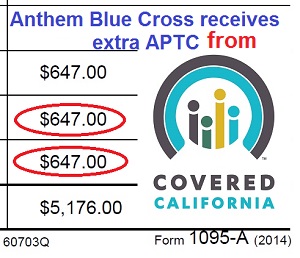

Covered California reports paying Anthem Blue Cross $647 in tax credits when consumer was on Medi-Cal.

Information from a consumer’s 1095-A Marketplace Statement reveals that Covered California continued to credit Anthem Blue Cross with Advance Premium Tax Credits (APTC) even after the consumer had transitioned to Medi-Cal. While there doesn’t appear to be any fraud, Anthem did receive at least $647 for an individual who was no longer a member of their health plan sold through Covered California.

1095-A reports tax credits to Anthem Blue Cross on cancelled plan

It was a difficult realization for my client to accept that reporting a decrease to her income through Covered California would trigger Medi-Cal eligibility. She had been enrolled in the Anthem Blue Cross Enhanced Silver 87 plan and she had been making subsidized premium payments every month. But with her unemployment benefits exhausted and no immediate prospect for employment, we both knew that we had to be honest and report that her income was near zero.

Change of income, transition to Medi-Cal

I made the change to her account in the Covered California CalHEERS program on November 4, 2014. On November 5th, Covered California generated a letter stating that she no longer qualified for the ACA health insurance APTC for a private health insurance plan. It is my understanding that Medi-Cal is retroactive to the beginning of the month in which you become eligible. In my client’s case, the wheels of the Medi-Cal machine should have been turning so she could receive health care benefits for November.

When an individual is determined eligible for Medi-Cal, the eligibility date is the application submission date and eligibility begins the first day of the month in which the individual applied. For example, a consumer who applies on the 10th of the month and is found eligible will receive coverage for benefits effective the first of that month.- Medi-Cal Advance Study Course, page 5

- [wpfilebase tag=fileurl id=451 linktext=’Covered California Medi-Cal Advance Study Course’ /]

User ID insuremekevin changed the applicant’s income on November 4th, which triggered Medi-Cal eligibility.

No premium payments made

In an effort to conserve cash and with the understanding that she would eventually receive Medi-Cal my client did NOT make her November or December premium payments. Her last premium payment was for October, 2014. I was able to confirm this because Anthem Blue Cross paid me a commission on her health insurance premiums from the month of her first enrollment in May, 2014, all the way through October. They did not pay me a commission for the Covered California Silver Plan for November or December. But Covered California shows they paid Anthem $647 on her 1095-A in APTC for the two months my client was on Medi-Cal in 2014. (See full 1095-A image below)

Covered California, Anthem show plan cancelled

Even though my client was deemed eligible for Medi-Cal in November, Covered California shows in her account that her eligibility for the tax credits ended December 1st. Anthem Blue Cross also shows her plan was cancelled on December 1st. But if she didn’t make her November premium payment, Anthem should have cancelled her plan back to October 31st, the last day coverage for which a full premium payment was received by Anthem Blue Cross.

Covered California Enrollment Summary shows the consumer’s Anthem plan ended Dec. 1, but she transitioned to Medi-Cal in November.

Was Blue Cross really paid APTC?

But even if we conclude the November APTC payment to Anthem Blue Cross was caused by a date error, Covered California should not have paid Anthem the $647, indicated on my clients 1095-A, for December. Her plan shows cancelled in both the Covered California and Anthem Blue Cross systems. How could Covered California send an APTC payment to Anthem Blue Cross and have them accept it when both their systems agree that my client was no longer a member of the Anthem Blue Cross Plan?

Anthem Blue Cross shows the consumer’s health plan was cancelled for the month they received tax credits from Covered California.

$200 million date and plan errors

Almost all of the problems of erroneous APTC payments being sent to health plans reside within the CalHEERS program. CalHEERS (California Healthcare Eligibility, Enrollment and Retention System) is the $200 million software package developed by Accenture for Covered California. Within my client’s account are conflicting dates. Notably, there are fields that show my client’s eligibility for the APTC ends on January 1, 2015. The Program Eligibility By Person page on the Summary section shows that the APTC ends on December 31, 2014. Both of these dates conflict with the 12/01/2014 End Date shown in other parts of the account. No where does it show my client was eligible for Medi-Cal 11/01/2014 or that her participation should have been cancelled for lack of premium payments. But Anthem Blue Cross is money ahead by not accepting the small consumer premium payment and keeping the large $647 tax credit from Covered California.

Who terminates health plan when Medi-Cal eligible?

The other flaw in the CalHEERS program is the series of events that DON’T take place within the program when an individual moves from APTC to Medi-Cal. As an agent, all I can do is submit a Change Report for the decrease of income. When that is processed the Household Enrollment Summary just indicates the new program is Medi-Cal. I am not given an opportunity to terminate the existing health plan and CalHEERS is not generating the termination. I suspect this has also happened when county social services departments audit Covered California account and drop families into Medi-Cal but the health plan remains active and APTC is paid on the member’s behalf. Another question is which Medi-Cal managed care plan was receiving premium payments while at the same time Anthem Blue Cross was receiving the tax credits?

Tax filers repaying tax credits they never received

Under different circumstances my client could be liable for the erroneous payments to Blue Cross reported on the Marketplace statement. Since her Modified Adjusted Gross Income will be under 138% of the federal poverty line she will not have to repay the advance premium tax credits. However, if she just stopped making her premium payments, would Covered California have continued to make the APTC to Anthem? How does a tax filer begin to fight against having to repay excess APTC for a health plan they were not enrolled in?

A comment on my Getting a Corrected 1095-A post suggest that Covered California has reported paying APTC to health plans on behalf of other individuals when they were no longer enrolled.

I ended my coverage on 12/1/2014 (and started getting covered by my employer’s insurance on 12/1), yet my initial 1095-A form has Columns A, B and C for December filled in, implying that I have paid a premium and received assistance (neither true). – Lion Today

Who is responsible for repaying tax credits?

If we assume that the APTC wasn’t really paid to Anthem, we still have the problem that a tax filer could be repaying tax credits that were never issued on their behalf. Will Covered California’s sending of corrected 1095-A restore any level of confidence that consumers aren’t being fleeced for tax credits they never received? And what if Covered California really has sent months of tax credit payments to the health plans on behalf of people who stopped making premium payments or shifted into Medi-Cal? If the tax filers do get corrected 1095-As, will the health plan be forced to repay the APTC to Covered California?

Will Covered California consumer get answers?

Both Anthem Blue Cross and Covered California must provide answers as to the tax credits that were paid on my client’s behalf. Covered California needs to become transparent with how they make the tax credit payments and subject their process to an external audit. The CalHEERS program needs to be fixed so that APTC can’t be paid when a consumer transitions to Medi-Cal.

Covered California Medi-Cal letter and consumer 1095-A reporting APTC for November and December shown below.

Covered California sent my client a letter on November 5th, one day after I changed her income, notifying her she was no longer eligible for the Premium Tax Credits.

Covered California is reporting that they paid Anthem Blue Cross $647 tax credits for November and December 2014 when the consumer stopped making premium payment and changed income to become eligible for Medi-Cal.

If your 1095-A indicates tax credits were paid to a health plan in which you were not enrolled, contact Kevin Knauss so I can add your circumstances to the list.