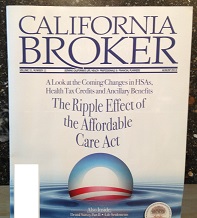

Obamacare featured prominently on the cover of California Broker

Imagine my surprise when a trade publication for one of the most conservative industries showed up in my mailbox with the Obama for President logo prominently displayed on the cover. The August 2013 edition of California Broker incorporated the Obama red, white and blue “O” with the title of The Ripple Effect of the Affordable Care. Along with the cover were four articles, also branded with the “O” signifying Obamacare, dedicated to educating health insurance agents and brokers about helping their clients navigate the flood of new regulations under health care reform. At least on the face of it, the insurance industry has gone from a position of repeal and replace of Obamacare to embrace and profit.

Insurance agents begin to accept Obamacare

Many agents who sell health insurance and have vehemently opposed the Affordable Care Act have gone through the classic stages of grief over its passage: denial, anger, depression, bargaining and finally, acceptance. While some in the industry still hold out hope that the fortieth plus attempt to repeal the ACA will be a charm, most have accepted the new law and are looking ways to adapt and profit from its provisions.

Some health insurance agents are still in denial and anger phase

It was apparent that many health agents were beginning to warm up to Obamacare as the part of the new marketing landscape they had to operate in on a webinar hosted by the former Director of Sales and Marketing for Covered California where he answered the numerous questions agents had about their role in the new health benefits exchange. With the exception of a few questions from agents still in the anger phase, most agents wanted to know how they could participate and the steps they needed to take to become certified representatives for Covered California

Does Covered California really need agents?

Covered California full page ad in California Broker: Agents Wanted

It’s uncertain what sort of impact agents will have with enrolling millions of uninsured California residents in guarantee issue health insurance through the state’s exchange. Covered California will have a “do-it-yourself” website portal, hundreds of call center staff and thousands of Certified Enrollment Counselors working to enroll the estimated 2.5 million people that are uninsured and eligible for the Advance Premium Tax Credit (APTC).

Agents compete against one another, carries they represent and now California

It’s tough enough for agents to compete with the actual insurance companies they represent who go right to consumers with direct mail campaigns, ubiquitous internet ads and their own dedicated call centers. The marketing muscle of Covered California combined with millions of dollars being spent on outreach and education and nonprofits set up to enroll new members are purposely designed to make health insurance agents irrelevant in the individual market.

Are there any marketing gimmicks to help agents?

There have been some stabs at software to make the health insurance agent slightly more useful to individuals in an effort to compete against the state exchanges. The Affordable Health mobile application is supposed to give agents or consumers a quick summary of their eligibility and potential plan benefits under the Silver health plan being offered through the exchange. The only problem I see is the lack of data input necessary to make an informed decision. The CalHEERS website portal for Covered California will be quite extensive in terms of the questions regarding sources of income, dependents and employer insurance offered in order to make an eligibility decision for the different levels of APTC. It would be unfortunate if a family made a poor decision on health insurance based on any software program that did not apply the same criteria as the federally authorized exchanges.

Small groups are more complex

The bright spot for health insurance agents and brokers is that Covered California is specifying that only certified agents can represent their Small Business Health Options Program (SHOP) plans. The downside is that there may not be much enthusiasm on the part of small businesses look at the SHOP plans for a new group plan or switching their existing plan to one offered through Covered California. In addition, those carriers not participating with SHOP like Anthem Blue Cross (Anthem drops out of SHOP) , Aetna and United HealthCare will be equally aggressive at retaining their existing business and competing with the new plans.

Everybody wants a piece of the Obamacare marketing pie

A $995 Health Care Reform Specialist Certificate. Is this like buying accreditation?

There are also whole micro-industries that have sprung up with magazines and seminars aimed at educating agents about health care reform…for a price. For the low low price of only $995, an agent can attend a seminar and become a Certified Healthcare Reform Specialist. Never mind that this Specialist designation is not recognized by the state of California and an agent will still have to attend Covered California training to get certified.

Real money: dental, vision, life, disability

For agents and brokers diving into the health care reform marketing pool, the goal isn’t necessarily to sell health insurance with its small commissions. The bigger fish agents are trying to hook are the ancillary benefits like dental, vision, life, and disability insurance. Whether it is to an individual or a small group, the ancillary products pay better commissions because they represent more money to the carriers and are not subject to the Medical Loss Ratios like health insurance.

Show me the money

What agents have finally realized is that when you are handed a lemon, make lemonade. With Obamacare, the lemonade is the 2.5 million people that are eligible for guarantee issue subsidized health insurance. That is a huge pool of prospective clients that might also need dental, vision, life and disability insurance. Cha-ching!

Let’s talk about your life insurance…

The cynic in me constructs a sales pitch whereby the salesman shows the prospect the cost of the health insurance, then the premium he or she will actually pay with the APTC and then proceeds to cross sell the ancillary benefits on the premise that he just saved the client money by applying the subsidy to the monthly health insurance premium. There is nothing that gets some sales people more motivated than a well planned sales strategy with an unbeatable “close”. Bonus, there is real money to be made on the ancillary products.

Health insurance companies ahead of the marketing curve

Health insurance companies have seen the proverbial writing on the wall for sometime with health care reform and have been positioning themselves to maximize the expanded market for their products. Health insurance companies have been investing in companies that service the ancillary market like eye glass manufacturers and beefing up their dental plans. It took a little longer, but health insurance agents have finally seen the light that there is money to be made with health care reform. If everything goes accordingly to plan for the insurance agents, President Obama might be featured on next years cover of California Broker as Insurance Salesman of the Year for all the dollars he helped generate in the industry that has been notably unfriendly to the Affordable Care Act.