There are two programs through the California Department of Health Care Services for disabled individuals to receive Medi-Cal. The programs have higher income levels than other Medi-Cal programs to account for disabled individuals who continue to work. The working disabled programs help reduce health care costs, leaving more money to meet rent, food, and transportation expenses.

Qualified Disabled Working Individual

The first program is called Qualified Disabled Working Individual that is based on the Medicare Savings Program. This assistance program is targeted to people who may have gained Medicare Part A because of an illness or disability and are under 65 years of age. Because the individual has returned to work, they have lost Medicare Part A, which is the hospital insurance of Original Medicare.

The conditions that must be met from Social Security

• Continue to have a disabling impairment.

• Sign up for Premium Hospital Insurance (Part A).

• Have limited income.

• Have resources worth less than $4,000 for an individual and $6,000 for a couple, not counting the home where you live, usually one car, and certain insurance.

• Not already be eligible for Medicaid.

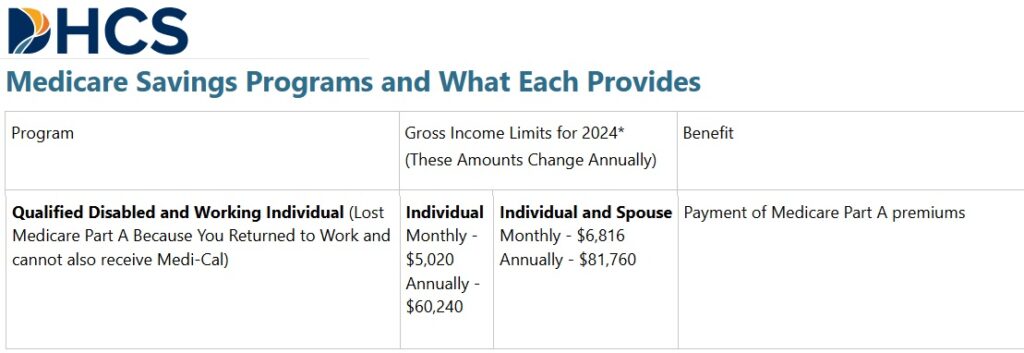

The income limits will change every year when the federal poverty level is updated.

2024 Income maximum

Single Adult $5,020 monthly, $60,240 annually

Individual and Spouse: $6,816 monthly, $81,760 annually.

However, never assume you are not eligible. The income calculations are complicated. Always apply at your country Social Services Medi-Cal office and let them determine if you are eligible for the Qualified Disabled Working Individual program to have Medicare Part A premiums covered.

250% Working Disabled Program

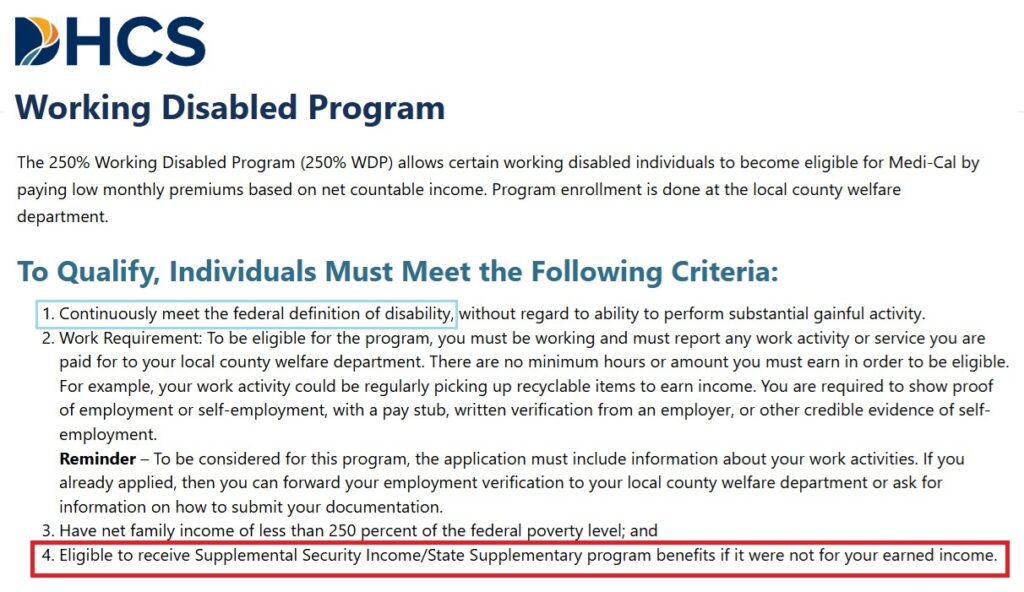

The second program offered is not tied to Medicare. For working disabled individuals who have household income under 250 percent of the federal poverty level, they may qualify for low or no monthly premiums for Medi-Cal. In addition to meeting the federal definition of disability, your household income is too high for no cost MAGI Medi-Cal.

The big condition that must be met is that you would normally be eligible to receive Supplemental Security Income, if it were not for your income from wages or self-employment. To be eligible for SSI, you need to be disabled, have few or no resources, and monthly income less than $1,550 for an individual. If you meet the criteria for SSI, except for the monthly income, you might be eligible for the 250% Working Disabled Program.

For 2024, 250 percent of the federal poverty level for monthly income for a single adult is $3,138 or $37,656 annually. The monthly income for MAGI Medi-Cal, for individuals under 65 years of age, is $1,732, which is 138 percent of the federal poverty level.

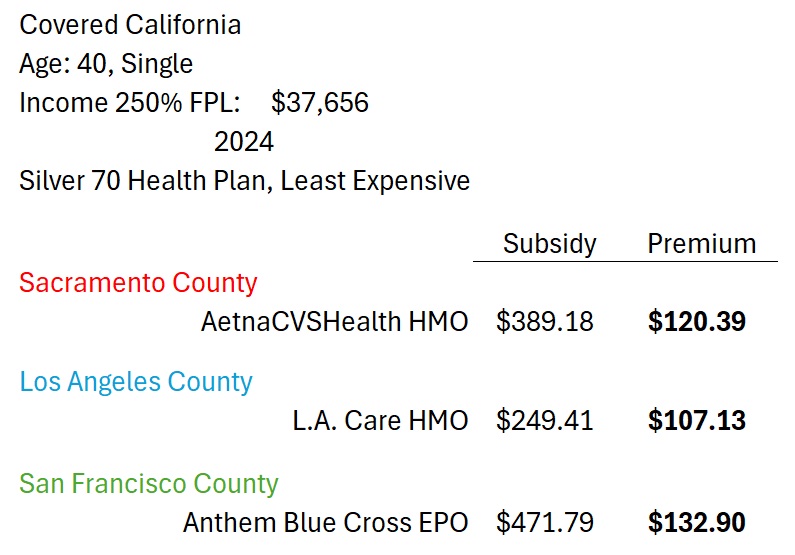

Covered California Health Insurance Subsidy at 250% FPL

For some folks the question is why not just enroll in Covered California with the subsidies to lower the health insurance premiums. If the monthly income is under 150 percent FPL, the individual would be offered a Silver 94 health plan with very low copays, no medical deductible, and potentially with a $0 monthly premium.

Unfortunately, many disabled people, especially if they have a spouse, earn too much to qualify for the enhanced Silver 94 plan. If the individual’s income is bumping up to 250 percent, they are eligible for a Silver 70 and the subsidy does not cover the entire cost of the monthly health insurance premium.

Through Covered California a 40 year old single adult with an annual income of 250 percent of the FPL, $37,656 annually, would see the following subsidy and monthly rates in the following counties for a least expensive Silver 70 plan. (250% FPL dollar amount increases based on the household size.)

Sacramento County

AetnaCVSHealth HMO: $120.39 after a subsidy of $389.18.

Los Angeles County

L.A. Care HMO: $107.13 after a subsidy of $249.41

San Francisco County

Anthem Blue Cross EPO: $132.90 after a subsidy of $471.79

In addition to the monthly premium, there are health care expenses with the Silver 70 plans.

- Office Visit $50

- Specialist Visit $90

- Lab Tests $50

- X-Rays $95

- Imaging $325

There is a medical deductible of $5,400 that is only triggered if you are hospitalized as an inpatient. After a pharmacy deductible of $150, excluding generics, prescription medications have monthly refill copayments.

- Tier 1 $19

- Tier 2 preferred brand $60

- Tier 3 non preferred brand $90

- Tier 4 specialty 20% coinsurance

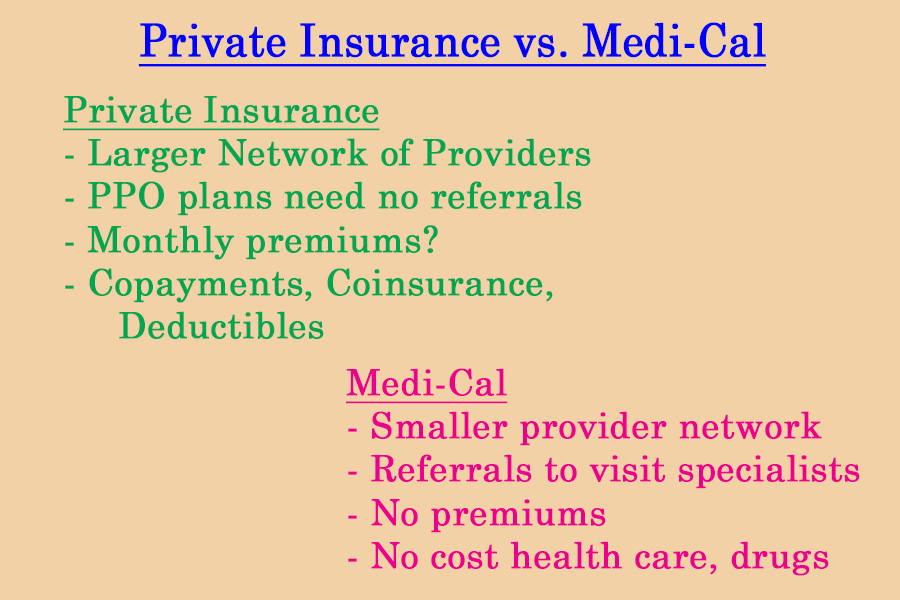

The benefit of a private individual and family plan through Covered California, or off-exchange, is a wider network of providers such as doctors, hospitals, and therapists. If you select a PPO plan, there is no referral to see a specialist in-network. Prior authorization for some health care services and prescription medications applies to ALL health plans, private or Medi-Cal.

While the network of health care providers is small with Medi-Cal programs, if you qualify for the 250% Working Disabled Program, you may be able to save quite a bit of money. To see you if you might qualify, contact your county’s social service department for Medi-Cal eligibility unit.