Consumers who are currently insured in the individual market directly through an insurer “off-exchange” may be eligible to receive financial help if they purchase coverage through Covered California during this new SEP. It is important to note that consumers who earn from 138 percent FPL through 600 percent FPL may receive state and/or federal subsidies which means they would be more likely to retain their coverage. Covered California estimates that about 280,000 Californians enrolled off-exchange may be eligible for financial help. Most of these consumers would be eligible for both state and federal subsidies, while about 40,000 of those consumers are middle-income Californians earning more than 400 percent FPL and may be eligible for the new state subsidy.

A new Special Enrollment Period (SEP) has been established for consumers who:

• Learned about the Individual Shared Responsibility Penalty or the California Premium Subsidy after Open Enrollment.

• Have current health insurance coverage through an off-exchange plan but wish to purchase a plan through Covered California to qualify for the new California Premium Subsidy or existing federal subsidies, which are only available through Covered California.

Consumers may purchase a Covered California plan through April 30, 2020 if they have experienced one of the new Qualifying Life Events (QLEs) listed above.

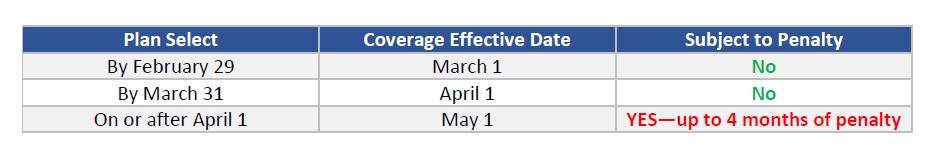

Coverage Effective Dates and State Penalty

California’s new Individual Shared Responsibility Penalty offers a grace period for short coverage gaps of up to and including three (3) months. Therefore, consumers who wish to avoid the Penalty must have coverage effective April 1, 2020.

• Consumers who enroll by March 31 will NOT be subject to the mandate penalty

• Consumers who plan select on or after April 1 will have a May 1 effective date and, therefore, may be subject to 4 months of penalty.

Consumers can estimate their potential penalty by using the Franchise Tax Board’s Penalty Estimator.

There are many considerations a consumer already enrolled in an off-exchange plan may need to consider when deciding to move to an on-exchange product. Covered California encourages off-exchange consumers to work with a Certified Insurance Agent for this transition. Because Agents are licensed by the California Department of Insurance and are experts in products offered both off- and on-exchange, Covered California has implemented the following changes during this SEP:

• Coveredca.com will encourage consumers with off-exchange coverage to reach out to their Agent if they have one. Consumers without a delegated Agent will be directed to Help On-Demand so a Certified Insurance Agent can assist them.

• Off-exchange insured consumers who contact our Consumer Service Center and those who do not have a delegated Agent listed on their account will be directed to Help On-Demand so a Certified Insurance Agent can assist them.

Some factors a consumer may wish to consider when deciding whether or not to enroll in coverage through Covered California are:

• Understanding Subsidy Eligibility: Consumers need to understand the amount of subsidy they may be eligible for and how subsidies work (e.g., they may be eligible for more or less than they thought at the end of the year).

• Coverage Benefits: In many cases consumers can switch to identical or virtually identical coverage with the same insurer. However, it is important to make sure consumers compare the coverage benefits in their current, off-exchange product with the coverage benefits in the Covered California product they are considering. A few things to consider when comparing plans: copayment amounts, coinsurance amounts, deductibles, out-of-pocket maximums, and the premium after any applicable subsidy.

• Date Coordination: Make sure consumers coordinate their cancellation and effective dates so they don’t pay for double coverage or have a period of time without coverage.

• Return to Off-Exchange: If a consumer decides to return to their previous off-exchange plan, they will need to wait until the annual Open Enrollment Period (OEP), unless they have a Qualifying Life Event (QLE) and become eligible for a Special Enrollment Period (SEP).

• Income Changes: If a consumer’s income increases or household size changes, they may no longer be eligible to receive a subsidy, or their subsidy amount may change.

• Treatment of Health Care Expenses Already Incurred: If a consumer has already incurred health care expenses in their off-exchange coverage, they need to understand when they will and will not be able to transfer their spending to apply to the deductible and maximum out-of-pockets in their new coverage. Generally, all expenses incurred will be credited when the consumer stays with the same carrier and the same benefit design and/or metal tier. Expenses will not be credited when a consumer chooses to change carriers.

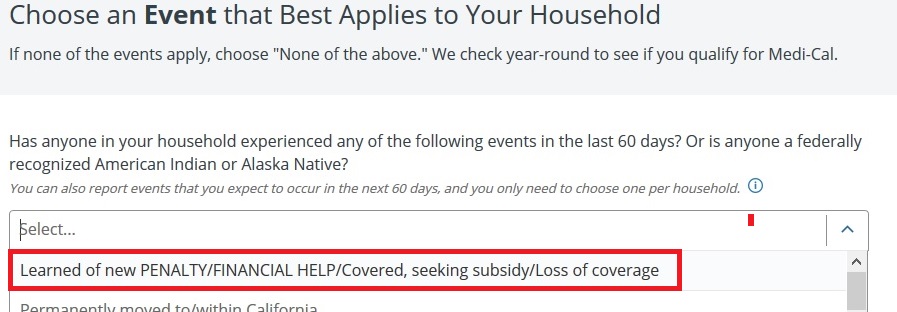

Processing Special Enrollment Applications

To enroll during this new Special Enrollment Period, select “Report a Change” within the consumer’s account to be taken to the Special Enrollment page. You will be asked to select from a drop-down list of Qualifying Life Events. The first drop-down option (Learned of new PENALTY/FINANCIAL HELP/Covered, seeking subsidy/Loss of coverage) should be used for this additional Special Enrollment Period until April 30, 2020.

The first option in the Special Enrollment drop-down includes both the two (2) special QLEs above as well as the standard/permanent QLE of losing coverage within the past or next 60 days. All three of these QLEs (Learned of new PENALTY/FINANCIAL HELP/Covered, seeking subsidy/Loss of coverage) will allow for coverage effective the first of the following month.

Please Note: Consumers must still effectuate their plan by paying their binder payment timely, per their selected carrier’s rules. Consumers may use the “Pay Now” feature in their consumer portal or call their carrier directly to effectuate their coverage.

Special Enrollment Period for State Subsidy or Penalty Fact Sheet

• After surveying the public and certified insurance agents, it was determined that too many California residents were still unaware of the new state subsidy or state penalty.

• For the 2020 benefit year, a new, short-term qualifying life event (QLE) will allow certain consumers to enroll through a special enrollment period (SEP) from February 18 through April 30, 2020.

• Consumers unaware of the state penalty, the new financial help, or who are currently insured off-exchange and want to switch to Covered California to benefit from the new state subsidies will be able to apply for Covered California.

• Those currently uninsured should contact Coveredca.com or our Service Center (800) 300-1506 to enroll.

• For insured Consumers looking to move to Covered CA they should contact their current Certified Insurance Agent to walk them through the process and facilitate the change.

• If the consumer does not have a Certified Insurance Agent, they can utilize our Help-On-Demand tool and will get a call back within 20 minutes.

• Things for consumers to consider when switching from an off-exchange insurance plan to Covered California plan include:

— Covered California is working with issuers and regulators on a plan to allow the transfer of deductibles accumulated off-exchange to an on-Exchange health plan.

— If the consumers income increases or household size changes, they may no longer be eligible to receive a subsidy, or their subsidy amount may change.

— Coverage may be different depending on the metal tier that is selected.

— Consumers may need to coordinate the date of cancelation with effective date, so they are not paying for double coverage.

— Consumers should check the carrier’s network to verify their current doctors are in network.

• Qualified consumers will receive a first of the month start date following plan selection.

• The sooner the first payment is made, the sooner consumers will receive their ID card and welcome packet and can use services. Consumers can pay their first month’s bill through CoveredCA.com.

• Consumers should be notified that if they don’t have coverage they may receive a penalty when they do their taxes.

• If you enroll by March 31, you will not incur a penalty. However, if you wait and enroll in April, you will have to pay the penalty for the entire period of the coverage gap, including the three-month short coverage gap period (e.g., four or five months of coverage gap for coverage start date of May or June 1).

— Consumers enrolling by February 29 would have coverage effective March 1 (and no penalty as only two months without insurance);

— Consumers enrolling by March 31 would have coverage effective April 1 (and no penalty as only three months without insurance); and

— Consumers enrolling by April 30 would have coverage effective May 1 (and would have a pro-rated penalty of 1/3 of the annual penalty amount — assuming the individual is not otherwise exempt)