Dave Jones slams President Trumps Executive Order as potentially destabilizing to the whole individual and family health insurance market.

California Insurance Commissioner Dave Jones slammed President Trump’s Executive Order relaxing enforcement of the Affordable Care Acts provisions as potentially destabilizing to the health insurance market.

Commissioner Jones issues statement on Trump Affordable Care Act Executive Order

FOR IMMEDIATE RELEASE: January 21, 2017

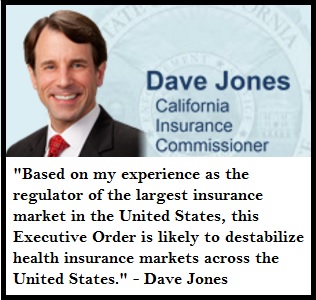

SACRAMENTO, Calif. – Insurance Commissioner Dave Jones issued the following statement today after President Donald Trump issued an Affordable Care Act Executive Order:

“President Donald Trump’s Executive Order is directly contrary to his pledge to replace the Affordable Care Act with terrific “insurance for everybody” while repealing the ACA.

The effect of the Executive Order will be to create uncertainty in health insurance markets as to whether the federal government will enforce critically important provisions of the Affordable Care Act. The Executive Order specifically directs federal agencies not to enforce ACA provisions that make sure that all Americans are getting health insurance so that the costs of treating sick and unhealthy Americans are spread across large enough risk pools so as to make it possible for private health insurers to provide health insurance.

Without the enforcement of these ACA provisions, many health insurers ultimately will be forced to withdraw from health insurance markets. Health insurers withdrawal from health insurance markets will decrease competition, make health insurance unavailable, and drive up health insurance prices.

Based on my experience as the regulator of the largest insurance market in the United States, this Executive Order is likely to destabilize health insurance markets across the United States. President Trump’s Executive Order also is contrary to his promise to provide health care coverage to all Americans.”

President Trump Executive Order To Minimize Economic Burdens of ACA

[wpfilebase tag=file id=2065 /]

Health Plans May Exit Market

Health Insurance companies and Health Plans start filing their next year’s rates with the California Department of Insurance and California Department of Managed Health Care between May and July. They will be watching closely to see if changes to the ACA provisions under the Trump Administration are eroding their membership. In other words, if people learn that they may not be penalized for not having health insurance under Trump, will they begin to drop their current coverage? If too many healthy people cancel their health insurance, carriers will have to increase their rates for 2018 to cover claims expenses.

Cost Sharing Reductions May Vanish

Another market destabilizing action the health insurance industry is watching is whether the Trump Administration will continue the cost sharing reductions for the Silver health plans.

Under the ACA individuals and families who qualified the monthly tax credit subsidy, but have incomes below 250% of the federal poverty level, were offered reduced cost sharing plans. These plans are known as Enhanced Silver Plans and have lower deductibles, copays, coinsurance, and maximum out-of-pocket amounts. The federal government pays health plans to offer these reduced member cost sharing plans. In a 2016 a lawsuit, filed by the House of Representatives, the plaintiffs claimed the payments to the health plans for the cost sharing reductions were not properly authorized by congress and should be stopped.

A judge ruled in favor of those claiming the payments were not properly authorized but put the decision on hold as the Obama administration appealed the decision. It is unclear if the Trump administration will continue to defend the cost sharing reduction payments. If they decide not to continue the appeal, and the judge lets the order stand, the cost sharing reductions for members in those Enhanced Silver Plans (73, 87, and 94) may immediately stop.

This would result in a health plan member in a Silver 94 plan with a $5 office copay suddenly having to pay the standard Silver 70 plan copay of $35. The deductible for a Silver 94 plan is $75. A standard Silver 70 has a $2,500 deductible. It all adds up to a situation where it could costs too much to use the health insurance even if the family can afford the premiums with the ACA subsidy.

Health Insurance Markets Enter Death Spiral

If the cost sharing reductions vanish, some individuals and families may just drop health insurance altogether rationalizing that if they can’t afford to see a doctor, why pay for health insurance? This could be another blow to the health insurance industry. Some health plans may decide to pull out of the health insurance Marketplace Exchanges like Covered California altogether if they see their current membership start to erode.

The loss of health plan members will drive up rates, which forces more people to drop insurance. As one former health insurance executive framed it, “the individual and family market for health insurance will go into a death spiral.” Healthy people drop coverage because there is no penalty for not having it. Low and moderate income families drop health insurance because they can’t afford it. The health plans are left with a membership of people with many health challenges creating health care claims that their premium revenue won’t cover. Crash.