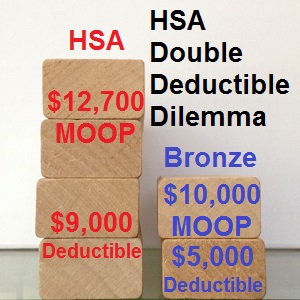

A little known provision of health plans that also are designated as being a Health Savings Account (HSA) require a single member of a family to meet double the deductible amount of an individual before coinsurance is applied to health care services. Unlike traditional family plans where any one member of the household can transition into coinsurance after the individual deductible is met, the entire “Family” deductible must be met in a HSA before coinsurance is applied.

Double the individual deductible

This means that if just one person in the family needs medical treatment under a HSA they must meet double the individual deductible before cost sharing to reduce medical expenses is activated. All ACA exchange health plans designated as a HSA are a Bronze metal level. In California, Bronze level HSA’s have an individual deductible of $4,500 and a family deductible of $9,000. In general, family deductibles are twice the amount of an individual deductible. Non HSA Bronze plans have a $5,000 individual deductible and $10,000 per family.

Meeting deductible triggers coinsurance

In either case, the deductible must be met before coinsurance or cost sharing percentages are triggered. The issue is whether a family member can meet the individual deductible amount or must meet the family deductible amount. Under the HSA plan provisions, carefully spelled out in the Evidence of Coverage in most health plans, the family deductible must be met, even if by just one person, to trigger the coinsurance.

Blue Shield EOC HSA plan in California

The individual Medical Deductible applies when an individual is covered by the plan. The Family Medical Deductible applies when a Family is covered by the plan, and the entire Family Medical Deductible must be met before Blue Shield begins payment for Covered Services for any Member with Family coverage. Once the respective Deductible is reached, Covered Services are paid at the Allowable Amount, less any applicable Copayment and Coinsurance, for the remainder of the Calendar Year. – Page 4 ,BSC HSA EOC available for download at end of blog post

The burden of a double deductible for a single member of a family also applies to HMOs like Kaiser.

Plan Deductible

In any calendar year, you must pay Charges for Services subject to the Plan Deductible until you meet one of the following Plan Deductible amounts:

- $4,500 per calendar year for self-only enrollment (a Family of one Member)

- $9,000 per calendar year for an entire Family of two or more Members

If you are a Member in a Family of two or more Members, you reach the Plan Deductible when your entire Family reaches the Family amount. Every Member in your Family must pay Charges during the calendar year until the entire Family reaches the $7,000 Plan Deductible. – Page 22 (I believe the $7,000 reference is a typographical error in the Kaiser EOC. All other references state $9,000 family deductible.)

HSA tax deduction

A Health Savings Account allows the individual or family to make annual contributions to a bank account and then deduct those contributions on their federal taxes. The family then pays out of the account for health care services. With an HSA, no health care expenses are covered by the health plan until the deductible is met, excluding preventive services that are always no cost. Whereas the Silver, Gold and Platinum health plans have set copayments for specific services like labs, tests and office visits, a HSA plan member must pay the full negotiated rate until they meet their deductible.

Double whammy for ill family member

The double whammy for a family occurs if just one person in the household has an accident or becomes ill. That person must meet the full family deductible before the coinsurance applies. In effect, that single household member must pay double the deductible of an individual with no other household members on an HSA plan. In addition to a $9,000 in medical expenses to meet the deductible, the member must also meet a higher maximum out-of-pocket amount as well. This has come as quite a shock to many families that learn their HSA plans cause them to pay for health care beyond what they expected or experience under a traditional health insurance plan.

Aggregate deductible

The difference between the HSA deductible scheme and a traditional health plan deductible is difference between either an aggregate or embedded deductible. The family HSA is an aggregated deductible meaning that either one or several people on the plan can satisfy the deductible amount. For example, if the HSA family deductible is $9,000 and three members of the family each incur $3,000 in medical expenses, or any combination that equals $9,000, then the family deductible is met.

Embedded deductible

With the embedded deductible of traditional health plans, each family member can meet the individual deductible and then receive certain covered benefits where the family pays a coinsurance amount. Once two members of the family meet their embedded deductible, the family deductible is satisfied and everyone benefits with the activation of coinsurance for high cost medical services.

More misery: out-of-network providers

Also keep in mind that if the Health Savings Account is a PPO, the cost of health care provided by an out-of-network provider will accrue in a separate column from the in-network providers. Consequently, the medical expenses for just one person can far exceed any expected individual deductible and maximum out-of-pocket amount as in-network and out-of-network provider costs accumulate separately to meet separate maximums. Check the Evidence of Coverage and Summary of Benefits documents for specific dollar amounts associated your HSA plan.

There are individual and Family Calendar Year Medical Deductible amounts for both Participating Providers and Non-Participating Providers. Deductible amounts for Covered Services provided by Participating Providers only accrue to the Participating Provider Medical Deductible. Deductible amounts paid for Covered Services provided by Non-Participating Providers accrue only to the Non-Participating Provider Medical Deductible. – BSC EOC HSA Page 4

Maximum out-of-pocket amounts

When the member accrues $6,350 in out-of-pocket expenses (deductible, coinsurance, prescription drug costs, etc.) during the calendar year, the health plan pays for all covered in-network medical expenses under most Bronze, Silver and Gold metal level plans. (Platinum plans have a $4,000 MOOP.) Unfortunately for HSA families, one member of the household not only has to pay double the deductible, but they have to meet the Family out-of-pocket maximum of $12,700 before all covered benefits are paid by the health plan.

Blue Shield HSA maximum out-of-pocket amount

The individual Calendar Year Out-of-Pocket Maximum applies when an individual is covered by the plan. The Family Calendar Year Out-of-Pocket Maximum applies when a Family is covered by the plan, and the entire Family Calendar Year Out-of-Pocket Maximum must be met by any one or combination of Members covered by the plan. – Page 4

Consider HSA costs

Health Savings Accounts can be a good value for many families that can make annual contributions to the special bank account. Those funds can also be used to pay for dental and vision services as well. But under circumstances where only one family member suffers a health challenge, the out of pocket costs for the HSA plan can be unexpectedly high. When you consider that HSA plans in California are typically just a few dollars difference from a traditional Bronze plan, a family of two or more should seriously consider whether they can afford the higher deductible and maximum out-of-pocket amounts of the HSA plan.

[wpfilebase tag=file id=45 /]

[wpdm_package id=174]