Small groups that offer employee only coverage allows the employee’s dependents to receive tax credits from Covered California.

One of the most frustrating aspects of the Affordable Care Act is that it excludes family members from receiving the premium tax credits to reduce their health insurance if one of the parents is offered affordable employer group health insurance. One way around this problem is for the employer to offer employee only coverage. Covered California for Small Business health insurance exchange offers the employee only option for employers when they set up their group health plans.

Small group plans not affordable for dependents

The Affordable Care Act states that if the contribution of an employee to his or her own health group health insurance premium is less than 9.5% of the employee’s household Modified Adjusted Gross Income, then the health insurance is considered affordable. This means that if an employee’s health insurance premium is $600 per month for only the employee, and the employer makes a 50% contribution, the employee must pay $300 per month. This would be considered affordable insurance for a family income over $37,800 per year. Even If the dependent coverage of a spouse and two children brought the employee’s health insurance premium to $1,300 per month, it is still considered affordable.

Dependents ineligible for Covered California tax credits

If the employer sponsored health insurance is considered affordable, then the other family members are ineligible for the premium tax credit assistance through Covered California to lower their health insurance premium. If the employer offers 100% contribution to the employee only health insurance premium, the remaining family member will never be eligible for the tax credits regardless of how low the household is. For many low and moderate wage employees their dependents under 18 years of age are eligible for Medi-Cal kids at no cost. But this still leaves spouses without affordable coverage in many situations.

Employee only health plans can help families

One way to help the dependents of an employee offered affordable health insurance is for the employer to elect to offer health insurance only to the employees and not the dependents. In this manner, regardless of the affordability of the employee health insurance, the dependents are not offered the group plan. With no offer of dependent group health insurance the spouse and children are eligible for the premium tax credits.

Family’s sacrifice health insurance for a parent

While it sounds harsh to suggest that employers should not offer health coverage to dependents, it is a greater travesty for the spouses of employees to forego health insurance because the group plan is too expensive. Sadly, I’ve seen this happen on more than one occasion. It is rather ridiculous to think that the mother or father of several children could become ill and virtually no access to health care services because they don’t have insurance. This is a choice these families make because the dependent coverage might run $400 or $500 per month which busts the family budget.

CCSB plans are competitive

The Covered California for Small Business (CCSB) exchange plans are competitively priced. One cost advantage is that they don’t have the Pediatric Dental and Vision benefits embedded into the plan. The children’s dental and vision coverage is an additional rider that an employee can add. Not having the pediatric dental and vision included in the plans is great for employers offering employee only coverage since there will almost never be any individuals under the age 18 years old enrolled in any of the group plans.

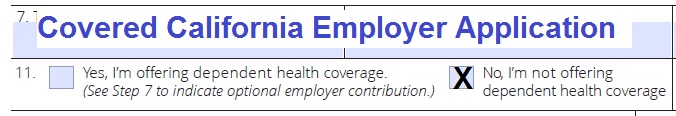

Check the box, “I’m not offering dependent health coverage” to create employee only small group plan.

Family of four example

Here is hypothetical example of how a small employer group could offer employee only coverage to allow the employee dependents to receive the tax credits from Covered California. We have a family of four (two adults and two children) who live in San Francisco, zip code 94103, rating region 4. They have Modified Adjusted Gross Income of $65,000 per year. This is enough income to make all the household members eligible for the Advance Premium Tax Credits to enroll in private health insurance and not have the dependents under 18 subject to Medi-Cal.

Comparing family health insurance monthly premiums

Below is monthly health insurance for a 2016 Silver 70 PPO plan offered through Covered California with the tax credits. The first Rate column is for the entire family. After the tax credit their monthly rate would be $473 which would be 9% of their monthly income. ($473 divided $5416.67 monthly income.) Rate II column shows their monthly health insurance premium if the 42 year old parent was offered employee only coverage through the employer and not on the family plan through Covered California.

| BSC 2016 | 4 person | 3 person |

| Age | Rate I | Rate II |

| 42 | $402.00 | $0.00 |

| 38 | $378.00 | $378.00 |

| 10 | $193.00 | $193.00 |

| 12 | $193.00 | $193.00 |

| Premium | $1,166.00 | $764.00 |

| Tax Credit | $693.00 | $291.00 |

| Total | $473.00 | $473.00 |

Small group family premiums

Next we have the health insurance rates for the family if they ALL enrolled in a Blue Shield Silver HMO plan offered through Covered California’s Small Business exchange. The employer has decided to make a 50% contribution to the employee only health insurance premium. When the 50% contribution is applied to the employee only premium, the total premium amount that the family is responsible for is $1,458.66. That amount is 27% of the household income.

| BSC Silver HMO October 2015 Rates | Small Group | |

| Age | Rate | 50% Cont. EO |

| 42 | $608.06 | $304.03 |

| 38 | $571.81 | $571.81 |

| 10 | $291.41 | $291.41 |

| 12 | $291.41 | $291.41 |

| $1,762.69 | ||

| Premium | $1,458.66 | |

Combining employee only and Covered California

But if the employer offered employee coverage the other family members could go to Covered California and enroll in a family with the tax credits. The combined employee premium from the small group and the total tax subsidized premium for the Covered California family health plan would equal $777.03. Unfortunately, the combined split health insurance premiums represents 14% of the household income, but it is far less expensive than employer group coverage for the whole family.

| Employee Only | $304.03 |

| Covered CA | $473.00 |

| Monthly Premium | $777.03 |

Employee only coverage not for every group

Employee only coverage group plans is not for every company. Employees have middle to upper income wages would probably prefer to have their spouse and dependents all on one plan. But for the low to moderate wage employees, especially those several children, having an employee only plan could save the family hundreds of dollars of month at a minimum or allow their spouse to actually afford coverage through Covered California. That’s the way the ACA is supposed to work; everyone has access to affordable health insurance.

Visit my page Covered California for Small Business page for more information.

To receive a small group quote, download the census template, fill-in with employee information and email it to me.

- [wpfilebase tag=fileurl id=806 linktext=’ Small Employer Group Census Template’ /]