Covered California has crunched the insurance plan rate increase numbers for 2024 and concluded that that weighted average increase will be 9.6 percent. Of course, your monthly health insurance premium for 2024 is not linked to a weighted average. You may experience a big increase in your monthly premiums or see a rate decrease, regardless of the Covered California marketing spin.

Marketing That Leaves Out the Subsidy Details

What Covered California consistently fails to mention is that your monthly health insurance premium after the subsidy is not entirely based on how much the rates increased for your health plan. The biggest influence is the cost of the second lowest cost Silver plan. The monthly subsidies are based on the rate of the second lowest cost silver plan for your age in your region. The subsidies are calculated to make the second lowest cost Silver plan a certain percentage of your household income.

If the second lowest cost Silver plan has a rate increase larger than your selected health plan, that translates into a relatively larger subsidy and, in turn, a lower monthly premium for you. If the rate of the second lowest cost Silver plan is far less than your selected plan – or decreases from the previous year – and your health plan has a big rate increase, the net effect is that the subsidy drops and you pay much more for health insurance.

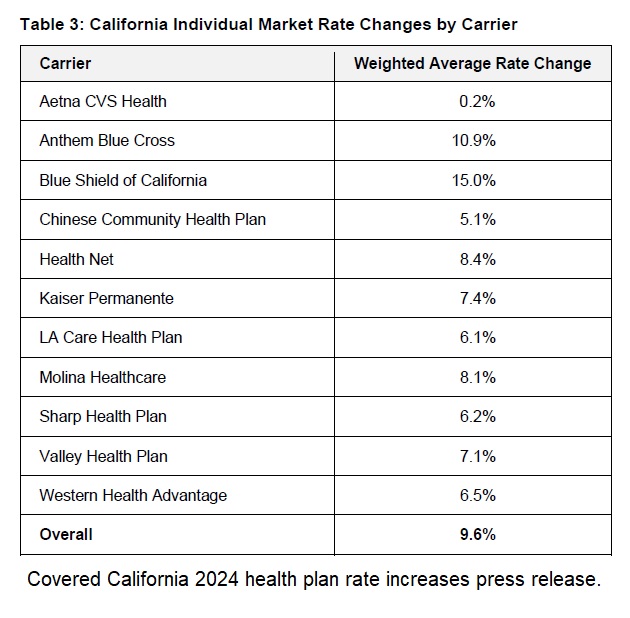

Weighted Average Rate Increase by Carrier

The table below shows the weighted average rate change for the various carriers throughout California as determined by Covered California for 2024. Blue Shield will have a 15 percent average rate increase. (Note the Covered California table fails to make the distinction between the Blue Shield PPO and HMO plans, which usually have different rate changes.) If you are in a region where a Blue Shield plan is the second lowest cost Silver plan with 15 percent rate increase, you get a nice bump in the subsidy. If your Anthem Blue Cross plan increased 10 percent and the second lowest cost Blue Shield Silver plan increased 15 percent, that combination may deliver you a monthly premium decrease.

However, if you are in a region where Aetna CVS Health is the second lowest cost Silver plan, you may see a dramatic premium increase. This is because the Aetna CVS Health is slated to increase approximately 0.2 percent. This means that the subsidy with the Aetna CVS Health second lowest cost Silver plan will only slightly increase for 2024 over 2023. If you have the Blue Shield PPO with a 15 percent increase in that region, your 2024 subsidy will not change by much and you may be paying a considerably higher amount for your health insurance if you keep the Blue Shield plan.

New Health Plans, Expansions, Oscar Drops Out

Other considerations are changes to the carriers. Oscar is exiting the California market. The loss of Oscar will impact Southern California and the Bay Area. This forces Oscar plan members to find another plan for 2024. Oscar was competitively priced relative to other plans that had many of the same doctors such as Blue Cross EPO and Blue Shield PPO. The result is that many Oscar consumers will need to pay more for health plans that have their doctors in-network.

Inland Empire Health Plan will be offering plans in Riverside and San Bernardino. Since we don’t know what Inland’s rates will be, we don’t know how they may disrupt the second lowest cost Silver plan rankings. Because Inland is heavily involved in the Medi-Cal market, they will probably have low rates compared to any EPO or PPO plans in the region.

Aetna CVS Health will be expanding their coverage into Contra Costa and Alameda counties, a region underserved by health plans. Historically, whenever a new health plan expands, the rates are low and they shoot for the second lowest cost Silver plan ranking. This usually translates into the second lowest cost Silver plan rate with little change, and sometimes a decrease, between plan years. In other words, no change in the subsidy available to consumers in other health plans.

No Medical Deductibles!

The other big announcement from Covered California is that in 2024, the enhanced Silver plans 73, 87, and 94 will have no medical deductible. While this is good, we have to remember that consumers only have to meet the medical deductible if they are hospitalized or in a skilled nursing facility. The vast majority of health care services are delivered on an out-patient basis that is subject to coinsurance percentage. Many routine health care services with the Silver, Gold, and Platinum plans have set copayments, not subject to the plan deductible.

Covered California Press Release on 2024 Carrier Rate Increases

Covered California’s Health Plans and Rates for 2024: More Affordability Support and Consumer Choices Will Shield Many From Rate Increase

July 25, 2023

SACRAMENTO, Calif. — Covered California announced its health plans and rates for the 2024 coverage year with a preliminary weighted average rate increase of 9.6 percent.

The rate change can be attributed to many factors, including a continued rise in health care utilization following the pandemic, increases in pharmacy costs, and inflationary pressures in the health care industry, such as the rising cost of care, labor shortages and salary and wage increases.

“While this is a challenging year for health care costs, Covered California’s market remains stable and continues to deliver more choices to our consumers,” said Covered California Executive Director Jessica Altman. “Despite this year’s increases, because of the extension of enhanced federal subsidies through the Inflation Reduction Act and new financial support from the state, Californians will have more help paying for their plan than ever. In fact, many consumers who receive financial help will see no change to their monthly premiums, and some will see their deductibles eliminated entirely.”

More Affordability Support Than Ever Before

Due to the structure of Affordable Care Act subsidies and enhanced financial help in California, many enrollees will not see any change in what they pay each month for their coverage in 2024. Costs will vary based on individual and family circumstances and income, but the monthly cost of coverage for many of those receiving subsidies will not increase, and in some cases it will decrease.

As a result of the extension of the enhanced subsidies provided by the Inflation Reduction Act, consumers who enroll in health care coverage through Covered California will continue to benefit from record-low monthly costs. Consistent with the current year, nearly 20 percent of enrollees will have $0 premiums. Over one-third of enrollees would see no change or a decrease in their monthly premiums if they stay with the same carrier in the same region.

In addition, thanks to new subsidies made possible by the budget package recently passed by the state Legislature and enacted by Gov. Newsom, new benefits that will further decrease the cost of health care will be available in 2024 for Californians with incomes up to 250 percent of the federal poverty level, or $33,975 for single enrollees and $69,375 for families of four.

The new state-enhanced cost-sharing program will strengthen these Silver Cost Sharing Reduction (CSR) plans, increasing the value of Silver 73 plans to approximate the Gold level of coverage and increasing Silver 87 plans to approximate the Platinum level of coverage. Silver 94 plans already exceed Platinum-level coverage. Over 650,000 enrollees will be eligible for these cost-sharing reduction benefits.

Deductibles will be eliminated entirely in all three Silver CSR plans, removing a possible financial barrier to accessing health care and simplifying the process of shopping for a plan. Other benefits will vary by plan but will include a reduction in generic drug costs and copays for primary care, emergency care and specialist visits and a lowering of the maximum out-of-pocket cost.

For example, a 27-year-old in Los Angeles County at 210 percent of the federal poverty level, or an annual income of $28,500 per year, with an Enhanced Silver plan[i] will see no change in their monthly premium. The same is true for a 36-year-old in Alameda County at 180 percent of the federal poverty level, or an annual income of $24,480, who has a Gold plan. With the new subsidies in place, neither of these consumers will face any deductible if they choose any plan at the Silver level or above.

“Nearly 90 percent of Covered California’s enrollees receive financial help, with many paying $10 or less per month for their health insurance,” Altman said. “With the enhanced subsidies and increased affordability support available to consumers, access to high-quality, affordable health care has never been more within reach for Californians.”

California’s Individual Market Rate Change for 2024

While post-pandemic medical trends — such as increased utilization of health care services, medical cost inflation and labor dynamics — are driving this year’s increase, the rates are more than a one-year story.

Over the past five years, these trends, combined with a big jump in enrollment due to the COVID-19 pandemic, increased federal and state subsidies, and implementation of the state penalty for going without coverage, have all affected premium levels for Covered California in different ways.

With steady enrollment, a strong marketplace, and active negotiations with carriers to ensure consumers are receiving the best value, Covered California has held the average annual rate increase over the past half decade to just 3.6 percent. As a result, Californians in the individual market have benefited from among the lowest average rate increases in the nation over the past five years.

This year’s 9.6 percent increase reflects an average of proposed rates across all health insurers who offer individual plans, and rates can differ greatly by plan and region (see Table 2: Covered California Individual Market Rate Changes by Rating Region, and Table 3: California Individual Market Rate Changes by Carrier).

The preliminary rates have been filed with California’s Department of Managed Health Care (DMHC) and are subject to final review and public comment. The final rates, which may change slightly from the proposed rates, will go into effect on Jan. 1, 2024.

Increased Competition, More Consumer Choice

Covered California’s strong enrollment combined with one of the healthiest consumer pools in the nation continues to attract health insurance carriers, which has resulted in increased competition and choices that benefit Californians.

In 2024, with 12 carriers providing coverage across the state, all Californians will have two or more choices, 96 percent will be able to choose from three carriers or more, and 92 percent will have four or more carriers to choose from.

Changes to this year’s carriers include:

Inland Empire Health Plan, one of the 10 largest Medicaid health plans in the nation that serves more than 1.6 million residents, will join Covered California and begin offering coverage in Riverside and San Bernardino counties.

• Aetna CVS Health, which joined Covered California in 2023, will expand into Contra Costa and Alameda counties next year.

• Health Net will expand into Imperial County, offering an additional HMO plan.

• Oscar Health, which serves just over 31,000 enrollees in California, announced that it will be withdrawing from California in 2024, following its withdrawal from several other markets nationwide in prior years.

Enrollees will be given the opportunity to choose a new plan or to move to the carrier with the lowest-cost plan in the same metal tier. “Increased competition benefits our marketplace and provides our enrollees with meaningful choices for their health coverage,” Altman said. “With Inland Empire Health Plan joining the marketplace and carrier partners like Aetna CVS and Health Net expanding their service areas, Covered California consumers will have more choices than ever to shop, compare and find a plan that best fits their family’s needs.”

[i] The Affordable Care Act requires health plans to reduce cost-sharing amounts and out-of-pocket maximums for consumers at or below 250 percent of the federal poverty level ($33,975 for single members and $69,375 for families of four). Consumers can access these benefits by enrolling in cost-sharing reduction plans, also referred as Enhanced Silver plans.