The first paragraph of the 2021 Instructions for form FTB 3849 says it all. “…, for all months in taxable year 2021, applicable taxpayers are not eligible for advance payment of the California premium assistance subsidy…” In other words, if you received the California premium assistance subsidy through Covered California, you will most likely have to repay all of the subsidy you received that lowered your health insurance premiums.

Most California Subsidies on FTB 3895 Must be Repaid for 2021

Fortunately, for most California taxpayers, the amount of the California premium assistance subsidy (CPAS) they received was relatively small. For some Covered California households who received large monthly amounts of the CPAS, the repayment could significantly add to their California income tax liability for 2021.

How did this repayment situation happen?

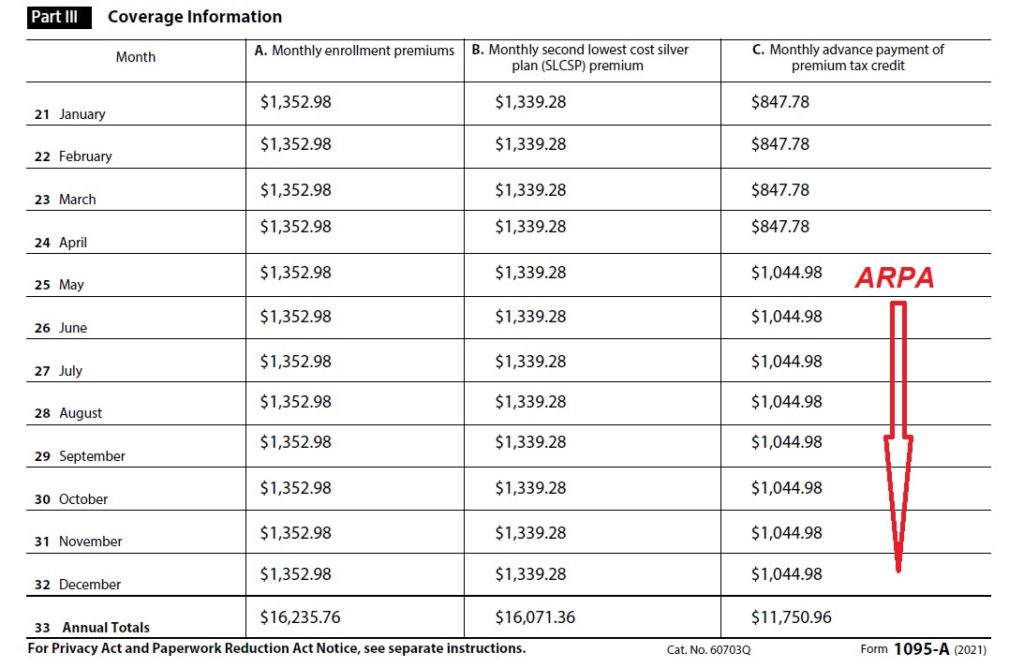

Early in 2021, the American Rescue Plan Act was passed that increased the federal Premium Tax Credit subsidy for health insurance. However, the increased federal subsidy, that applied to all households regardless of income, was not implemented in the Covered California system until May of 2021. For the first 4 months of 2021, Covered California was advancing the state premium assistance subsidy for households with incomes between 200 and 600 percent of the federal poverty level.

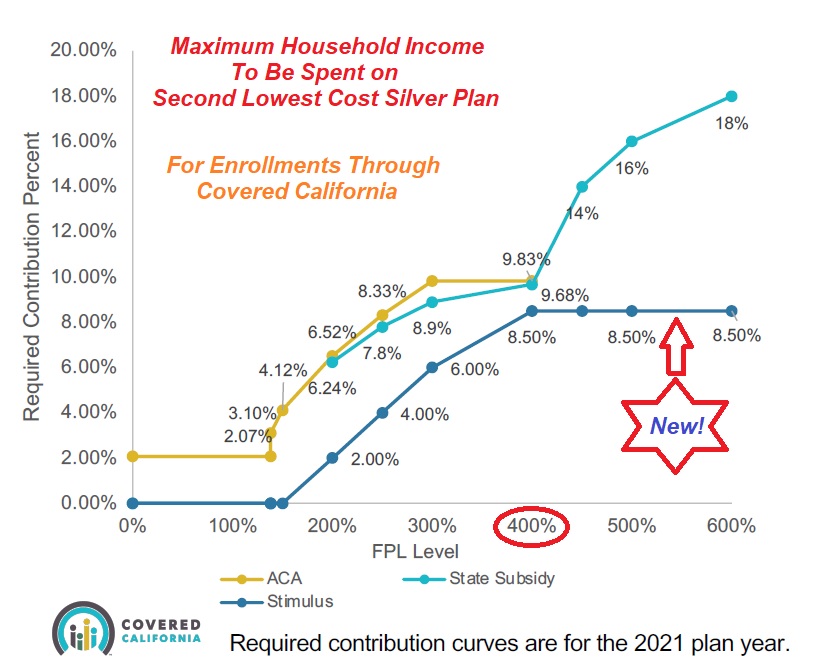

The increased federal subsidies brought the cost of the health insurance below any consumer responsibility percentage targeted in the CPAS. For example, the CPAS was meant to lower the cost of the second lowest cost Silver plan from 8.33 percent to 7.8 percent for household incomes at approximately 250 percent of the federal poverty level. This little extra subsidy to lower the cost could be as little as $30 per month for some families.

Before the American Rescue Plan, there were no subsidies for Covered California households with incomes greater than 400 percent of the federal poverty level. To help higher income families, California offered subsidies for household incomes between 401 and 600 percent of the federal poverty level. The CPAS could easily amount to several hundred dollars per month per person.

1095-A Subsidy Bump for 2021

If you look at your 2021 1095-A from Covered California, and you were receiving the monthly federal subsidy (Advance Premium Tax Credit), you will notice that the subsidies increased beginning in May.

Plus, if you reported to Covered California that you collected unemployment insurance benefits in 2021, you will see another increase in the subsidy (C. Monthly advance payment of premium tax credit.) The unemployment insurance benefit dropped the household income down to 138.1 percent of the federal poverty level. This meant that, regardless of the initial estimated income, the subsidies were essentially equal to the cost of the second lowest cost Silver plan in your region.

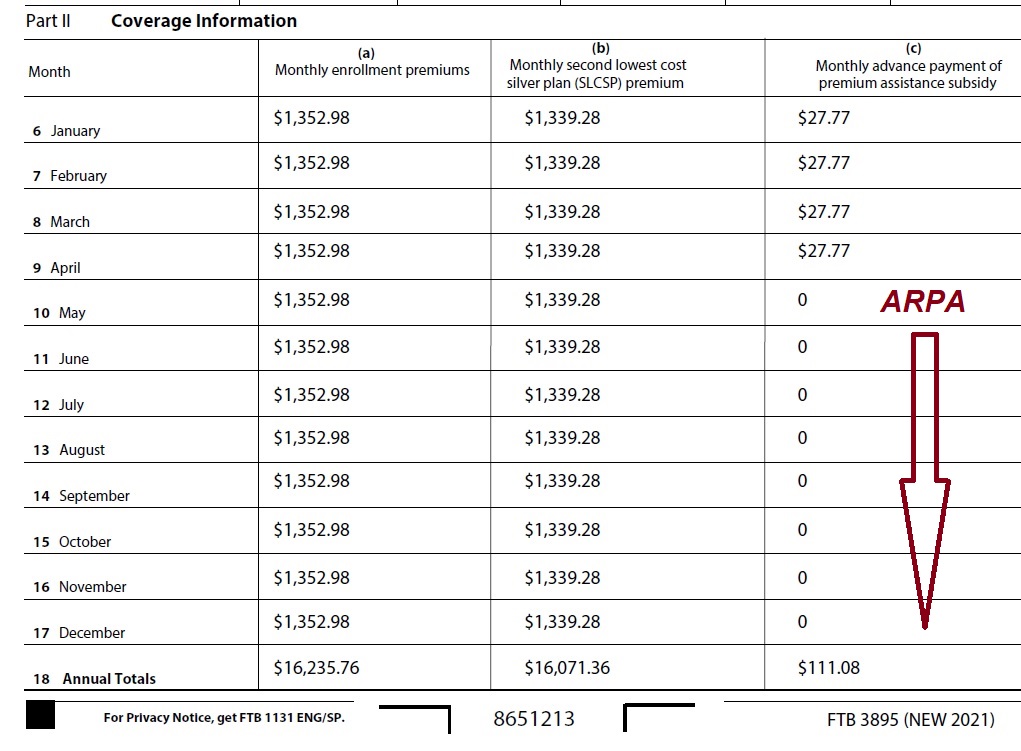

When you look at your California FTB 3895, you will notice you may have received the California subsidy (C. Monthly advance payment of premium assistance subsidy) from January through April. The CPAS stopped when the ARPA larger federal subsidy kicked in. The annual total (line 18) is amount that most California taxpayers will have to repay to the Franchise Tax Board.

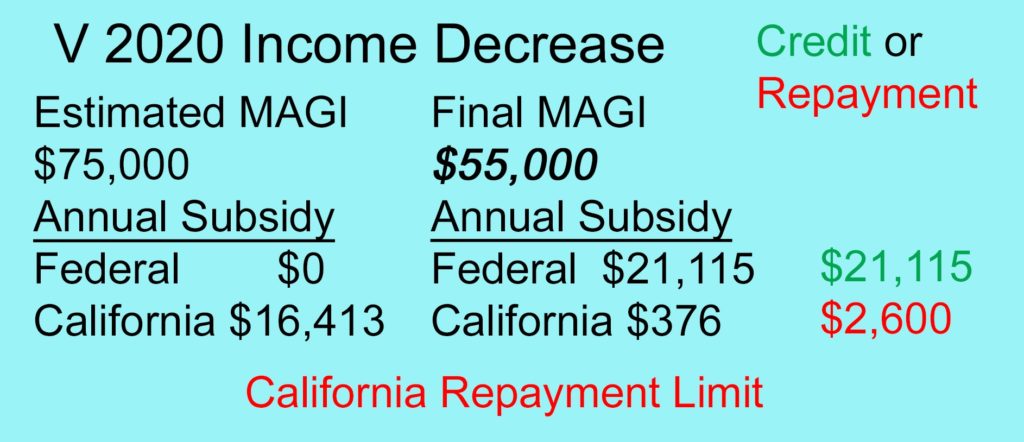

The repayment of the CPAS is not a penalty, it is a function of the formula used to calculate CPAS. It has always been the case that if the federal subsidy brought the cost of the health insurance below the California percentage of consumer responsibility, the CPAS had to be repaid. For instance, a household estimated their income at 450 percent of the federal poverty level in 2020. But their final income (Modified Adjusted Gross Income) was 350 percent of the federal poverty level when they filed their income tax return. The household would have to repay most of the CPAS back to the Franchise Tax Board because of the larger federal Premium Tax Credit subsidy.

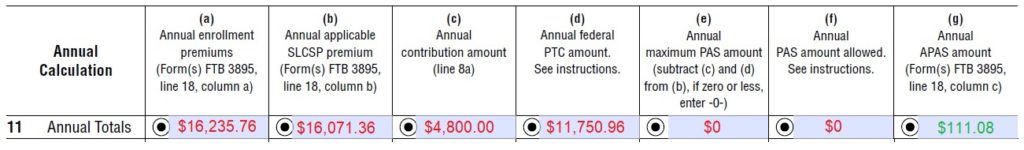

For most taxpayers, the repayment California premium assistance subsidy will be relatively small. In this example, using California form 3849, you can see that the increased federal subsidy (d) plus consumer responsibility (c) is greater than the second lowest cost Silver plan. The family was not entitled to any CPAS because the federal subsidy picked up the cost of the benchmark second lowest cost Silver plan.

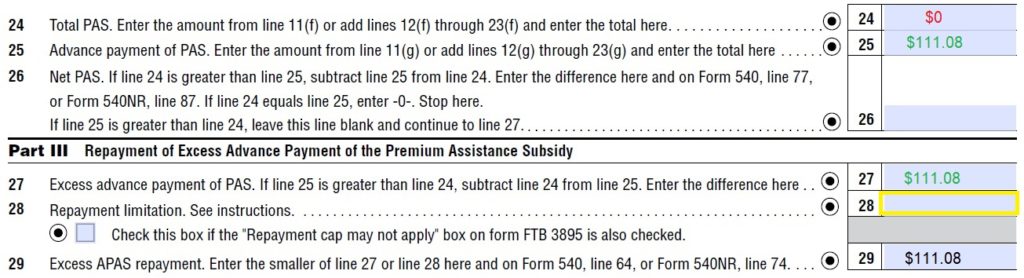

Continuing to follow FTB form 3849, the taxpayer was not eligible for any CPAS, $0 on line 24. On line 25 is the amount of CPAS, $111.08, they received in the first 4 months of 2021. The entire $111.08 CPAS must be repaid to the Franchise Tax Board.

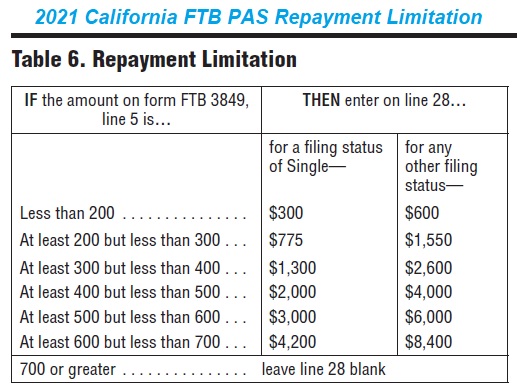

For consumers who received thousands of dollars in CPAS, it may be subject to a repayment limitation.

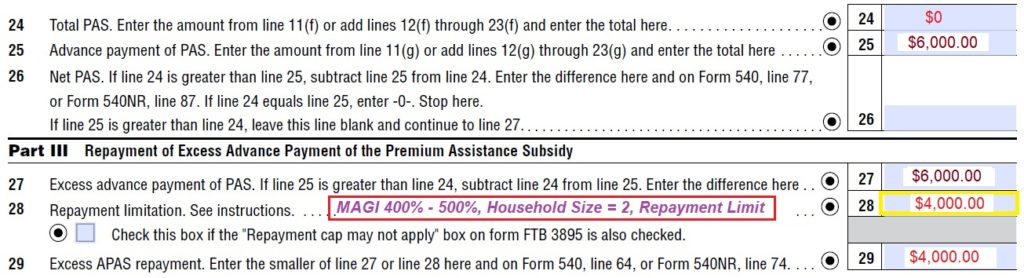

In this example, a couple received $6,000 in CPAS in the first 4 months of 2021. Because their final federal MAGI is between 400 and 500 percent of the federal poverty level for a household of 2, they are limited to repaying only $4,000 of the CPAS.

As far as I can discern, the repayment limitation is not based on the artificially lowered MAGI due to the unemployment benefits of 133 percent on IRS form 8962. It is based on the federal MAGI from 2021 tax return.

Of course, we must keep the California FTB repayment in perspective. The California premium assistance subsidy for incomes between 401 and 600 of the federal poverty level was to help keep health premiums between 14 to 18 percent of the household income. The American Rescue Plan Act increased the subsidies so that no household, regardless of income, would pay any more than 8.5 percent of their income for the second lowest cost Silver plan. Even though a California tax payer may have to repay a few hundred or a couple thousand dollars to the Franchise Tax Board, they should have received a federal subsidy far in excess of any repayment of the CPAS.

California Franchise Tax Board Subsidy Reconciliation Webpage