Life or final expense insurance is nice to have as long as it doesn’t bust the household budget. Life insurance can be complicated with all the different types of products like Term, Whole Life, Universal Life, Accidental Death, and a variety of riders you can add on to them. I like to keep things simple so I only offer Term Life insurance. The applicant or policy owner pays a monthly premium for a set death benefit. There is no cash value to Term life insurance. By selecting a death benefit to cover just funeral expenses and possibly a few months of transition money for the survivors, the cost of Term life insurance can be affordable.

You don’t have to be super human fit to get life insurance. There are a variety of health challenges the life insurance companies will still issue a policy for.

Impaired Risk Life Insurance

- Alcohol and Substance Abuse

- Arthritis

- Asthma

- Cancer: bladder, breast, cervix, colorectal, Hodgkin’s and lymphoma, leukemia, ovarian, prostate, skin, testicular, etc.

- Cholesterol

- Colitis-Crohns

There are also simplified issue policies that require no exam, blood or urine samples. Of course, you will always get a better rate if you can submit to a para-medical exam.

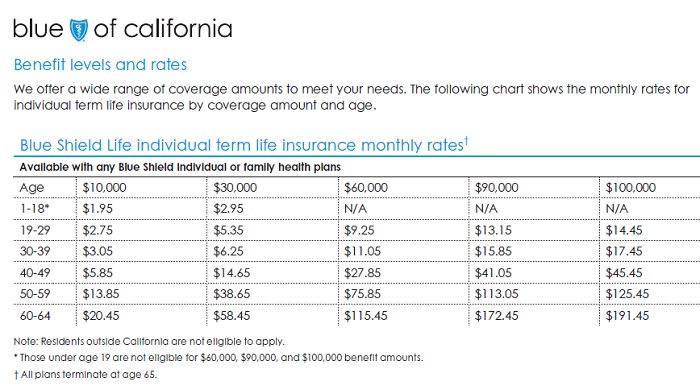

All the quotes I provide are confidential and your information is never sold. I have access to several different life insurance companies so we can compare rates after determining what is the most appropriate amount of life insurance for which term needed. Sometimes you can even tag life insurance onto your health insurance policy like with Blue Shield below.

Life insurance for business situations below.

Blue Shield of California offers affordable Term life insurance. You do not have to be enrolled in a Blue Shield health plan to apply. A 45 year old man can get $30,000 of Term life insurance starting at $14.65 per month. While that is not huge amount of cash, it will pay the final expenses for a funeral. Contact me to discuss your particular situation and if Term life insurance is right for you.

There are eight health questions on the application and a para-medical examination is not required. Any person of 1 year of age to 64 years old can be insured. The minimum death benefit is $10,000 and the maximum death benefit is $100,000.

Blue Shield of California Term Life Insurance Application

Business Failure To Survive Insurance

These types of failure to survive policies are focused on individuals in business arrangements where their sudden death or disappearance would leave lenders, employers, or partners with significant liabilities.

Another form of Final Expense insurance are irrevocable Funeral Trusts. These are single premium policies, one time payment, that earn interest over the years. If the person has to go onto public assistance such as Medicaid, the irrevocable trust is not included in the spending down of assets to be eligible for Medicaid. The irrevocable trusts are separated from other life insurance assets because they can only paid to funeral home for final expenses. Call me for a quote.