Navigating The Medicare Maze Of Options

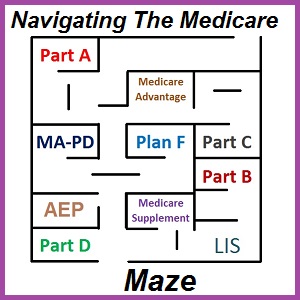

If you are new to Medicare, you know how complicated it can be with all the various options available to you. The first step is to try and get your arms wrapped around the various parts of Medicare. Then you can begin to make an intelligent decision about your Medicare health and drug coverage options that are best for you.

One of the beautiful aspects of Medicare is that you will always be covered and that you are given lots of flexibility to change health and drug plans every year. The downside is that this flexibility with multiple health coverage options can create confusion as you try to navigate through the Medicare Maze.

This high level overview and will not address every situation that a Medicare beneficiary may find them self in. This short primer is meant help you understand the different parts of Medicare and how they work, or don’t work, together. The following information can also be found in the Medicare and You Handbook.

Original Medicare Parts A and B

Original Medicare, for most people, is pretty darn good insurance. While it may not be as benefit rich as a Cadillac employer plan, it is usually better than many individual and family plans, and certainly better than having no insurance at all.

Original Medicare consists of two parts

Medicare Part A is hospitalization insurance.

Part A is the Hospital inpatient Insurance and Part B Outpatient insurance.

For most people who have work 40 quarters, or had a spouse who meets the work requirement, Part A is premium free. For individuals who have not reached age 65, they may be awarded Medicare on the basis of certain illnesses or disabilities.

Part A was designed to help cover the costs of hospital stays. It also includes coverage for hospice, home health care and skilled nursing for 100 days.

Part A does have a deductible for the first 60 days of your inpatient stay at a hospital. There are daily copayment amounts for hospital stays over 60 up to 150 days. These amounts can change every year.

Unlike traditional insurance that has a yearly or annual deductible that once met you are done with it, the Part A hospital deductible can reoccur during the year with each new hospitalization after a 60 day period. For example, you are admitted for gall bladder surgery in February. That would trigger your first deductible. Later in the year you go into the hospital for hip a replacement that would trigger another benefit period deductible amount. There is no annual cap or maximum out-of-pocket amount relative to the Part A hospital deductible unlike most other health insurance plans.

Medicare Part B covers outpatient services.

Medicare Part B covers outpatient services such as doctor visits, lab tests, imaging, outpatient surgery, durable medical equipment, and several other benefits. Part B has a monthly premium. It can either be deducted from your Social Security benefits or you, if you are not receiving Social Security, you can make quarterly premium payments.

Part B also has a deductible. Once you have satisfied the deductible amount, you usually pay 20% coinsurance for the Medicare approved services or equipment. Like Part A, Part B has no maximum out-of-pocket amount or cap. Consequently, for some medical situations that require many follow-up office visits, labs, and imaging, the 20% coinsurance can be overwhelming for some people.

Original Medicare is a giant PPO plan. You can go anywhere in the United State and visit a provider, and as long as that provider accepts Medicare Assignment, they agree to accept the Medicare reimbursement rate for services, Medicare will pay the claim. However, some providers will charge an excess fee up to 15% over the Medicare reimbursement rate that you may be on the hook for in addition to the deductible and coinsurance Medicare cost-sharing amounts.

Original Medicare does not cover most dental, or vision services and it doesn’t cover hearing aids.

Part D Prescription Drug Coverage

Part D Prescription Drug coverage is insurance to help lower the cost of Medicare drugs.

Original Medicare has no drug coverage outside of what may be administered to you as an in-patient in a hospital. Part D of Medicare is insurance coverage for prescription medications you generally receive at your pharmacy.

Part D prescription drug coverage is considered a Medicare Advantage plan. That is because the federal government pays the Part D plan every month on your behalf to lower the monthly premiums. You do not have to enroll in a Part D plan, but if you wait to enroll you will be hit with a penalty. The late enrollment penalty is added to the monthly premium amount for the Part D plan and never goes away.

Part D plans are state based, which means no matter where you live in your state, if a Part D plan is offered that you like, you can enroll in it. Part D prescription drug plans can be confusing. Some have a deductible, others do not. Some have the donut hole or gap coverage, others do not. Not all plans cover the exact same drugs at the same tier levels. The best resource for filtering out Part D prescription drug plans is Medicare.gov. You can enter your drug list and it will sort the plans that will give you the best bang for your buck. But remember, these plans change every year.

During the annual enrollment period AEP, which occurs November through early December, you can change your Part D prescription drug plan for the next year. So, if you don’t like your current Part D plan, or it is substantially changing for the next year, Medicare gives you the opportunity to switch plans.

To recap, once you are determined eligible for Medicare, you enroll in Part A and Part B. You then choose a Part D drug plan and you are covered for hospital, outpatient, and prescription medication. But wait, you still have more options!

Part C Medicare Advantage Plans

Part C, Medicare Advantage plans, administer Original Medicare benefits.

Medicare Part C are the Medicare Advantage health insurance plans. Medicare Advantage health insurance plans are run by either private companies or local organizations. When you enroll in a Medicare Advantage health plan, the plan sponsor then handles all of your Medicare benefits, claims, and expenses.

Medicare Advantage plans are guarantee issue. This means regardless of your health challenges, the plan must accept you. You don’t lose your Medicare eligibility if you enroll in a Medicare Advantage plan and you can return to Original Medicare in the future if you don’t like the Medicare Advantage plan you’ve chosen.

Most Medicare plans include both health and prescription drug coverage, they are known as MA-PDs (Medicare Advantage with Part D prescription drug coverage). MA-PDs are usually county based. A MA-PD offered in Sacramento County may not be offered in Los Angeles County. Sometimes similar plans will be offered by the same plan sponsor in two counties, but some of the copayments for services may be slightly different. If you move outside of the county coverage area, you will be given Special Enrollment Period to enroll in a new MA-PD or return to Original Medicare.

Medicare Advantage plans need to be as good, or better, than Original Medicare coverage for the beneficiary. Medicare Advantage plans may or may not have a monthly plan premium. Regardless of whether the Medicare Advantage plan is $0 cost or has a monthly premium, you must still make the Part B premium payment to Medicare.

A nice feature of Medicare Advantage plans is that they usually have an annual maximum out-of-pocket amount unlike Original Medicare. In this sense, they are more like a traditional health insurance plan. Once you hit the annual maximum out-of-pocket amount, the plan picks up all the copayments and cost sharing amounts for the rest of the year for covered benefits.

Medicare Advantage plans also have set copayment amounts for a variety of common and routine health care services such as office visits, labs, imaging, and hospital stays. This takes some of the guess work out of trying to estimate how much a health care procedure will cost you.

Medicare Advantage plans come in many different flavors such as HMOs, PPOs and Medicare Savings Accounts. Many Medicare Advantage plans are HMOs meaning you will need a Primary Care Physician. The Primary Care Physician will refer you to other specialists within the network. There is no coverage if you go out-of-network. It is important to make sure the Medicare Advantage HMO plan has the doctors, hospitals, and other providers you want to see.

Similarly, the Part D drug coverage can be different between Medicare MA-PDs. You’ll want to refer to the covered drug list to make sure your prescriptions will be covered and at what tier level.

Just like the Part D drug plans, Medicare beneficiaries can change their Medicare Advantage plans every year during the annual enrollment period (AEP) or return to Original Medicare altogether. But remember, if you leave a MA-PD plan that has drug coverage, and return to Original Medicare, you will need to enroll in a Part D prescription drug plan in order to avoid any penalty for lack of drug coverage.

Medicare Supplement Plans

Medicare Supplement plans help cover the cost-sharing of Original Medicare.

Finally, there are Medicare Supplement or Medi-gap plans. These are not Medicare Advantage plans. Medicare Supplement plans do not have prescription drug coverage. Medicare Supplements cover some of the Original Medicare cost-sharing that beneficiaries have to pay such as deductibles and coinsurance. You can have Original Medicare Plus Part D Plus a Medicare Supplement plan.

When you first become eligible for Medicare Part A and Part B, you will have a six month window to enroll in a Medicare Supplement plan with no medical underwriting. That means you won’t have to answer any medical questions about your health. You can enroll in the plan of your choice and receive the same rate for your age as anybody else. If you wait longer than six months, and then apply for a Medicare Supplement plan, you will have to answer health questions. There are a few other scenarios outside of the six month initial window when Medicare Supplement plans are guarantee issue. Please refer to the Medicare Supplement guide and your local state regulations for those conditions.

There several different Medicare Supplement plans. Don’t confuse the lettering system of Medicare Supplement Plans (A, B, C, G, F, etc..) with the Medicare Parts A, B, C, and D. They are different. Except for a few states, each Medicare Supplement Plan has the same benefits as the exact same plan in another state. Plus, regardless of which health insurance company is offering the Medicare Supplement plan, it will have the exact same benefits. A Plan G in Nevada will cover the exact same Medicare cost-sharing expenses as a Plan G in California.

Medicare Supplement plans will have a monthly premium. As the Medicare Supplement plans cover more cost-sharing of Original Medicare, the monthly premiums go up. This means a Plan G that covers all Original Medicare cost-sharing except the Part B deductible will have a higher monthly premium than Plan A that has less cost-sharing coverage

Medicare Supplement plans can increase every year because you are a year older. Plus, the Medicare Supplement plan insurance company can also raise the rates on top of the age based premiums. This means that, for some people, paying the monthly premium of a Medicare Supplement plan can become too much of a financial burden. You can always terminate your Medicare Supplement plan and still be covered by Original Medicare, or, during the annual enrollment period switch to a Medicare Advantage MA-PD plan.

If you leave a Medicare Supplement plan, you can keep your Part D plan until you decide to enroll in a Medicare Advantage plan that includes the prescription drug coverage. Then you will be dis-enrolled from the standalone Part D drug plan.

You can’t have both a Medicare Advantage MA-PA plan and a Medicare Supplement plan.

You can’t have both a Medicare Advantage MA-PD and a standalone Part D prescription drug plan.

Extra Financial Help Paying For Medicare

There is extra help for Medicare beneficiaries to pay for Medicare premiums and cost-sharing.

For many Medicare beneficiaries, even the low Part B premium and modest Part D prescription drug plan premiums can be too great of an expense. There are several programs to help Medicare beneficiaries reduce their health and drug costs. There is the Low Income Subsidy Extra Help for the Part D drug coverage. This program is administered through Social Security.

There is Medicaid, known as Medi-Cal in California. Under the rules of Medicaid, a Medicare beneficiary can receive Extra Help paying for the Part B premium, Medicare cost-sharing, or the premiums and cost-sharing of Medicare Advantage MA-PD plans. There are four different levels of assistance based on household income or disability. Contact your local county social services department and request an eligibility determination for Medicare Extra Help.

To recap, once you become eligible for Medicare Part A and Part B, known as Original Medicare, and you have decided you like Original Medicare, you will need to enroll in a Part D drug plan to avoid any late enrollment penalty. You can also opt to enroll in a Medicare Supplement plan to cover the cost-sharing expenses of Original Medicare.

Another option once you are eligible for Original Medicare is to enroll in a Medicare Advantage plan. Depending on your state and county, the Medicare Advantage plan may or may not cover prescriptions. In this event, you would be allowed to enroll in a standalone Part D drug plan.

Regardless of whether you select a Medicare Supplement plan or a Medicare Advantage MA-PD plan, you will always be given the opportunity drop any Medicare Supplement plan or leave the MA-PD plan and stick with just Original Medicare with a Part D plan.

You can also apply for extra help, either through the Low Income Subsidy program or Medicaid to see if you qualify for assistance paying Medicare Part B premium, cost-sharing, or prescription drug coverage.

Video Explaining Original Medicare, Part D, Medicare Advantage, Medicare Supplements