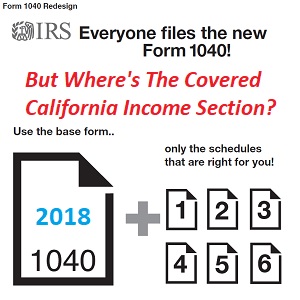

Under the 2017 tax reform legislation the IRS federal income tax forms for 2018 tax returns have been changed. Covered California participants will need to reference line 7 of the 2019 1040 tax form, instead of the line 37 of the old forms to get their Adjusted Gross Income (AGI). Line 8b is only the AGI. Covered California uses the Modified Adjusted Gross Income (MAGI) which also includes Social Security retirement and disability payments, along with tax exempt interest and generally nontaxable foreign income earnings.

For 2019, the IRS has changed the line numbers on the 1040 from the 2018 version of the 1040 tax return.

New Line For Adjusted Gross Income Estimate

While the MAGI definition remains the same, where you find all the dollar amounts to calculate the MAGI on the new 2018 tax form 1040 have changed. The sections where a Covered California participants enters additional health insurance Premium Tax Credits or the repayment of that subsidy have also changed. Tax preparation software should figure out all the credits and repayments. However, because of the 2017 tax reform legislation, which removed some deductions and added others, a household’s MAGI estimate may need to be recalculated. Hence the need to know where to find the dollar amounts on the redesigned 1040 form. See the definitions of MAGI and household members below.

The new 2018 tax forms look like they have been simplified, but they haven’t. Line 7 is the new Adjusted Gross Income (AGI) field whereas it used to be line 37 on the old forms. All of the information used to determine the AGI is still there but the dollar amounts may be captured in new Schedules. For example, deductions tax payers could take to reduce their AGI, lines 23 – 35 on the 2017 form 1040, are not listed on the new 2018 form 1040. Those deductions are now captured in Schedule 1. Deductions for items such as self-employment tax, self-employed health insurance premiums, health savings account contributions, and IRA contributions are listed on Schedule 1.

Schedule 1 Captures Covered California Income & Deductions

Also captured on Schedule 1, that is part of the MAGI calculation, is the income from business income (Schedule C), capital gains or losses (Schedule D), Schedule E rents, royalties, and partnerships, and unemployment compensation to name a few. The IRS essentially took lines 10 – 35 of the old 2017 form 1040 and put them in Schedule 1. Unfortunately, in what I find confusing, the tax payer adds the additional income from Schedule 1 (lines 1- 8) to line 7a of form 1040, and then must subtract Schedule 1 adjustments (lines 10 – 21) on line 8a of the form 1040 to get line 8b Adjusted Gross Income. The redesign seems to be more appropriate for tax software than manual calculations.

What will not reduce the AGI is the new Qualified business income deduction, which is taken on line 10. This is the 20% business income deduction that was passed in the 2017 tax reform legislation. This deduction will lower the taxable income amount but not the MAGI used for determining the Advance Premium Tax Credit subsidy to reduce health insurance premiums through Covered California.

New Covered California Countable Sources of Income Table

Covered California has published a new Countable Sources of Income list to assist consumers in estimating their income. It generally follows the new 1040 form line numbers, but it doesn’t list the Schedule numbers where some of the lines are found. Specifically, don’t confuse Line 9a on the Countable Sources of Income table (Ordinary/qualified dividends, 1099-Div) for the Line 10 of the new 1040 form. Line 10 on the new 1040 is the qualified business income deduction. The Covered California Line 9a refers to the old 1040 form. I’m sure Covered California will update the document with current line numbers and respective schedules in the near future.

The 2017 Tax Cuts and Jobs Act also made changes that will impact taxable income for businesses and self-employed individuals. Some of the changes will reduce deductions and others will reduce income. If you are self-employed or own a small business and have been eligible for the Advance Premium Tax Credit subsidy through Covered California in the past, you will need to work with your tax preparer to see if the new tax reform changes effect your estimated MAGI for 2019.

Basically, the redesigned 2018 form 1040 has made it more difficult to quickly locate all the necessary information for estimating a household’s MAGI. Virtually all of the dollar amounts were listed on the first page of the old form 1040. Now Covered California participants will have to review page 2 of the 1040 and Schedule 1 income and deductions to get most of the information for their estimated MAGI. Fortunately, it doesn’t look like the 20% qualified business deduction, referred to in my post Trump Tax Reform May Cut Your Subsidy, will be applicable. But the elimination of certain business deductions may impact the MAGI.

2018 Form 8962 MAGI Household Definitions

Household income. For purposes of the PTC, household income is the modified adjusted gross income (modified AGI) of you and your spouse (if filing a joint return) (see Line 2a, later) plus the modified AGI of each individual whom you claim as a dependent and who is required to file an income tax return because his or her income meets the income tax return filing threshold (see Line 2b, later). Household income does not include the modified AGI of those individuals whom you claim as dependents and who are filing a 2018 return only to claim a refund of withheld income tax or estimated tax.

Modified AGI. For purposes of the PTC, modified AGI is the AGI on your tax return plus certain income that is not subject to tax (foreign earned income, tax-exempt interest, and the portion of social security benefits that is not taxable). Use Worksheet 1-1 and Worksheet 1-2 to determine your modified AGI.

Taxpayer’s tax return including income of a dependent child. A taxpayer who includes the gross income of a dependent child on the taxpayer’s tax return must include on Worksheet 1-2 the child’s tax-exempt interest and the portion of the child’s social security benefits that is not taxable.

Coverage family. Your coverage family includes all individuals in your tax family who are enrolled in a qualified health plan and are not eligible for MEC (other than coverage in the individual market). The individuals included in your coverage family may change from month to month. If an individual in your tax family is not enrolled in a qualified health plan, or is enrolled in a qualified health plan but is eligible for MEC (other than coverage in the individual market), he or she is not part of your coverage family. Your PTC is available to help you pay only for the coverage of the individuals included in your coverage family.