Covered California has released new Job Aids that review and describe some of the changes they have made to their online enrollment application. Many of the new functions address deficiencies in the original software, other features to help consumers more easily report changes, and the new addition of enrolling in a family dental plan.

Covered California has released new Job Aids that review and describe some of the changes they have made to their online enrollment application. Many of the new functions address deficiencies in the original software, other features to help consumers more easily report changes, and the new addition of enrolling in a family dental plan.

Note: not all of the functions represented or discussed in the Job Aids will be available to consumers updating their accounts. Some of the features are only available to Service Center Representatives, County Eligibility Workers, Plan Based Enrollers, Certified Enrollment Counselors, and Certified Insurance Agents.

Changes to the Covered California Application

Click on the PDF file to review the entire document as I only included some of the highlights from all the documents. The Job Aids will reference the Single Streamlined Application which is also synonymous with the term CalHEERS program which is also sometimes referenced in the documents.

Changing Expected Yearly Household Income

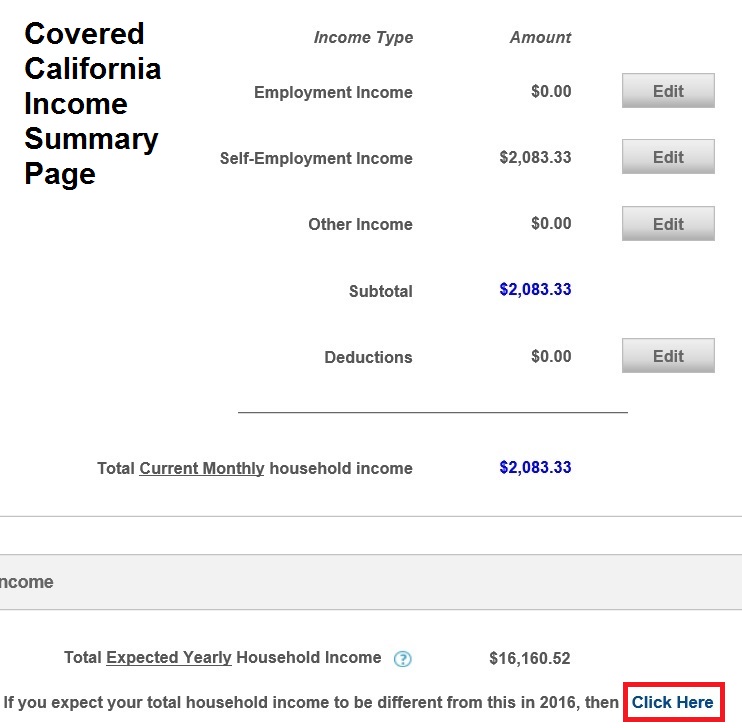

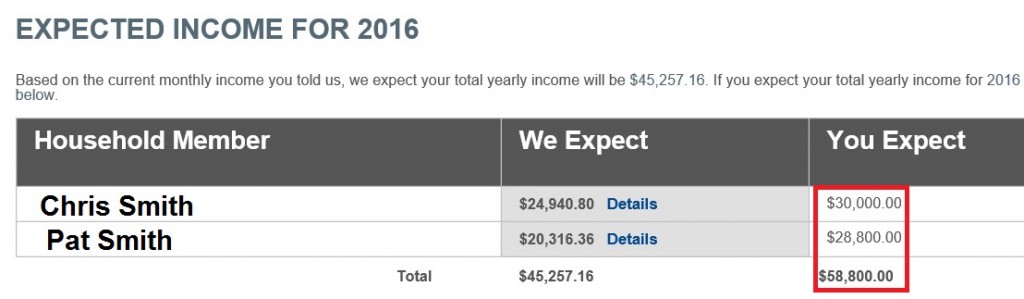

Covered California has copied a very consumer friendly tool from the Healthcare.gov application and that is a global change to the expected yearly household income. Even though people put in all their wages, self-employment, and other income to match their current sources of income, some folks know their income will be higher than what the system has calculated. At the bottom of the Income Summary page Covered California is now letting people override their entered income data.

If you expect your total household income to be different from this in 2016, then Click Here

This is perfect for someone who knows they will work over-time and their wages will be higher than what they entered. The system allows you to just put in a higher or lower figure for each individual listed on the income section. If the income is higher, then the Advance Premium Tax Credit will be lower than initially calculated. This is easier than changing the household income by job because it can be confusing as to whether you make changes to the 2015 income or the 2016 income. In the big picture, the details don’t matter as long as you correctly estimate the Modified Adjusted Gross Income for the Advance Premium Tax Credit premium assistance subsidy. Listing the sources of income is important if you are asked to verify your income and Covered California can match your proof of income to the source you have listed on the application.

Change Plan not available after income change

After you have changed the income you are not allowed to change health plans. You must first accept your current plan. Then the Change Plan link will become available in the Actions box on the right side of the home page. You can then select Change Plan and you can go shopping for a different health plan to enroll into. This all seems counter intuitive, but I’ve done it a couple times. Even though you get a confirmation that you have enrolled in a same plan, the Change Plan will override that selection. The new plan will show up under Current Enrollment under the Summary Page.

Dental Plans

You must also either select or decline a family dental plan before you are allowed to change plans. For more information see How to change plans after Covered California automatic renewal

Job Aid: Single Streamlined Application

- [wpfilebase tag=fileurl id=1045 linktext=’ Job Aid – Single Streamlined Application PDF’ /]

The Covered California Single Streamlined Application (SSA) supports all online applications, whether processed during Special Enrollment, Open Enrollment, as a Report a Change or a re-application. The SSA is aligned with the paper application and provides online help to inform and improve the Consumer experience. This Job Aid provides an overview of the SSA, with a focus on highlighting features and pages for Certified Insurance Agents (Agents), Certified Enrollment Counselors (CECs), County Eligibility Workers (CEWs), Plan Based Enrollers (PBEs), and Service Center Representatives (SCRs).

Extra Social Services Support

The Apply for Benefits – Get Help With Costs page provides links to access information about help with costs and guides selection of the application type (either subsidized or unsubsidized) that best matches the Consumer’s situation.

Immigration Verification

If the Eligible immigration status checkbox is checked, additional fields appear, such as the Document Type dropdown. Select an option from the Document Type dropdown list and enter information in the additional fields that display, based on the option selected from the dropdown list. Note: ‘Other document with an Alien Number’ and ‘Other document with an I-94 Number’ options have been added to the Document Type dropdown list.

Former Foster Care

Financial assistance applications display a series of Former Foster Youth (FFY) questions for any household member between the ages of 18 and 26 who indicate they were a FFY. Information displays in a popup to communicate that immediate coverage for former foster youth through the county human services agency is available.

Note: FFY-one-person households are not required to enter their income as CalHEERS does not count income for FFY. Multi-person households containing a FFY are required to answer questions about their income.

Personal Data – Tax Information Page

Warning messages appear when contradictory tax filing statuses are selected (For example, a warning message appears when one spouse selects ‘Married Filing Jointly’ and the other selects ‘Head of Household’)

Warning messages appear when contradictory tax dependent and custodial parent statuses are entered. For example, if a health coverage applicant indicates they are claimed by a Non-Custodial Parent not listed on this application and the applicant does not have any parent/caretaker relationships established on this application, the user will not be able to continue from the page.

It is important to note that Consumers with certain types of Minimum Essential Coverage (MEC) may be eligible to receive APTC/CSR if they have been offered but turned down enrollment in these MECs, or if their enrollment will be terminated before their coverage in a subsidized Covered California plan starts.

‘Medicare’ has been added and the ‘Indian Health Service’, ‘Tribal Health Program’ and ‘Urban Indian Health Program’ options have been removed from the Does this person have or has this person been offered affordable, minimum standard health insurance for 20XX? dropdown list

Employer information is required by Federal and State regulations to notify the employer that one of their employees has been determined eligible for APTC through Covered California. The following employer information is gathered: Employer Contact Person, Phone Number, Address, and County. However, the contact person, phone number, and the mailing address are optional fields when the consumer indicates they are employed.

Self-Employment Income

A negative number can be entered on the Add Self-Employment Income page to reflect situations where costs exceed income.

For example, if self-employment expenses exceed self-employment income by $500, -$500 can be entered in the How much net income (profits after expenses) will this person get from this source this month($) field on the Add Self-Employment Income page.

Reviewing Application

Clicking the Edit button in the Application Type section returns the user to the Help Paying for Coverage page to change their application type selection. The user is then navigated through the application pages to enter information appropriate for the application type

Job Aid: Covered California Plan Selection

- [wpfilebase tag=fileurl id=1046 linktext=’ Job Aid – Covered California Plan Selection PDF’ /]

This Job Aid shows how to assist Individuals with health plan selection – reviewing and selecting a Covered California health insurance plan that meets their needs – and the optional family dental plan selection, and then enrolling in their plan choice(s).

Overlap in Coverage

When there is an overlap in coverage for at least one member of the household, the Overlap in Coverage popup displays. This popup warns the user that coverage already exists for the period indicated by the Coverage Dates, for example, if the case was terminated but plan coverage has not yet ended. After noting when the previous coverage period ends, click the OK button to close and proceed.

Dental Plan Selection

Shop for Dental Plan button. This launches the Plan Selection page to browse Dental Plans, select a plan, and enroll. Clicking the Decline Optional Dental Insurance button displays the Decline Optional Dental Insurance popup box. The popup displays a message for the user to choose one of two options:

- Click the Decide Later button to retain the option to select a dental plan during Open Enrollment. Note: The option to “Decide Later” is only available during Open Enrollment.

- Click the Decline Optional Dental Insurance button to acknowledge declining dental insurance. If declined, the Dental Table will be removed from the page.

It doesn’t look as if individuals and families who are deemed eligible for Medi-Cal can enroll in a family dental plan because the dental plan selection comes after the health plan selection. Medi-Cal eligible consumers are not given the option to select a health plan. This may change in the future. You can get individual and family dental and vision quotes here -> Dental For Everyone.

Job Aid: Current Enrollment and Enrollment History

- [wpfilebase tag=fileurl id=1047 linktext=’ Job Aid – Current Enrollment and Enrollment History PDF’ /]

This Job Aid illustrates how to view enrollment information for all benefit years. All user roles have access to the Current Enrollment and the Enrollment History pages, where detailed enrollment records associated with a case may be viewed. Two pages are available to view: the Current Enrollment page which replaces the Plan Enrollment Summary by Program page and the Enrollment History page which replaces the Plan Enrollment Summary by Person page.

Note: Only Administrative users—Service Center Representatives (SCRs) and County Eligibility Workers (CEWs)—can view the Enrollment Transaction Details page.

Enrollment pages allow users to view enrollment records for Covered California programs with the following statuses:

- Pending

- Cancel

- Enrolled

- Terminated

There is still an issue of a consumer accessing the summary page and important documents like a 1095-A if the consumer has terminated their participation in a Covered California health plan.

Job Aid: Report A Change

- [wpfilebase tag=fileurl id=1048 linktext=’ Job Aid – Report A Change PDF’ /]

This Job Aid shows how to use the Report a Change function on behalf of a Consumer to make changes to their application information. After making changes to the Consumer’s information, it is crucial to re-run the eligibility determination for the household. Changes such as removing or adding a household member, changing a physical address, or updating income information may impact the Consumer’s coverage or eligibility for financial assistance. Eligibility results should be carefully reviewed with the Consumer to be sure that any impacts of the changes are understood.

The Report a Change functionality is used in a variety of change scenarios but the steps for each change scenario are similar. This Job Aid will highlight the steps to complete the following common types of reported changes:

- Remove a household member

- Add a household member

- Report a change of address

This Job Aid also describes how to use Report a Change functionality to change the application type from unsubsidized (the Consumer receives no help with the cost of coverage) to subsidized (the Consumer receives help paying for coverage in the form of monthly premium assistance, cost sharing reductions, tax credits, or Medi-Cal). The additional steps required for reporting changes during Special Enrollment periods are also described.

Job Aid: Income Pages

- [wpfilebase tag=fileurl id=1049 linktext=’ Job Aid – Income Pages PDF’ /]

This Job Aid shows how to enter income into the CalHEERS application. As income is directly related to a consumer’s eligibility for financial assistance, it is important to redetermine eligibility upon completing changes to income pages.

Important notes –

- The CalHEERS online application will no prorate monthly income.

- Total current monthly income will only report income being received as of the date of the change. Income that ended before or is set to begin in a future month will not be displayed.

- One-time lump sum payments can be reported with a start and end date over a particular date period or entered as being received on a specific date.

- There is now a function to allow consumers to override the Expected Yearly Household Income determined by the system based on the entries. If the Expected Income is manually updated, CalHEERS recalculates the household’s monthly income by dividing the annual total by 12. CalHEERS sends the recalculated monthly income amount to Counties when processing Medi-Cal eligible members.

Job Aid: Enrollment Transaction Definition

- [wpfilebase tag=fileurl id=1050 linktext=’ Job Aid – Enrollment Transaction Definitions PDF’ /]

This Job Aid lists and defines the various types of Enrollment Transactions and Enrollment Change types that are referenced on the Current Enrollment, Enrollment History and Transaction History pages. All users have access to these pages, while only Service Center Representatives and County Eligibility Workers have access to view the Enrollment Transaction Details page.

2016 Plans and Benefits Update

- [wpfilebase tag=fileurl id=1044 linktext=’ 2016-Plans-and-Benefits Update Presentation’ /]

Power Point presentation of the new standard benefit design changes for 2016, new health plans, and new family dental plans offered through Covered California.