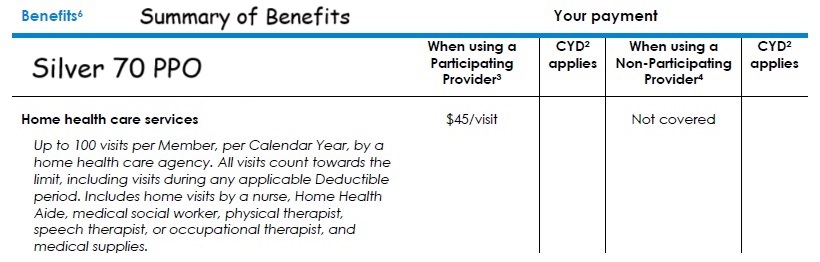

There are maximum of three visits per day. This might be a combination of a visit from a nurse, home health aid, or physical therapist. Each visit cannot be longer than 2 hours in duration. The home health care must be from an in-network provider for the health plan to cover the costs.

The health plans will cover up to 100 visits. This translates into almost five weeks of home health care visits if three visits were provided each day. If you receive only one visit per day, you may receive services for over three months.

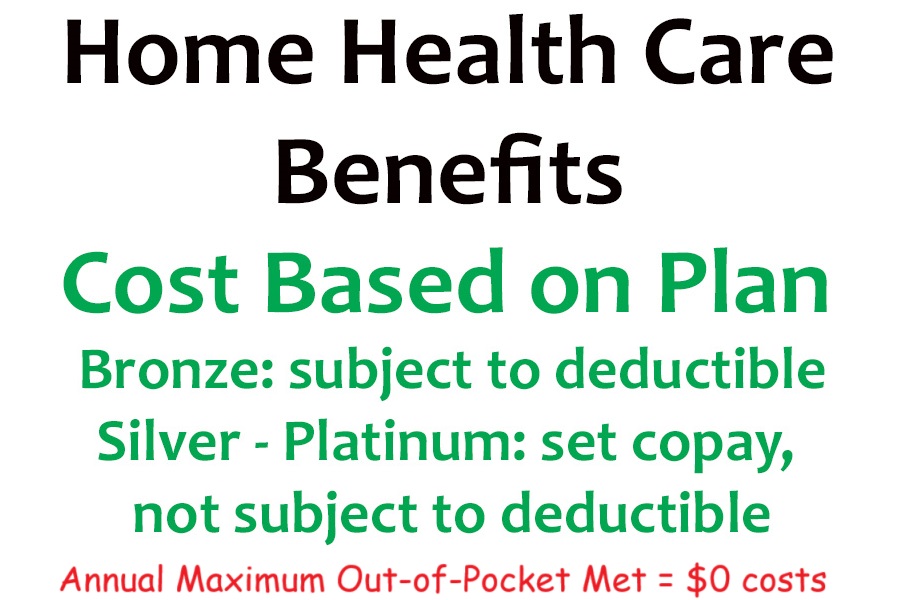

The copayment or coinsurance of the home health care service will be determined by the metal tier of the health plan. For example, home health care services under the Silver 70 metal tier plan have a $45 copayment is not subject to meeting the medical deductible. With a Bronze plan, if you have not already met the medical deductible, you will have to move through the deductible before you go into coinsurance. If you have met your maximum out-of-pocket amount of the health plan for the year, then there will be no cost for the services.

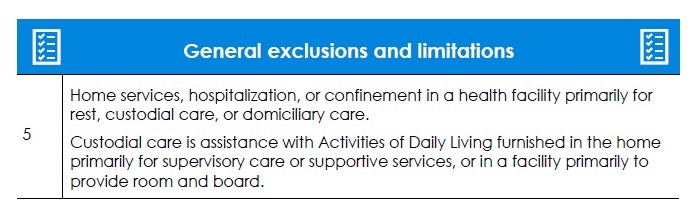

The home health care services are focused on treating medical conditions. The services are not to be a form of custodial care or assistance with housekeeping. Home infusion and injectable medication services fall under a different category with the health plans. These services would not necessarily count toward the three-visit maximum. In addition, the copayments are generally $0 when a nurse is administering drugs or enteral nutrition.

Skilled Nursing Facility Benefit

There are times when you can’t recuperate at home because you are not ambulatory, and you need specialized help. In these situations, your physician will recommend and draw up orders for you to recuperate at a skilled nursing facility. At a skilled nursing facility you will have your own bed, receive meals prepared by the facility, and have nurses, therapists, and other services come to provide treatment.

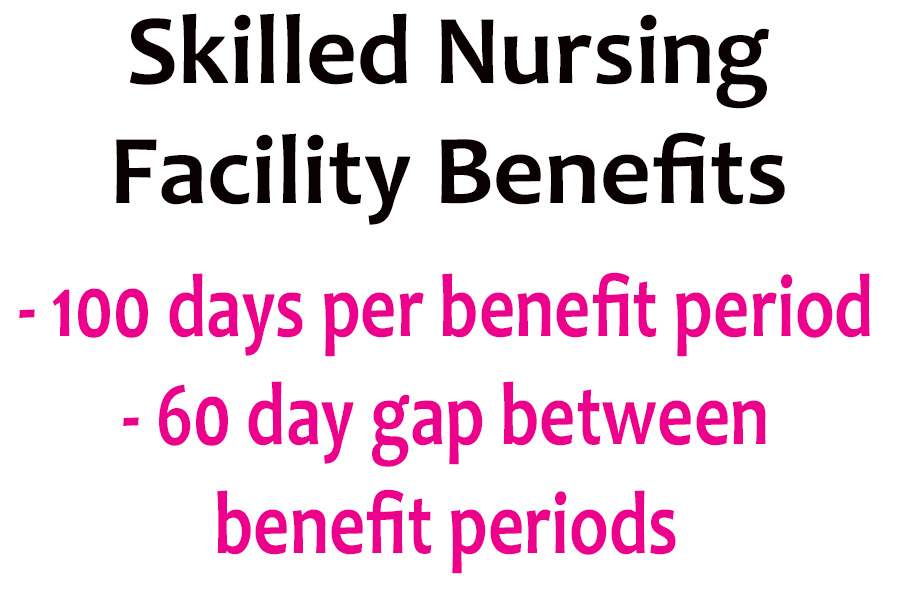

The summary of benefits of the health plans indicates 100 days of skilled nursing facility residency per member per benefit period. The benefit period begins when you enter the facility and ends when you leave or 60 days after you are discharged. This is where the descriptions get a little hazy. One interpretation is that you can have multiple 100-day stays during the year as long as there is a 60-day span between admissions.

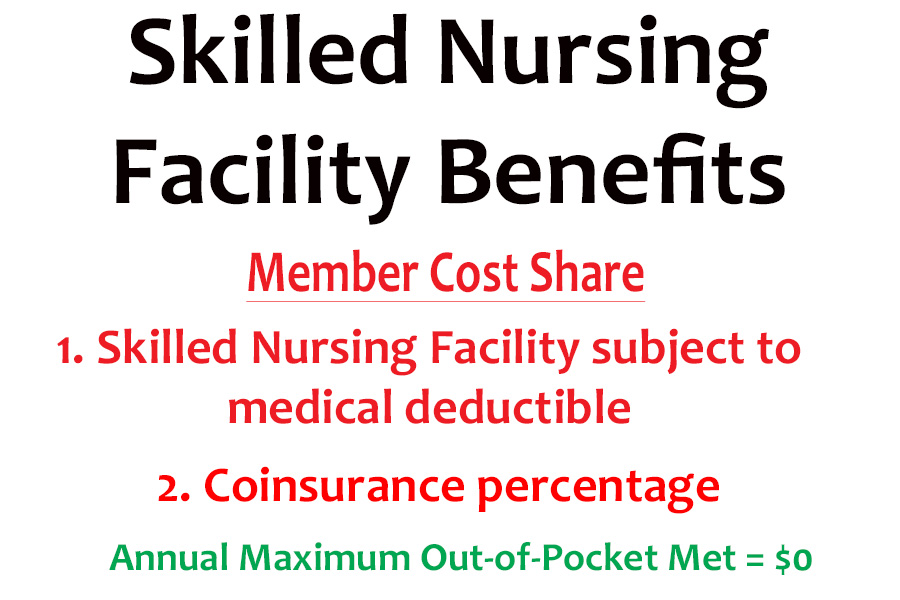

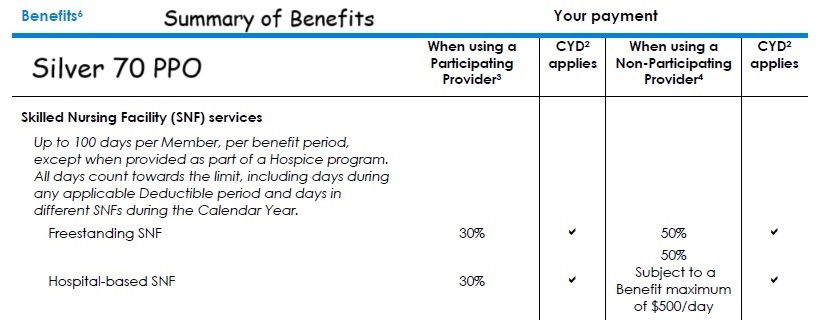

Unlike the home health benefit, skilled nursing is subject to any medical deductible. If you have a Silver 70 plan, you must meet your $5,400 medical deductible (2025) before you go into 30 percent coinsurance. For example, if you have met your deductible, and the daily rate for the skilled nursing facility is $400 per day, you would pay $120 per day. Of course, once you have met your maximum out-of-pocket maximum amount, the health plan will cover all costs of the in-network facility.

It doesn’t make a difference if your health plan is a PPO, HMO, or EPO, they all include benefits for home health care and skilled nursing facility stays. You can receive both benefits. You may have a skilled nursing facility stay, then receive home health care visits. Most of complaints from plan members is that the either the skilled nursing or home health benefits are ending too early, and the individual still needs assistance. If you feel the benefit is ending too soon, you can appeal the decision with the health plan and also request an independent medical review from the California Department of Managed Health Care.