Health insurance plans offered through Covered California for 2025 have modest improvements for consumers. The general trend has been to lower the cost sharing and out-of-pocket costs for health plan members. Significant for Covered California members is that in place of the Silver 70 plan, consumers will be offered the enhanced Silver 73 plan.

Lower Cost-Sharing in many 2025 Health Plans

With the exception of the enhanced Silver plans, all of the standard benefit health plan designs are offered off-exchange, direct from the carriers with no subsidies, or to consumer who enroll through Covered California and indicated they want no premium assistance.

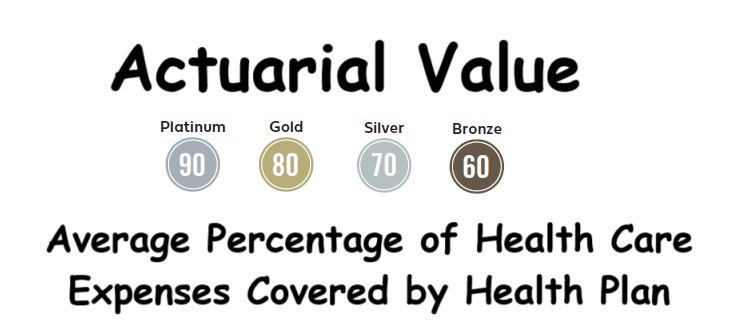

What does the Health Plan Number Mean?

The number after the metal tier of the health plan (60, 70, 80, etc.) is the actuarial value of the plan. That means that the average person will have the percentage of their health care expenses covered by the health plan as indicated by the number. For example, the average person with a Bronze 60 plan will have 60 percent of their health care expenses covered by the plan. In reality, some people will have less or more of their health care expenses covered by the plan depending on the nature of the accident or illness.

Copayments and coinsurance percentages in the blue background cells are not subject to either a medical or pharmacy deductible. Not reflected in the Covered California summary of cost-sharing is the coinsurance for outpatient procedures that can range from 10 to 40 percent depending on the metal tier of the health plan.

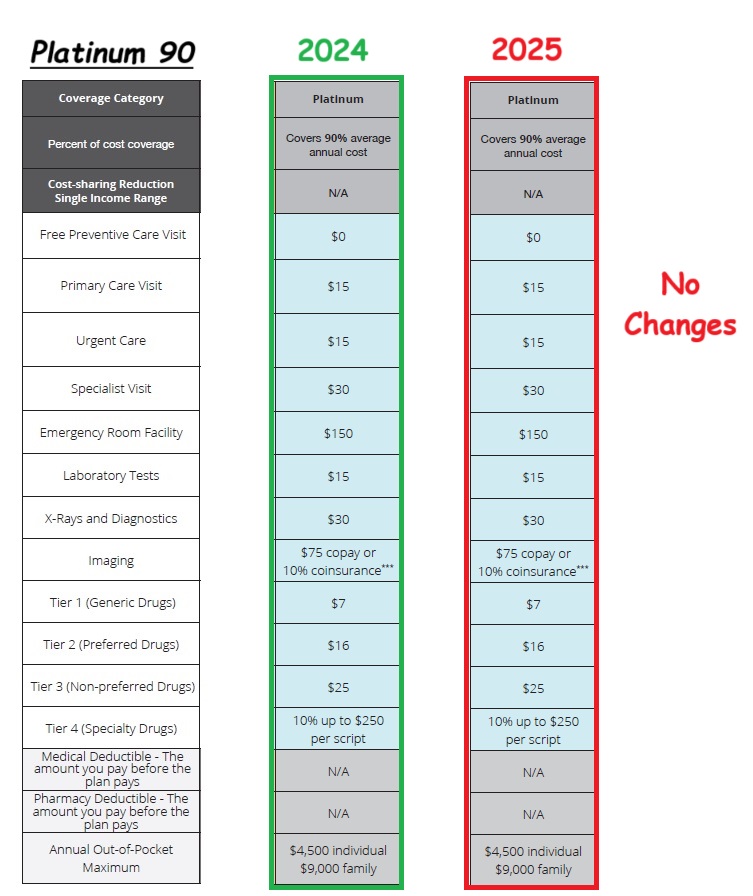

Platinum 90

Platinum 90 plans have no changes for 2025 from 2024. It maintains low copayments for routine health care services, 10 percent coinsurance for outpatient procedures, and maximum out-of-pocket amount of $4,500 for an individual.

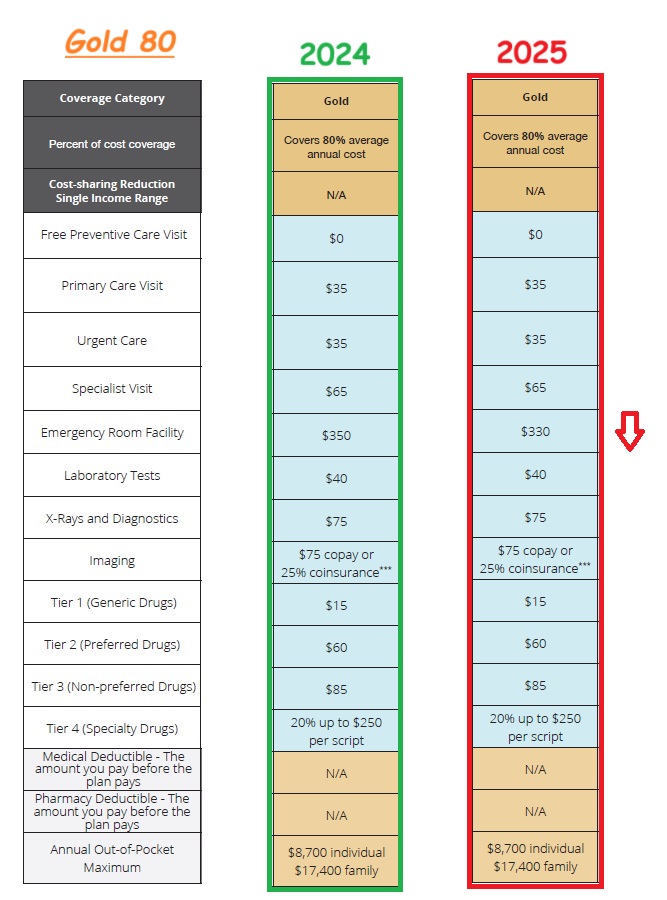

Gold 80

The only change to the Gold 80 plans is lowering the emergency room facility copayment from $350 to $330.

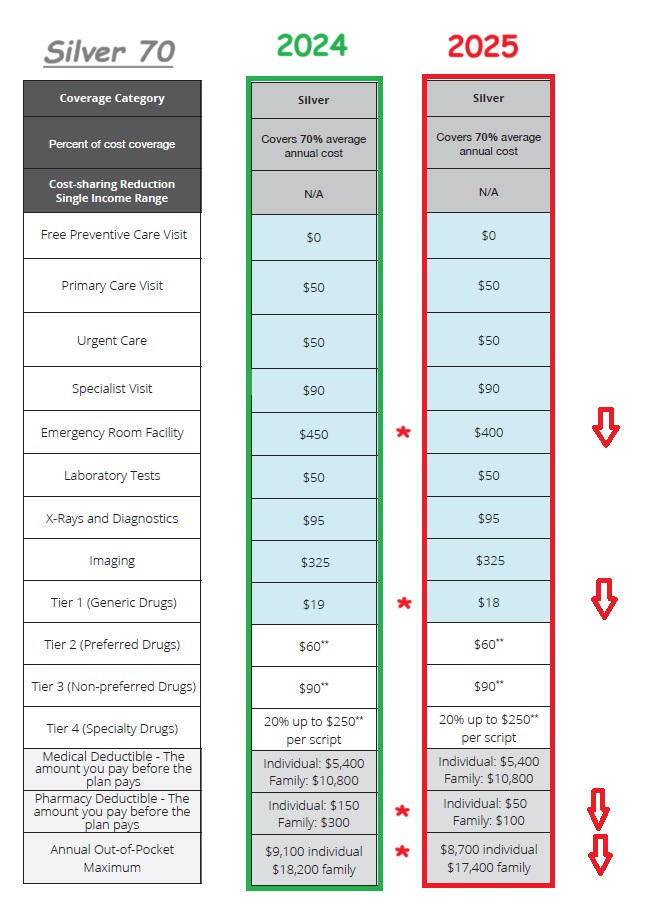

Silver 70

The Silver 70 standard benefit design plan has several reductions for consumers. The emergency room facility copayment was lowered from $450 to $400. Generic drugs will be $18 maximum for a 30-day supply, down from $19. The pharmacy deductible has been lowered from $150 to $50 for an individual. Once the pharmacy deductible is met, the plan member pays the copay for tier 2 and 3 drugs, and coinsurance for tier 4 drugs. Finally, the maximum out-of-pocket maximum has dropped from $9,100 to $8,700 for an individual.

Bronze 60

The Bronze 60 plans have the most significant changes. Primary care and urgent care visits are no longer limited to an accumulated 3 visit maximum at a set copayment. These two health care services now have a set copayment of $60 with no limit on the visits for 2025. Specialist visits are still limited to three, additional visits are subject to the negotiated rate until the medical deductible is met.

The medical deductible for the Bronze 60 has been lowered from $6,300 to $5,800 for an individual. Generic drug copayments increased from $17 to $19 maximum. The pharmacy deductible was dropped from $500 to $450 for an individual. Finally, the maximum out-of-pocket amount was reduced from $9,100 to $8,850 for an individual.

However, with the cap on visits removed for primary care visits, many people may give the Bronze 60 a second look if they had a Silver 70 plan. The Bronze 60 will be more usable for people who have regular visits to a primary care provider or physical therapy. The Silver 70 will still be a better selection if the individual has brand name prescriptions or specialty drugs as the Silver plans have better cost-sharing coverage for those prescriptions.

One health plan increased their Bronze 60 plan rates by 10 percent, in part because of the changes to the plan. This is compared to a 7 percent increase for the Silver 70 plans.

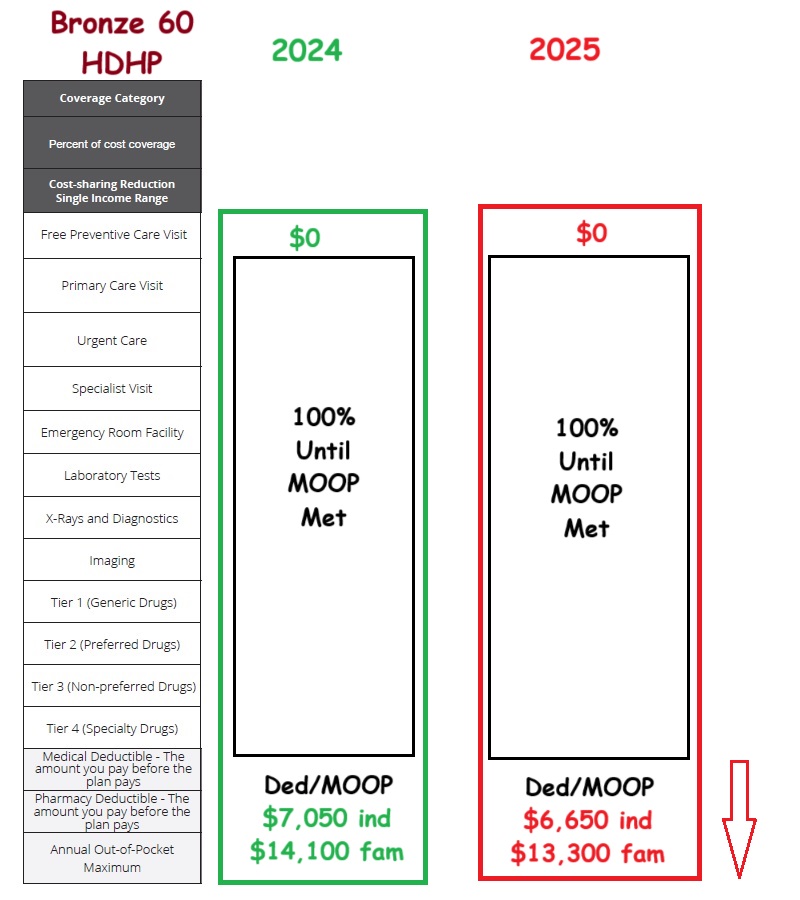

Bronze 60 High Deductible Health Plan

For 2025, the Bronze 60 HDHP deductible/maximum out-of-pocket amount has been lowered from $7,050 to $6,650 for an individual.

Enhanced Silver Plan Changes

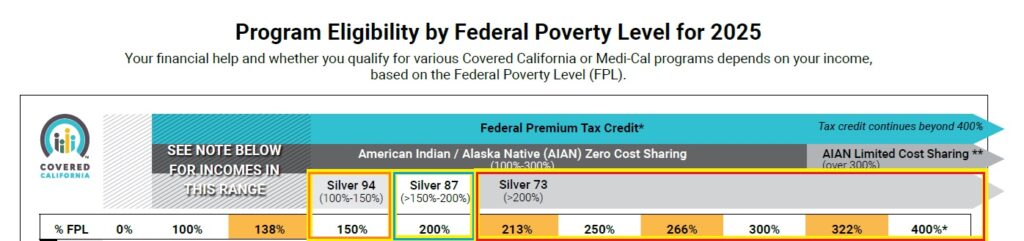

The enhanced Silver plans are only available to individuals and families who enroll through Covered California. The household income must be within a narrow band as a percentage of the federal poverty level.

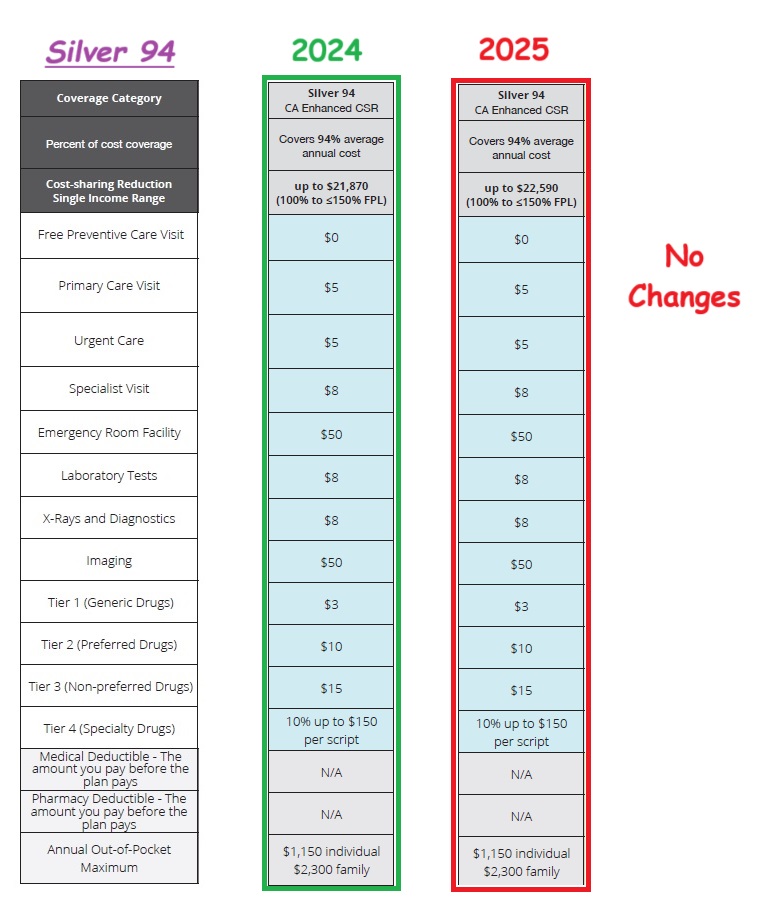

Silver 94

Silver 94 plans have an actuarial value of 94, which is better than a Platinum 90 plan. They are offered if the household income is between 139 and 150 percent of the federal poverty level. There are no changes to this plan for 2025. The Silver 94 maintains low copays for routine services, no deductibles, and maximum out-of-pocket amount of $1,150 for an individual.

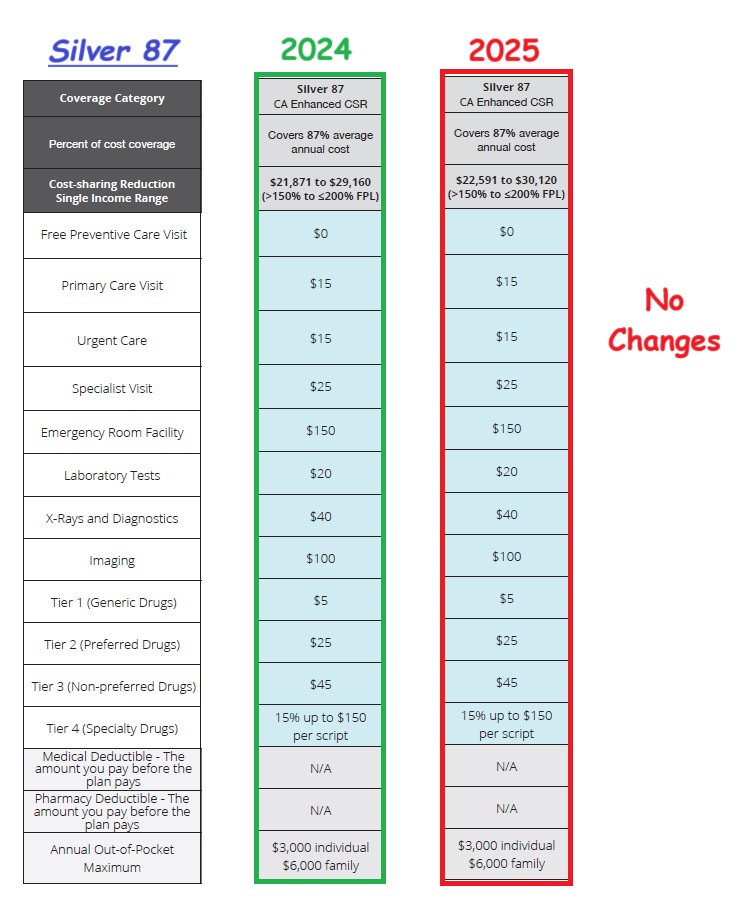

Silver 87

Silver 87 is offer to households with income between 151 and 200 percent of the federal poverty level. There are no changes for 2025. There are still lower copays for health care services and drugs compared to a Silver 70 plan. The maximum out-of-pocket amount is $3,000 for an individual.

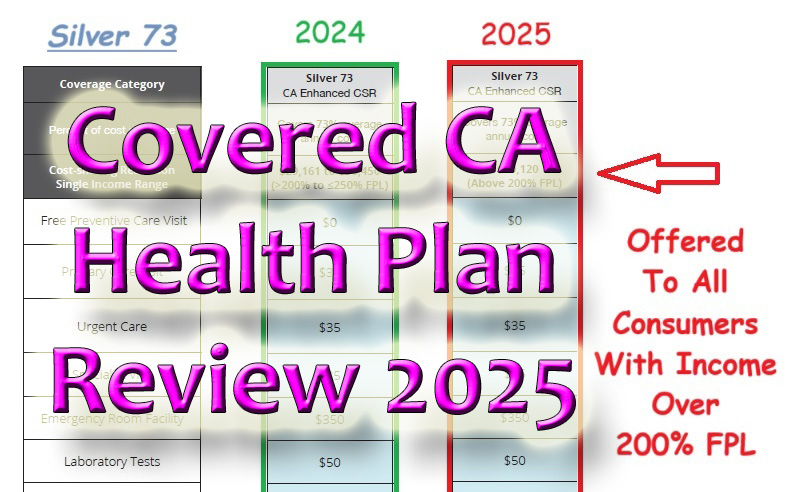

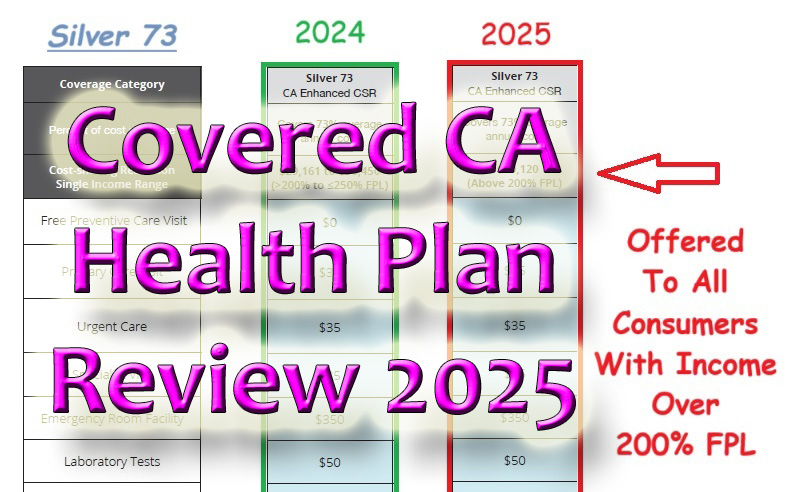

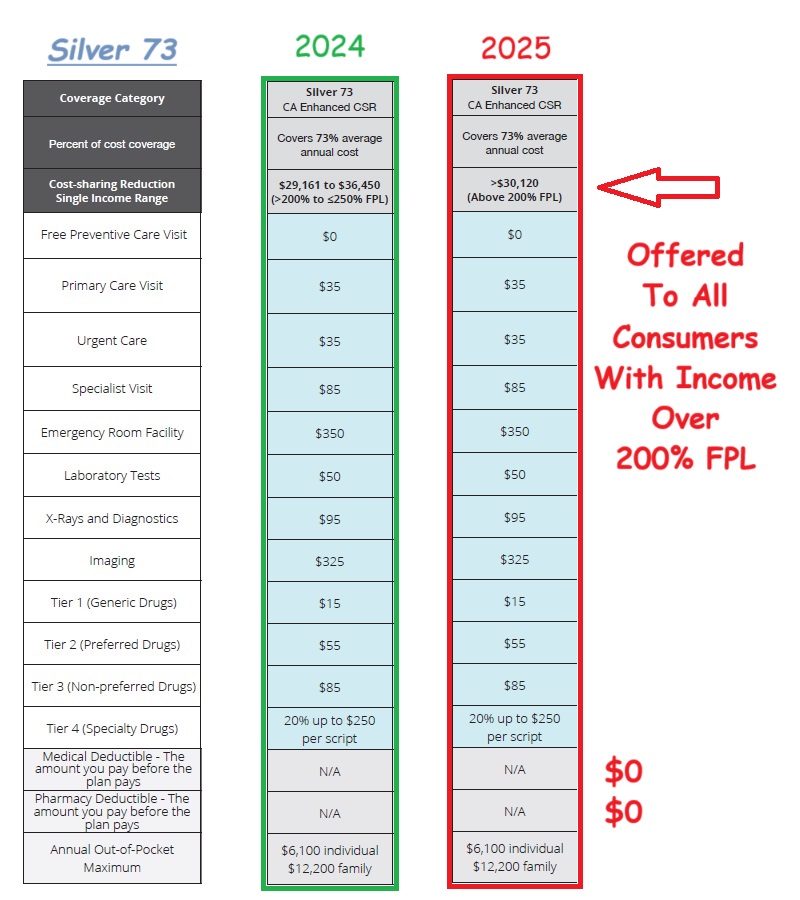

Silver 73

The Silver 73 has lower cost-sharing than a Silver 70 and is unchanged for 2025. There are no medical or pharmacy deductibles. The maximum out-of-pocket is $6,100. The most significant change is that it will be available to any Covered California enrollee with income over 250 percent of the federal poverty level. In 2024, the consumer could have a income no greater than 250 percent of the FPL to receive the Silver 73. Covered California Income Table 2025

The Silver 70, through Covered California, will be offered to applicants who enroll and request no health insurance premium assistance. There are also the Silver 70 Off-Exchange plans that are a near mirror of the Covered California Silver 70. The Silver 70 OE plans will have slightly lower rates.

In general, for 2025, individuals and families will have access to health plans that reduce their health care expenses modestly from 2024. The challenge for people with Bronze 60 plans is to keep a better plan for 2025 or move up to the Silver 73, which has a lower maximum out-of-pocket amount.

There is also an argument for people with off-exchange health plans to enroll through Covered California for the Silver 73 plan. While they would be paying a higher premium, assuming no APTC subsidy based on high income, the copayments are lower, there is no medical deductible, and the maximum out-of-pocket is lower by $2,600 for an individual compared to the Silver 70 plan.