Do you need insurance to cover the deductible of your health plan? There is insurance for health insurance health care expenses and deductible. But is the insurance to cover the deductible of your catastrophic high deductible health plan cost efficient?

Insurance for the large Catastrophic High Deductible Health Plans

There are insurance products to help cover the health care expenses associated with health insurance for years. Most of the plans are specific to the health care costs associated with illnesses such as heart attacks, cancer, or hospitalization. A new insurance product released in 2023 helps cover part of the deductible of the Affordable Care Act catastrophic high deductible health plans.

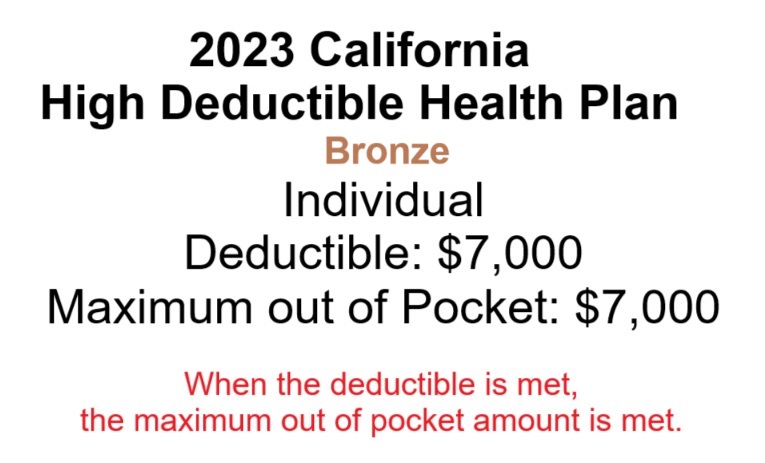

In California, for high deductible health plans (HDHP) in the individual and family market are designed so the health plan’s deductible is the maximum out of pocket amount (MOOP.) Once an individual reaches the maximum out of pocket amount, the health plan covers the rest of the health care expenses, 100 percent, for the remainder of the year.

The Bronze high deductible health plans are attractive because of the lower rates compared to Silver, Gold, or Platinum plans. However, there is no help for the health expenses until the plan member reaches the maximum out of pocket amount. For 2023, the maximum out of pocket amount of the high deductible health plans is $7,000.

Deductible Insurance

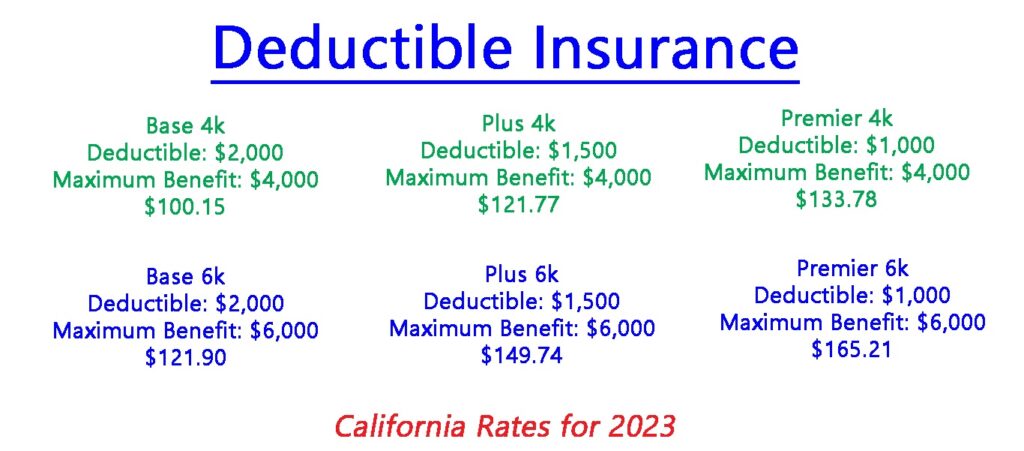

There are a couple of different models of the deductible insurance plans. All of the designs require the individual to meet a deductible between $1,000 to $2,000. The plan’s deductible are health care expenses you must pay before the deductible insurance is triggered. Also with the models are two different maximum benefits of either $4,000 or $6,000. In other words, the plan will cover either $4,000 or $6,000 in health care expenses in a calendar year.

Comparing Rates and Plans

The least expensive deductible insurance plan I reviewed for California in 2023 was $100.15 per month regardless of age or region of the state. The plan has a $2,000 deductible and a maximum benefit of $4,000. When performing a review of costs, I opted to use the highest level benefit deductible insurance plan. This plan has a $1,000 deductible and a $6,000 maximum benefit for $165.21 per month.

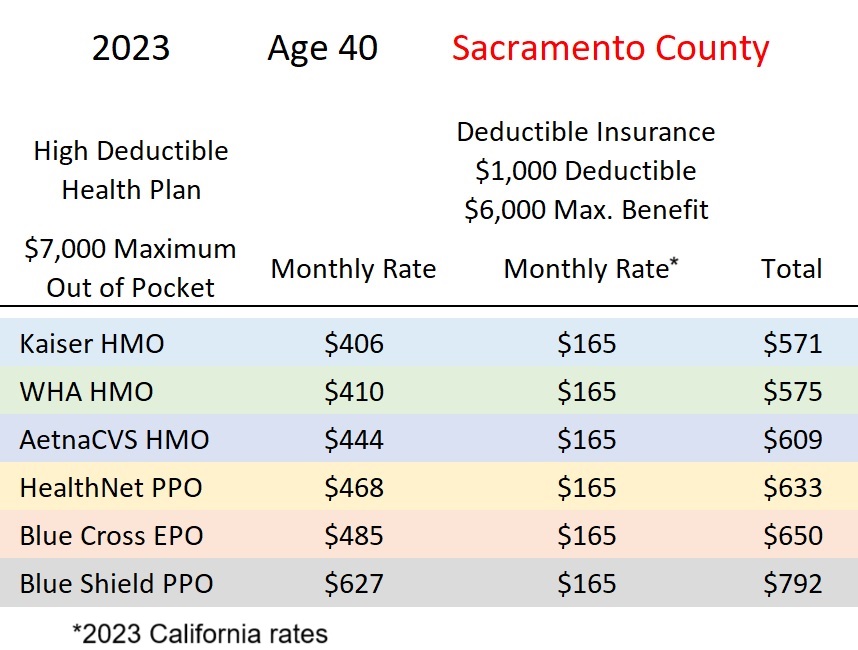

The deductible insurance plan effectively raises the monthly health insurance premiums by $165 per month. A 40 year old individual in Sacramento County will pay $406 monthly for a Kaiser HDHP. The addition of the deductible insurance makes the monthly amount $571. In the worst case scenario, you would need to incur $1,000 in allowable health care expenses, then the deductible insurance is triggered to cover the remaining $6,000. The $7,000 maximum out of pocket amount is met and the health plan covers all costs after that point.

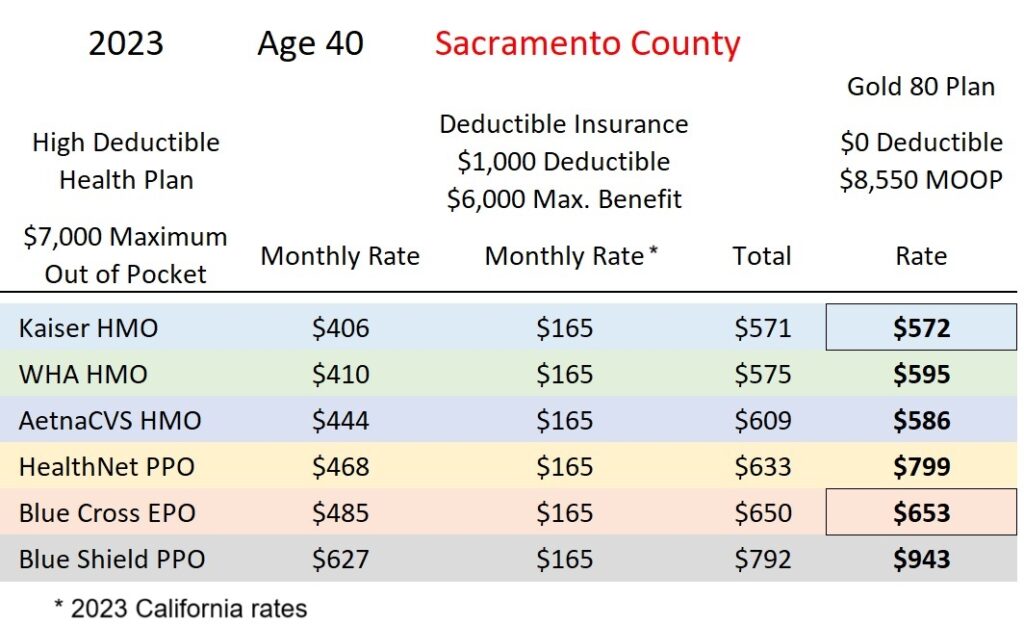

If a person did not want any medical deductible, they could opt for a Gold 80 plan. With the Gold 80 plan, the member goes straight into set copayments for routine services or coinsurance for outpatient procedures and hospitalization. The Kaiser Gold 80 (coinsurance plan) is only $1 more than their Bronze HDHP with the deductible insurance included. The Blue Cross Gold plan is only $3 more on a monthly basis.

The AetnaCVS HMO Gold 80 is less than the rates of their HDHP with the deductible insurance. The Blue Shield PPO Gold 80 is $151 more than their HDHP with the deductible insurance. If you are an AetnaCVS member, you might be better with the Gold 80 plan. For Blue Shield PPO members, the deductible insurance may be a good deal.

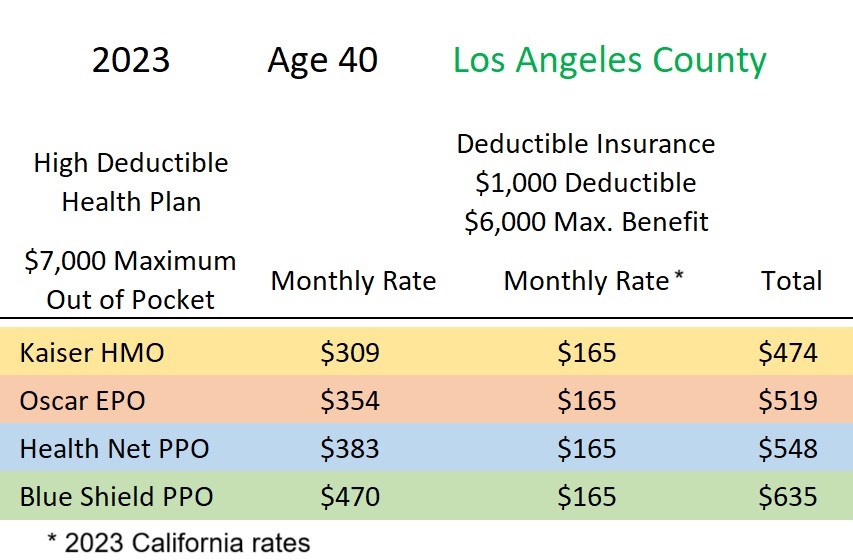

Health plan rates vary with the age of the individual and the region of California where they reside. Even though the monthly rates for the Bronze HDHP are less in Southern California, the deductible and maximum out of pocket amount of $7,000 is the same. For the Kaiser Bronze HDHP with the deductible insurance added, the monthly premium amounts would be $474 for the 40 year old.

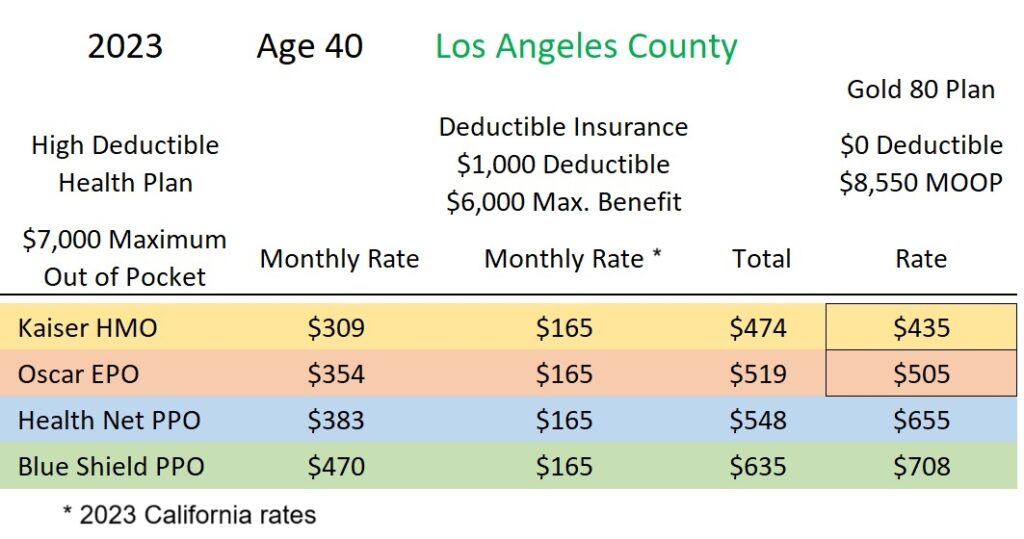

Of course, the Gold 80 plan rates are also lower in Southern California. Both the Kaiser and Oscar Gold 80 plans have a lower monthly rate than the combination of the Bronze HDHP with the deductible insurance. The Gold PPO plans from Health Net and Blue Shield are more expensive than a HDHP with the deductible insurance.

While the Gold 80 has a maximum out of pocket of $8,550, the plan design shields the plan member from sudden high cost health care for routine health care services with the set copayments. Under the terms of the Bronze HDHP, the member pays the full contracted rate of the health care services until the deductible/maximum out of pocket is met.

For the highest benefit plan in California, you are paying $165 per month for the insurance to cover up to $6,000 of your health care expenses. It will cost you about $150 per month to carry a $6,000 balance on a high interest credit card. If you were to deposit the $165 every month in a dedicated savings account, it will take you a little over 3 years to save $6,000. Once you have $6,000 in the savings account, the bank will pay you a little interest every month.

If the deductible insurance was around $50 to $60 per month, I begin to see how it make financial sense for some people. As it stands, this deductible insurance coverage, similar to the heart attack, cancer, and hospital indemnity insurance, does not make financial sense, at least not in California in most situations. Silver 70 plans are a good alternative since the medical deductible only applies to hospitalization and skilled nursing facilities. In other words, you are not likely to move into the Silver plan deductible.

Conditions, Limitations, Exclusions

If the rates for you seem attractive, carefully review the exclusions, limitations, and fees beyond the monthly premium. Rates for the primary applicant including children or spouse will be less than individual plans. On this plan, there is a $35 one-time non-refundable processing fee. The monthly rates include a $19 administration fee and a $4 membership fee.

The deductible insurance plan does not cover professional fees or physician in a doctor’s office, outpatient prescription drugs or any expense not covered by the health plan. Essentially, the health care service needs to be outpatient service or hospitalization. The health care service also needs to be part of the covered benefits of the health plan. The deductible insurance plans only work with Affordable Care Act health plans either through Covered California or off-exchange direct from the carrier.