The Medicare Part D prescription drug plans will be substantially different in 2025. The maximum out-of-pocket amount is dropping, and a new prescription payment plan is being added. In addition, the coverage gap or donut hole phase has been eliminated. These substantial changes mean that Medicare beneficiaries need to scrutinize the 2025 changes to their current plan to make sure it still makes financial sense.

The biggest change to the 2025 Medicare Part D drug plans will be lowering the maximum out-of-pocket amount from $8,000 to $2,000. Once the Part D plan member accrues $2,000 in true out-of-pocket drug costs, they will not pay for any future drug purchases. For example, if your out-of-pocket drug costs equal $2,000 in July, you will continue to receive your monthly prescriptions at $0 cost to you at the pharmacy.

The changes apply to both stand alone Part D plans with Original Medicare and the prescription drug coverage embedded in Medicare Advantage plans.

New Part D Cost Structure and Payment Plan for 2025

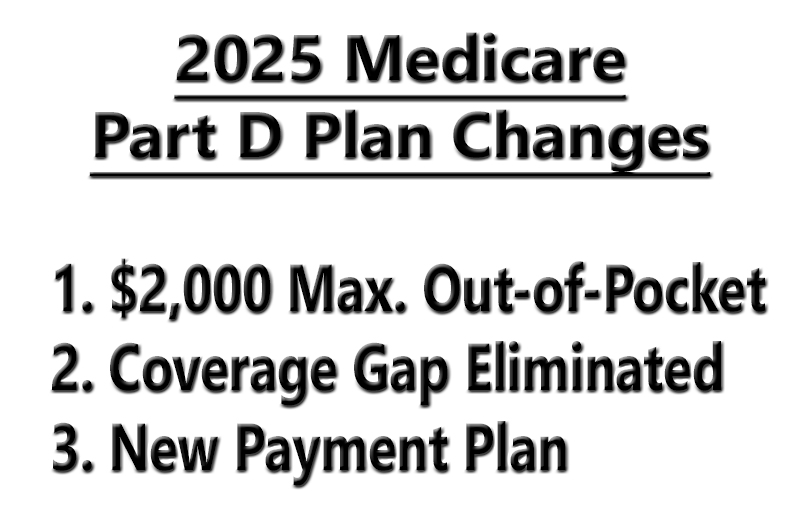

The 2025 Medicare Part D standard benefit structure will have a $590 deductible. After the drug deductible is met the plan member goes into the initial coverage phase. During the initial coverage phase, the plan member is responsible for 25 percent of the drug costs. Once the combination of the deductible and initial coverage phase dollar amount hits $2,000, the plan member goes into the catastrophic phase and the costs of all drugs through the drug plan are covered 100 percent.

Note, not all drug costs add to meeting the $2,000 maximum out-of-pocket. Drugs purchased outside of the U.S. are not covered as well as drugs not on the drug formulary. Plus, some people participate in programs that may cover the costs of some of the drugs. Those expenditures are added to the members out-of-pocket costs, but the plan member does not pay them.

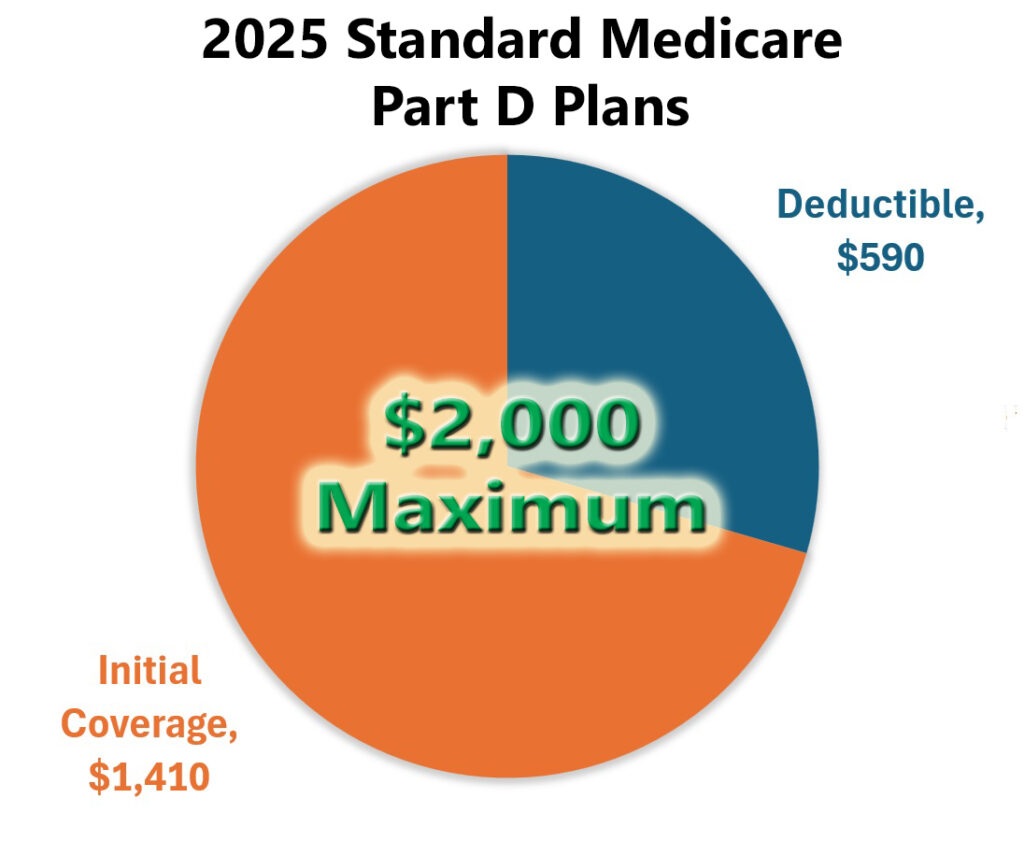

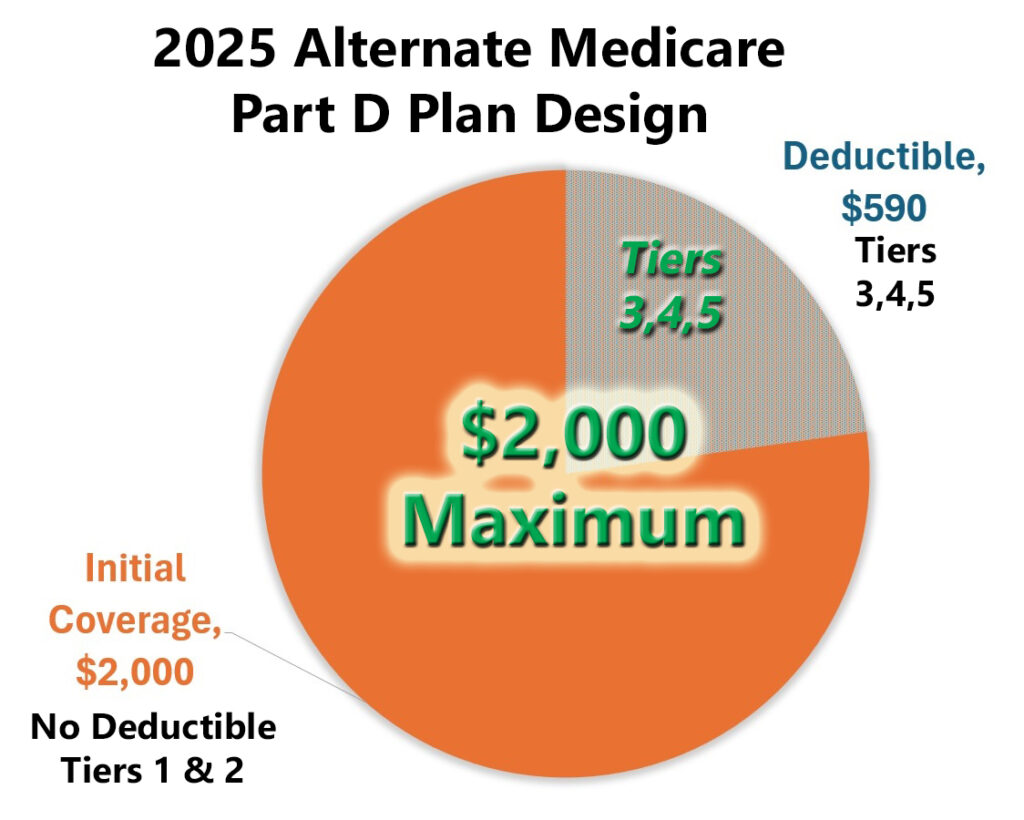

Medicare allows the plan sponsors or insurance companies to offer alternate Part D benefit structures, as long as they are actuarially equivalent to the standard benefit design. You may be offered a drug plan with no deductible. You would go straight into the initial coverage phase paying either a copayment or coinsurance for your prescription medications. Regardless, once your out-of-pocket costs reach $2,000, all your prescription medications either at a retail pharmacy or mail order are covered 100 percent for the remainder of the year.

Another Part D benefit structure we have seen in past years will have drug tiers 1 and 2 not subject to the deductible, while more expensive drugs in the higher tiers are subject to the drug deductible. In this design, drugs in tiers 1 and 2, usually generics, have a set copayment for a monthly amount. They are not subject to any deductible. However, brand name and specialty drugs in tiers 3, 4, and 5. Are subject to the pharmacy deductible. In other words, you must spend $590 on those drugs in the higher tiers before their prices drop to either a copayment or coinsurance.

The same maximum out-of-pocket (MOOP) rules apply. Once your drug costs equal $2,000 out of your wallet, you reach the catastrophic phase and all the drugs are covered for the remainder of the year. Some drug plans may have a sixth drug tier where certain maintenance drugs are $0 cost to the plan member. Of course, a 30 day supply of insulin remains at $35 per month.

Accumulation Accounting

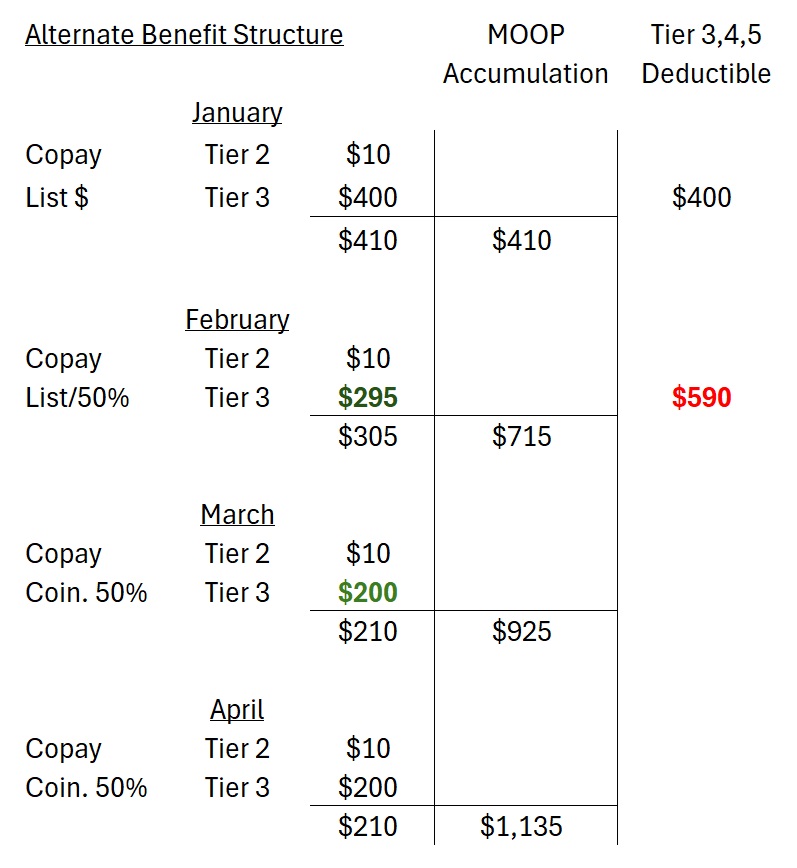

Let’s look at the drug costs under an alternate Plan D drug design that may be offered to you. In this plan structure, drugs in tiers 1 and 2 are not subject to the deductible. Drugs in tiers 3, 4, and 5 are subject to a $590 deductible. Your drug generic drug in tier 2 has a $10 copayment for a 30-day supply. Your second drug is in tier 3 and has a list price of $400 for a one-month supply.

January: you pay $10 for the tier 2 drug and the full cost of $400 for the tier 3 drug. The full cost of the tier 3 drug accumulates to meeting your deductible. Your total cost of $410 accumulates toward meeting your maximum out-of-pocket (MOOP.)

February: You meet your deductible with part of the list cost of the tier 3 drug. A remainder of the drug cost is subject to 50 percent coinsurance outlined in the Part D drug plan. Your total monthly drug cost is $305 and is added to the MOOP, $715.

March: Your tier 3 drug is fully subject to 50 coinsurance and the 30-day supply costs $200. The total costs of your two drugs equals $210 and is added to the MOOP accumulation, $925.

April: The monthly $210 drug costs continue to be added to your MOOP column and totals $1,135 at the end of April.

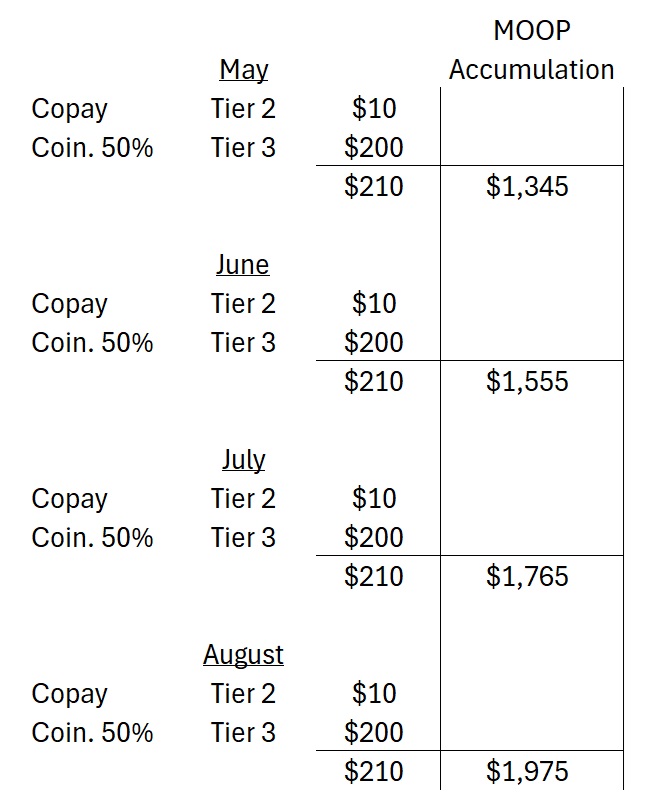

The months of May through August have your drug costs remaining at $210 and add to the MOOP. At the end of August, you have spent $1,975 on your prescription medications.

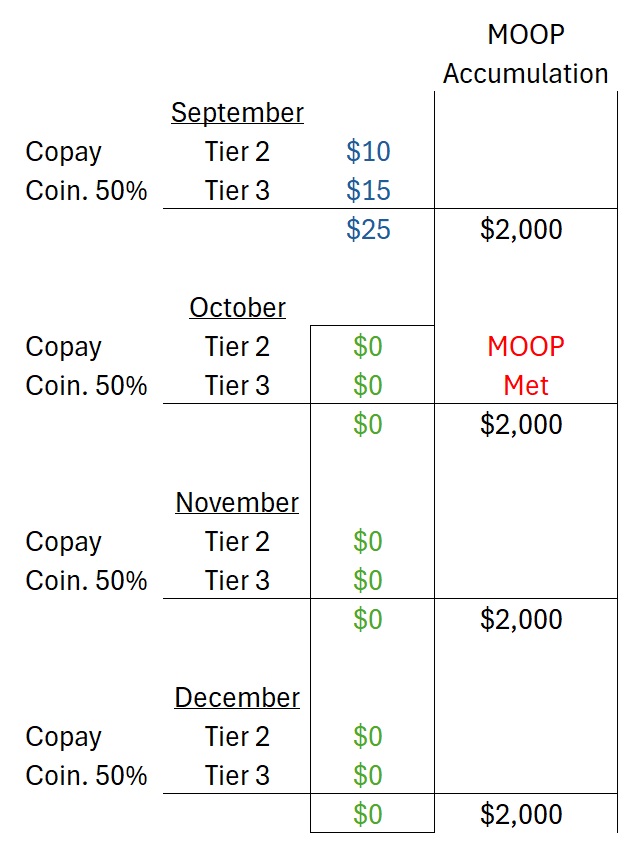

Your September prescription refill costs hit the $2,000 MOOP and reduces your drug costs to $25 for the month. For the remainder of the year, because you have met the MOOP, you pay $0 for your drugs.

Part D Drug Cost Payment Plan

A new feature of the Medicare Part D drug plans for 2025 will be the ability for the plan member to opt into a payment plan for the drug costs. For people with generic drugs at a set copayment, the payment plan may not be advantageous. The payment plan helps spread the cost of expensive drugs, subject to any deductible, over the course of the year. While you can opt into the payment plan at any time of the year – and alternatively opt out once you have started – enrolling late in the year may provide very little benefit.

The payment plan is administered by the Part D drug plan. It essentially takes your drug cost, divides it by the number of months left in the year, and you pay a reduced monthly amount. For example, if you had one drug that cost $600 and you received that drug only once in January, under the payment plan you would pay $50 each month for the rest of the year.

Unfortunately, our prescription medication costs are not one and done. Our drug costs have a monthly frequency. It is further complicated by drugs that may be subject to a deductible and are expensive until they go into a copayment or coinsurance of the initial coverage phase.

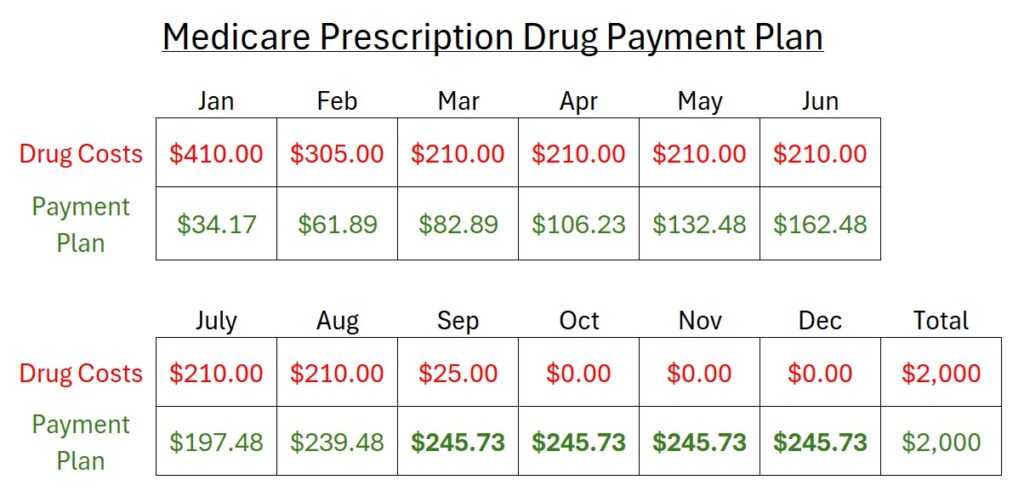

Based on the previous alternative Part D drug plan costs, this is a hypothetical accounting of how the payment plan may work. The drug cost row is the monthly price of the prescription drugs, which drops in February as the deductible is met. The drugs costs are static, March through August, at $210 per month. In September, the plan member meets the MOOP and the drug costs drop. In the months of October through December the plan member has no drug costs as they have met the $2,000 maximum out-of-pocket amount.

The Payment Plan row takes the accumulated drug costs, less any previous payments, and divides the remainder by the number of months left in the year. The monthly payment increases every month until September when the MOOP is met and there are no additional drug costs. The payment or $245.73, beginning in September and lasts through the end of December. Total payments under the payment plan equal $2,000, the maximum out-of-pocket amount for the plan member.

The final four months of the payment plan have a higher dollar amount than the full cost of the drugs of $210 beginning in March. However, it may be preferrable to pay the $245.73 in the latter months as the full cost of the expensive tier 3 drug in January and February.

Unknown changes to drug plan in 2025

All the Part D drug plan sponsors will react differently to the changes for 2025. Some of the changes you might experience are,

- Monthly premium increases

- Some drugs no longer covered

- Drugs moved from a lower tier to a higher tier such as moving the drug from tier 3 to tier 5

- Higher copayments and coinsurance for the same drugs you are taking

- Higher drug costs at standard pharmacies versus preferred pharmacies

There may be some behind-the-scenes changes to the drug plans such as

- Reluctance to grant formulary exceptions where the plan member asks to have a non-formulary drug added to their plan

- Reluctance to grant a tier change for a drug – taking a drug from tier 3 to 2 to save the consumer money

- Some plan sponsors may tighten prior authorization and place more emphasis on step therapy. Step therapy is where a plan member must start with a generic version drug before going straight into the brand name drug when their doctor first prescribes the medication.

However, if you are taking a brand name drug and switch plans, the new drug plan must provide a one refill for the prescription. Review the Evidence of Coverage for any new drug plan you may consider, learning how they administered the transitions.