Old income and deduction data can create new errors in Covered California.

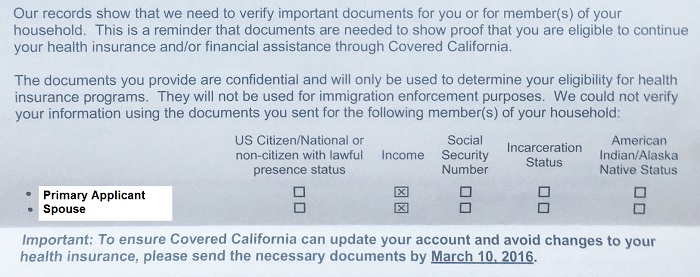

One of the most important parts of the Covered California health insurance application is making sure that the household monthly and annual income is correct. Some consumers may encounter problems with incorrect income information through no fault of their own. As Covered California has updated and improved their CalHEERS online application, older information may get orphaned. This is the only explanation for a consumer whose Covered California account showed a negative monthly income, but a positive annual income.

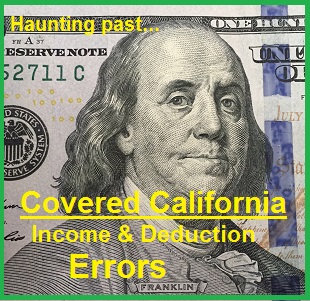

Covered California demands income verification

One of my clients was frustrated that he had received a second letter demanding he verify his estimated income. He had filed his taxes on time; we updated the consent for verification and uploaded the latest 1040 tax return. Yet, Covered California was still requesting he verify his household income. Upon researching his income, which hadn’t changed since he and his wife originally enrolled in 2014, I was surprised to learn his monthly income was negative.

Covered California income verification demand letters and keep monthly premium assistance.

Covered California account holders are receiving letters demanding income information they may already have submitted.

Original income and deduction data continue to haunt applications

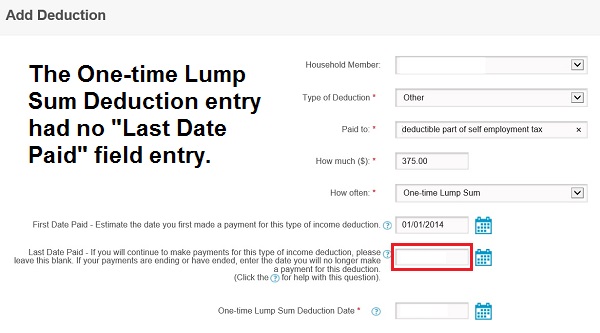

While his monthly income was negative, and should have dumped him and his wife into Medi-Cal, the household income was positive! The negative monthly income was being triggered by even larger monthly deductions. All the deductions were characterized as One-Time Lump Sum events, but there was no end date specified in the Last Date Paid field. But when the consumer entered the deductions in 2014, the Covered California application didn’t have Last Date Paid fields. The field to stop an income or deduction amount wasn’t added until late 2014.

Original One-Time Lump Sum Deduction information was transferred to the new Covered California enrollment making the making the household monthly income negative.

Just viewing deduction pages updates information

As I opened up the data page for each deduction, and then clicked Continue to move on to the next entry, the program automatically supplied the Last Date Paid and the One-Time Lump Sum Deduction Date. This update removed all the erroneous recurring One-Time Lump Sum Deductions from the income summary. After reviewing all the deductions, the monthly income had returned to a positive number and the annual income estimate had not been affected. This was the easiest income fix I had ever done with a Covered California application.

Always Report A Change

The final step to make sure the One-Time Lump Sum Deductions new end dates would be effective was to complete a Report a Change operation to the account. With the Report a Change operation it triggers a Special Enrollment Period and the correct information in the SEP fields must be correctly entered or the whole change blows up. [Covered California SEP Toolkit and Instructions] The correct outcome is that the Covered California lets the consumer select the existing plan.

An updated Covered California CalHEERS program release added Last Date Paid fields after consumers had already submitted information and the program initially could not handle the data until it was viewed and triggered the end dated automatically.

Always review application every year

The larger lesson is that it is paramount to always review all the information in the Covered California application on a yearly basis. Because Covered California is routinely making changes to the CalHEERS program, information entered into the application in an earlier build may not get properly handled in successive releases. I don’t know if correcting the One-Time Lump Sum Deductions will stop my client from receiving the income verification demand letter from Covered California. However, the complete fix is that the primary applicant will be sending Covered California an affidavit stating he will earn his targeted income amount…and Covered California must accept that verification.