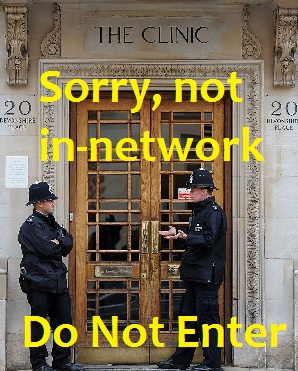

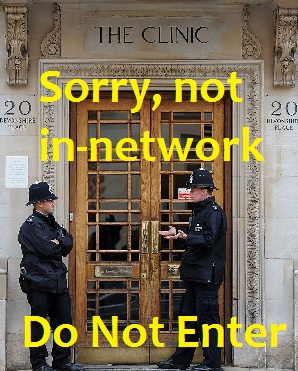

Non-participating providers will not be covered under the new EPOs

Consumers looking to select a new affordable Care Act health plan will have to carefully consider the benefits and limitations of the different provider networks associated with each plan. In addition to the familiar PPO and HMO designs, many carriers have added the EPO. Which network is best for your family?

Freedom to choose

PPO: Preferred Provider Networks usually have the greatest number of doctors, hospitals and associated providers to select from. In general, you can make an appointment with any physician in or out of the network without a referral. However, some visits and procedures require prior approval before the health plan will either recognize or pay for them. *The ultimate PPO health plan is Original Medicare where virtually every physician’s group has doctors that accept Medicare assignment.

PPOs accommodate favorite specialists

PPOs are the only provider network that will allow you to see a physician outside the network and have the expenses accumulate toward the deductible and maximum out of pocket amount. The deductible, copayments and coinsurance always favor in-network providers. But if you have specialists you just can’t live without, the out-of-network PPO will at least accommodate them.

$0 cost preventive care can be expensive

Just be careful of the double whammy of out-of-network physicians who refer you to an out-of-network facility such as a hospital or surgery center. If the procedure is a zero copayment for a preventive benefit like tubal ligation or colonoscopy and it is performed at an out-of-network or non-participating facility, you may be on the hook for the full cost. Expenses associated with non-participating physicians and facilities must also meet a higher maximum out-of-pocket amount before the health plan covers all benefits at $0 for the remainder of the year.

Have your provider list and check it twice

I’m convinced that most doctor offices don’t understand the difference between participating and non-participating providers. I have called numerous physicians to check if they accept a particular insurance plan and I will be told, “We accept all PPOs.” Sorry, that wasn’t my question. In short, you can’t trust the doctor office to give you good information regarding the status of their participation in an individual health insurance plan.

In-Network Hospitals by Health Plan by Region/County

Comparing PPO, EPO, HMO covered costs

This short spreadsheet shows some of the covered costs and restrictions for different benefits under PPO, EPO and HMO plan designs. While PPOs give the greatest flexibility to see different physicians, they also have inherent complications that might inadvertently cost members more money.

Separate deductibles

PPO plans have a separate deductible for in-network and out-of-network costs. The costs are tracked continually throughout the year. When you visit an in-network physician or facility, those expenses go toward your “In-Network” deductible, coinsurance and the annual maximum-out-of-pocket (MOOP). There is a separate column for the out-of-network charges. Once you meet the in-network MOOP, all network charges are covered. But if you go out-of-network you’ll continue to pay those expenses until the “Out-of-Network” annual MOOP is reached.

Allowable Amounts

However, PPO plans also impose Allowable Amount limits on health care services. The Allowable Amount is not necessarily what the doctor or other provider might charge you. For example, you receive an out-of-network MRI. The imaging facility send you a bill for $1,000. The out-of network coinsurance is 50%. The health plan determines the Allowable Amount for the MRI is $800. They pay 50% or $400. You pay the other 50% ($400) PLUS the balance of the invoice of another $200.

Exclusive, the new restrictive

EPO: Exclusive Provider Networks are a hybrid between the PPO and HMO model. Similar to a PPO, a member can make an appointment with any doctor in the network. The member doesn’t need a primary care physician for most visits to a specialist. The EPO shares the HMO design of not recognizing any medical health care expense outside of the network. A simple consultation office visit with a specialist not participating in the EPO will not be covered by the plan and you will have to pay for the visit out of pocket and no amount will accumulate to either the deductible or the maximum out of pocket.

Are they in-network?

Physicians that have not participated in a HMO style health plan or are generally unfamiliar with the EPO network may inadvertently refer patients to doctors outside of the network. Referral mistakes routinely happen in the PPO world, “We accept all PPOs”, leaving the members to argue with medical offices and insurance companies over the payment of services. Bottom line, if you are in an EPO, know where to find your provider list and only accept a referral to a doctor or facility from the network of providers.

More coordinated care

HMO: Health Maintenance Organizations utilize the concept of a selected primary care physician (PCP) as the “gate keeper” to specialists, expensive tests and outside facilities. With the exception of obstetrical and gynecological services, most HMO’s mandate that you must see or at least contact your PCP for a referral. One of the ways HMO’s help curb costs is by not allowing members to access potentially high cost services outside of the network. The HMO health plan has contracts with different providers and facilities and won’t pay for any treatment outside of the network.

HMOs may have more providers than new PPO plans

Many new health plans seem to have reduced provider networks. Even the PPO plans have contracted with fewer doctors eliminating physician groups and facilities that may have charged a premium for their services. However, many regional HMO plans have not reduced their networks. Health plans from Kaiser and Western Health Advantage are offering their full network of providers in the new ACA plans. The health plans with full networks seem to have higher premiums associated with the insurance. But then again, you get what you pay for.

Healthcare Service Plans

For 2015 Health Net will be introducing a Healthcare Service Plan (HSP) in place of their PPO plans in Southern California. With a HSP the member must choose a Primary Care Physician (PCP) for all their routine check ups and to contact if they feel ill, excluding emergency treatment. There is no out-of-network coverage similar to an HMO. Unlike an HMO where most referrals must come from the PCP, HSP members are allowed to schedule an office visit with a specialist as long as that provider is in the network. Because the HSP model is new to California, it will be important to carefully read all the terms and conditions of the Evidence of Coverage document about when a member can actually “self-refer” to another provider and how those health care expenses will be handled.

Because all members in EPOs and PPO will be assigned a Primary Care Physician in 2017, there is little difference between and HSP and EPO.

Basic video review of PPO, EPO & HMO models