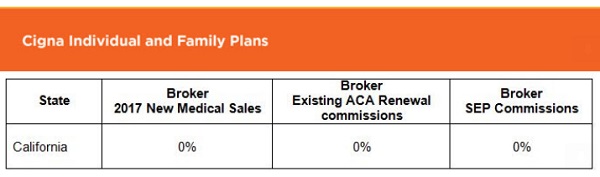

Cigna will pay not broker or agent commission on California individual and family plans for 2017.

Cigna notified their appointed health insurance agents at the end of September that they will not pay any commissions in California for individual and family plans. In other words, or symbols,

Cigna gives the middle finger to agents.

Cigna has given the middle finger to agents who assist consumers with enrollment into their health plans. Essentially, Cigna has thrown agents under the bus in order to preserve their profits.

Cigna is cutting out all agent compensation on all of their 2017 individual and family plans sold in California.

The modifications to commissions do not affect any IFP dental plans or any other business you may have with other Cigna business units.

Because of these changes, brokers will not be able to quote or enroll a customer using our Cigna forBrokers.com portal. If you would like to enroll a customer, you will need to utilize a paper application.

Discontinuation and renewal letters have begun mailing and they will continue through October 28, 2016. Copies of these letters will be available on Cigna forBrokers.com.

If you have any questions, please contact Cigna Broker Support at 877.Cigna.15.

Thank you.

Cigna Individual & Family Plans

There was no real explanation for the obviously cost-saving measure of eliminating commissions to agents. I can’t imagine an agent assisting with an enrollment into a health plan in which he or she will not be compensated. Even a token one-time fee like Kaiser would keep agents at least offering Cigna health plans as an alternative to their competition.

In the last year Cigna has been pushing all their other insurance products. While the Cigna dental insurance is pretty good, Cigna has a lot of indemnity products that really aren’t consumer friendly. Insurance products like heart attack and stroke indemnity plans generate great commissions for the agents but limited benefits for the consumer. Cigna has also been pushing out emails to get agents to sell their life insurance products.

Perhaps that is the marketing plan for some agents. Sell a “Loss Leader” like health insurance, then put on the hard-core pressure tactics to sell dental, indemnity, and life insurance to the client. Some agents look at health insurance as a cross-selling opportunity. That has never been my interest or style.

Obamacare has greatly complicated the role of the health insurance agent. We not only have to know the plan offerings of 10 different carriers, in over 19 different California regions, we are expected to guide the client with estimating their Modified Adjusted Gross Income for the ACA tax credits and constantly changing Covered California application. Agents are already working for free when it comes to helping people with Medi-Cal enrollment.

I can only assume that Cigna doesn’t need agents to market their health plans in California. That is certainly their right. But it makes it really difficult to take any Cigna insurance product seriously when they place no value on my efforts to assist a family with a Cigna health plan enrollment. If Cigna doesn’t need me, maybe I don’t need them and maybe I should make sure none of my clients hear about Cigna as a health insurance option in the future.