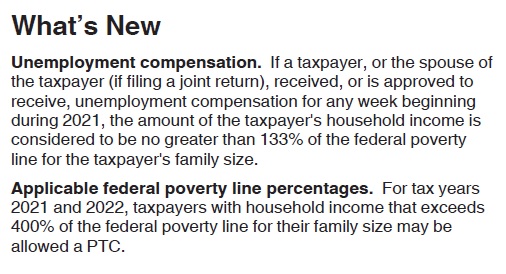

There were two significant changes to the ACA health insurance subsidy for consumers enrolled through Covered California in 2021. The 400 percent income cliff was removed and consumers who received unemployment insurance in 2021 were eligible for an increase in the health insurance Premium Tax Credit subsidy. The IRS has updated the relevant forms to reflect changes to the health insurance subsidy for 2021.

The federal health insurance subsidy is calculated on IRS form 8962. Prior to 2021, if the household Modified Adjusted Gross Income exceeded 400 percent, the taxpayer could not receive any Premium Tax Credit for health insurance and had to repay any Advance Premium Tax Credit paid by a marketplace exchange such as Covered California.

For 2021, text regarding income over 400 percent, tallied on line 5 of form 8962, has been removed. The elimination of the 400 percent income cliff was the result of the American Rescue Plan passed in 2021. Any subsidy a household may be entitled to with income over 400 percent is now based on making the second lowest cost Silver plan no more than 8.5 percent of the household income.

Unemployment Insurance Compensation Subsidy Benefit

Another important change that only relates to tax year 2021 is an additional health insurance Premium Tax Credit subsidy for a tax payer or spouse who received unemployment insurance benefits for at least one week in 2021. Many consumers were able to take advantage of the increased subsidies by reporting they received unemployment benefits in their Covered California accounts. When the unemployment benefit was recorded in the income section of the application, the household income was artificially lowered to 138.1 percent of the federal poverty level. This lower income triggered higher monthly subsidies and the ability for the consumer to enroll in an enhanced Silver 94 health plan.

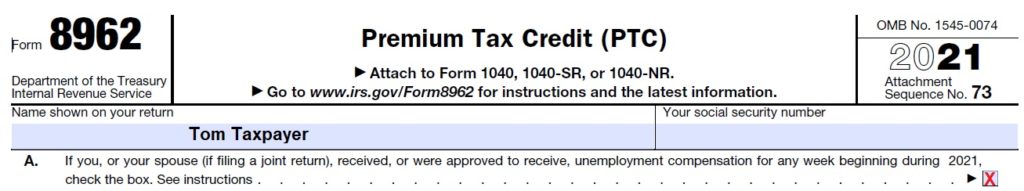

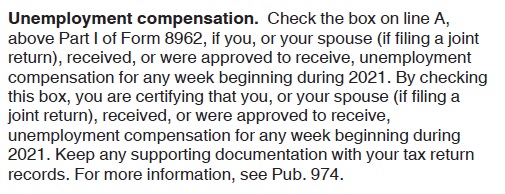

To alert the IRS that a taxpayer is eligible for lower unemployment income benefit, and corresponding higher subsidies, they have added a check box as the first conditional eligibility question on form 8962.

The big question from my clients was would they somehow have to repay the increased subsidies at tax time. Similarly, would a taxpayer who did not report they received unemployment in their Covered California account be able to take the increased subsidies when they filed their taxes. We did not know the answers to these questions until the IRS released the 2021 instructions for form 8962, Premium Tax Credit, reconciliation. The 2021 tax form 8962 has been updated to properly calculate the unemployment insurance benefit.

Form 8962 Without Unemployment Benefit

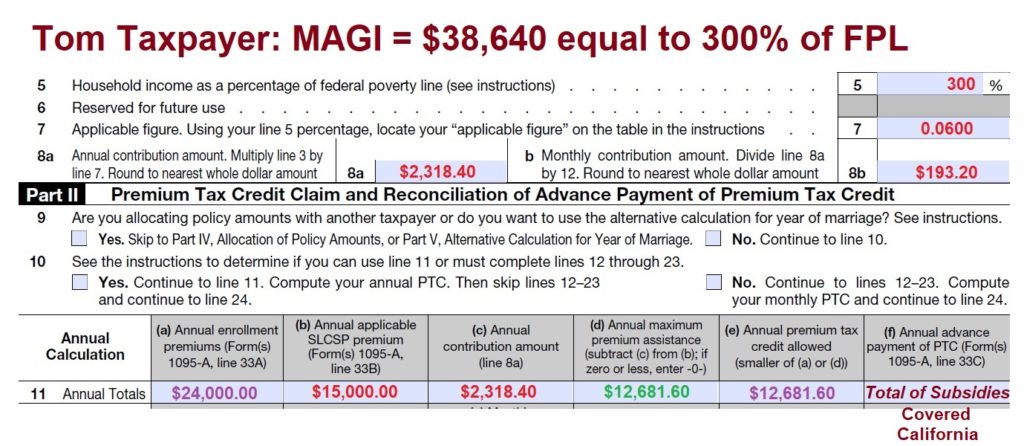

Tom Taxpayer accurately estimated his 2021 income on the Covered California application at $38,640. That figure, for a single adult, is equal to 300 percent of the federal poverty level. If Tom received no unemployment insurance in 2021, his income translated into an applicable figure (consumer responsibility) of 0.0600 (6%.) Tom’s annual contribution or responsibility to pay for the second lowest cost Silver plan (line 8a) is $2,318.40 or $193.20 per month.

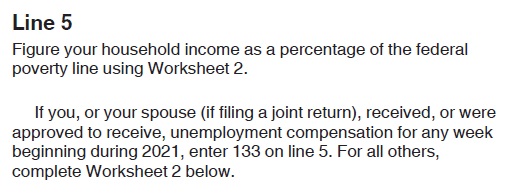

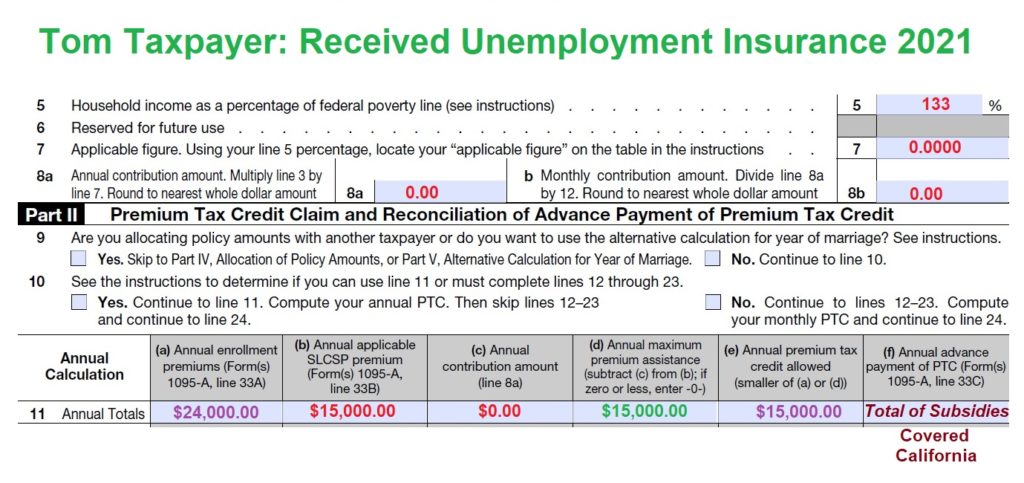

If you are using tax preparation software, it should ask all of the pertinent questions and determine your subsidy based on the IRS rules. Otherwise, most of the changes are subtly noted in the instructions for form 8962. For example, when you get to line 5, your household income as a function of the federal poverty level, the instructions direct you to enter 133 IF you received unemployment compensation in 2021.

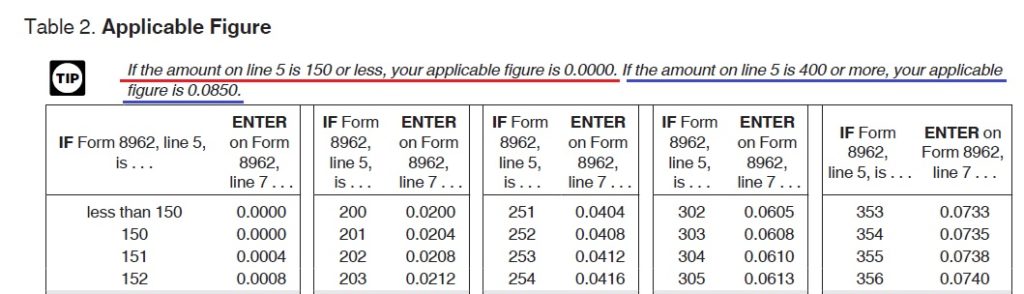

What may be confusing is that on the applicable figure table (applicable figure is a technical term for consumer responsibility percentage for health insurance) there are no percentages lower than 150. The little tax tip at the top of the table notes that federal poverty levels less than 150 has an applicable figure of 0.0000.

This means that the tax payer has a consumer responsibility of zero for the second lowest cost Silver plan offered. In other words, the subsidy will be equal the annual cost of the second lowest cost Silver plan. However, the subsidy can be no larger than the annual premium of a lower cost health plan. If you had a lower cost Bronze plan, the subsidy will be limited by the lower Bronze annual premium.

Form 8962 With Unemployment Benefit Check Marked

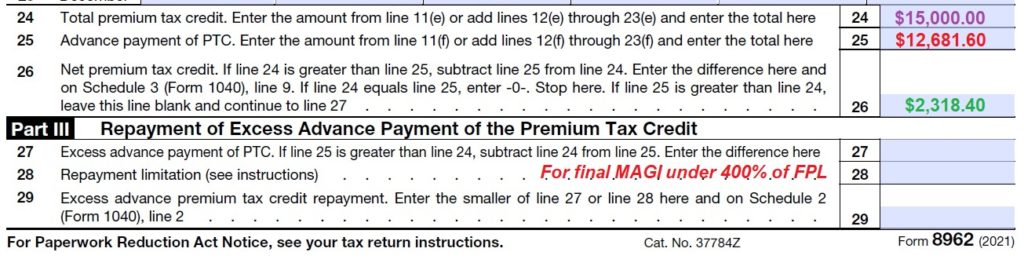

Tom received unemployment insurance in 2021. Because of the unemployment insurance, Tom’s household income is 133 percent of the federal poverty level, regardless of his income. That 133 percent of the federal poverty level translates into $0 annual contribution for the second lowest cost Silver plan. Since the second lowest cost Silver plan premiums equaled $15,000 for the year that amount becomes the maximum subsidy allowed. Tom is eligible for an additional $2,318.40 ($15,000 – $12,681.40) in Premium Tax Credit because of the unemployment insurance benefit.

If the tax payer did not report the unemployment insurance compensation through Covered California – and received no additional subsidy during the year – the tax payer can capture the additional Premium Tax Credit through form 8962.

Part II of form 8962 calculates the annual Premium Tax Credit by subtracting the annual contribution from the second lowest cost Silver plan (SLCSP) as reported by Covered California on the 1095A. In this example, Tom did not report the unemployment compensation to Covered California. He continued to pay his consumer responsibility (6%) based on an income of 300% of the FPL. When form 8962 is completed with the lower 133% FPL and 0% contribution, the allowable Premium Tax Credit is $15,000; the amount of the second lowest Silver plan. Tom is eligible additional Premium Tax Credit subsidy as he did not receive it during the year.

If the tax payer received too much subsidy during the year, they must repay the excess subsidy as calculated on line 27. If the MAGI is under 400% of the federal poverty level, there are repayment limitations. If the MAGI is over 400% FPL, the subsidy is govern by a consumer responsibility of 8.5% of the second lowest cost Silver plan. If the tax payer received subsidies based on a 6% consumer responsibility, but has a final income that puts the tax payer in the 8.5% applicable figure range, the tax payer will only have to repay the difference between 6% and 8.5% calculation.