Indemnity insurance to help pay the deductible on high deductible health plans.

Even with the Obamacare subsidies, many individuals and families still opt for the least expensive Bronze high deductible health plans. The high deductible health plans require the consumer to spend $4,500 to $6,500 in a medical deductible before any real cost sharing with the health insurance company starts. As more consumers opt for these least expensive Bronze plans more insurance companies are creating insurance products to help cover the high deductible of these plans. But are these indemnity plans worth the money and will they actually pay when you need the money?

Insurance to cover the deductible of Bronze health insurance plans

These insurance plans that help cover a portion or all of a high deductible are known as indemnity insurance plans. Instead of paying the doctor or hospital they pay the insured. The most widely known are the Accidental Death and Dismemberment Insurance plans that are coupled with credit card enrollment and purchases. But there are also indemnity plans for critical illnesses like cancer, heart attack, strokes, hospital admissions and emergency room treatment. Some of the insurance plans can be very inexpensive to purchase because the likelihood of paying out on an accidental injury with the copious exclusions of the plan is very low.

Indemnity insurance fine print

In general, I’m not a big fan of these indemnity plans. They always sound good when they are pitched to the consumer with the stories of how uncle Fred’s family was saved because he took out that critical illness cancer policy. The first problem for consumers is the number of caveats and exclusions, of which there can be many, that prevent the insured from ever collecting a dime. For example, most will not pay for injuries sustained while engaged in high risk sports like skydiving or hospitalization for hernia surgery. The next issue consumers face is just submitting the claim form with all the physician signatures and proper health insurance billing codes. And you can bet that if one number or letter is wrong on that form, they will send it back to the consumer.

Accident insurance can help cover high deductible

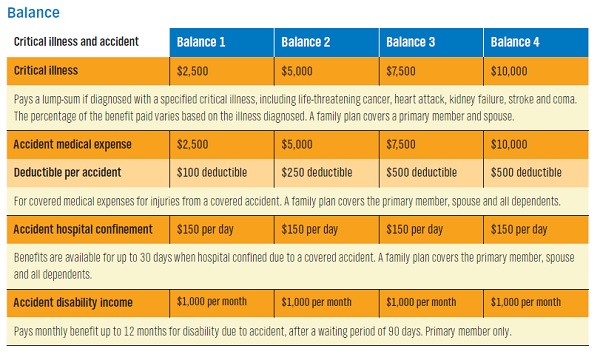

Regardless of my reservations, some of these indemnity plans may be beneficial to some consumers with high deductible health plans under the right conditions. I was intrigued by one new product offered by Anthem Blue Cross called Balance that combines critical illness, accident, hospital, and disability income into one plan. Within the collection of the various types of indemnity insurance, Balance then offers four different levels of reimbursement for the insured.

Accident insurance versus Silver plans

Theoretically, the Balance 3 plan with a $7,500 accident medical expense benefit (after $500 deductible) should cover the Bronze high deductible through its maximum out-of-pocket amount of $6,500. The monthly premium for an individual for the Balance 3 option is $54.95 and $89.95 for a family. In some situations, the cost of the Balance plans plus the monthly premium of the Bronze plan is close to the cost of Silver plan with a lower deductible, coinsurance, and most routine medical expenses covered by set copayments. It is important to remember that these indemnity plans don’t offer any coverage for routine office visits or prescriptions medications.

Silver plans may offer better coverage for routine medical expenses

A forty year old individual in Southern California (zip code 90411) can get a Bronze high deductible plan from Molina for approximately $191 per month in 2016. A Molina Silver plan with a $2,250 deductible, 20% coinsurance, copayments for routine office visits, and coverage for prescription drugs is only $236 per month. That is only a $45 difference between the Bronze and Silver plan whereas the Balance 3 plan to cover the Bronze deductible is $55 per month. In Northern California (zip code 95608) a forty year old can purchase a Blue Shield Bronze plan for $332 per month. For an additional $56, he or she can step up to the Silver plan for $388. That’s only a dollar more than the cost of Balance 3 and you don’t need to have an accident or critical illness before the health plans covers your routine medical expenses.

Critical illness and disability insurance coverage

Of course, these Balance plans have coverage for certain critical illness, a modest $150 per day hospital confinement payment, and $1,000 per month of disability income included. But you must read the fine print to find all the conditions, limitations, and exclusions for when the plan pays and any waiting periods. The Balance plans do offer a better value for large families as the monthly premium is less than double the individual rate for a family plan. The Balance 1 plan with a $2,500 accident benefit is $51.95 per month for a family. That’s approximately $625 per year to potentially avoid paying the deductible on a standard Silver plan.

Multiple partners offering the indemnity insurance

The Balance category of plans is actually offered by Independent Holding Company. Enrollment requires membership in another company called Communicating for America, which also sells a similar product to the Balance plan portfolio that also includes some term life insurance. It all gets a little confusing when you try to trace the different administrators of the Balance plan benefits. The Balance plans don’t have to be used just with Bronze plans. The coverage can be kept even if the family moves to a group plan and there are no medical questions.

Accident insurance for the unexpected medical costs

The overall concept of insurance to cover the deductible of a high deductible Bronze plan isn’t bad. Unlike standard health insurance, the benefits of the indemnity plans only cover healthcare expenses from accidents or critical illness. The limitation of just covering accidents helps keep the premiums low and most families look toward health insurance as a backstop for unexpected accidental mishaps in their lives. But before you jump into one of the Balance plans to help cover a deductible, it’s best to really analyze why you want it and will it really cover you when you need it.

For more information on Balance plans visit:

https://www.ihcbenefits.com/Balance/Agent/9200904

[wpfilebase tag=file id=1541 /]

[wpfilebase tag=file id=1542 /]