California Individual and Family Dental Plans

If your health insurance is not through Covered California, and you are either Medi-Cal, Medicare, or in an employer sponsored health plan that doesn’t offer dental insurance, you can enroll in an off-exchange dental insurance plan.

Delta Dental Premier Network Plans

Delta Dental for individuals and families is offered through a group association called Morgan White Group. There are several different PPO plans with one that includes no waiting periods call Immediate Coverage. The Premier plans have a larger network of dentists. Not all Premier network dentists will accept the standard Delta Dental PPO plans as in-network. For a quote and enrollment visit Insurance for Everyone.

Five Year Comparison of Delta Dental PPO Costs and Premiums

Delta Dental California IFP

Delta Dental offers two PPO plans and two HMO plans that can be purchased directly from Delta Dental. There is the Basic PPO and Premium PPO plans that use their PPO network. There are also two different levels of HMO dental plans called DeltaCare USA. The Premium PPO lists coverage for dental implants.

There are also dental plans available directly through Anthem Blue Cross and Blue Shield of California. Call me for quotes on those products that are competitively priced.

Waiver of Waiting Period

Most dental plans include waiting periods for minor and major restorative work, usually 6 and 12 months respectively. This means, before the dental plan will share the cost of the dental treatment for certain services, the waiting period must be met. For example, if you need a cavity filled, minor restoration, and you have only had the dental plan 4 months, you will get the dental plan’s negotiated rate with the dentist, but the dental plan will not contribute any dollar amount to the service. After 6 months, and the waiting period has been met, the dental plan will pay its cost-sharing percentage stipulated in the plan.

If you have dental insurance, but have lost that coverage or switch to a new dental insurance plan, the waiting periods may be waived. Waiving the waiting periods is on a case-by-case basis. The enrollee must request waving at the point of enrollment or within 30 days of the effective date. Also, there must be no break in coverage. For coverage to qualify as prior creditable coverage the other policy must have been in force for 12 months. You will need to verify your previous coverage usually by supplying the dental plan member ID card and recent invoice or letter stating when the coverage terminated or will terminate.

Covered California

If you are enrolled in a health plan through Covered California you may enroll in an adult dental insurance plan offered through Covered California. Remember, all individual and family plans come with embedded pediatric dental benefit. Only adults, over 18 years old, need to buy dental insurance. But you can still enroll dependents 18 and under years of age on a family dental plan.

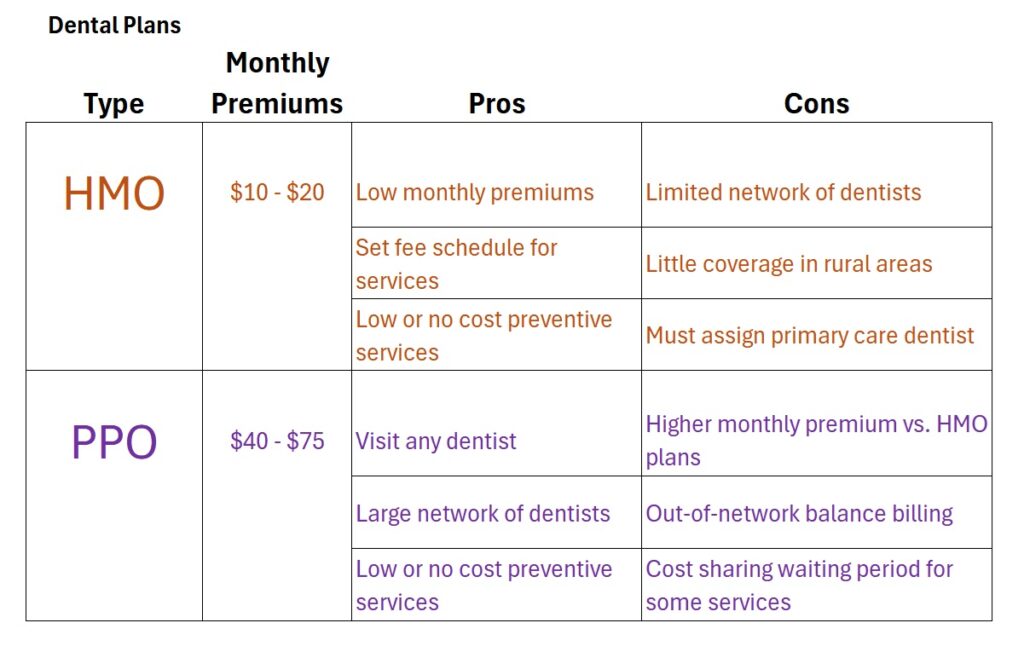

The dental insurance options through Covered California are pretty good. They have a full menu of benefits and you can choose from a dental HMO or PPO plan. The monthly premium rates are competitive with off-exchange plan offerings.

Unlike health insurance, there is no standard benefit design when it comes to dental plans. Even though the majority of dental plans have coverage and benefit designs that are similar within the PPO and HMO categories, it’s important to read the fine print for deductibles, exclusions, waiting periods, and reimbursement schedules. A starkly lower premium rate between two plans with similar coverage and benefits indicates that the lower priced plan may have some restrictions or exclusions within the plan.

Before you select a dental plan, consider a few basic questions:

- What dental plan does your current dentist accept?

- Will your current dentist accept out-of-network reimbursements from Dental PPO plans?

- Does your dentist accept any Dental HMO plans that usually have lower premium rates?

- Does anyone in the family need braces or orthodontia coverage?

Dental insurance comes in three flavors

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental indemnity plans

DPPOs have a network of dentists that have agreed to accept the reimbursement rates from the insurance plan. Using an in-network dentist reduces the member’s out of pocket expenses.

DHMOs also have a network of dentists and members of the DHMO plans can only see dentists in the respective network. The monthly premiums are usually less than DPPO plans but they usually have office visit copayments.

Dental indemnity plans pay a set amount per specific dental service. The payment can either be made directly to the dentist or the member can file a claim and be reimbursed.

Include vision insurance

Vision insurance may be purchased with either the Blue Shield Specialty Duo dental and vision plans or with dental insurance through the Dental for Everyone website.

Enrollment fees – Most dental insurance will have no enrollment fees associated with plan. Some of the carriers offered on the Dental for Everyone website do require a one-time enrollment fee.

Covered California family dental plans

Covered California family dental insurance can only be enrolled into through the Covered California website. If you are not a Covered California member, you can get a quote and enroll in dental insurance using the Dental for Everyone website or some health plan such as Anthem Blue Cross and Blue Shield also offer dental insurance.

Dental Insurance Terms

Copayment: refers to any stated copayment for an office visit regardless of the dental services being provided

Deductible: Some plans have no deductible for any services. Others will have an individual and family deductible not by a split reference i.e. $50/$150. Once the family deductible is met, other members will not have to pay a deductible amount for services. If Orthodontia is covered, there may be a separate deductible for those services. Some plan have higher deductible for members over 65 years of age.

Maximum Benefit: is the maximum amount of dollars a dental plan will pay within a year toward dental services for an individual. Once the maximum amount is reached, the member must bear the full cost of any additional dental treatment until the following year. Some plans have no cap on how much the dental plan will pay on behalf of the member. There can also be a separate annual maximum for orthodontia services.

Waiting periods are the amount of time the member must wait after the plan starts before the insurance will cover a specified dental procedure. If the Waiting column has three numbers such as 0 – 6 – 12, the first number is the waiting period for preventive services, the second is for minor or restorative services, and the third number indicates the waiting period for major services such as root canals and crowns. Orthodontia usually has a separate waiting period.

Member Pays is how much the member will pay for the services listed after any waiting period has been met. Some plans will have set copayment amounts for each dental service. Some of the plan documents refer the benefits as how much the plan will pay. Some plans will indicate the plan pays 20%, which means the member pays 80% of service. These amounts only apply to in-network providers. You may actually pay a higher percentage for out-of-network dentists.

Progressive reduction: some carriers reduce the coinsurance percentage the member is responsible for over two to three years. The longer the member has the dental insurance, the less the member has to pay for specific dental services. For example, a progressive reduction of 40% – 0% would mean in the first year the member would be responsible for 40% of the cost of the dental services. In year two or three, depending on the plan, the member’s responsibility would drop to zero.

Networks: some plans will require the member to pay a different coinsurance percentage based on whether the dentist is in or out of network. This would be designated by 40%/50%, where the coinsurance would be 40% for in-network and 50% for out of network dentists.

Cleanings: preventive services that usually include a teeth cleaning every six months with exam and x-rays once every twelve months.

Fillings: minor restorative service to fill one or two cavities on the surface of a tooth.

Crown: a major service for most dental plans.

Root Canals: a major service for most dental plans.

Orthodontia: some plans will only cover orthodontia for dependent children under 19 years old. Other plans will cover orthodontia for adults. Most orthodontia coverage includes a separate deductible, coinsurance and maximum benefit payment that is different from preventive, minor, and major dental services.

Dentures and implants: a few of the dental plans will cover limited amounts for dentures and dental implants.