If you are one of the thousands of Californians who have suffered because of the poor coordination and planning between Covered California and the participating health plans, I hope you will consider filing a complaint against them. While Covered California is one of those bureaucracies that is comfortably insulated from being held accountable for their actions, or lack of thereof, the health insurance companies have caused enormous pain and suffering from their fumbling on a number of issues.

Issues worthy of filing a complaint

- Lack of customer service

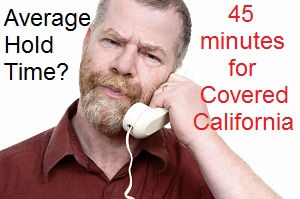

- Excessive waiting times to talk to an agent at either Covered California or the health plan

- Not having premiums payments credited to your account

- Being mapped into a new health plan without your authorization

- Not receiving your invoice in a timely fashion in order to make your premium payment

- Incurring health care costs because you have not been issued a membership ID

- Paying for doctor visits, procedures and medications out-of-pocket

- Having to skip prescription medication because you could not pay for them with out insurance

- Having to visit and emergency room to receive care because of no member ID card

- Missing a doctor appointment because of no member ID card

- Drug formularies that don’t include your current medications

- Provider networks that don’t support your current physicians

- Being enrolled in the wrong plan

- Your application was never sent to the carrier by Covered California

- Your enrollment application was denied, changed, lost or never processed

There are two agencies that will take your complaint

Department of Insurance

Department of Insurance regulates PPOs (Preferred Provider Organizations) and EPOs (Exclusive Provider Organizations) health insurance plans.

Department of Managed Health Care

Department of Managed Health Care regulates HMOs (Health Maintenance Organizations) and they oversee the Department of Health Care Services who is a partner with California Health Benefits Exchange (Covered California). Their complaint form can be found at http://www.dmhc.ca.gov/dmhc_consumer/pc/pc_default.aspx

Let your voice be heard

If enough complaints are lodge against the poor operation of Covered California and the health plans perhaps some legislative or executive action will be taken to protect the rights of the consumers against the monopoly of Covered California.