Covered California income advice triggers a $13,000 tax bill for one Moorpark family.

It is a scenario that kept this insurance agent up at night. What would happen if I gave a client the wrong advice when applying for health insurance through Covered California? Fortunately it wasn’t my errant recommendation but that of Covered California that saddled a Moorpark family with the repayment of over $13,000 in Advance Premium Tax Credit overpayments.

Covered California confused on modified income

As Covered California opened their online doors in the autumn of 2013 for enrollment into their qualified health plans for 2014, there were constant questions as to what actually constituted income for the Modified Adjusted Gross Income (MAGI). The household MAGI is the foundation for how much Advance Premium Tax Credit would be applied to lower the individual’s or family’s monthly health insurance premium to make it affordable under the new Affordable Care Act.

MAGI is not always line 37 of the 1040

The foundation of the MAGI is the IRS form 1040 tax return. For many individuals and families the MAGI will be equivalent to line 37, Adjusted Gross Income, from the 1040. However, the term modified denotes that there are other sources of income that must be added to, or modifying, the AGI. Specifically, social security retirement benefits and tax-exempt interest, both of which are normally not part of the tax filers AGI, are considered part of the MAGI.

Covered California should have been the income experts

Unfortunately, everyone, including agents, enrollment assisters, and Marketplace exchanges such as Covered California, wanted to simplify and trim the explanation of what income must be reported for the MAGI. The preferred short cut explanation to the consumer question of what constituted income was, “Line 37 of your 1040 or the AGI.” Even though the people helping consumers enroll in the Marketplace health plans were not experts or even familiar with federal taxes, they are not relieved of their responsibility to know the actual definition of MAGI because of their ignorance.

Covered California bad advice triggers $13,000 tax bill

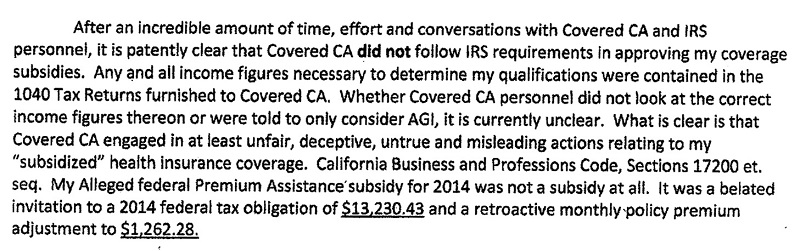

It was this ignorance and lack of attention-to-detail on the part of Covered California that lead the Polk family of Moorpark, CA, down the wrong road. The failure of Covered California to properly inform Mr. Polk of the income that is counted for the MAGI ultimately resulted in his having to repay $13,230.43 in excess Advance Premium Tax Credits for 2014.

Social security, tax-exempt income are part of MAGI

Mr. Polk learned from his CPA on April 7th, 2015 that he owed $13,230.43 for the repayment of excess APTC for 2014. The CPA had properly taken the Covered California 1095-A and completed IRS form 8962 Premium Tax Reconciliation. It was clear on form 8962 that the addition of the Polk’s social security retirement income and tax-exempt interest had pushed the Polk household income over 400% of the federal poverty line. This wasn’t new information. They had this income before they applied health insurance through Covered California. But no one at Covered California asked them about this income that is typically not listed on line 37 of the 1040 because it is not taxed.

Repayment relief if MAGI under 400%

Had the Polk MAGI been 399% of the FPL they would have been granted some relief from having to repay all the excess APTC. (See: IRS limits APTC excess repayment.) Under the current guidelines if the Polk MAGI was 399% of the FPL, they only would have had to repay $2,500. But because their MAGI exceeded 400%, under the ACA rules and IRS interpretation, they are liable for the repayment of the full amount of the APTC.

Pay now or accrue penalties and interest

While the revelation of a $13,000 tax bill would have pushed lesser men to a state where they had to use their health insurance for a heart attack, Mr. Polk started contacting the agencies involved looking for answers. At the end of hours of phone calls Mr. Polk was left with the IRS assessment and his own conclusion that Covered California failed to consider all of the household income that constituted the MAGI. Covered California had committed an act of misfeasance – the willful inappropriate action or intentional incorrect action or advice. The characterization of the bad Covered California income advice was of no consequence to the IRS. They wanted the Polk’s to repay the APTC or face penalties and interest.

Polk’s file an appeal

Somewhat astonished that the organization tasked with helping consumers find affordable health insurance had managed to add to his pain and suffering with the IRS, Mr. Polk filed an immediate appeal with Covered California over the incorrect income calculation. Mr. Polk included a position statement or historical account of income advice with the appeal; the full text can be downloaded at the end of the post. Here are a few snippets of his argument and conclusions.

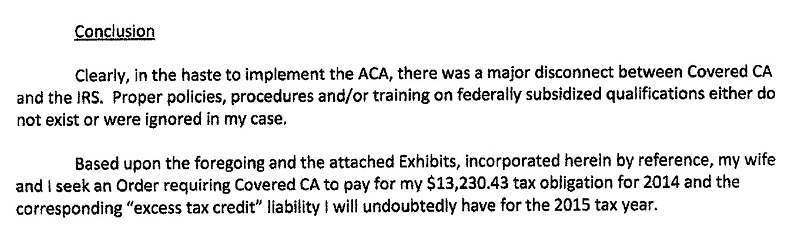

Administrative law judge issues a decision

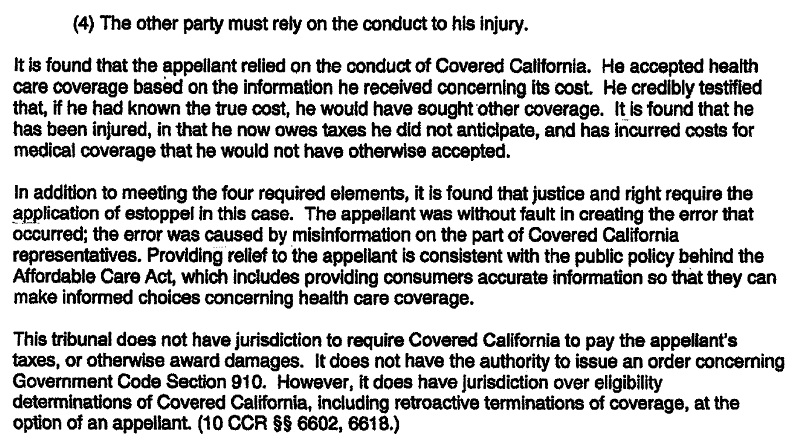

The appeal hearing was conducted on August 13, 2015 and the administrative law judge’s decision was released on September 16, 2015. While the findings of the judge were consistent with Mr. Polk’s accounting of his interactions with Covered California, the Administrative Law Judge has no authority to force Covered California to repay the excess APTC owed by the Polk’s. Download the complete text of the decision at the end of the post.

Reasonable expectations dashed

Twice, once in 2013 and again in 2014, Covered California approved the Polk family for the tax credit subsidy, even after they received his 1040 tax returns that showed tax-exempt income. Mr. Polk answered all their questions and submitted the necessary documents Covered California requested. Mr. Polk had a reasonable expectation that if something was amiss with regards to his eligibility for the ACPTC Covered California would have notified him of the issue.

Covered California only tells feel good marketing stories

Due to my inherent cynicism I normally assume an individual who is recounting a grievance has shaded the narrative in their favor. In this instance, Mr. Polk filed a formal appeal, had the appeal heard by an administrative law judge, and received a decision by the judge verifying the facts and the injurious effects to his tax liability. Has there been so much as an apology from Covered California? No. They are the faceless bureaucracy that runs a marketing spin machine. Just like an automobile manufacturer, Covered California only touts how wonderful they are and never mentions how many people have been injured from their misrepresentations.

Covered California wanted to dumb-down the ACA

Covered California’s service representative training was a victim of their pervasive marketing push to dumb-down the enrollment process. The Covered California CalHEERS online enrollment program actually did a decent job of constructing the various types of income that constitutes MAGI. If the Covered California representative would have actually interviewed Mr. Polk the social security and tax-exempt income would have been brought up. I feel a little foolish asking the questions when I am enrolling an individual or family especially if it is obvious the consumer has no income and is only eligible for Medi-Cal. But asking all the questions is the only way to ensure you haven’t missed an income amount or a deduction.

ACA tax credits are rooted in the IRS 1040

It is not readily apparent that the Covered California income section is based the 1040 and the MAGI, but it is. The different elements of the MAGI can be confusing. At the beginning of the 2014 open enrollment the IRS had not released form 8962 Premium Tax Credit Reconciliation and the companion instructions for calculating the MAGI. There was a vacuum of information relating to what income counted toward the MAGI. I would not have thought that this vacuum extended to the very organization tasked with determining the eligibility of consumers for the APTC.

Consumers hungry for real information

The black hole of credible information about MAGI was so big in 2014 that I took it upon myself to outline how the form 1040 tax return relates to the elements of the MAGI household income in a blog post. (See: What counts for Covered California income? ) I’m sure Covered California had the same trepidations about broaching the topic of taxes as I did. Did I really want to open myself to accusations about interpreting IRS regulations inaccurately? The daily questions from consumers convinced me that if Covered California wasn’t going to provide some guidance, I should. Ultimately, Covered California did provide more detailed consumer information on what was included in the MAGI. But that information and customer service training came too late for Mr. Polk.

Covered California: increasing stress and anxiety

The Polk family tax saga presents us with the paradox of the ACA. Covered California is consumed with improving health care outcomes by feverishly working to enroll every possible human in health insurance. Yet they are completely oblivious to the mental and physical destruction their errors cause consumers. (See: Covered California consumers pushed to suicidal thoughts.) Their actions are causing injury and more than just on a monetary level. Stereotypical of a government bureaucracy, the bungling customer service of Covered California pushes stress and anxiety levels of consumers who must work with them into the danger zone. I’ve had numerous people contact me in tears from the frustrations they’ve experience with Covered California. Unfortunately, the number of nervous breakdowns caused Covered California errors and lethargic bureaucracy is not a statistic that they track.

Covered California cares about their bottom, not yours

Just like the insurance companies, Covered California is ten steps ahead of the consumer. They have constructed their organization, the consumer agreement, and regulations in a fashion to limit their liability for inaccurate advice given by their staff. As an agent I must carry Errors and Omissions insurance in case I give stupid advice. This obviously doesn’t apply to Covered California. I wish consumers did not have to approach Covered California in an adversarial fashion but they must. Covered California is a sales organization, note the .com web address. As such, their first focus is their bottom line, not the consumer’s bottom. Consequently, consumers must be wary when working with Covered California. The Polk family put their faith in Covered California and got burned.

- [wpfilebase tag=fileurl id=1153 linktext=’ Polk Family Statement of Facts against Covered California’ /]

[gview file=”https://insuremekevin.com/download/covered_california/1095_A/Polk_statement_of_facts.pdf” save=”0″]

- [wpfilebase tag=fileurl id=1152 linktext=’ Polk vs Covered CA Decision’ /]

[gview file=”https://insuremekevin.com/download/covered_california/1095_A/Polk_Covered_CA_decision.pdf” save=”0″]

If you would like to share your story or contact Mr. Polk regarding other actions involving Covered California, please send me an email using the Contact page and I will forward it to Mr. Polk.