How are health insurance rates determined?

Since the beginning of health care reform under President Obama there has been intense speculation about how the health insurance companies will react when setting rates for the various health plans they offer. Health insurance is not a commodity like wheat, oil, or pork bellies where the market place of buyers and sellers agree upon a price. While competition does impact the rates to a certain degree, health insurance prices are largely determined by the health care services to be covered, the cost of health care services, and the expected claims for those services within a geographical location where the plan is being offered. While this post focuses on the rates for individual and family plans, the principles can also be applied to small and large group rate determinations as well.

Health insurance companies go through a very complicated process and analysis to determine their rates. I’m not an expert on rate calculation. I’m just a health insurance agent who has watched the rates swing up and down in response government regulations. I’ve also read and studied the rate filings the carriers submit to the California Department of Managed Health Care (DMHC) and Department of Insurance (CDI). The rate filings are really boring to read and difficult to understand. But they provide insight into the costs health insurance companies must consider when pricing their plans.

Member Share of Cost

Two of the biggest drivers of health insurance rates are the deductible and the annual maximum out-of-pocket amount. When a health plan lowers either the deductible or the maximum out-of-pocket amount, the rates increase. When more of the potential health care costs are shifted to the member, the health plan has to pay out less in claims because of a high deductible, the rates are lower. One great features of the ACA is that it standardized plans into metal tier levels. The rates for Covered California standard benefit design plans of Bronze, Silver, Gold, and Platinum can be easily compared.

Comparing Health Insurance Rates In California

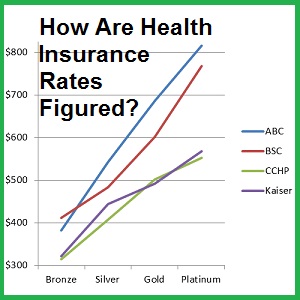

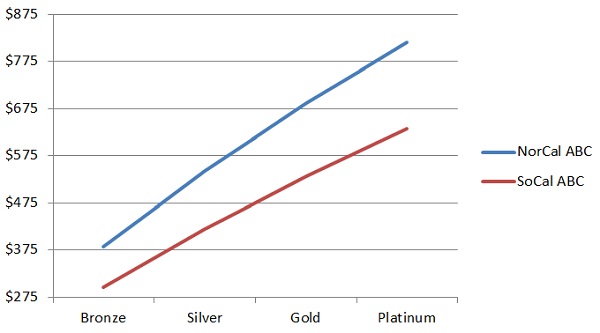

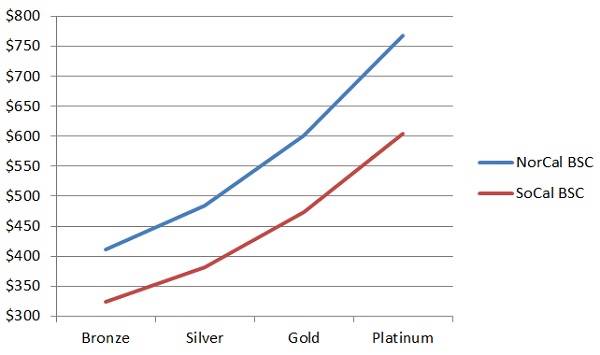

The graph below depicts the rates for a 40 year old individual living in San Francisco. Plotted are the rates for Anthem Blue Cross (ABC), Blue Shield of California (BSC), Chinese Community Health Plan (CCHP), and Kaiser. Where the member must cover more of the health care costs under the high deductible Bronze plan, the rates are less than the no deductible Platinum. Most of the rate increases for each health plan follow almost a straight line from Bronze to Platinum.

Northern California rates for rating region San Francisco for a 40 year old from Anthem Blue Cross, Blue Shield of California, Chinese Community Health Plan, and Kaiser.

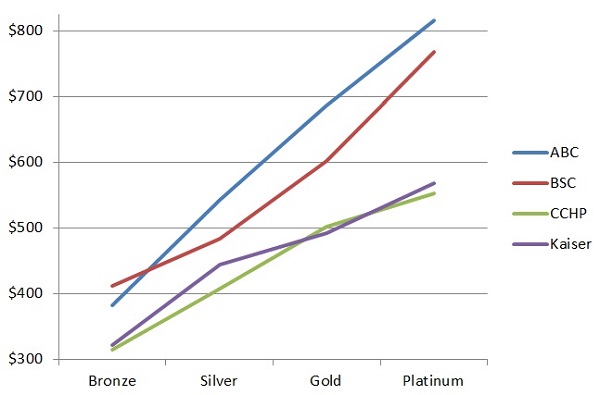

Southern California rates for a 40 year old from Anthem Blue Cross, Blue Shield of California, and Kaiser.

One of the reasons for a near straight line is that the metal tiers are based on an actuarial value: Bronze 60%, Silver 70%, Gold 80%, and Platinum 90%. In other words, a Silver 70% actuarial value plan is estimated to cover 70% of the average member’s health care costs. In essence, the health plan rates are merely reflecting the potential for the insurance company to realize a greater proportion of the costs of the health care services.

You’ll notice that the HMO plans are usually less expensive than either the PPO or EPO plans in a given region. HMO plans like Kaiser are good at limiting health care expenses because the majority of routine health care services must be approved by the member’s Primary Care Physician. Consequently, the utilization of expensive medical procedures such as MRIs or CT scans is lower.

In general, even if you compare non-standard benefit design plans that are offered off-exchange, because they must still meet the metal tier actuarial standards, the rates and increases are similar to the standard benefit design plans. It is not as easy to compare the rates of plans that have differing covered benefits. For instance, a health plan that does not cover maternity benefits will in evidently be less expensive than a plan that does for the same age of individual and geographical location.

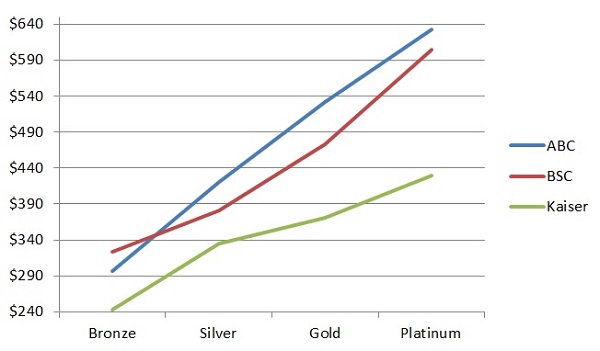

Beyond covered benefits and member share of costs; the geographical region the health plan is built around can have substantial impacts. This is due to the fact that the cost of health care services can vary from town to town. California has 19 different rating regions to account for the varying degrees of provider availability and costs of health care services within those regions. For example, Southern California rates are less expensive than Northern California. If we compare the rates for a 40 year old individual, with the same metal tier plans, we can see approximately a $100 dollar difference between the Anthem Blue Cross and Blue Shield plans being offered in Southern California as compared to Northern California.

Anthem Blue Cross rates for a 40 year old enrolling in an EPO plan. The blue line represent the higher rates for the same metal tier plan in San Francisco. The red line is the lower rates for Region 16 in Los Angeles County.

Blue Shield of California rates for a 40 year old enrolling in a PPO plan. The blue line represent the higher rates for the same metal tier plan in San Francisco. The red line is the lower rates for Region 16 in Los Angeles County.

Why are rates in Southern California less expensive? People I’ve talked to at the health insurance companies point to the increased competition among hospitals and providers. One complaint from a carrier has been Sutter Health owns so many hospitals in Northern California they have a near monopoly for hospital services in certain regions. With fewer hospitals and doctor medical groups to contract with, the health plans must necessarily pay higher reimbursement rates for the same procedures to Northern California hospitals as they do to Southern California facilities. See List of In-Network Hospitals by County/Region.

The top secret data that goes into determining health insurance rates are the actual types of claims submitted by members. Each insurance company has a unit dedicated to reviewing and analyzing claims data. With years of data on office visits, hospital emergency room visits, different types of surgeries, births, diagnosed chronic illnesses, and prescribed drugs, (plus lots of other data) the insurance companies have gotten very good at estimating how much they will have to pay in claims for a given rating region based on past claims experience.

While the insurance companies don’t release this data, they do use it in their rate filings. When a health plan submits a rate filing with either DMHC or CDI within the package is an actuarial memorandum. This document spells out the insurance companies justification for a requested rate increase OR decrease.

When Health Net initially filed their 2017 rates with CDI for their EPO and PPO they noted contributing factors that were driving their rates upwards. (Most of the time, the rate filings refer to the total per member per month (PMPM) costs to the health plan.)

Rate increases are primarily driven by the following items:

- Larger than expected substance abuse claims causing 2016 to be underpriced by 21.6%

- Sunset of reinsurance that represents $117 PMPM in claims for 2016 (18.0% rate increase)

- Claims trend of 7.8%

- Initiatives reducing needed rate increase by -15.7%

- Reduction of taxes and fees (HIT and Premium Tax) reducing rates by -5.8%.

While Health Net was grappling with larger than expected substance abuse claims, Blue Shield noted in their 2017 rate filing about higher than expected costs from people enrolling during a Special Enrollment Period.

Changes due to Duration

The following dynamics were observed from members enrolled during 2014 and 2015 plan years, and have contributed to higher per member per month claim cost.

A gradual ramp-up in utilization by member in the initial months of their coverage duration. This dynamic is associated with new members, and high volume of new members in 2014 resulted in a lower allowed PMPM in 2014 plan year than in 2015. To the extent that the volume of new sales relative to total membership is expected to decrease over time, we expect claim cost to be higher in 2016 and 2017 than in 2015.

In addition, members who joined during the special enrollment period were observed to utilize services at a much higher rate than those who joined during open enrollment period. With influx of new members through special enrollment expected to continue in 2017, claim cost is also expected to increase.

All the carriers discuss the cost of taxes, expected increase of member utilization, increasing cost of health care services, increasing cost of prescription medications, pediatric vision and dental costs, medical loss ratio, actuarial value of their plans, membership projections, along with some other relevant statistical information.

Health Insurance Companies Are Fleecing Consumers

The giant conspiracy theory, which is probably partially true, is that the carriers pad their numbers to justify their rate increases. But some carriers requested rate decreases for some plans in some regions. If you read some of the comments and questions posed by DMHC and CDI to the carriers about their rate justification you will see that the state regulators do challenge some of the assumptions and calculations underlying the proposed rate increases. When you realize that the insurance companies are collecting billions of dollars in premiums every year, a few extra pennies per member per month can add up to large profits at the end of the year.

For example, one benefit that is included in all individual and family plans is the pediatric dental and vision coverage. The cost of providing this insurance is built into every health plan offered, but how many children have actually used the services?

From the Health Net rate filing

An off-system adjustment of $4.76 was made to account for pediatric dental and vision. This benefit is currently not included in our internal systems, thus claims have to be adjusted for it. It is computed as the per child per month cap rate multiplied by the percentage of children age 0-18 on plans that include pediatric dental or vision coverage during the experience period, CY 2015.

The cost of a health plan is similar to the rates for our household water service. A large part of the monthly water bill is not the water we use, but for the continuously pressurized water system that will supply enough water to fight a house fire. The health plans have to be able to cover the costs of ALL the provided benefits even if the member never uses them.

Paying For Benefits Members Don’t Use

Another example of a mandated coverage benefit that is not fully used by the members is the no-cost colonoscopies. When an individual turns 50 years old they can get a no-cost colonoscopy to check for colorectal cancer. The health plans know that less than 100% of individuals eligible will actually take advantage of this benefit. But they also need to cover the costs in case a higher percentage of members do have the colonoscopy procedure and they have to pay for.

Repeal and Replace Obamacare

As of March 2017, the Republican controlled House of Representative has introduced an alternative to the Affordable Care Act (ACA) called the American Health Care Act (AHCA). The passage of either the original bill or an amended AHCA will most likely eliminate some or all of the essential health benefits mandated by the ACA. (Under congressional rules of budget reconciliation that the AHCA was introduced under, only budget and tax issues can be addressed. The ACA essential health benefits can’t be changed. That would require a separate bill.) If health plans can cover fewer benefits the rates for the new plans will be lower than current rates. Fewer mandated benefits means fewer health care services that the health plans have to pay on.

Fewer Benefits – Lower Rates

Even if the metal tier actuarial values are kept in place under the new AHCA, it will be hard to easily compare rates for plans that might offer drastically different benefits. For example, individuals may be able to purchase a plan that does not include maternity coverage in a Silver metal tier level. Consumers may erroneously select a Silver plan based on its lower premium only to find out that there is no coverage for pregnancy. Hence, that is why it was priced lower.

Buying Across State Lines

Another idea floated by Republicans and President Trump is allowing individuals and families to purchase health plans across state lines. But as we know, health plans currently develop their rates based upon the health care costs and claims experience for a specific region. Allowing people to purchase a plan who don’t reside in the rating region is similar to the special enrollment claims experience of Blue Shield. New members who enrolled through a special enrollment period had higher claims. This unknown membership element makes it difficult for the insurance carriers to price their product if they don’t know who their members will be.

Opening up health plan enrollment across state lines may drive some carriers to only offer HMO or EPO plans. A member can only receive services from providers within the provider list. There is no out-of-network coverage. In other words, PPO plans may become an endangered species as insurance companies attempt to dissuade people from other states from purchasing their health plans. In an effort to combat fraudulent substance abuse benefit claims, Health Net instituted a number of conditions in order to enroll in their PPO plans. Individuals had to provide proof they actually lived in the rating region for the plan and they had to attest that an unrelated third party was not paying their claims. Anthem Blue Cross switched many of their 2016 PPO plans to EPO plan in 2017. This shielded Blue Cross from unexpected out-of-network claims.

I am not an apologist for the health insurance companies and how they determine their health insurance rates. Facts that cannot be denied are that the rates are driven by how much of the health care service costs are borne by the member, the relative regional costs that the insurer must cover, and the expected utilization of those services by plan members. The insurance companies will design health plans in response to any new laws and create the lowest possible rates in order to cover their costs and attract consumers. Whether the consumers will like the plan they purchase with the lower rates and fewer covered benefits remains to be seen.

[wpfilebase tag=file id=2124 /]

[wpfilebase tag=file id=2125 /]