Reporting an income change to Covered California can be complicated.

Consumers who have purchased their health insurance through Covered California are always being admonished to report any changes to their income to keep their tax credits in sync with their estimated Modified Adjusted gross Income. The latest spring 2015 iteration of reporting a change to a consumer’s income under the Special Enrollment Period section can be slightly confusing. In addition, Covered California doesn’t inform consumers that reporting a change to income also triggers another eligibility review and that the consumer must re-enroll in their health plan.

Income change qualifies under Special Enrollment

The first bit of confusion after a consumer reports a change to their income is that they are greeted with the Special Enrollment Period (SEP) page. Not only do consumers not know that changing income triggers a SEP, but income change is not listed as a qualifying event from which the consumer can select. Technically, reporting a change of income is not a qualifying life event for a SEP.

March 2016

Covered California has updated their CalHEERS program that calculate changes to income differently. They have made it easier to report a single change of income without multiple start and stop dates. The APTC is then calculated on a prorated bases. To learn more see updates to Covered California income reporting, former foster youth and Medi-Cal changes.

Covered California Special Enrollment Screen

2018 Update: Covered California has made the SEP Report a Change simpler than the steps outlined below. If you are only reporting a change to your income, and nothing else, select “None of the above (continue to review my application for Medi-Cal/AIM)”. By selecting Other Qualifying Live Event, the application will be put into a conditional mode where you will have to prove the condition by submitting documentation. In the case of changing the income, you would have to call CC and let them know you only wanted to change income and nothing else. To save the phone call, select “None of the Above” and as long as your Monthly household income is above the Medi-Cal level, you will be able to proceed with selecting a health plan with the accompanying new subsidy amount.

After you’ve made the income changes you are brought to the SEP page.

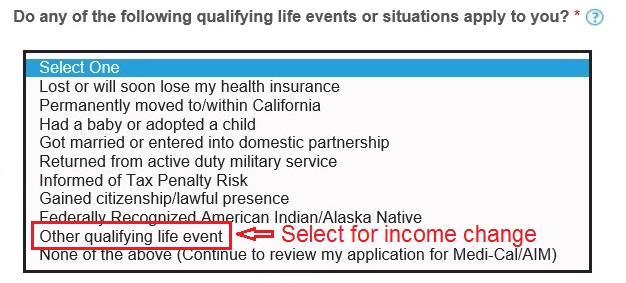

1. For the question “Do any of the following qualifying life events or situations apply to you?” you want to select “Other qualifying life event” for your income change.

Select “Other qualifying life event” from Covered California qualifying events drop down for income change reporting.

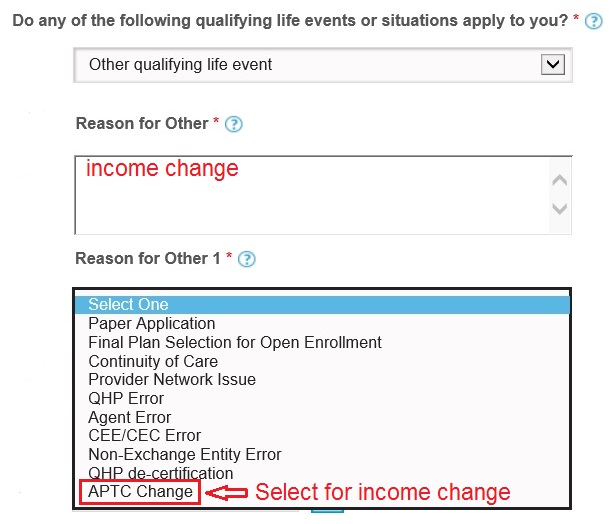

2. When you select “Other qualifying life event”, two more boxes will appear. In the first box “Reason for Other” type the words “income change”.

In the second box, from the drop down menu select “APTC Change”, that stands for Advance Premium Tax Credit change. However, changing your income may not necessarily change your APTC. If you add a baby to your health plan your APTC will most certainly change.

Write in “income change”, select “APTC Change” from drop down menu for income change reporting.

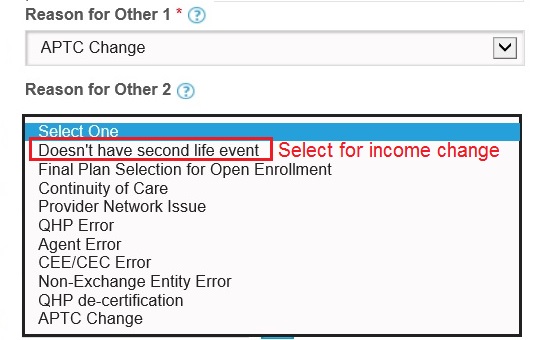

3. You will also see another box labeled “Reason for Other 2”. From the drop down menu select “Doesn’t have second life event” if you are only reporting a change to your income. Covered California will use the responses in the Reason 1 and 2 boxes to verify that a Special Enrollment is warranted under their rules.

Select “Doesn’t have second life event” usually when reporting income change to Covered California.

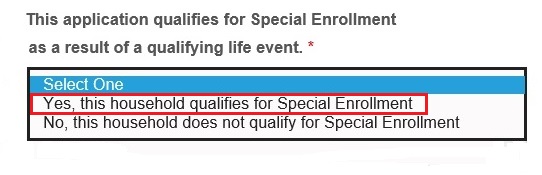

4. The next question will be if “The application qualifies for Special Enrollment as a result of a qualifying life event”. From the drop down menu select “Yes, this household qualifies for Special Enrollment”.

Select “Yes, this household qualifies for a Special Enrollment” when reporting a change to income.

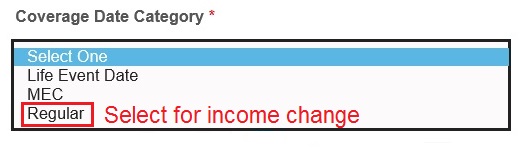

5. The “Coverage Date Category” question is the next box you must tackle. The type of qualifying event or date category determines the effective date of the health plan. For a simple income change you want to select Regular which will apply any change to the APTC or Enhanced Silver Plan in a future month. If you select Life Even Date or MEC, you could possibly create real challenges for your health plan’s billing system resulting in you having to pay a retroactively higher premium.

Coverage Date Categories

Select “Regular” as the Coverage Date Category for reporting a change to income.

Life Event Date: to be used when adding a new born or adopted child to the health plan. Use the date of birth or finalized adoption date. The effective date of the policy will be the date of birth or adoption

MEC (Minimum Essential Coverage): to be used in the event of loss of Minimum Essential Coverage. This could be from the loss of employer group coverage or government provided health insurance. The effective date will be the first day of the next month. If the group plan ended on April 30th, the new Covered California plan will become effective May 1st. This would hold true if you were reporting the change on May 15th.

Regular: is to be used for all other qualifying events including a change of income. The effective date will be like a regular open enrollment start date. If the event occurred on or before the 15th of the month, the plan will become effective the first of the next month. If the reported date is after the 15th of the month, the plan will become effective the first of the following month. April 15th = May 1st. April 16th = June 1st.

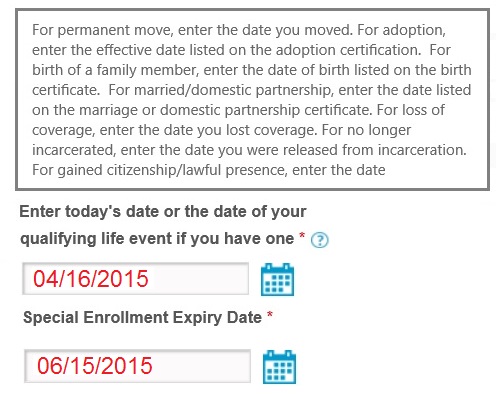

6. The final step is to enter the date of the income change. It is generally best to use the date you are making the change. Back dating the income change could create billing issues for your carrier. We also have to remember that this is an estimate of your income. The Expiry or expiration date will always be 60 days after the life event date you enter.

**This information was developed and confirmed with the Covered California service center. Covered California is preparing a job aid on the income change topic. I will post it here when it is released.

You can usually use the date you are updating your income in the Covered California system.

Submitting Special Enrollment income change

After you submit the change to Covered California the system will crunch the numbers and return a new household eligibility. If you lowered your income don’t be surprised that you, your children, or the whole family is now in Medi-Cal. Another possibility is that you may be offered and Enhanced Silver Plan or your current Enhanced Silver Plan changed. If your income increases enough, over 400% of the federal poverty line, you may lose your monthly tax credits altogether.

If you have not been determined eligible for Medi-Cal after your income change and are still receiving the Advance Premium Tax Credits –

Don’t Forget to Re-Enroll in your Health Plan!

Because the income change goes through the Special Enrollment procedure you must choose your health plan just like you did when you first enrolled. You have 60 days (the Expiry Date) to choose or keep your existing health plan. You will lose your coverage if you don’t select to keep or change your health plan after you’ve changed your income.

Qualifying Event – Coverage Date Category table

| SEP Qualifying Event | Coverage Date Category |

| Lost of will soon lose my health insurance | MEC |

| Permanently moved to/within California | Regular |

| Had a baby or adopted a child | Life Event |

| Got married or entered into a domestic partnership | Regular |

| Returned from active military service | Regular |

| Informed of Tax Penalty Risk | Regular |

| Gained citizenship/lawful presence | Regular |

| Federally Recognized American Indian/Alaska Native | Regular |

| Other qualifying event – Income Change | Regular |

| None of the above | MEC |