Where do I get health insurance?

1. Medi-Cal,California’s version of Medicaid, is available to individuals and family’s whose income is Modified Adjusted Income is under 138% of the federal poverty level. Children’s dental and vision benefits are included. Adult dental benefits are also offered. Each California county administers Medi-Cal enrollment, but eligibility can be done through applying with Covered California.

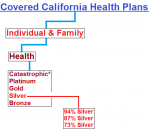

2. Covered California is the health insurance exchange for individual and family plans for Californian’s who qualify for tax credits to lower their monthly health insurance premium. All the health plans include children’s dental and vision benefits. Adult dental insurance may be purchased without a subsidy.

3. Direct with Health Plans Individuals and families can purchased health insurance directly from a health insurance company or health plan. All plans include children’s dental and vision benefits. Adults dental and vision plans can be added with some carriers. No tax credits are available to lower the monthly health insurance premium when enrolling directly with a carrier.

4. Employer Group – many small and large employer groups offer employee and dependent health insurance. Employers only have to make a contribution to the employee’s health insurance cost, not the dependents. Children’s dental and vision benefits may or may not be included with the plans. Family dental and vision insurance is usually offered through the group. Covered California offers small group health plans.

5. Medicare is generally available to individuals over 65 years old or have a permanent disability and are under 65 years old. Medicare can work with employer group plans. There are also supplement plans to cover costs the Original Medicare Parts A and B do not cover. Dental and vision benefits are not a part of Original Medicare, but maybe offered by some Medicare Advantage plans.

California Five Paths to Health Insurance Video

Blog post of California Paths to Health Insurance

California Regions

California is broken up into 19 health insurance regions. (See the map). Your primary residence will determine which region and health plans are available to you or your family. Some regions may only offer one or two health plans. Insurance premiums will vary by region.

Navigating Health Insurance

Navigating the new landscape of health insurance presented by the Affordable Care Act and Covered California for individuals and families can be confusing. Instead of jumping right into picking a plan based on a health plan marketing, the advice of a friend or even an insurance agent, I recommend you start with YOU and your family’s health care needs and priorities. You can do this by filtering out health plans that don’t meet your criteria.

Doctor and Hospital Filter

There is no use enrolling in a health plan that doesn’t support the doctors, hospitals and other health care providers that you have come to rely on for delivering your health care. While it can be daunting, you need to find out which providers are “in-network” for California Individual and Family Plans (IFP). Sometimes you can call the doctor’s office or check the providers website. You can also use the provider search tool or Doc Finder search on most of the health plans websites. Caution – when using the health plans search function make sure you select the right type of plan. Searching for providers under a group plan may yield incorrect results leading you to believe a doctor is in-network when they really aren’t. Alternatively, a Certified Insurance Agent should also be able to help you filter out health plans that don’t support your providers.

Prescription Drug Filter

If you or any member of your family takes prescription medications you’ll want to review the Drug Formularies for the plans that support your providers. A drug formulary is a list of covered prescription drugs and how much they will potentially cost offered within the health plan. Not all brand name drugs are covered by all health plans and if they are covered, some plans may have them in a different tier. Drugs are group by tiers (1,2,3,4, etc.) with the higher tiers having higher copayments or coinsurance.

Premium Filter

Once you’ve filtered health plans by your provider and prescriptions, then you can begin to look at the different plans and coverage. This really comes down to a cost versus benefit analysis. The reduced copayments, coinsurance and deductibles of a Gold or Platinum plan may outweigh the higher premiums relative to a Silver or Bronze plan. Since all the plans have a capped annual maximum out-of-pocket amount (between $6,250 – $4,000), the analysis should focus on routine health care costs associated with any chronic health challenges such as office visits, labs, and prescription drugs.

Tax Credit Filter

Finally, you need to decide whether it is worth participating in Covered California to receive Premium Tax Credit assistance to reduce your monthly premiums. You can only receive the ACA tax credits to reduce the health insurance premiums by enrolling in a health plan offered through Covered California. Not all individual and family plans are offered on California’s health insurance exchange Covered California.

Agent Filter

You can make your health insurance search easier by finding a Certified Insurance Agent that will help you filter the health plans and determine if purchasing health insurance through Covered California is best for you and your family.

Do I have to buy health insurance? |

No, If you are… |

| Offered employer group plan that is too expensive* |

| Making less than 138% of federal poverty line |

| Part of an employer group plan |

| Eligible for religious exemption |

| Undocumented immigrant |

| have Private insurance |

| Part of Indian tribe |

| Incarcerated |

| Tricare, VA |

| Medicare |

| Medi-Cal |

Shared Responsibility Payment OR

Individual Mandate

| What are the penalties for not having health insurance? | |||

| 2014 | 2015 | 2016 | |

| Adult | $95 | $325 | $695 |

| Child | $48 | $163 | $348 |

| Family | $285 | $975 | $2,085 |

| Or Income | 1% | 2% | 2.50% |

IFP – SHOP – Open Market

| Covered California | |||

| IFP | SHOP | Open Market | |

| I have | |||

| Been denied health insurance | X | X | |

| A pre-existing condition | X | X | |

| No health insurance | X | X | |

| A big family | X | X | |

| No money | X | ||

| I work | |||

| for myself | X | X | |

| for a company that doesn’t offer health insurance | X | X | |

| I run | |||

| a small nonprofit | X | X | X |

| a small business | X | X | X |

| IFP: Individual & Family Plans, Tax Credits | |||

| Open Market: No individual or family tax credits | |||

| SHOP: Small Group Health Plans < 50 employees, tax credits |