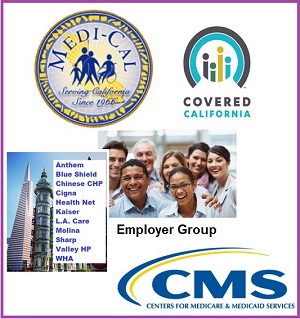

In California there are essentially five different paths to getting health insurance. Each of the different options have varying conditions and restrictions. Below is a summary of the five paths to California health insurance. There is also a short video you can watch titled California Paths to Health Insurance which also explains the five different paths. All information contained here and in the video was accurate as of June 2015.

Expanded Medi-Cal

Medi-Cal is open year round for incomes below 138% of the federal poverty line.

With Medi-Cal expansion under the Affordable Care Act, individuals and families can be automatically enrolled in Medi-Cal if their income is under 138% of the federal poverty line. Medi-Cal health plans have no monthly premium and most all the health care services are no cost to the members. You can enroll directly at your county social services department or through Covered California. Medi-Cal enrollment is open year round.

Enrollment for the expanded Medi-Cal is based solely on the individual or family income. It is not based on any assets such as a savings account, car, or homeownership. When the family or individual’s income increases, they can move into a tax subsidized health plan offered through Covered California. There are still Medi-Cal programs for individuals who are disabled, blind, or living in a skilled nursing facility which may have income and asset restrictions attached to enrollment.

Tax credits are only available through Covered California, but there are income limits.

Covered California for tax credits

Individuals and families whose household income is between 138% and 400% of the federal poverty line are eligible for the Advance Premium Tax Credits to lower their monthly health insurance premium. The tax credits to purchase private health insurance are only available through Covered California. California is broken up into 19 different regions that have a variety of regional HMO health plans and PPO insurance plans. Not all health plans are available in all regions.

For families’ with children under 19 years old, if the household income is under 266% of the federal poverty line the children will be automatically enrolled into Medi-Cal. Parents and guardians can still choose to purchase private health insurance for the children off of the Covered California health insurance exchange but there will no tax credits to lower the premium.

Individuals and families can buy health insurance directly from the carriers without tax credits.

Buy direct with carrier

You can also purchase health insurance direct from a health plan or insurance carrier. There will be no tax credits to reduce the monthly health insurance premium, but there are also no income restrictions. You can enroll during open enrollment, which happens each autumn around October or during a Special Enrollment Period if you have a qualifying life event such as moving to a new region, loss of employer based health insurance, loss of Medi-Cal because your income has increased, a marriage or divorce.

All the same plans that are offered through Covered California are also offered off the exchange directly with the carriers at the same premium rates. Some carriers offer additional health plans that closely resemble the standard benefit designs offered through the exchange but with subtle differences to deductibles, copayments, or coinsurance. There are also health insurance companies that offer individual and family plans that are not sold through Covered California.

All the plans sold either through Covered California or off the exchange direct with a carrier include pediatric dental and vision insurance. None of the health plans can deny enrollment or coverage because of pre-existing conditions or pending medical services such as surgery.

Employers must make a contribution toward the employee’s health insurance, but not the dependents.

Employer sponsored health insurance

Many employers, small and large, offer health insurance to their employees. The employer must make a contribution toward the employee’s health insurance premium, but they are not required make contributions to a spouse or dependent’s health insurance to lower the monthly premium.

If the employee only health insurance premium with the employer contribution is less than 9.5% of the household income, the health insurance is considered affordable and any spouse or dependents are not eligible for tax credits through Covered California. Children of a parent or guardian offered employer based health insurance may still be eligible for Medi-Cal kids based on the household income.

Medicare is minimum essential coverage and not eligible for tax credits.

Becoming eligible for Medicare

When individuals turn 65 years old and have worked for at least ten years they are eligible for premium free Medicare Part A and enrollment in Part B. If you are eligible for Medicare you are generally ineligible to receive tax credits for a private health plan through Covered California.

Individuals who have been determined permanently disabled and are under 65 are also eligible for Medicare. Medicare health insurance is only for individuals, there are no family plans. A household can have a mix of health insurance coverages including Medicare, Medi-Cal, individual plans, or employer based coverage.

For additional information on how to select a health plan see the California Navigator Page.