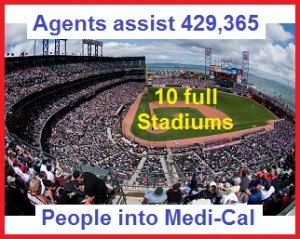

Agents assisted 429,365 individuals with Medi-Cal eligibility over a 19 month period.

Covered California Certified Insurance Agents assisted 429,365 individuals for possible enrollment into the expanded ACA Medi-Cal health insurance from January 1, 2014 through July 31st, 2015. The Medi-Cal assistance enrollment figure comes from a Public Records Act Request that I submitted in early October of 2015 to Covered California. As the $58 compensation to agents for Medi-Cal enrollments ceased over the summer I felt it was important to learn the level of agent involvement with funneling Californians in Medi-Cal health plans.

Agent agreement to assist Medi-Cal consumers

In addition to the cessation of Medi-Cal payment to agents, which was based on a one-time allocation of funding administered by the Department of Health Care Services, the Covered California Board was set to adopt agent specification iterating that agents are duty bound to assist Medi-Cal eligible consumers with their Covered California application at their October 2015 meeting.

Agents working for free?

Many agents felt as if Covered California is forcing them to work without compensation if the consumer they are assisting is eligible for Medi-Cal. If the consumer is eligible for the ACA Premium Tax Credit subsidy, they are allowed to enroll in a private health plan for which the agent earns a fee or commission. If the Covered California stream line application determines that the family or individual is only eligible for Medi-Cal the agent receives no reimbursement for ha or her time completing the application on the consumer’s behalf.

Separate but equal enrollment

At the October 8th Board meeting several agents expressed their dissatisfaction with the current Medi-Cal situation in public comments before the Board. Some agents suggested that Covered California should consider something akin to a special enrollment office just for Medi-Cal. The rational being that those eligible for Medi-Cal could then apply for other social services they may qualify all under one roof. One agent expressed a wide held sentiment that the current and proposed agent rules as forcing agents to perform duties for which they were not compensated and maybe against the law.

Proposed Covered California agent agreement continues the rule that agents continue to assist Medi-Cal eligible consumers without prejudice or directing them to another organization.

Agents helped 429,365 consumers with Medi-Cal

I put in my two-cents worth of wisdom during the public comment period where I began with the Medi-Cal assistance numbers provided to me by Covered California.

“We were able to pull the number of the Medi-Cal applicants that agents assisted from 01/01/2014 to 07/31/2015. The total number is 429,365. Please note that this number reflects those applicants who were Conditional Eligible, Eligible and Pending” – Office of Public Records Act Request, Covered California.

The last sentence is important because Covered California doesn’t make the final Medi-Cal enrollment decision. They had the data off to the respective county where the applicant lives for final enrollment. Some of the 429,365 may have been determine ineligible for Medi-Cal in the final analysis of their situation or income. The reply did not break down how many of the individuals were children in mixed households where the parents were eligible for premium tax credits for private health insurance, but because of the household income the children were automatically Medi-Cal eligible.

Medi-Cal is just part of the health insurance puzzle

From my perspective Medi-Cal enrollment is just part of the territory. I’ve had families start out with premium assistance and then a loss of employment knocks the kids or the whole family into Medi-Cal. There are other households that start as Medi-Cal and their business take off and all, of the sudden their income floats them up to the premium assistance level. It can be very hard to guess who will or won’t be Medi-Cal eligible until you put the household income into the system.

Medi-Cal torture

Of course there are those college kids that are obviously Medi-Cal because they are living off of loans or grants. But those applications are rather quick and not really an issue. I do feel uncomfortable about breaking the news to a family with children that they are Medi-Cal eligible. It’s like I’m sentencing them to be tortured. Some of these counties that administer Medi-Cal are out of the dark ages. They are understaffed, unfriendly, and just generally horrible at any level of customer service.

Agent’s job stops at eligibility determination

Even Covered California is frustrated with how the Medi-Cal transition and enrollment is handled. But there hands are tied as it is not there area of responsibility and it has its own set of state and federal rules. Executive Director Peter Lee was very clear at the Board meeting that the expectation that Covered California had was that the age to would take the consumer over the finish line in his words. The agent responsibility was to complete the application and then the CalHEERS program would determine eligibility. If the eligibility was Medi-Cal, the agent’s job was done.

Middle income families shocked over Medi-Cal bureaucratic quagmire

Covered California is not asking the agents to be consumer advocates once they were in the Medi-Cal. I think most agents understand that part, but they still feel a sense of duty to try and help clients who are having a tough time interacting with this new bureaucracy. We have to remember that most of the new people in Medi-Cal have no experience, nor did they want to experience, the labyrinth of this bureaucratic beast. We are talking generally middle income families who all of the sudden have their children, or even themselves, on public assistance. It’s a shock to the system.

Dwindling commissions threatens agents assistance with Medi-Cal

As I told the Board in my public comments, I view my commissions and fees from clients in private health plans as subsidizing my time and energy enrolling individuals and families in Medi-Cal. My bigger concern is the deflation of agent commissions and how it might jeopardize my ability to serve any consumer who calls me.

Western Health Advantage’s discriminatory Covered California commission structure

Western Health Advantage announced a split commission structure for 2016. If I enroll an individual in a Covered California plan they will pay me $22 per month for that member. But if I enroll that same person in a WHA plan off the exchange, they’ll pay me a 5% commission. I read that as they really don’t want sales through Covered California. If they pay a lower commission on Covered California enrollments they may be hoping that agents take business elsewhere or off the exchange with them.

Anthem Blue Cross drops commissions again

Anthem Blue Cross announced that they are reducing their 2016 compensation from $18 per member per month (pmpm) down to $16 pmpm for the first year of the plan. If the consumer renewals the plan in year two they will pay $12 pmpm. Anthem Blue Cross and all the other exchange carriers pay Covered California $13.95 per month for each individual enrolled in a health plan with them through Covered California. As if I in sync with the deflating commission trend, the Board at the October 8th meeting voted to lower the commissions they pay on small groups written by agents down to 5% from 6%.

Cutting expenses at the expense of agents

In summary, health insurance rates are going up and agent commissions are going down. That means the expenses of the health plans, including Covered California, are going down. My expenses don’t decrease because I offer less customer service. On the contrary, once my customer service goes down, my revenue will decrease because I’ll lose clients.

Medi-Cal is no worse than Covered California

But I don’t really buy into the argument that Covered California is forcing the agents work for free or that the agent contract is flawed. I’m not an attorney, but I’ve always seen the agent contract mainly referred to as an agreement. Covered California doesn’t pay agent commissions on individual and family plans. The health plans pay the commissions or fees. Covered California only pays agents for small group enrollments through the Covered California for Small Business program.

Is it time to quick being an agent?

Until there is a lawsuit concerning the agent contract or agreement, and that document is adjudicated by a court, it remains the foundation of the relationship between agents and Covered California. Agents can either decide to participate and enroll people through Covered California or walk away.

Does Covered California understand agent compensation?

The fact that agents assisted with over 400,000 Medi-Cal eligibility determinations over a nineteen month period is substantial. The fact that agents enroll 40% of all consumers in Covered California is meaningful. The fact that Covered California is allowing for the continuous erosion of agent commissions, even after they tell us how important we are to their success, is important. It’s important because they either don’t understand how commissions work or they don’t care.

Covered California is shrewd business man

I think Covered California is a smart and savvy capitalist business man. The smart manager will squeeze that last ounce of productivity out of any resource and toss it aside. Agents are expendable. Covered California has their core consumers enrolled thanks to the efforts of agents. They no longer need agents in the consumer market place. Carriers don’t want agents because they are an added expense.

Health plans taking over for agents

We’ve already seen the trend of the Plan Based Enrollers increasing consumer assistance with enrollment. The goal is to get 100% of all Covered California members enrolled through a Navigator, Certified Enrollment Counselor, Plan Based Enroller, or directly through the Covered California call center. That would mean that none of the health plans would have to pay any commissions. Alternatively, the health insurance companies are hoping that if they keep pushing down the commissions for the individual and family plans agent will just give up writing it. We’ve already seen this with Medicare Advantage Plans where the plans themselves do all the marketing and enroll consumers directly. They have all but cut agents out of the enrollment process saving the companies millions of dollars.

“Certified Plan-Based Enroller” (PBE) means an individual who provides Enrollment Assistance to Consumers, as defined in Section 6700 of Article 9 of this chapter, in the Individual Exchange through a Certified Plan-Based Enroller Program. Such an individual may be:

(a) A Captive Agent of a QHP issuer; or

(b) An Issuer Application Assister as defined in 45 CFR Section 155.20, provided that the issuer application assister is not employed or contracted by a PBEE to sell, solicit, or negotiate health insurance coverage licensed by the California Department of Insurance. – Covered California definitions

Medi-Cal health plans getting fat from health individuals

Of course the health plans are the biggest recipient of all the new government money under the ACA, and I’m not talking about the premium tax credits. Many for profit insurance companies such as Anthem Blue Cross, Blue Shield of California, Health Net, and Molina are involved in Medi-Cal health plans. In 2014 the average capitated monthly premium amount for an individual enrolled in a Medi-Cal plan was $611. That’s over $7,320 annually for that 19 year old college student that will never use Medi-Cal because they go to the student health center.

Getting ready to ditch the agents

Agents are expendable to the process for Covered California and the carriers. We are not expendable to consumers who need guidance and can’t receive help from bureaucracies who don’t have time for them. Who is going to help the consumer with a billing problem? Not Covered California. Who is going to help the consumer determine which providers are in-network or which drugs are covered? Not Covered California. Commissions pay for me help consumers with billing problems, network and pharmacy questions, and help enroll people in Medi-Cal.

But when those commissions dwindle done to subsistence level…well…I have to go find another line of work.