One of the biggest questions regarding eligibility for premium assistance or discounts under the new Affordable Care Act is what type of income must the applicant count? The Covered California CalHEERS enrollment website has been updated with a variety of pages to capture income and deductions to calculate the Modified Adjusted Gross Income for the health insurance subsidies.

2020 Covid-19 Income

Federal Pandemic Unemployment Assistance and Lost Wages Assistance are countable sources of income. Federal stimulus checks are not counted as income. Medi-Cal does not count any of the federal sources of income issued as a result to the Covid-19 pandemic response.

- Do You Report The Extra $300 Lost Wages Assistance to Medi-Cal or Covered California?

- Coronavirus Aid Payment as Income for Covered California and Medi-Cal

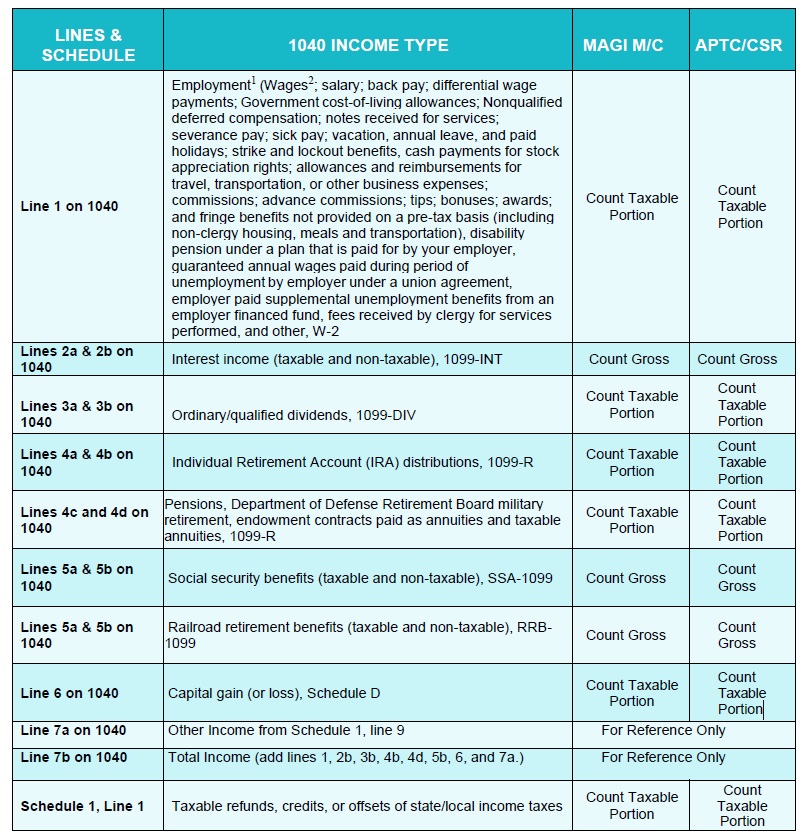

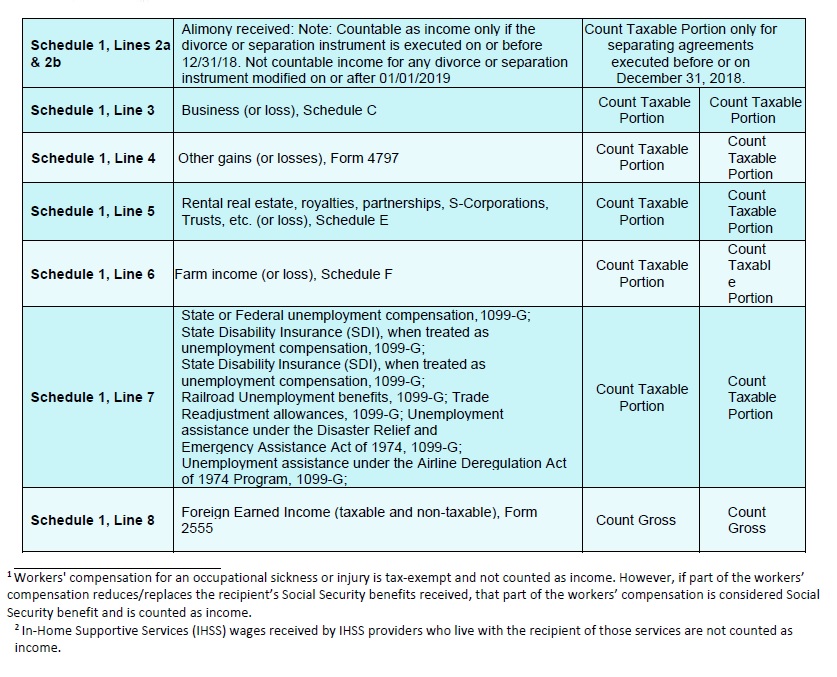

2020 Covered California Countable Sources of Income

Countable_Sources_Income 2020 Covered California

2020 guide to countable sources of income from Covered California for the Modified Adjusted Gross Income based on revised federal income tax form 1040 for 2019.

All sources of household income

Absolutely critical is that the calculated amount is “Household” income. That means everyone who has wages and income, including not only the head of household, but the spouse, children and other dependents, must be included if they are part of the application for health insurance. This means I must include the interest from my son’s savings account if I must include that amount on my tax return of if he must file his own tax return. See also: The IRS definition of a household member

Modified Adjusted Gross Income

The official definition of the household income is the Modified Adjusted Gross Income (MAGI). The term “Modified” is applied because the Adjusted Gross Income from the Federal Tax Form is further modified with some additions and subtractions depending on the circumstances. Some of the modifications are critical for ultimately determining Medi-Cal eligibility. The UC Berkeley Labor Center document describes the modifications. See also: Monthly Household Income Estimator with spreadsheet, What type of IRS income counts for MAGI.

MAGI

This is household income definition from the IRS Form 8962 Premium Tax Credit.

Modified AGI. For purposes of the PTC, modified AGI is the AGI on your tax return plus certain income that is not subject to tax (foreign earned income, tax-exempt interest, and the portion of social security benefits that is not taxable). Use Worksheet 1-1 and Worksheet 1-2, later, to determine your modified AGI.

Covered California Income Section

It can be complicated to determine what is counted as income for Covered California and the Modified Adjusted Gross Income. Covered California presents income and deductions one way on their enrollment pages while the IRS refers to federal tax filing forms. In addition, some of the income excluded for federal taxes is included in the Modified Adjusted Gross Income (MAGI).

New-> DHCS MAGI Medi-Cal individual household size flow chart.

Extra deductions deflate income

If you hand your W-2s, 1099s, and a box of receipts to your tax preparer every year to do your taxes, figuring out what is actually considered income can be a little confusing for the ACA tax credits. Even for the seasoned do-it-yourself tax people, deciding what dollar amounts Covered California wants in which income sections can be complicated. Even though your income might be correct, there’s the possibility the wrong deductions are added to the Income Deduction deflating the MAGI and setting you up for the repayment of excess tax credits the following year.

Household income

Remember, the MAGI includes the income of all the members of the household, not just the primary tax filer. AGI is the Adjusted Gross Income from either the Form 1040EZ, 1040A, or 1040. It is modified by adding untaxed Social Security benefits and tax-exempt interest. Some of the income reported on the 1040s actually comes from other supporting documents such as Schedule C, D, E and F. The income of dependents must also be included if the dependent meets the tax filing threshold to file a federal income tax return. Unfortunately, the Covered California income section of the enrollment application doesn’t mirror the 1040s so it can be confusing to determine what they are asking for.

Income and Deductions

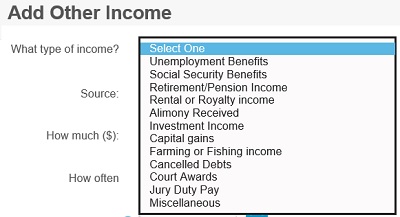

There are four sections to the Covered California Income section: Employment Income, Self-Employment Income, Other Income and Income Deductions. All these sections represent different lines on the 1040 forms. In one sense, it doesn’t matter if you put all your income in one section as long the Income Summary accurately reflects what you estimate will be your MAGI for the current tax year. However, if you can separate the income and deductions into the proper sections, it makes it easier to perform mid-year adjustments on specific income streams instead of one large composite amount.

Monthly vs. Annual income

It’s also important to understand that the Advance Premium Tax Credits to lower your monthly health insurance bill are calculated on your estimated annual MAGI. Eligibility for Medi-Cal is determined by your monthly income. Even if you earned $100,000 in the first six months of the year, and then adjust your monthly income to zero because you lost your job, your tax credits will be cancelled and you’re your family will be put into Medi-Cal.

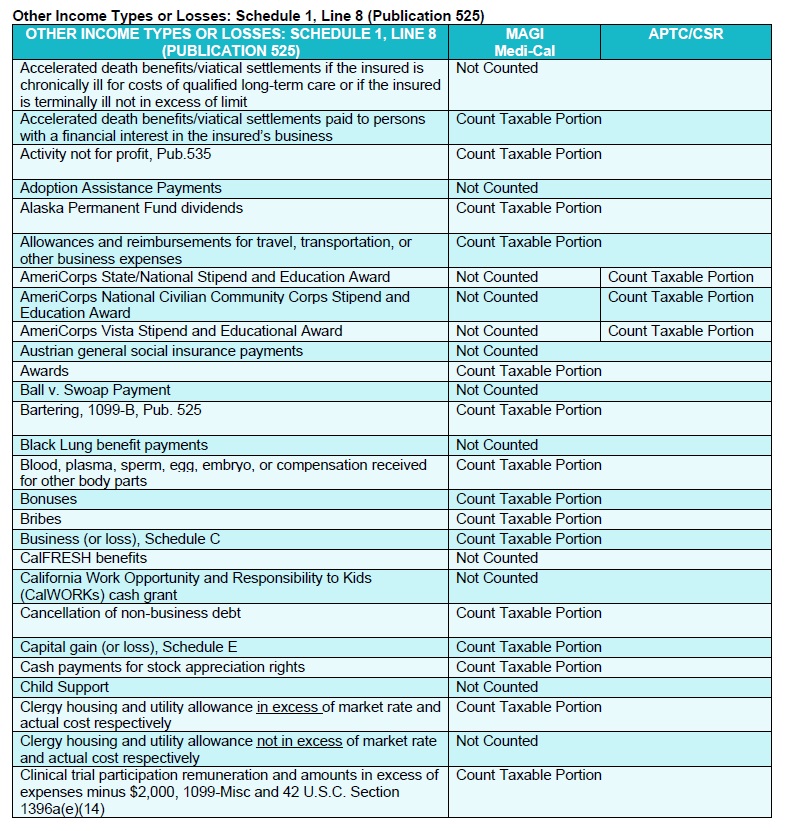

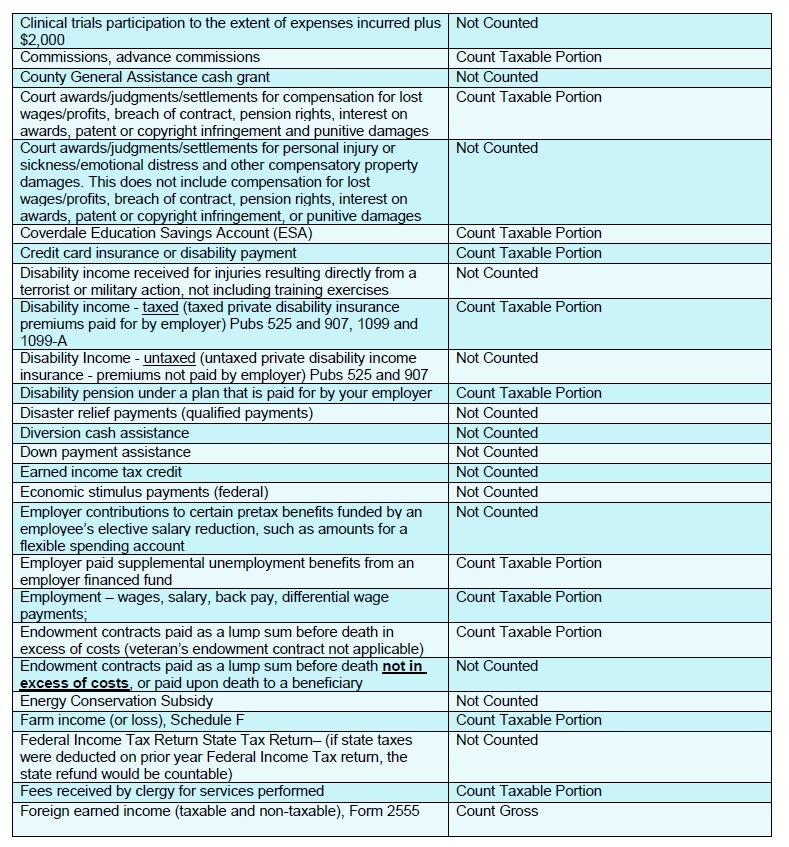

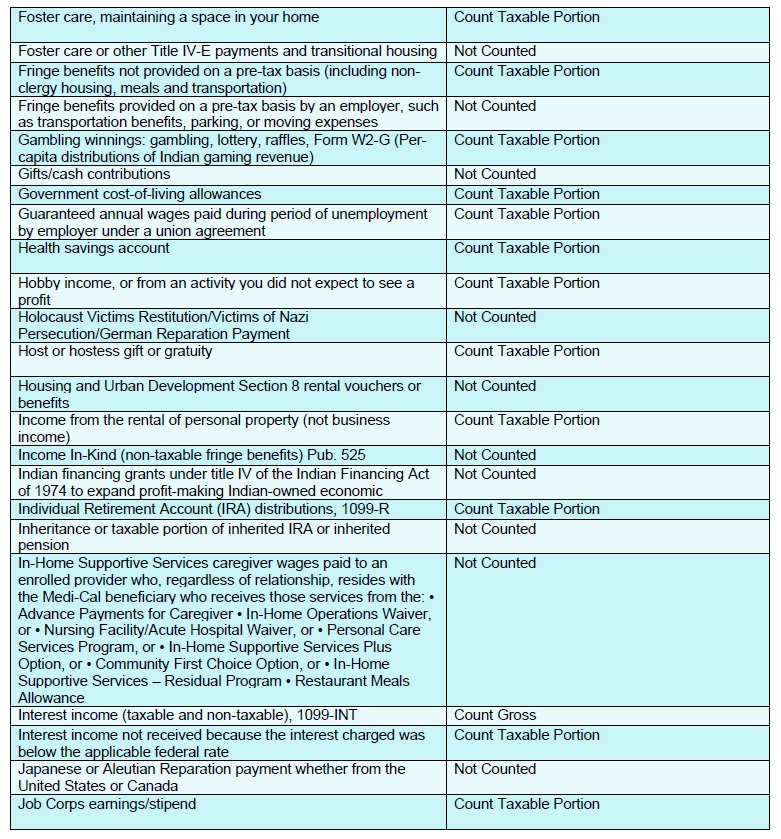

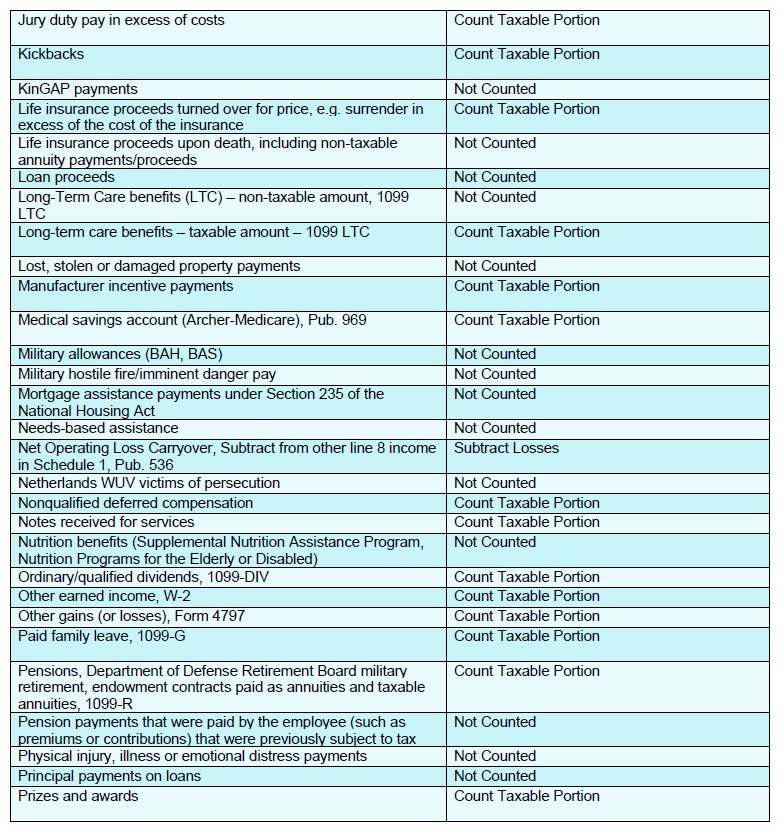

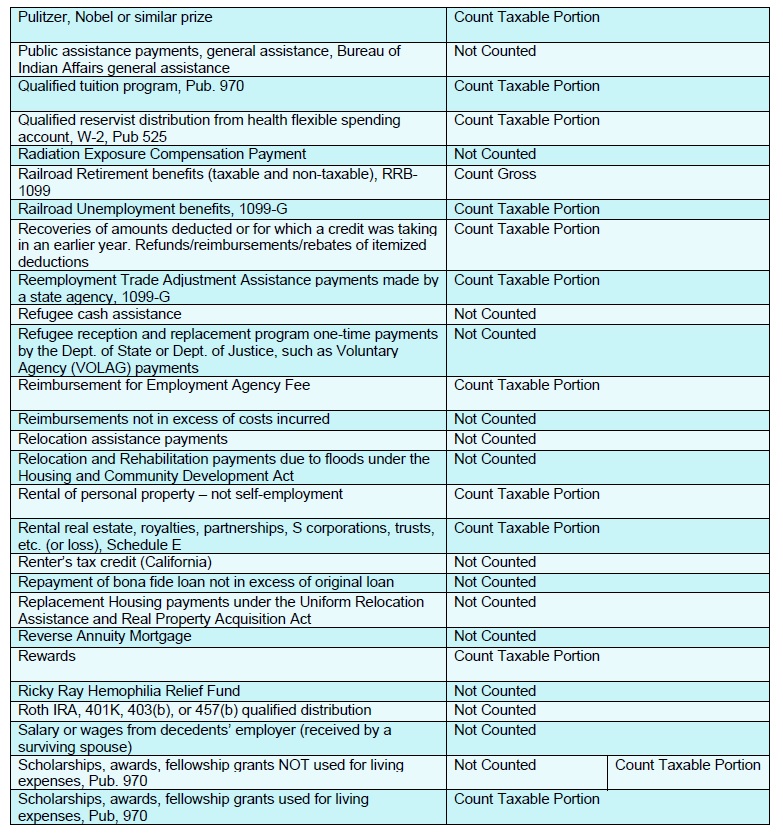

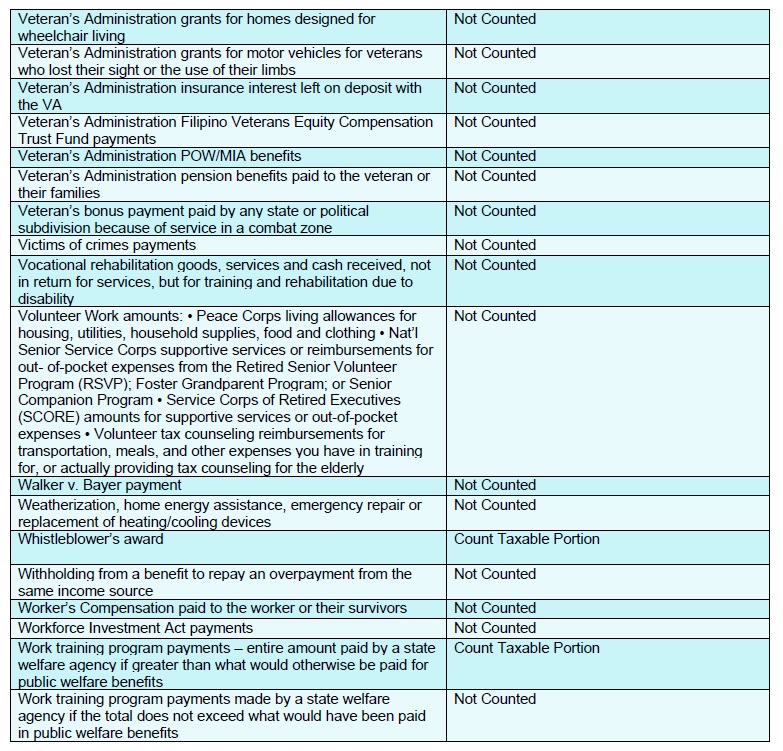

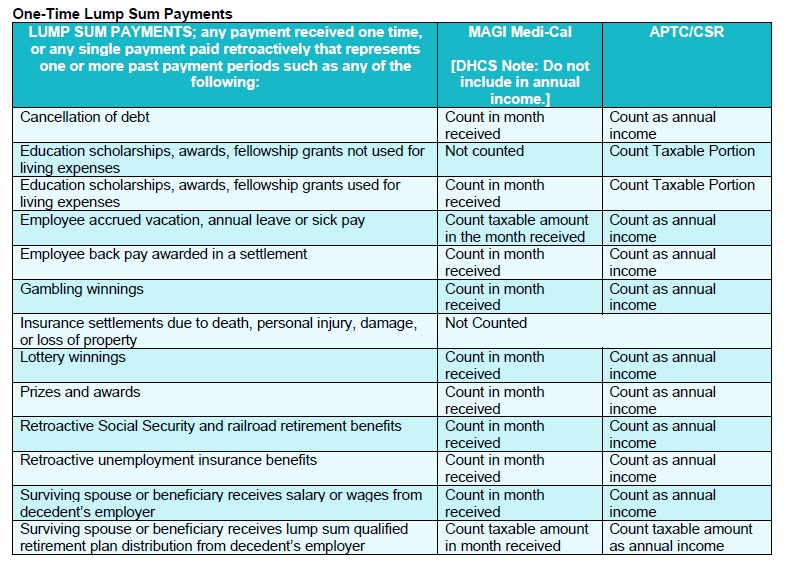

Covered California Countable Income Sources

Covered California has put together their own version of what sources of income should be included for MAGI.

Countable_Sources_Income 2020 Covered California

2020 guide to countable sources of income from Covered California for the Modified Adjusted Gross Income based on revised federal income tax form 1040 for 2019.

MAGI by 1040 lines

The following chart represents forms of income and adjustments (deductions) used to calculate the MAGI. The CC Type indicates the Covered California income section the income or deduction would be entered into. The other columns show which line from the respective form the income or deduction is pulled from.

2020 Covered California Guide To Income and Deductions

CC Type: Covered California Income Section Type

The list below is based on the old 1040. The IRS updated the 1040 form which added more schedules and changed line numbers.

- E: Employment

- S: Self-Employment

- O: Other

- D: Deductions

| 2014 | Line | Number | ||

| Income | CC Type | 1040 | 1040 A | 1040 EZ |

| Wages-Salary-Tips | E | 7 | 7 | 1 |

| Interest | O | 8a, b | 8a, b | 2 |

| Dividends | O | 9a, b | 9a, b | |

| Taxable refunds | O | 10 | ||

| Alimony received | O | 11 | ||

| Business Income Sch. C | S | 12 | ||

| Capital gain-loss Sch. D | O | 13 | 10 | |

| Other gains-loss f4797 | O | 14 | ||

| IRA Distibutions taxable | O | 15b | 11b | |

| Pension/Annuities taxable | O | 16b | 12b | |

| Real Estate income Sch. E | O | 17 | ||

| Farm income Sch. F | O | 18 | ||

| Unemployment | O | 19 | 13 | 3 |

| Social Security* | O | 20a | 14a | |

| Other, 1099 Misc. income | O | 21 |

| Deductions | CC Type | 1040 | 1040 A | 1040 EZ |

| Educator expenses | D | 23 | 16 | |

| Reservists/Artist expenses | D | 24 | ||

| Health Savings Accounts | D | 25 | ||

| Moving expenses | D | 26 | ||

| Self-employment tax | D | 27 | ||

| Self-employed SEP | D | 28 | ||

| Self-employed health | D | 29 | ||

| Penalty on savings | D | 30 | ||

| Alimony | D | 31a | ||

| IRA deduction | D | 32 | 17 | |

| Student loan interest | D | 33 | 18 | |

| Tuition and fees | D | 34 | ||

| Domestic production | D | 35 | ||

| AGI | 37 | 21 |

For a list of forms for downloading visit IRS 2014 Forms – Instructions

Modified income

Income that is not reported on the 1040 for tax purposes, but is included for the MAGI are-

- Social Security benefits (lines 20a and 14a) which include Social Security Disability (SSDI) but NOT Supplement Security Income (SSI)

- Interest that is usually tax-exempt such as from certain municipal bond investments

- Foreign earned income and housing expenses on Form 2555

Employment Income

Employment income is any hourly wage, salaried position, and tips. This type of income has taxes withheld from the paycheck and the employee receives a W-2 at the end of the year.

Self-Employment Income

Self-Employment is essentially the 1040 Schedule C form that determines net profit of a small business. The Schedule C deducts allowable business expenses from revenues of the business. If you use the Schedule C income for the Self-Employment income on Covered California, don’t take the expenses in the Income Deduction sections because you will be deflating your MAGI.

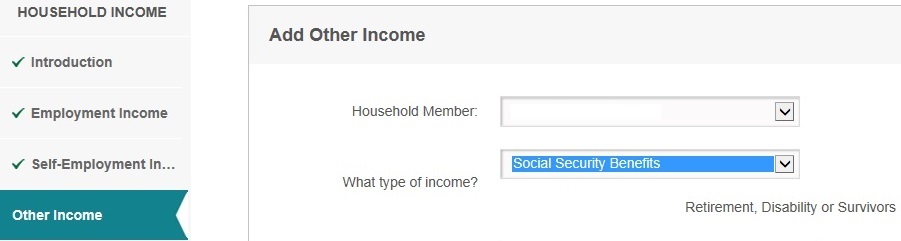

Other Income

Covered California wants Capital Gains, Sch. D, Rental income, Sch. E, and Farm income, Sch. F, to be placed in Other Income. Again, don’t include allowable expenses on these schedules to be reported also under the Income Deductions section. All the other income streams also get lumped in other income such as unemployment benefits and social security.

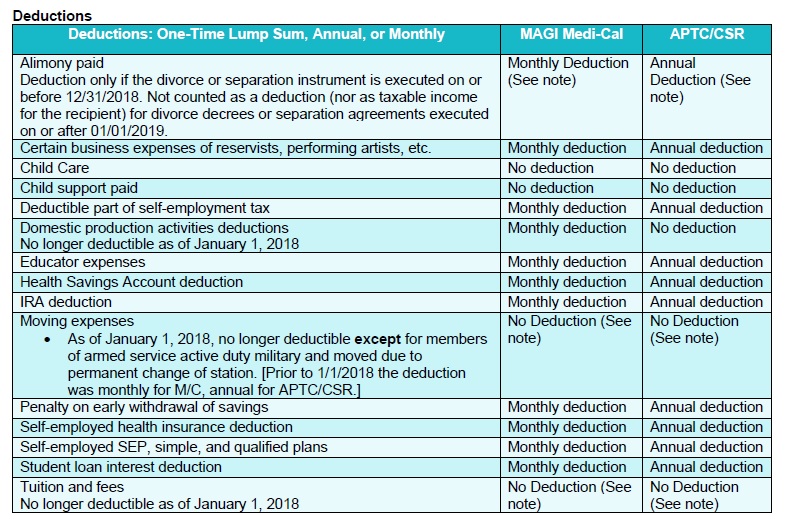

Income Deductions

The income deductions or adjusts come right from the 1040 forms. Always check with the supporting document or form to see what is actually allowable. For instance, only part of the federal Self-Employment tax, Schedule SE, is deductible. DO NOT Include any itemized deductions from Schedule A such as mortgage interest deduction.

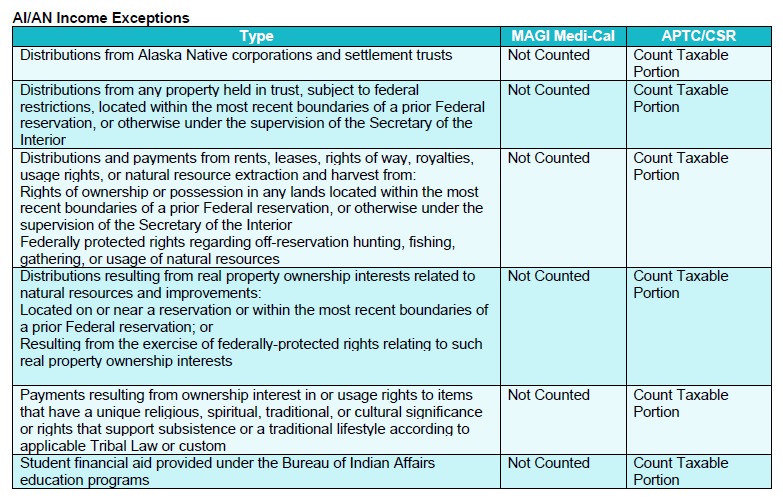

Medicaid or Medi-Cal will exclude from the income

- Scholarships, awards or fellowships for educational purposes

- Certain American Indian and Alaska Native income

- An amount received as a lump sum is counted as income only in the month receive

Every family income is different

The Federal tax forms are a guide to previous income and adjusted gross amounts. Each family will be different and their household income can fluctuate widely from year to year depending on type of employment and other factors. It’s just important to forecast the income as accurately as possible to avoid having to pay back premium tax credits because the household income was higher than expected.

When you are ready to enroll, have the following:

- Number of people being enrolled (whole or partial family), including the birth date of each person

- Social security number(s) for each family member

- Home ZIP code

- Most recent income tax filings, including dependent tax information and head of household status (if any)

- Legal immigration information, such as your immigration number

- Information about your status as a member of a federally recognized tribe

Wages, Self-employment, Other Income

The online application allows you to attribute different income types to different members of the household.

- Wages: income where a W-2 is issued and taxes withheld

- Self-Employment: where profits are revenue – expenses and a Schedule C is filed for profit loss

- Other: Retirement, SSDI, Rental income, interest, dividends, etc.

It is important not to lump all the income under the primary applicant. If there are three jobs contributing to the household income they should all be separately listed under the members names who produces the income. This makes it easier to adjust the household income later if there is a job change.

Seasonal jobs

For income from a seasonal job or where there are specific gaps during the year like a teacher, I’ve been entering the total amount for the year and selecting “Annual” from the frequency drop down menu. This will automatically break the total income into monthly income amounts which will be lower average of the total income. This avoids over-estimating the household income by entering the monthly seasonal wages and having the system calculate the total for 12 months. Finally, check the income summary to make sure it matches with you past tax returns or what you estimate for 2013/2014.

Partial year enrollment

If you are coming into an ACA health plan after the year has started, you’ll be calculating your income for the remainder of the year. For example, if you lose group coverage in June and start a Covered California plan in July, you’ll use the monthly income for July going forward. But it is important to include income from the previous job with a start and end date so your estimated annual tax credit is credit. This is similar to having lost a job; the income changes and that affects the monthly tax credit.

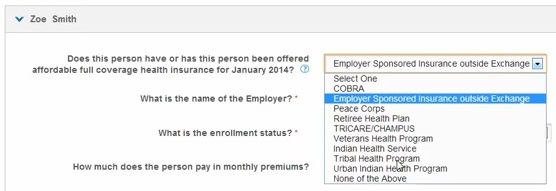

Employer sponsored health insurance

Families will be asked if they are enrolled or have been offered any employer sponsored health insurance. If so, that makes the family ineligible for premium assistance or tax credits. If the “employee only” contribution is greater than 9.5% of the household income, then the household can purchase a health plan through Covered California and receive premium assistance. Married couples must file a joint tax return to be eligible for the tax credit premium assistance. – Source: Covered California.

Domestic Partnerships

Domestic partnerships are treated like married couples for the purposes of employer sponsored health insurance. If one partner is covered by a group health insurance plan and that plan allows employees to extend health covered to registered domestic partners, then the dependent partner would not be eligible for premium assistance through Covered California. Just like married couples, if the “employee only” contribution exceeds 9.5% of the household income, then the partners can get premium assistance with a Covered California health plan. Domestic partners must also file a joint tax return to be eligible for the tax credit premium assistance. – Source: Covered California.

In-Home Supportive Services (IHSS)

Under certain circumstances, the IRS does not count IHSS payments as taxable income. See IRS FAQ 2014-7. Covered California has indicated that if the IHSS payments are not considered taxable income, then they would not need to be included as income on the Covered California application.

Social Security Disability Income

Social Security Disability Income (SSDI) is considered income. Supplement Security Income (SSI) is not part of MAGI.

Better safe than sorry

Regardless of your household income, if you have been offered employer sponsored health insurance you will not be eligible for premium assistance unless the employee only health insurance contribution is greater than 9.5% of the household income. This is where having all the tax forms and wage statements will help verify that premium is greater than 9.5% of the income.

Are gifts of money considered income?

I recently received an inquiry relating to a monthly gift and if it was considered income.

“Should my spouse report a monthly gift received of $1,000 in the form of a check as part of the total household income? None of the documents cited list gifts as income.”

On the topic of gifts the IRS notes on one their webpage of FAQs about gifts,

The laws on Estate and Gift Taxes are considered to be some of the most complicated in the Internal Revenue Code. For further guidance, we strongly recommend that you visit with an estate tax practitioner (Attorney or CPA) who has considerable experience in this field.

Eight Tips to Determine if Your Gift is Taxable

IRS Tax Tip 2012-62, March 30, 2012

If you gave money or property to someone as a gift, you may owe federal gift tax. Many gifts are not subject to the gift tax, but the IRS offers the following eight tips about gifts and the gift tax.

- Most gifts are not subject to the gift tax. For example, there is usually no tax if you make a gift to your spouse or to a charity. If you make a gift to someone else, the gift tax usually does not apply until the value of the gifts you give that person exceeds the annual exclusion for the year. For 2011 and 2012, the annual exclusion is $13,000.

- Gift tax returns do not need to be filed unless you give someone, other than your spouse, money or property worth more than the annual exclusion for that year.

- Generally, the person who receives your gift will not have to pay any federal gift tax because of it. Also, that person will not have to pay income tax on the value of the gift received.

- Making a gift does not ordinarily affect your federal income tax. You cannot deduct the value of gifts you make (other than deductible charitable contributions).

- The general rule is that any gift is a taxable gift. However, there are many exceptions to this rule. The following gifts are not taxable gifts:

• Gifts that are do not exceed the annual exclusion for the calendar year,

• Tuition or medical expenses you pay directly to a medical or educational institution for someone,

• Gifts to your spouse,

• Gifts to a political organization for its use, and

• Gifts to charities. - You and your spouse can make a gift up to $26,000 to a third party without making a taxable gift. The gift can be considered as made one-half by you and one-half by your spouse. If you split a gift you made, you must file a gift tax return to show that you and your spouse agree to use gift splitting. You must file a Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, even if half of the split gift is less than the annual exclusion

- You must file a gift tax return on Form 709, if any of the following apply:

• You gave gifts to at least one person (other than your spouse) that are more than the annual exclusion for the year.

• You and your spouse are splitting a gift.

• You gave someone (other than your spouse) a gift of a future interest that he

or she cannot actually possess, enjoy, or receive income from until some time in the future.

• You gave your spouse an interest in property that will terminate due to a future event. - You do not have to file a gift tax return to report gifts to political organizations and gifts made by paying someone’s tuition or medical expenses.

For more information see Publication 950, Introduction to Estate and Gift Taxes. Both Form 709 and Publication 950 can be downloaded at www.IRS.gov or ordered by calling 800-TAX-FORM (800-829-3676).

Links:

- Publication 950, Introduction to Estate and Gift Taxes

- Form 709, United States Gift Tax Return

- Form 709 Instructions

Schedule E Rental Real Estate Loss

A retired couple owns rental property and their income is modest. In 2012 the Schedule E Supplement Income and Loss form they filed with their 1040 federal taxes reduced their Adjusted Gross Income to near zero. Neither one of them receive Medicare and they were hoping that the premium assistance through Covered California would make their health insurance premiums manageable.

As far as I can tell, because the loss from Schedule E is placed on line 17 of the 1040 tax form, above line 37 which is the final AGI, an AGI income below the federal poverty line would trigger a Medi-Cal only offering for this couple. The big caveat is IF the couple expected this near zero AGI income to reoccur in 2015. Remember, the premium assistance is for 2015 health plan premiums coupled with 2014 income. 2012 and 2013 are just guides for determining household income. You don’t know what the income will be in 2015, so all you can do is estimate.

It is hard to predict the future, but if the loss is not expected to repeat itself in 2015, the couple might be safe with estimating their household income without that loss included. It is always best to discuss this situation with your tax adviser. The call center at Covered California has been of little help, from my experience, drilling down into the details regarding what income is counted. They are quick to refer you to your Certified Public Account (like we all have one those on staff) to give guidance to the income rules that they enforcing.

Submitting affidavit of income

As a general rule, the household will have to verify the income. The most recent tax filing can be upload that shows a negative number, but a comment should be attached regarding the reason for the loss or zero AGI. (See Uploading Documents to Covered California). Additionally, the family can upload bank statements showing the deposit of funds from self-employment, pay stubs, and rental receipts. The primary tax filer can also submit an affidavit swearing or attesting to the fact that they do have real “cash” income beyond what the 1040 tax form indicates.

Income Attestation Form for Covered California

Mid-Year Adjustments

A recent email on the income topic posed the question,

- “What if the household increases during the year and the family is no longer eligible for premium assistance?

- “How will the IRS know and reconcile the differences?”

These are good questions and reasons to be concerned about owing back premium assistance that the individual or family may not be entitled to. First, it is important to modify the income, either up or down, when a change occurs either through calling Covered California, logging into your account, or calling the certified agent you worked with to make the changes on your behalf. (See: Income change triggers Special Enrollment Period)

Second, Covered California will send a form 1095-A stating the amount of premium assistance that was paid to the health plan on your behalf. If you have made the mid-year adjustments there should be no over or under payment of the tax credits.

Finally, because the premium assistance is done on a monthly basis, and if your income increases beyond the eligibility for premium assistance, your household was still entitled to those tax credits before your income went up. The household’s final Modified Adjusted Gross Income will be reported on form 8962 Premium Tax Credit. With the 1095-A from Covered California, the advance tax credits will be reconciled with the total Premium Tax Credit the household is eligible for.

IRS Issue Number: HCTT-2015-08 February 5, 2015

Important Information about Advance Payments of the Premium Tax Credit and Your Tax Return

Taxpayers with household incomes of 400 percent or more of the federal poverty line must repay all of the excess amount. See the instructions for Form 8962, Premium Tax Credit (PTC) for more information on the federal poverty line amounts.

IRS FAQs

4. What happens if my income or family size changes during the year?

The actual premium tax credit for the year will differ from the advance credit amount estimated by the Marketplace if your family size and household income as estimated at the time of enrollment are different from the family size and household income you report on your return. The more your family size or household income differs from the Marketplace estimates used to compute your advance credit payments, the more significant the difference will be between your advance credit payments and your actual credit. If your actual allowable credit on your return is less than your advance credit payments, the difference, subject to certain caps, will be subtracted from your refund or added to your balance due. If your actual allowable credit is more than your advance credit payments, the difference will be added to your refund or subtracted from your balance due.

Notifying the Marketplace about changes in circumstances will allow the Marketplace to update the information used to determine your expected amount of the premium tax credit and adjust your advance payment amount. This adjustment will decrease the likelihood of a significant difference between your advance credit payments and your actual premium tax credit. Changes in circumstances that can affect the amount of your actual premium tax credit include:

- Increases or decreases in your household income.

- Marriage.

- Divorce.

- Birth or adoption of a child.

- Other changes to your household composition.

- Gaining or losing eligibility for government sponsored or employer sponsored health care coverage.

Reporting and Claiming

11. Will I have to file a federal income tax return to get the premium tax credit?

For any tax year, if you receive advance credit payments in any amount or if you plan to claim the premium tax credit, you must file a federal income tax return for that year. If you receive any advance credit payments, you will use your return to reconcile the difference between the advance credit payments made on your behalf and the actual amount of the credit that you may claim. This filing requirement applies whether or not you would otherwise be required to file a return. If you are married, you must file a joint return to be eligible for the premium tax credit.

12. If I get insurance through the Marketplace, how will I know what to report on my federal tax return?

The Marketplace will send you an information statement showing the amount of your premiums and advance credit payments by January 31 of the year following the year of coverage. For example, you will receive the 2014 information statement by Jan. 31, 2015, and can use this information to compute your premium tax credit on your 2014 tax return and to reconcile the advance credit payments made on your behalf with the amount of the actual premium tax credit.

MAGI – Modified Adjusted Gross Income – Affordable Care Act

Covered California finally gave a presentation on the MAGI in August of 2014. You can read an overview and see slides of the presentation at Covered California MAGI Training.

In general, a household’s income for the purposes of determining Advance Premium Tax Credits (APTC) is the Adjusted Gross Income (AGI) filed by the individual or family. But there are a few differences between income that is not taxable for federal filing purposes and the income that must be reported for determining eligibility for the APTC. These exceptions to traditionally non-taxable income create the Modified Adjusted Gross Income for the ACA.

The actual language in the ACA read as thus-

Modified adjusted gross income means adjusted gross income (within the meaning of section 62) increased by—

(i) Amounts excluded from gross income under section 911;

(ii) Tax-exempt interest the taxpayer receives or accrues during the taxable year; and

(iii) Social security benefits (within the meaning of section 86(d)) not included in gross income under section 86.

As best I can determine, (i) Amounts excluded from gross income under section 911 refers to Foreign Earned Income Exclusion. If you are a U.S. citizen that claims the foreign income tax exclusion you should consult with your tax preparer on how to handle the MAGI calculation.

Social Security and Tax Exempt Interest

The two notable income inclusions for MAGI that are usually not considered taxable income are tax-exempt interest and Social Security benefits obtained either through disability or age. Both of these sources, normally not included as taxable income in most cases, are included for determining MAGI and ultimately the APTC.

Disability insurance payments

Another area of income that can be confusing is insurance payments. Insurance benefits from a life or disability policy purchased and owned by an individual and by extension their beneficiaries, is not taxable income. However, if the policy was purchased by an employer then they may be considered taxable income. It becomes more complicated if the employer owns the policy but both employer and employee make contributions toward the premium payments. Then part of the benefits representing the employee’s contribution may not be taxable. Again, you should consult a tax preparer or CPA for more information.

Workers’ compensation

Similarly, workers’ compensation and state disability insurance can be a gray area as to whether it is taxable income and subject to the MAGI. From the guidance I have received from Covered California and other sources, if the compensation and disability insurance benefits are in lieu of unemployment compensation, then they are to be included in the MAGI. Unemployment compensation is taxable and included in the MAGI.

I pulled these paragraphs out of the IRS Publication 525 on taxable income that can be downloaded at the end of the post.

Sickness and Injury Benefits

In most cases, you must report as income any amount you receive for personal injury or sickness through an accident or health plan that is paid for by your employer. If both you and your employer pay for the plan, only the amount you receive that is due to your employer’s payments is reported as income. However, certain payments may not be taxable to you. For information on nontaxable payments, see Military and Government Disability Pensions and Other Sickness and Injury Benefits, later in this discussion.

Workers’ Compensation

Amounts you receive as workers’ compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers’ compensation act or a statute in the nature of a workers’ compensation act. The exemption also applies to your survivors. The exemption, however, does not apply to retirement plan benefits you receive based on your age, length of service, or prior contributions to the plan, even if you retired because of an occupational sickness or injury.

Disability Pensions

If you retired on disability, you must include in income any disability pension you receive under a plan that is paid for by your employer. You must report your taxable disability payments as wages on line 7 of Form 1040 or Form 1040A until you reach minimum retirement age. Mini-mum retirement age generally is the age at which you can first receive a pension or annuity if you are not disabled.

IRS taxable income

From the IRS Tax Topics web page and their Publication 525 I compiled this list of incomes sources. If the type of income is marked Yes, it is included in the MAGI. If it also has a contradictory No, it isn’t considered taxable for federal income taxes OR part of the income might be MAGI and part not reported as MAGI. This might be the case for disability insurance where both employer and employee make contributions toward the premium. The column is either the reporting document you would receive for the income, the IRS Form used to determine the net taxable amount or the IRS reference document for the information.

I make no claims to the accuracy of this MAGI income table. Use this as a guide and then confirm your calculations with either your state or federal health exchange or tax preparer that your income should be considered in the MAGI.

| Tax Topics – Types of Income |

Taxable | Form | |

| Employer |

MAGI | ||

| Hourly Wages | Yes | W-2 | |

| Salary | Yes | W-2 | |

| Tips | Yes | W-2 | |

| Employer Contribution to Pension | No | ||

| Bartering Income | Yes | Form 1040, Sch. C | |

| Fair market value of barter | Yes | Form 1099-B | |

| Business Income | |||

| Sole Proprietor | Yes | Schedule C | |

| Partnership | Yes | Form 1065, Sch. K-1 | |

| Corporation | Yes | Form 1120 | |

| Subchapter S Corp. | Yes | Form 1120S, K-1 | |

| Cancelled Debt | |||

| Cancelled, forgiven, discharged debt | Yes | No | Form 1099-C |

| Loss of property | Yes | No | Pub. 544, 523 |

| Capital Gains and Losses | |||

| Sale of asset: gain or loss | Yes | Form 1040, Sch. D, Form 8949 | |

| Clergy | |||

| Employed clergy | Yes | Pub. 517, Pub. 15-A, Form 1040 Sch. A | |

| Self-employed clergy | Yes | Form 1040 Sch. C | |

| Housing allowance | Yes | No | |

| Dividends | 1099-DIV | ||

| Cash | Yes | ||

| Stock | Yes | ||

| Property | Yes | ||

| Estate, Trust, Subchapter S | Yes | ||

| Shareholder debt paid | Yes | ||

| Shareholder services received | Yes | ||

| Shareholder property use | Yes | ||

| Stock rights | Yes | ||

| Return of Capital | No | ||

| Ordinary dividends | Yes | ||

| Qualified dividends | Yes | ||

| Farming and Fishing Income | |||

| Farming income | Yes | Form 1040, Sch. F, Pub. 225 | |

| Fishing income | Yes | Form 1040, Sch. C, Pub. 334 | |

| Gambling Income and Losses | Form W-2G | ||

| Lottery winnings | Yes | Form 1040 Sch. A, Pub. 505 | |

| Raffles winnings | Yes | ||

| Horse races winnings | Yes | ||

| Insurance payments | |||

| Accelerated death benefits, viatical settlement | No | ||

| Disability insurance plan owned by individual | No | Pub. 525 | |

| Disability Pensions, 100% employer paid | Yes | Pub. 525 | |

| Endowment contract proceeds | Yes | No | |

| Government service disability payments | No | Pub. 525 | |

| Interest on life insurance benefit installments | Yes | ||

| Life insurance benefits lump sum | No | Pub. 525 | |

| Long Term Care Insurance | No | Pub. 525, Form 8853 | |

| Military disability payments | No | Pub. 525 | |

| Social Security Disability Insurance (SSDI) | Yes | ||

| State Disability Insurance Ca SDI | Yes | No | |

| Surrendered life policy | Yes | No | |

| Workers Compensation | Yes | No | |

| Interest | 1099-INT | ||

| Bank accounts | Yes | ||

| Money Market Accounts | Yes | ||

| Certificates of Deposit | Yes | ||

| Deposited Insurance Dividends | Yes | ||

| VA Dividend Insurance | Yes | No | |

| EE & Series I Savings Bonds | Yes | No | |

| Redeemed/Matured Savings Bonds | Yes | ||

| Educational Savings Bonds | Yes | No | |

| Dividends on deposits or shares | Yes | ||

| Treasury bills, notes & bonds | Yes | ||

| State, D.C., U.S. Possession bonds | Yes | No | |

| Tax exempt interest | Yes | ||

| Lump Sum Retirement Distributions | Form 1099-R | ||

| Lump Sum Amount | Yes | ||

| Lump sum roll over | No | ||

| Securities received, but not sold | No | ||

| Other | |||

| Alaska Permanent Fund dividend | Yes | ||

| Alimony received | Yes | ||

| Child Support received | No | ||

| Royalties | Yes | Form 1040, Sch. 3, Pub. 525 | |

| Passive Activities – Losses and Credits | |||

| Losses that exceed income | No | Form 8582, Pub. 925 | |

| Pensions and Annuities | |||

| Payments with no investment | Yes | Pub. 575 | |

| Payments with prior investment | Yes | No | Pub. 575 & 721 |

| Receipt of Stock in Demutualization | |||

| Stock distribution | No | Form 1040, Sch. D, 8949 | |

| Cash distribution | Yes | ||

| Rental Income and Expenses | |||

| Income less expenses | Yes | Form 1040, Sch. E | |

| Renting Residential and Vacation Property | |||

| Rental income less expenses | Yes | Form 1040, Sch. E | |

| Rollovers from Retirement Plans | Pub. 575 | ||

| Rollover within 60 days | No | ||

| Scholarship and Fellowship Grants | Pub. 970 | ||

| Qualified educational expenses | No | ||

| Non-educational related funds | Yes | ||

| Payments for services | Yes | ||

| Social Security and Railroad Retirement | |||

| Social Security income | Yes | No | SSA-1099 |

| Railroad retirement benefits | Yes | No | RRB-1099 |

| Stock Options | |||

| Statutory (ISO) stock option sale | Yes | Form 6251, 3921, 3922 | |

| Non-statutory stock option sales | Yes | Pub. 525 | |

| Traders in Securities | |||

| Traders – income | Yes | Form 1040, Sch. C | |

| Mark to Market income | Yes | Form 1040, Sch. D, 4797, 3115 | |

| Unemployment Compensation | |||

| Unemployment Compensation | Yes | Form 1099-G | |

| Private unemployment benefits | Yes | No | |

| Welfare based on need | No | ||

| Disaster relief grants | No | ||

| Disaster relief payments | No | ||

| HAMP | No | ||

| Mortgage assistance section 235 | No | ||

| Nutrition for elderly | No | ||

| Relocation payments | No | ||

| Replacement housing | No | ||

| RTAA payments | Yes | ||

| Supplemental Security Income (SSI) | No | ||

| Victims of crime assistance | No | ||

| Winter energy cost reduction payments | No | ||

| Work-training program | Yes | No | |

| 401(k) Plans | |||

| Distributions from 401(k) plan | Yes | Pub. 525 |

October 2014 Update

IRS waiver of low income

Kaiser Health News is reporting, Consumers Whose Income Drops Below Poverty Get Break On Subsidy Payback, which indicates that the IRS won’t go after individuals and families that were deemed eligible for APTC but whose ultimate income is below the FPL. With in the article they cite §1.36B-2 Eligibility for premium tax credit from the IRS for this claim. While this may hold for states who did not expand Medicaid up to 138% of the FPL, I’m not sure if it is completely applicable for California who has expanded Medicaid up to 138% of the Federal Poverty Line. There is also the issue that within the Covered California agreement a household must report any changes to income within 30 days. My question has always been, if someone is approved for APTC at $20,000 at the beginning of the year, and then their annual income drops to $15,000 in the middle of the year (making the individual technically eligible for Medi-Cal) and this change of income is not report-

- Will the individual owe the APTC for the period when the income dropped below 138% of the FPL?

- Will they have to repay all the APTC for the entire?

The KHN provides a glimmer of hope that the IRS won’t come after people if their income dips below the FPL as stated on their 2014 federal tax return. But I really want to see it explicitly written in English by the IRS before I’ll believe it.

See also:

2019 Covered California Enrollment & Renewal Documents

How to report partial year income for ACA enrollment

Inflating the Income to Avoid Covered California Medi-Cal

Covered California Medi-Cal verification

Registered Domestic Partnerships might get a break, but might also be penalized.