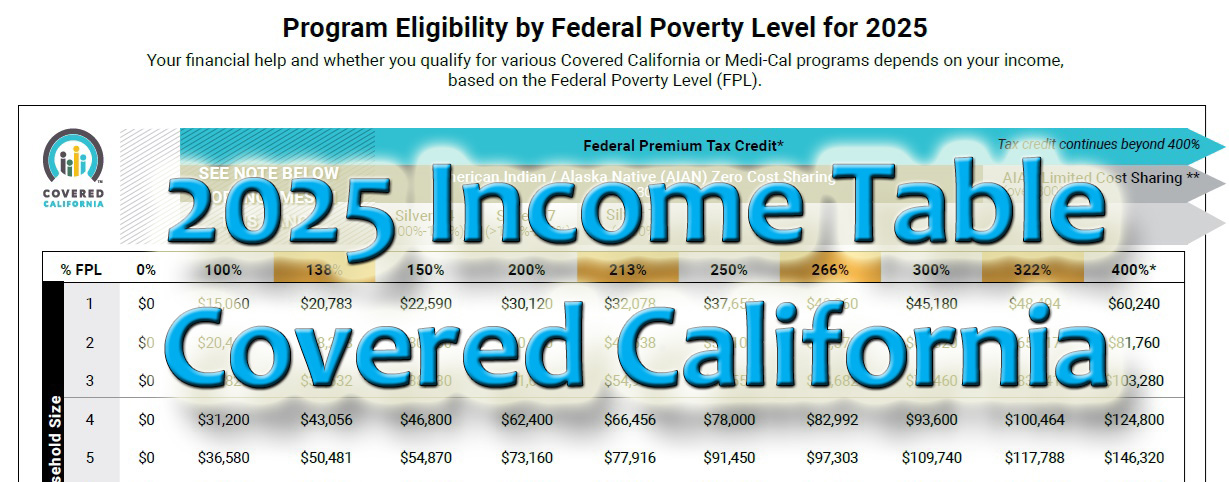

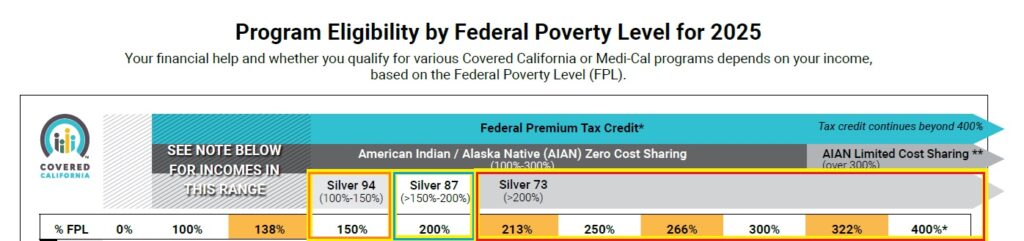

Covered California has released their Open Enrollment income table for 2025. The annual income to qualify for certain programs increased approximately 3 to 4 percent, depending on household size. One notable change is that households with a Modified Adjusted Gross Income greater than 200 percent of the federal poverty level will be eligible for an enhanced Silver 73 health plan.

Program Packed Income Table

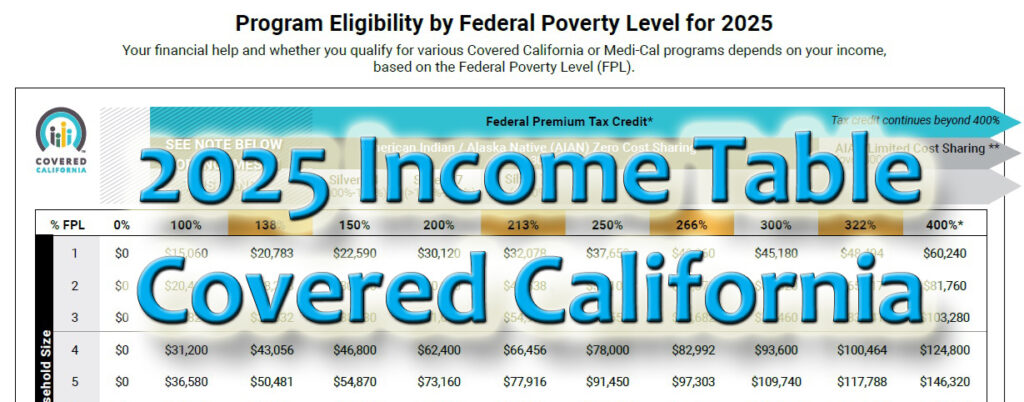

The Covered California income table can be confusing because of the amount of information that is presented relative to income program eligibility. On the left side of the table is the row identifier for Household Size. The household size is based on the primary tax filer’s tax household. The household size is the primary taxpayer, spouse, and dependents that are listed on the federal tax return.

Each row (1, 2, 3, 4,…) represents the number of household members. Find your household size row and read across to where your household MAGI would fall. Where the annual income falls on the table will determine what programs you and your family would be eligible.

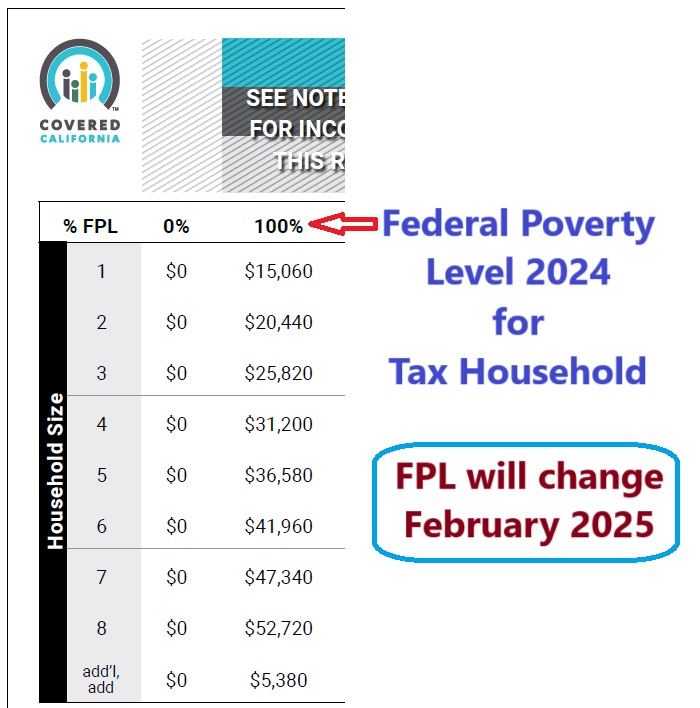

The table is broken up into columns that represent different income levels as a percentage of the federal poverty level (FPL.) The column 100% represents the 2024 FPL for the household size. The FPL is updated every year in January. When the 2025 FPLs are released, the Covered California income will be updated. The different programs are based on a percentage of the FPL.

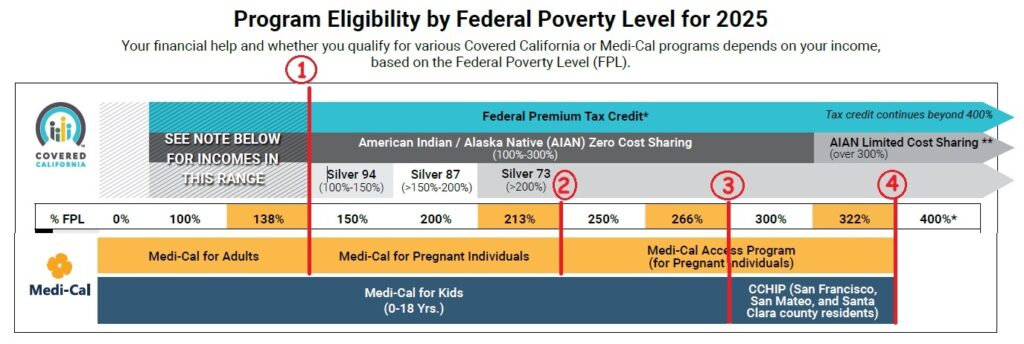

Specifically, income below 138% FPL (1) is eligible for Medi-Cal. The Medi-Cal program columns for adults is in yellow and correspond to yellow band at the bottom of the table. Income program eligibility for children’s Medi-Cal is the dark blue band. For children to be eligible for a private health plan with the Advance Premium Tax Credit (APTC) subsidies, the household income must be greater than 266% FPL (3). Children in the counties of San Francisco, San Mateo, and Santa Clara can have incomes up to 322% FPL and qualify for Medi-Cal (4).

Silver 70 Missing

When the household income is within a particular range of the FPL, they are offered an enhanced Silver plan. The enhanced Silver plans have lower health care cost sharing and lower maximum out-of-pocket amount than the standard Silver 70. Households with income between 138 -150 percent FPL are eligible for Silver 94. If the income is between 151 and 200 percent FPL, they are offered Silver 87. For household incomes over 201 percent FPL, they can select a Silver 73.

For eligible households with income over 250 percent FPL, only the Silver 73 plan will be offered, which is a better value than a Silver 70. At least for 2025, there will be no Silver 70 for qualifying households. The Silver 70 will still be offered to consumers who opt not to be considered for the Advance Premium Tax Credit subsidies based on household income.

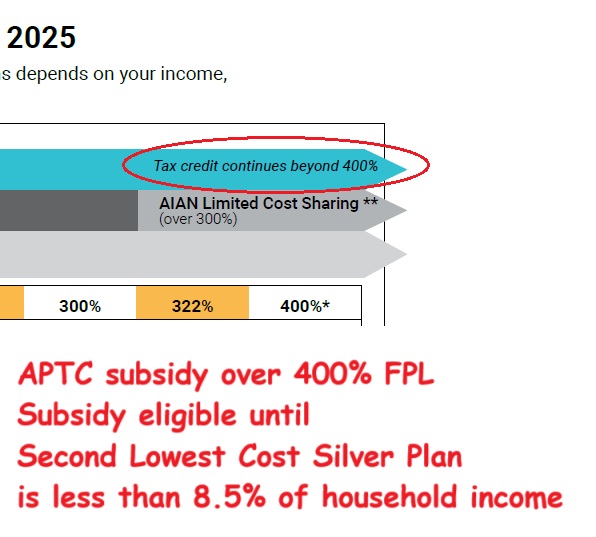

Subsidies over 400% FPL Calculation

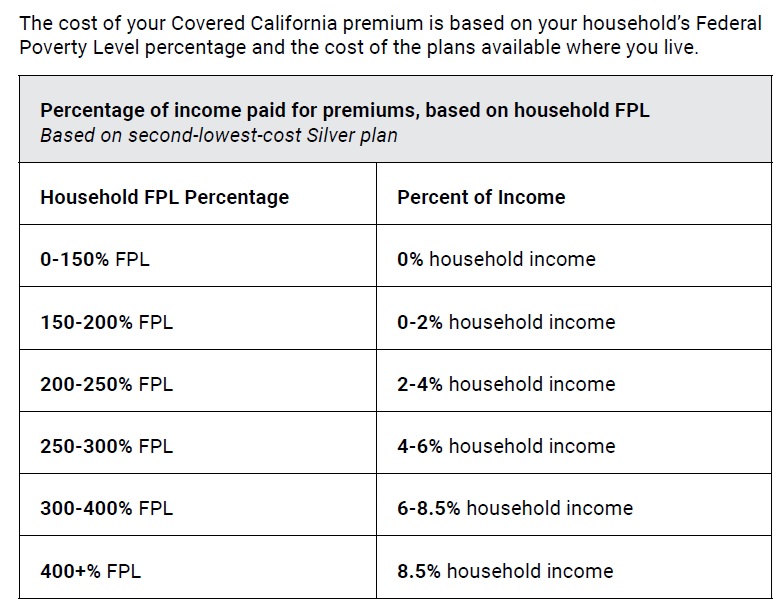

With the Inflation Reduction Act of 2021, the 400% FPL cliff for subsidy eligibility was removed. Consumers are eligible for the APTC subsidies with incomes over 400% FPL as long as the Second Lowest Cost Silver Plan (SLCSP) offered to them in their region has annual premiums greater than 8.5 percent of the consumer’s income.

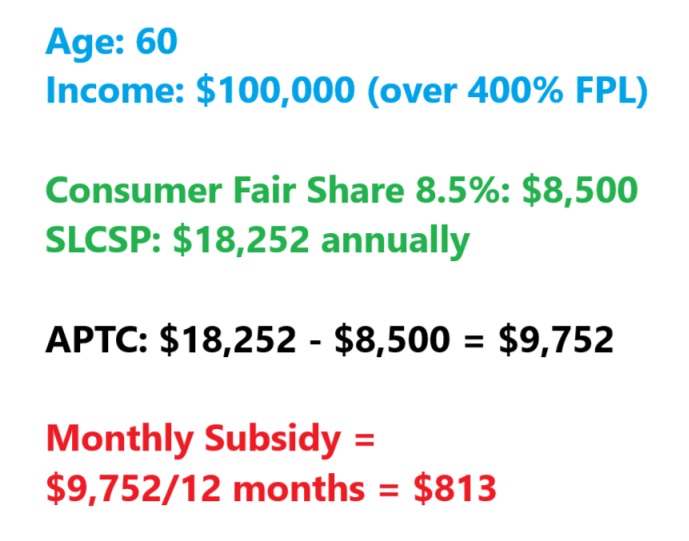

As an example, a 60-year-old individual estimates their income will be $100,000 (664% FPL) for 2025. The Affordable Care Act states that consumers should not spend more than 8.5 percent of their income health insurance with the SLCSP as the benchmark plan. The consumer fair share for this individual is $8,500. The SLCSP has an annual premium of $18,252. The APTC subsidy is $18,252 – $8,500 = $9,752. When divided by 12 months, that equates to a monthly subsidy of $813 for the consumer to apply to any metal tier plan to reduce the health insurance premium.

As the household income decreases below 400% FPL, the consumer responsibility percentage also decreases. For consumers with a household income between 138 and 150 percent FPL, there is no consumer responsibility for the SLCSP. In other words, the monthly subsidy equals the cost of the SLCSP offered to them, on top of being offered a Silver 94 plan.

Finding Household, Income, Program Eligibility

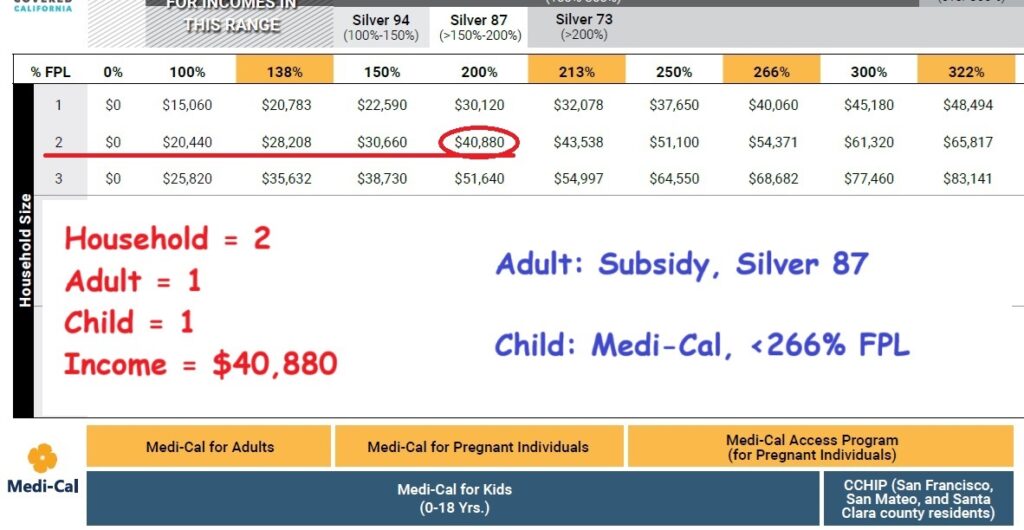

Household of Two

In this example, the two-person household consists of one adult and one child. The annual income is $40,880. We follow row 2 over to the income column which shows the adult is eligible for a Silver 87 with subsidies. The child, because the income is under 266 percent FPL, is only eligible for Medi-Cal through Covered California.

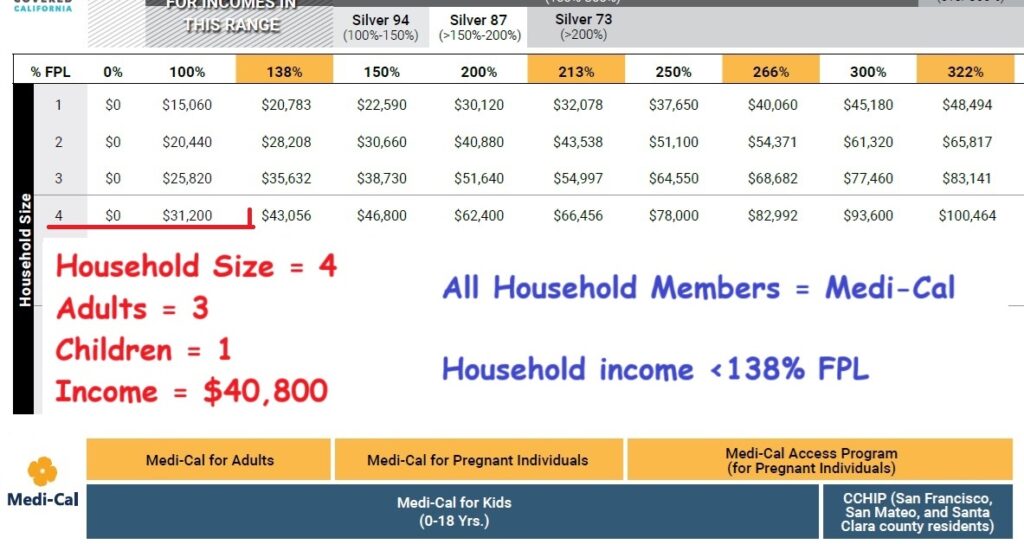

Household of Four

This household has three adults and one child. The income is $40,800. From row 4, we see that income is below 138 percent FPL making all family members eligible for Medi-Cal.

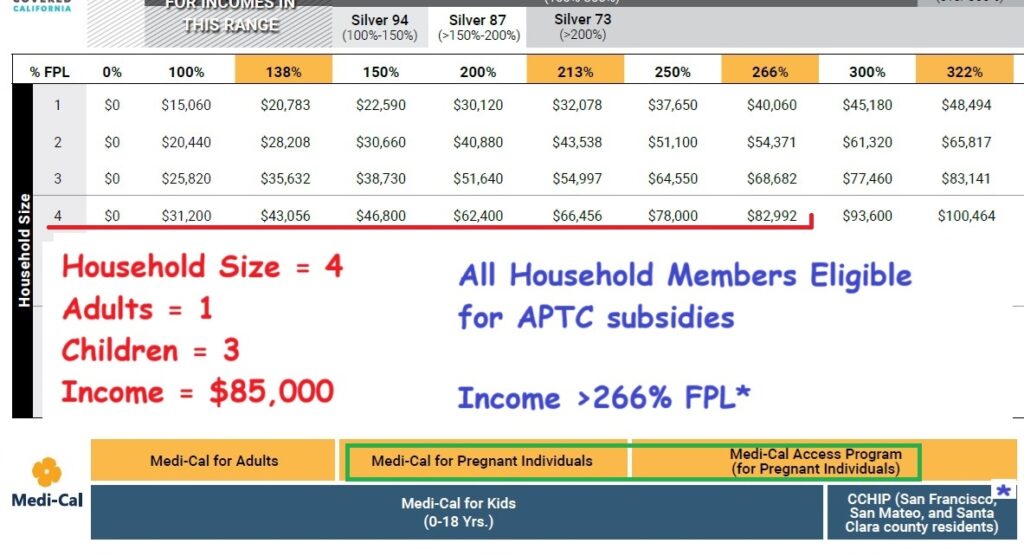

Household of Four Higher Income

While the household size is the same as the previous example, there is one adult and three children with an annual income of $85,000. We follow row 4 over to between the columns of 266% and 300%. Because the income is over 266 percent FPL, the children and adult are eligible for the subsidies through Covered California.

Also, on this example we see that if anyone is pregnant, and they disclose that information on the Covered California application, the individual may be eligible for Medi-Cal Access Program for Pregnant Individuals.