Covered California has released a revised 2020 income eligibility chart that supersedes the income table of the same name they distributed in September 2019. The revised chart more closely aligns with federal poverty level income table released by Medi-Cal in February. But there are still some differences that remain a mystery.

The Covered California Advance Premium Tax Credit subsidies and eligibility for the health insurance assistance is based on the federal poverty level. The federal poverty level is set each year and released after the first of the new year. This raises the question as to how Covered California could forecast the income table for eligibility and enrollment before the federal poverty levels are even released, as they do every autumn as open enrollment begins.

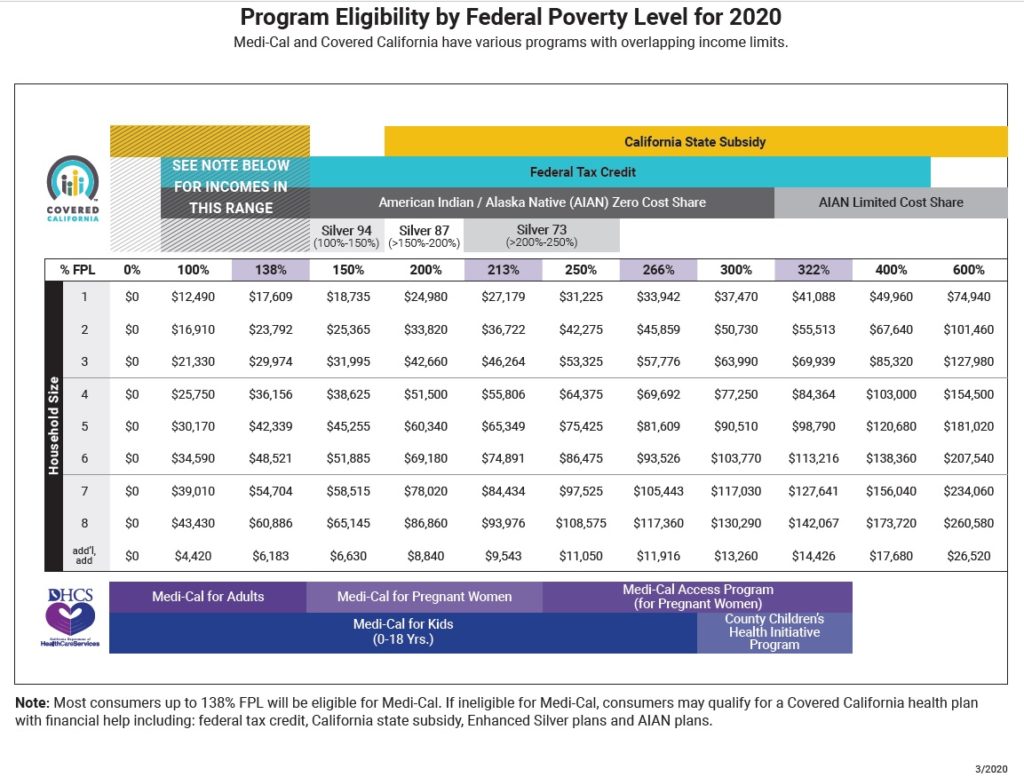

Revised Chart With New Medi-Cal Income Levels

The critical number for many individuals and families is the income of 138 percent of the federal poverty level. If an adult is under 138 percent, based on their monthly income, they are determined eligible for Medi-Cal and ineligible for the Covered California subsidy. The threshold for Medi-Cal, 138% FPL, jumped from $17,237 on the September chart up to $17,609 on the new revised income table. The new higher income amount concurs with the issued Medi-Cal income table for 2020.

If your income is at $17,500 for a single adult in Covered California, and you make a change to your account such as updating a phone number or email address, when you report that change, the application is run through the Business Rules Engine of the Covered California CalHEERS program. Each reported changed is treated like submitting the application for the first time to make sure it meets all the conditions for eligibility.

With the annual income of $17,500 or $1,458.33 per month, there is a high probability that you will be determined eligible for Medi-Cal and lose your monthly subsidy and private health insurance. The monthly income for the subsidies is $1,469 per month. Gotcha!

What is not discussed is that individuals and families applying for health insurance for 2020 during the 2019 open enrollment period are under the 2019 federal poverty levels those are the bench mark for eligibility, enrollment, and subsidies. However, if you make a change during the middle of year, the new 2020 federal poverty levels are then applied to the household situation. Theoretically, if a household never reports a change in 2020, then the new higher federal poverty levels will not be applied for eligibility. So far this has held true, but it catches people during the automatic renewal for the next year if their income is too low.

The income columns that have been revised are for the percentages 138, 213, 266, and 322 that all relate to Medi-Cal. The 138 and 266 percentages are Medi-Cal eligibility for adults and children respectively. The column for 322 percent applies to certain counties (Santa Clara, San Mateo, San Francisco) who have higher income eligibility for children in the County Children’s Health Initiative Program. The 213 percent is for Medi-Cal for pregnant women.

Medi-Cal 2020 Monthly Income Amounts

What has not change is the upper income limit of 400 percent for the federal Advance Premium Tax Credits. It is still at $49,960 while the Medi-Cal chart, based on the federal poverty level, is $51,040. The IRS uses the federal poverty levels for determining the subsidy when people file their taxes. However, the IRS uses the previous year’s federal poverty level for the reconciliation of the Premium Tax Credit on form 8962.

There really is no mystery as to why the Covered California income chart doesn’t match the Medi-Cal federal poverty level income table. Covered California is working with two different programs. They must screen for MAGI Medi-Cal eligibility based on current monthly income and the latest federal poverty levels, and, they must also determine the Advance Premium Tax Credit subsidies following IRS guidelines that use the previous year’s federal poverty levels. And if you follow all of that, you are smarter than me!

Note of Caution from Covered California

April 3, 2020: Federal Poverty Levels Have Recently Changed

Please reference the new Program Eligibility by Federal Poverty Level for 2020 chart for up-to-date information when assisting consumers with enrollment. As a reminder, Medi-Cal uses monthly income to determine FPL, but Covered California uses annual income to determine FPL; a mid-year change in income could cause the monthly (Medi-Cal) income to be different from the annual (Covered California) income, resulting in a different eligibility determination than expected.

Medi-Cal and Service Center Representatives

Using the Report a Change (RAC) feature to test income levels instead of the Shop and Compare Tool could result in a consumer becoming Medi-Cal eligible. Once the Covered California system determines anyone in the household to be Medi-Cal eligible, a referral is automatically sent to the county, and the case will not be accessible until the county completes its review. Please use the Shop and Compare Tool to determine eligibility. If you make changes to the application and accidentally create Medi-Cal eligibility, do not call the service center; Service Center Representatives can’t undo this action. If it was a true mistake, you must call the county.

Revised Covered California Medi-Cal Income Table for 2020

Revised Covered California Medi-Cal Income Table for 2020