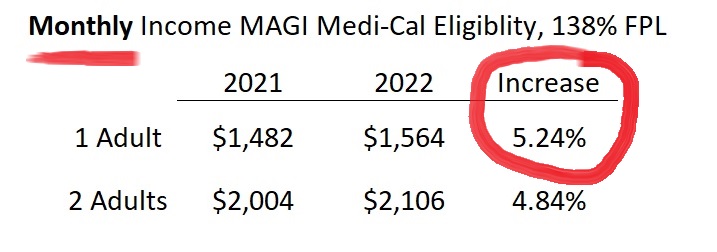

The Medi-Cal income eligibility amounts will have a large 5 percent increase for 2022. This means that a single adult, in order to qualify for Covered California and the health insurance subsidies, will need to have an income of more than $1,564 per month. The annual amount for a single adult for Covered California will need to be over $18,755 per year.

MAGI Medi-Cal Income Increases 5% for 2022

The federal poverty level (FPL) income amounts increased 5.2 percent from 2021 to 2022 for a single adult. The FPL is the foundation for determining eligibility for California’s MAGI Medi-Cal health insurance program. For adults, incomes under 138 percent of the FPL for the household size, makes the adults eligible for the Modified Adjusted Gross Income (MAGI) Medi-Cal. For children, 18 years old and younger, they qualify for MAGI Medi-Cal if the household income is under 266 percent of the FPL.

MAGI Medi-Cal screens for eligibility based on the monthly income of the applicant. Medi-Cal does have the option to review an applicant’s income on an annual basis. For a single adult, the monthly Medi-Cal income was $1,482. In 2022, the monthly income will increase to $1,564. In other words, an adult can earn up to $1,564 per month and still qualify for no cost Medi-Cal. MAGI Medi-Cal annual amounts for a single adult increased to $18,755, from $17,775 in 2021, for a single adult.

For 2 adults, monthly MAGI Medi-Cal for 2022 increased to $2,106, from $2004 in 2021. The annual income for 2 adults to remain eligible for MAGI Medi-Cal means they will have to have a household income under $25,268. The 2021 annual income amount for 2 adults was $24,040. Modified Adjusted Gross Income includes income from employment, net self-employment income, Social Security retirement, SSDI, foreign earned income, and tax-exempt interest.

Reporting a Covered California Change May Trigger Medi-Cal

For Covered California, individuals and families who enrolled during the Open Enrollment Period, the health insurance subsidies and eligibility, were based on the lower 2021 FPL amounts. If the monthly or annual incomes in the Covered California are below the new 138 percent of FPL, there should be no problems with continued enrollment. However, if a change is made to the Covered California application, the higher MAGI Medi-Cal income amounts will be applied to the original income estimate. Reporting a change on the Covered California application could trigger MAGI Medi-Cal, even if the change does not involve a change to the income.

While the higher FPL income amounts may not be updated in the Medi-Cal system until March, case eligibility workers can apply the higher amounts to applications when reviewing eligibility, according to California Department of Health Care Services. For some Medi-Cal programs, the higher FPLs, and potential eligibility, will be applied retroactively back to January 1, 2022. Usually, Covered California does not update their FPL numbers until March. If your estimated income has increased, and your current income estimate is below the new 138 percent of the FPL in the Covered California system, you should report a change to income on your Covered California application.

The following information is from the February 9, 2022, All County Welfare Directors Letter No.:22-03 regarding the new 2022 FPLs.

Advance Premium Tax Credit (APTC) individuals

APTC eligible individuals who are redetermined eligible for Medi-Cal using the 2022 FPL figures may be eligible for retroactive Medi-Cal. The county shall only retroactively change eligibility for APTC individuals who did not enroll in a Qualified Health Plan (QHP), did not pay a premium, or who did enroll in a QHP and pay a premium but have Medi-Cal covered medical or dental expenses that were not covered by their QHP during the retroactive period.

APTC eligible individuals, described above, may be eligible for retroactive Medi-Cal out-of-pocket expense reimbursements (Conlan). Please see MEDIL I 07-02 for additional information about the Conlan process.

Note: The Centers for Medicare and Medicaid Services has decided that there will be no reimbursement for premiums paid to Covered California QHPs. The notice sent by DHCS will state that no Covered California QHP premium reimbursements will be available. Please see ACWDL 16-08 for instructions on determining retroactive Medi-Cal coverage when an individual is transitioning from Covered California coverage.

Please note: DHCS is coordinating implementation of the 2022 FPLs in the California Healthcare Eligibility Enrollment and Retention System (CalHEERS) [aka Covered California] and Statewide Automated Welfare System (SAWS). DHCS anticipates the CalHEERS system and SAWS system will be updated with the annual 2022 FPL amounts in March of 2022.