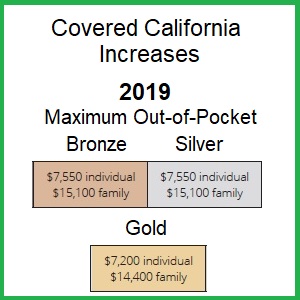

The big change for Covered California health plans is the hefty increase in the maximum out of pocket amount on Bronze, Silver, and Gold plans.

Covered California released their summary of benefits and cost-sharing for their 2019 individual and family plans and the maximum-out-of-pocket amount jumped 7% from 2018 for most health plans. While most of the set copayment amounts for many health care services increased slightly, or not at all, health plan members will be responsible for more of the medical expenses for high cost services such as surgeries.

In 2018 Covered California trimmed some of the member cost sharing or held it steady from the 2017 plan year. For 2019 Covered California is letting some of the member cost-sharing amounts rise. In the 2019 plan and rate booklet Covered California noted that the medical cost trend was approximately 7.5%. So having the maximum-out-of-pocket increase by a like amount potentially tempered some rate increases families will realize in 2019.

If you have a Platinum plan, of which 4% of Covered California members have, then your plan will not change. All the copayments and coinsurance (10%) will stay the same in 2019. What you have to look at is the increase in the premiums. The maximum-out-of-pocket (MOOP) is still $3,350 for an individual. The Gold plan, with higher coinsurance and copayments, has a MOOP of $7,200. That is a difference of $3,850. If the rate of the Platinum plan is greater than $320 ($3,850 divided by 12 months) over a Gold plan, then you at least need to look at Gold plans to potentially save money. You will need to analyze you average monthly health care and pharmacy expenditures under the Platinum vs. Gold to see if you are better off staying with a Platinum plan.

All cost-sharing is on an individual basis. Family maximums are 2 times the individual. Benefit and Cost Share Summary at end of post.

Maximum Out of Pocket On Gold Plans Spikes 16%

The big change for the Gold plan was an increase in the MOOP from $6,000 in 2018 to $7,200 in 2018. That is a 16% increase. Before 2018, the Gold plans did not make a lot of financial sense considering they were so much more expensive than Silver plans. In 2018 the Gold plan MOOP was reduced to $6,000 and the Silver plans offered through Covered California were artificially inflated by approximately 10%. This meant for consumers receiving very little monthly tax credit subsidy, they were better off enrolling in a Gold plan because for some carriers the rate was less than the Silver plan.

The Gold plan, like Platinum, as no medical deductible. You go straight into coinsurance for high cost medical services; 20% for Gold and 10% for Platinum. Both the copayments for primary office visits and urgent care will increase $5 on the Gold plans. Everything else stays the same except the MOOP. If the pricing differential remains between the Silver and Gold plans in 2019, Gold plans may offer a little more value especially for consumers with a need for frequent health care services.

Silver Plan Deductible Remains at $2,500

The Silver plans for 2019 have their MOOPs increasing to $7,550. That is only $350 more than a Gold plan. The medical deductible for Silver plans will remain the same at $2,500. The pharmacy deductible increased from $130 to $200. This means prescription drugs will cost more until the pharmacy deductible is met and the drugs, Tier 1 – 3, drop to set a copayment, which did not increase over 2018. Similar to Gold, the Silver plan copayments for primary care, urgent care and specialists all went up by $5.

The relative stability for consumers in Silver plans is good news. 56% of Covered California members are enrolled in a Silver plan. Families will have to pay close attention to the rate differential between Silver and Gold. If the rates are pretty close, especially if the Silver plans are artificially inflated by Covered California, selecting a Gold plan at a slightly higher rate may save money in the long run because there will be no deductibles and lower copayments.

Higher Bronze Plan MOOP

The Bronze plans had their MOOP increased to $7,550, the same as the Silver plans. The Silver plans offer a distinct advantage over Bronze if anyone takes prescription medication. The Bronze plans really offer no drug coverage. Most people view the MOOP of the Bronze plan as also the deductible. Once the MOOP has been met, then the health plan pays 100% of covered medical and pharmacy costs.

One strategy for lowering the overall household monthly health insurance premium is to select plans by household member based on their health care needs. Some household members maybe good with a Bronze plan while other would benefit from a Silver or Gold plan.

Enhanced Silver Plans Remain Stable

The Enhance Silver plans 73, 87, and 94 will have modest copayment increases for 2019. Primarily the Silver 73 and 87 will have a $5 increase in copayments for primary care visits and urgent care. Silver 87 will have a $5 copay increase for X-rays. Both Silver 73 and 87 will have the MOOP increased for 2019, $6300 and $2,600 respectfully. The drug deductible will also increase on Silver 73 from $130 to $175.

In general, if you are offered an Enhanced Silver 87 or 94 you should seriously consider it. This is especially true if any of the household members take prescription medications on regular basis. The Silver 87 is better than a Gold 80, and the Silver 94 is better than a Platinum 90. The rates for the Enhanced Silver plans are the same as a Silver 70, but the actual member cost-sharing is much better and saves lots of money.

If you don’t qualify for any tax credits, then you should look at off-exchange plans or those offered directly from the carrier. Many of the carriers such as Blue Cross, Blue Shield, Health Net, and Kaiser offer plans off-exchange that are not offered through Covered California. There can easily be a 10% savings with off-exchange plans of the same actuarial value.

Standard benefit design Covered California metal tier plans summary of benefits and cost sharing for 2019.