Open enrollment for the Affordable Care Act has come and gone for 2014. Unless you have a qualifying life event that triggers a Special Enrollment Period, individuals and families may not purchase a health plan either through Covered California or directly from one of the carriers. For that awkward moment when you realize you have no health coverage there is short term health insurance.

Short term health insurance in case you missed ACA open enrollment

No one planned on not having health insurance, but the rules changed in 2014 with the ACA. Similar to group plans, health insurance may only be purchased during either Open Enrollment or under a Special Enrollment Period. There are a variety of reasons why someone was unable to purchase a health plan or continue it after they enrolled-

-

Enrolled but was unable to resolve billing issues

-

Traveling out of the country

-

Dealing with other life issues

-

Didn’t feel they needed it

-

Recent college graduate

-

Waiting for Medicare

-

Forgot to enroll

-

In between jobs

-

New employees

Bridging the gap with short term health insurance

To bridge the gap between no health insurance and the next open enrollment there is short term health insurance. Short term or temporary health insurance can be viewed as a major medical policy. While you can see a doctor for a health challenge that crops up, it’s really geared for unforeseen Emergency Room visits at 3 am in the morning.

Short term health plans aren’t ACA compliant

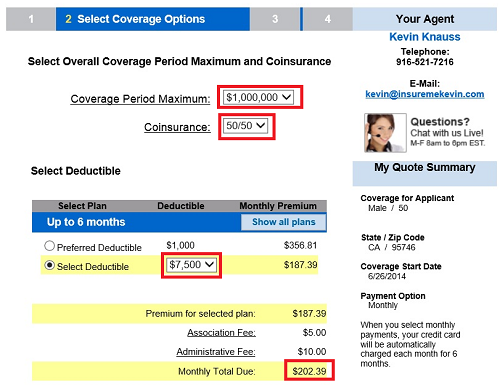

Short term health insurance is not ACA compliant. Preventive “no cost” office appointments like a “Well Woman” visits may be not be included along with the “no cost” child vaccinations, pediatric dental and vision benefits. (See HCC Short Term California brochure at end of post for a list of covered benefits in California.) The health benefits can vary by state. In addition, you can be denied if you have pre-existing conditions. Most domestic short term health insurance will not be underwritten if the applicant has the following –

-

Has another health insurance plan such as Medicaid

-

Been denied a short term policy for an untreated medical condition

-

Pregnant, in the process of adoption or infertility treatment

-

Overweight: 300 pounds for men or 250 pounds for women

-

Been treated for a variety health related conditions in the last 5 years such as cancer, stroke, heart disease, kidney disorder, joint diseases, diabetes or chemical dependency.*

-

Diagnosed with Acquired Immune Deficiency Syndrome (AIDS)

-

Not a US Citizen or legal resident

*Review the list of medical conditions for each short term health insurance policy.

Coverage for domestic use

Short term health insurance is not travel or vacation insurance. The coverage, in most cases, applies only when you are residing in the United States. There are specific health plans for individuals traveling abroad, foreign students studying in the U.S. and U.S. students studying in another country. Short term health insurance does not qualify as a credible ACA compliant health plan for the purposes of avoiding the individual mandate penalty.

Short term health plans can include children and start immediately.

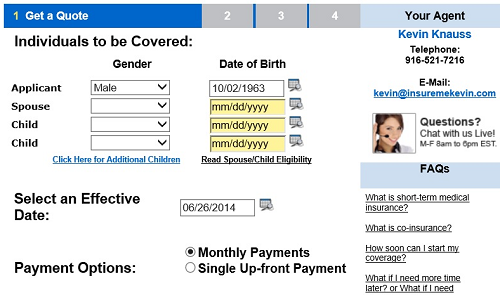

Choice of maximum amounts

Most short term health insurance plans will give you an option for the total amount of indemnity they will provide. In other words, how much they will pay on your behalf for health care. This amount can range from $1 million to $2 million for the benefit period. Usually the temporary health plans have a maximum of six month duration and you can reapply for a second six month period. Short term health plans will usually not be extended beyond two consecutive durations.

Choose your medical deductible and coinsurance

You will also be given the choice between coinsurance percentages and deductibles. Coinsurance is the amount you pay for health care services after you have met your deductible with the plan. Some plans offer an 80/20 or a 50/50 percentage split. For the 80/20 split, after the deductible is met, you would pay 20% of the health care expenses. The plan will pay 80% up to the maximum amount of the health plan. The deductible may be waived if you visit an urgent care center over an emergency room facility.

Short term health plans can vary by maximum amount, coinsurance, and deductible.

Are your doctors in-network?

Before you make any decision on a short term health plan you will want to review their provider list. If you need to see specific physicians locate the provider directory of the short term health plan to see if your doctor is in-network. If your doctor is out of network for the plan, there may not be any coverage for health care expenses associated with seeing the physician. However, emergency medical treatment will always be covered at a hospital emergency room if you are in an accident or suddenly stricken with illness.

Short term health plans can be reasonable priced

Short term health insurance isn’t the most ideal coverage for many people, but it can be relatively affordable. The monthly premium for a 50 year old male, $1 million maximum, 50/50 coinsurance, and a $7,500 deductible will run a little over $200 per month based on an HCC quote. If you are in reasonably good health, a short term health plan will bridge the gap until the next open enrollment period for a full ACA compliant health plan eligible for the Advance Premium Tax Credits to lower the monthly premium. You can get a quote by clicking on the HCC Short Term Medical Insurance image.

[wpfilebase tag=browser id=16 /]

Typical qualifying medical questions

Short term health plans are not guarantee issue like ACA policies. Certain pre-existing conditions will preclude coverage.